Tuesday Talk: Up Monday Doesn't Preclude A Repeat Performance On Tuesday

The market closed up on Monday, but early morning options trading in market futures show a similar decline for Tuesday. The stock market carousel continues for now. The strike in Hollowood maybe coming to an end, but the U.A.W. strike has many picket lines to go, including taking aim at non-unionized Tesla.

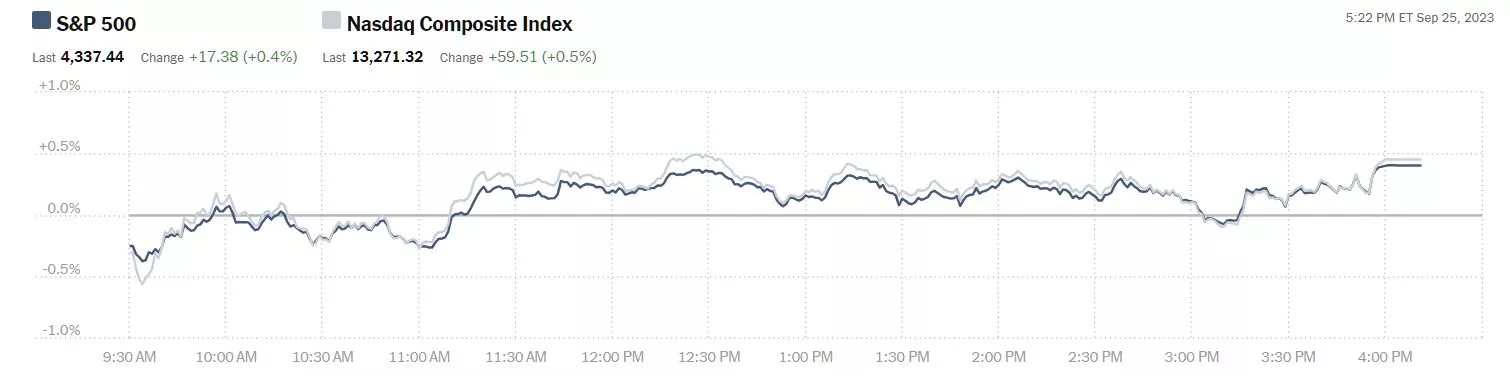

Yesterday the S&P 500 closed at 4,337, up 17 points, the Dow closed at 34,007, up 43 points and the Nasdaq Composite closed at 13,271 up 60 points.

Chart: The New York Times

Most actives were led by Tesla (TSLA), up 0.9%, followed by Ford (F), up 1.2% and Apple (AAPL), up 0.7%.

Chart: The New York Times

In morning futures activity, S&P 500 market futures are trading down 22 points, Dow market futures are trading down 149 points, and Nasdaq 100 market futures are trading down 82 points.

We start the column today with a report from the wild west world of crypto where contributor Charles Thuo reports Crypto Influencer Ben Armstrong Arrested, BEN Token Plunges.

Say what?

"BEN (BEN-X) token is plunging following the arrest of the renowned crypto influencer Ben Armstrong, popularly known as “Ben BitBoy.” Armstrong was arrested following a live-streamed altercation with his former business partner...

In a surprising turn of events, Armstrong’s YouTube livestream revealed that he was armed, carrying a loaded weapon in the backseat of his car while accompanied by another individual. Prior to the livestream, Armstrong had cryptically teased his audience about broadcasting from a “very special location.”"

"Less than an hour later, Armstrong was broadcasting live from the residence of Carlos Diaz, a consultant and NFT investor connected to the HIT Network. During the stream, Armstrong accused Diaz of wanting to harm him and alleged links to the Houston mafia, exclaiming, “I’m not scared of you, Carlos.”"

"Around the 19-minute mark, local law enforcement arrived at the scene and questioned Armstrong about the presence of a weapon, which he initially denied. Subsequently, Armstrong was instructed to put down his phone, leading to a 17-minute blackout on the livestream, though audio revealed ongoing discussions between Armstrong and the police officers...

