Tuesday Talk: Shut-down Averted But Showdowns Loom!

A government shut-down was averted over the weekend, but two showdowns loom large. The first is the challenge to Speaker McCarthy's leadership and the second is the widening UAW strike.

Investors worked hard on Monday to eke out a positive close, perhaps as a nod to the continuing resolution passed by Congress and simply the end of September, historically one of the cruelest months of the year for stocks, which certainly proved to be true this year.

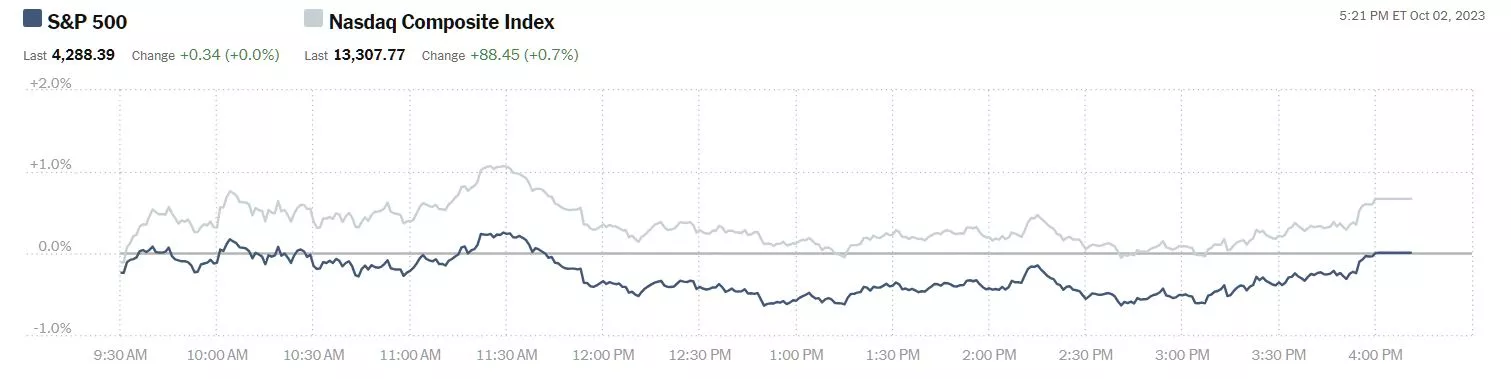

Yesterday the S&P closed at 4,288, up 0.34 points, the Dow closed at 33,433, down 74 points, and the Nasdaq Composite closed at 13,308, up 88 points.

Chart: The New York Times

Most actives were led by Tesla (TSLA), up 0.6% followed by Ford (F), down 0.9% and Bank of America (BAC), down 2.5%.

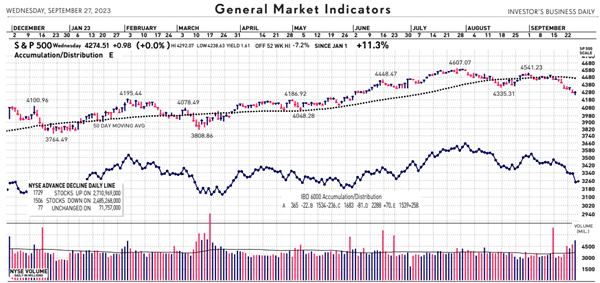

Chart: The New York Times

In morning futures trading, S&P 500 market futures are trading up 5 points, Dow market futures are trading up 25 points and Nasdaq 100 market futures are trading up 11 points.

With this data in hand this morning we take a look at what some TalkMarkets contributors think may happen in October.

Contributor John Gardner writes Conquer Your “FUD” Now, Because A Rally Should Come Later.

"In a letter to clients in early July, “After a strong first half, the stock market remains in Confirmed Uptrend”, I noted it was a fantastic first half. By the end of July, the S&P Composite 1500 had jumped nearly 19%, boosted by gains from all sizes and styles, nine of 11 sectors, and 70% of its sub-industries.

Concerns over “higher for longer” interest rates, continued strength in the jobs market, rising oil prices, a strengthening US dollar, worry of a US government shutdown, and weakness in China, to name a few of the biggies, have flipped the stock market’s trend from “Confirmed Uptrend” to “Market in Correction”.

All sizes, styles, 10 of 11 sectors, 82% of all subindustries, and 83% of all companies in the S&P 500 have fallen in price. As a result, it’s not surprising that investor sentiment is down and investor FUD (fear, uncertainty & doubt) is up."

"There is potential good news, though. That is, if history is on our side, a Q4 market rally may be in store for investors. The S&P 500 gained an average of 5% during the fourth quarter of all years since 1990, rising in price 82% of the time...Factors for a Q4 rally this year could come from the conclusion of hikes and strikes, as well as the projected recovery in S&P 500 earnings growth for the remainder of the year and into 2024.

As history has shown, I see the more growth-oriented groups outperforming the defensive sectors. But we may find that the best offense is a good defense, so let’s stay diversified!"

