Conquer Your “FUD” Now, Because A Rally Should Come Later

Image Source: Pexels

In a letter to clients in early July, “After a strong first half, the stock market remains in Confirmed Uptrend”, I noted it was a fantastic first half. By the end of July, the S&P Composite 1500 had jumped nearly 19%, boosted by gains from all sizes and styles, nine of 11 sectors, and 70% of its sub-industries.

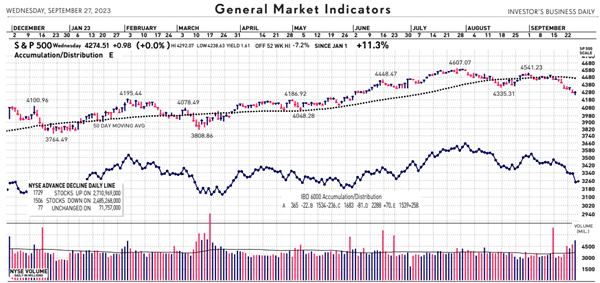

Concerns over “higher for longer” interest rates, continued strength in the jobs market, rising oil prices, a strengthening US dollar, worry of a US government shutdown, and weakness in China, to name a few of the biggies, have flipped the stock market’s trend from “Confirmed Uptrend” to “Market in Correction”.

All sizes, styles, 10 of 11 sectors, 82% of all subindustries, and 83% of all companies in the S&P 500 have fallen in price. As a result, it’s not surprising that investor sentiment is down and investor FUD (fear, uncertainty & doubt) is up.

There is potential good news, though. That is, if history is on our side, a Q4 market rally may be in store for investors. The S&P 500 gained an average of 5% during the fourth quarter of all years since 1990, rising in price 82% of the time.

In addition, all sizes, styles, and sectors posted average advances from 2.1% to 6.4%. Market leadership has come from the industrials, materials, and tech sectors, while energy and utilities were weak.

If this repeats, it would be a sharp reversal from the recent strength in the energy group as oil has run up recently to over $94 a barrel. Factors for a Q4 rally this year could come from the conclusion of hikes and strikes, as well as the projected recovery in S&P 500 earnings growth for the remainder of the year and into 2024.

As history has shown, I see the more growth-oriented groups outperforming the defensive sectors. But we may find that the best offense is a good defense, so let’s stay diversified!

More By This Author:

A Cable Giant Set To Benefit From Integration Of Several Businesses

BIZD: A High-Yielding ETF Tailor Made For This Interest Rate Environment

Academy Sports And Outdoors: A Retailer Worth Investing In As Economic "Soft Landing" Comes In

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.