The ongoing controversy surrounding Armstrong began when the HIT Network, the entity behind the “BitBoy Crypto” brand, severed ties with him due to concerns related to substance abuse and financial harm to employees. Several lawsuits have emerged in the aftermath, with Armstrong even soliciting donations on September 20 to fund his legal battles, sparking reactions within the crypto community.

How is Ben Armstrong related to the BEN token?

In a separate development, BEN token, introduced by Armstrong earlier in the year to promote crypto adoption, experienced a significant 21% drop in value as news of his arrest circulated on Tuesday."

"Armstrong’s removal from BitBoy Crypto in August through a unanimous decision by the company’s management likely played a pivotal role in the events leading to his arrest.

The unfolding drama surrounding Ben Armstrong continues to captivate the crypto community, with consequences rippling across various facets of the industry, including the fate of the BEN token."

TM contributor Carsten Brzeski writes Surging Oil Prices: A New Concern For Central Banks.

"Surging oil prices have become the new concern for central banks, aggravating the current trilemma: how to balance slowing economies, still too-high inflation and the delayed impact of unprecedented rate hikes. Interestingly, the answer to this conundrum differs between major central banks...

Oil prices are currently up by more than 25% this quarter and briefly reached 95 USD/b last week. Our commodities analyst Warren Patterson expects oil prices to break above 100 USD/b in the near term as supply cuts by OPEC+ countries more than offset weaker demand due to the global economy’s slowdown.

However, he doesn’t see oil prices remaining above 100 USD/b for long as weaker demand and political pressure to increase supply should help to bring oil prices back to levels slightly above 90 USD/b...

The current surge in inflation is different in that real wage growth turned negative quickly, which has slowed consumer demand drastically. This makes the chances of a prolonged second spike in inflation much smaller. With inflation currently trending down and wage growth stabilizing above 4%, real wage growth is set to soon turn positive again, but we wouldn’t expect it to erase the losses from the past two years.

At the same time, it is important to note that government support and employment growth have limited disposable income losses quite substantially...

If the labor market remains as tight as it is now and the economy bounces back a bit in early 2024, there is a risk that higher energy input costs would also put core inflation further above 2%. A lot depends on the strength of the economy in the months ahead, adding uncertainty for the ECB.

Prior to the pandemic, most central banks would probably have looked past surging oil prices. Some even considered rising oil prices to eventually be deflationary, undermining purchasing power and industrial competitiveness. However, we are no longer in the pre-pandemic era, but the era of returned inflation. The ECB has emphasized in recent months that doing too little is more costly than doing too much in terms of rates.

For the ECB, the recent staff projections were based on the technical assumption of an average oil price of 82 USD/b in 2024. If oil prices were to average 95 USD/b next year, this would probably push up the ECB’s inflation forecasts to 3.3% for 2024 (from 3.2%) and more importantly to 2.4% in 2025 (from 2.1%). As a result, the return to 2% would be delayed to 2026.

The delayed return to 2% would not be the only reason for the ECB to consider further rate hikes. Even though the ECB would still acknowledge the deflationary nature of a new oil price shock, the risk that this new oil price shock could lead to a de-anchoring of inflation expectations will definitely add to the ECB’s concerns, making not only an additional rate hike more likely, but also that they stay higher for longer."

See the full article for further details. Brzeski draws some comparisons to 1970's inflation which I did not include in my excerpts.

Ever on the look-out for positive crypto new contributor Cryspus Nyaga notes Bitcoin Outshines Stocks, Bonds As Risks Rise.

"The BTC/USD pair has moved sideways in the past few weeks. It has outperformed stocks as the Nasdaq 100 and S&P 500 have retreated by more than 7% from the highest levels this year.

It has also done better than bonds. The 10-year, 30-year, and 5-year bond yields have jumped to the highest levels in years. Bond yields move inversely to prices. They have risen in the past few months as the Federal Reserve has moved aggressively to fight against inflation.