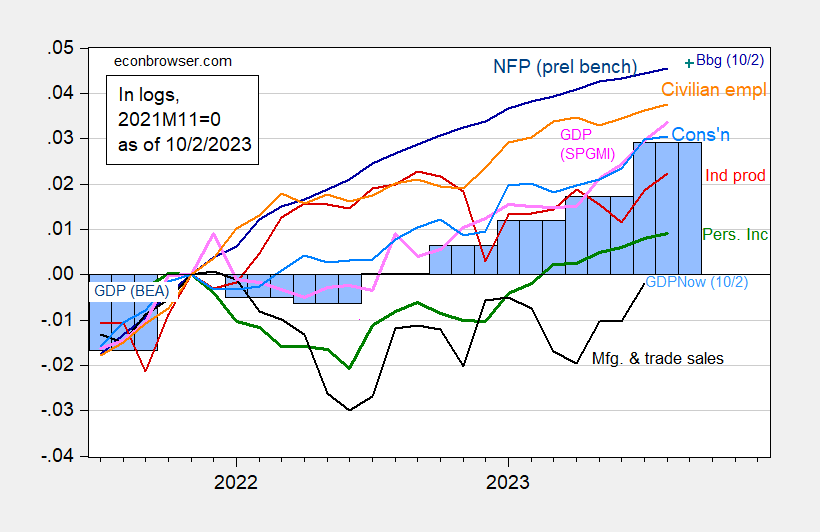

Economist and contributor Menzie Chinn charts Business Cycle Indicators At The Beginning Of October.

"With the monthly GDP reported today, we have the following picture of the economy.

Figure 1: Nonfarm Payroll employment incorporating preliminary benchmark (dark blue), implied September NFP incorporating Bloomberg 10/2 consensus (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2017$ (green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, BLS preliminary benchmark, Federal Reserve, BEA 2023Q2 second release via FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (10/2/2023 release), Atlanta Fed (10/2/2023 release), and author’s calculations.

Commentary from SPGMI:

Monthly GDP rose 0.4% in August following a 0.5% increase in July (unrevised). The increase in August extended a run of robust monthly gains that began in May. Over this four-month span, monthly GDP rose at an annual rate of 5.7%. The increase in August was fully accounted for by increases in net exports and nonfarm inventory investment; domestic final sales were essentially flat in August. The level of monthly GDP averaged over July and August was 4.6% above the second-quarter average at an annual rate. Implicit in our latest tracking estimate of 4.8% GDP growth in the third quarter is a slight (0.1%) decline in monthly GDP in September."

TM contributor Michael Kramer remains concerned as Rates Continue To Move Higher.

"Stocks finished the day lower as rates pushed higher again and spreads widened. The 10-year climbed to 4.69%, and the help to spread between the ten and the two widened to -42 bps, which is important. Again, the 10-year is very close to breaking out to a new level because, after 4.68%, I don’t see much standing in the way of a run to 5%. There seem to be several combinations that could take the 10-year higher, and the bull flag also appears to be another one..."

"Most of the move today was driven by the hotter-than-expected ISM data this morning. Tomorrow, we get the JOLTS data; if you remember, last month, the JOLTS data came in cooler than expected, and we got that big gamma squeeze higher, which took about a week or so to work off. So, something to be aware of tomorrow if the JOLTS comes in cool again and the market pops because I would think rates and the dollar would move down.

The JOLTS data tends to be very unpredictable and also tends to be subject to big revisions. Still, despite the big surge in rates, the S&P 500 was flat and found some support in the 4,270 area today."

"This level for the S&P 500 is very important because after this, again, there is much to support the market until 4,210."

The Staff of contributor Bespoke Investment Group asks if there is a Rocky Road Ahead?

"After a relatively dismal two months for stocks, the market kicked off what has historically been its strongest period of the year today. In the post-WWII period, the S&P 500's average performance in Q4 had a gain of 4.1%, which is more than double the 2.0% average gains of Q1 and Q2 and ten times the average gain of Q3 (0.4%)."

"With Q4 being the strongest quarter of the year and October being the most volatile month, they don't call October the month of market bottoms for nothing. In looking back at every market decline of at least 5% (without a rally of 5%+ in between), market lows have easily been the most prevalent in October. As shown in the chart below, 33 (14.4%) of the 'market lows' since 1945 have occurred in October, and the only two other months that account for even 10% of all market lows were March and September. Seasonality is on the side of the bulls heading into Q4, but that doesn't mean the road is smoothly paved."

TalkMarkets contributor Bill Smead presents the case for taking the long view in Acorns Grow Into Trees.

"When you are in a long-term bull market in growth stocks, you move from acorns growing into trees to asking trees to grow into a forest. We prefer to find meritorious acorns that could grow into trees, and this stock market is providing lots of opportunities in the smallest neglected large caps, and the largest neglected mid-cap stocks...The best bargains in this stock market run smaller than normal and skew towards deeply out-of-favor sectors of the economy like energy and real estate. Who wants to own undervalued stocks that might take time to be rewarded when the biggest of the big seem to have no end to their success?...When the smart investors (not measured as such by us) pile into a narrow group of stocks to find gains in a difficult environment, you should fear stock market failure. This is looking increasingly like a triple top in a tech-led financial euphoria episode dying to get crushed. Charlie Munger called it the biggest episode of his lifetime because of the totality of it!"

"Therefore, where can we turn to find substantial mid-cap and depressed large-cap stocks that have great merit and very solid forward economics? Look no further than the oil and gas sector...We are happy to be overweighted in oil and gas stocks like Ovintiv (OVV), Apache (APA) and Devon Energy (DVN) which could be positioned to grow into trees."

That's a warp for today.

As always, caveat emptor!

More By This Author:

Tuesday Talk: Up Monday Doesn't Preclude A Repeat Performance On Tuesday

Thoughts For Thursday: CPI Keeps The Market In Neutral