The US dollar index has been in a strong bullish trend in the past few weeks. It has risen to over $105.6, the highest level in more than 6 months. Historically, Bitcoin tends to have an inverse relationship with the US dollar.

It is not clear why Bitcoin is doing well in this environment. A likely reason is that there are still hopes that the Securities and Exchange Commission (ECB) will approve at least one of the spot ETF proposals. Several large companies like Blackrock, Invesco, and WisdomTree have filed for their spot ETFs.

A Bitcoin ETF will be positive for the ecosystem since it will lead to more inflows from institutional investors. Another important event is the ongoing Bitcoin purchases by MicroStrategy. The company bought 5,445 coins valued at over $150 million. It now holds coins worth over $4.6 billion in Bitcoins."

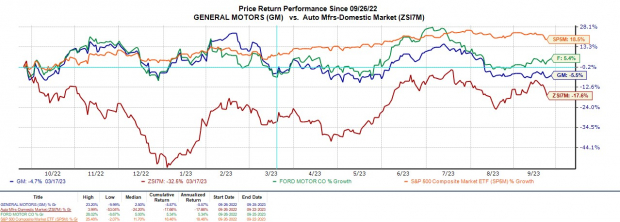

In the "Where To Invest Department", contributor Shaun Pruitt asks Time To Buy Or Stay Clear Of General Motors And Ford Stock As UAW Strike Continues?

"The United Auto Workers (UAW) strike could certainly affect General Motors (GM) and Ford the longer it lasts but there appears to be much risk already priced into their stocks.

Furthermore, while General Motors stock is only down -1% for the year, Ford shares are still up +8%. This may have many investors wondering if they should still buy General Motors and Ford stock for longer-term opportunities or stay clear at the moment."

Image Source: Zacks Investment Research

"General Motors and Ford currently hold the second and third spots in the domestic EV market respectively.

This year General Motors earnings are expected to be virtually flat but drop -5% in fiscal 2024 at $7.18 per share. However, FY24 EPS projections would still represent 46% growth over the last five years with 2020 earnings at $4.90 a share.

Plus, General Motors stock does make a strong case for being undervalued at just 4.2X forward earnings, and sales are forecasted to rise 9% in FY23 and edge up another 2% in FY24 to $175.19 billion.

Pivoting to Ford, annual earnings are now projected to jump 12% in FY23 at $2.11 per share compared to EPS of $1.88 last year. Fiscal 2024 earnings are forecasted to dip -7% at $1.96 a share but would represent a very stellar 378% growth over the last five years with Ford’s earnings at $0.41 a share in 2020.

Furthermore, showcasing a sharp post-pandemic recovery, Ford shares also make the case for being undervalued at 5.9X forward earnings. On the top line, sales are anticipated to rise 7% this year to $160.21 billion but dip -1% in FY24.

It appears that we are not at a turning point that calls for staying clear of General Motors and Ford stock as the valuation of both auto giants is attractive. With that being said, there could be better buying opportunities ahead as the UAW strike continues. "

See the full article for the charts and additional details.

Additional analysis on last week's Fed moves comes from contributor Ryan McMaken who writes The Fed Holds The Fed Funds Rate Steady - Because It Doesn't Know What Else To Do.

"The Federal Reserve’s Federal Open Market Committee (FOMC) on Wednesday left the target policy interest rate (the federal funds rate) unchanged at 5.5 percent. This "pause" in the target rate suggests the FOMC believes it has raised the target rate high enough to rein in price inflation which has run well above the Fed's arbitrary two-percent inflation target since mid-2021...

Fed Chair Jerome Powell repeated the usual stock language the committee routinely provides on how present high labor demand proves there is no economic turbulence on the horizon. This reliance on current jobs data deliberately hides a larger and more accurate assessment of the economy. Nonetheless, in his comments at the press conference, Powell stated some undeniable facts:

Inflation remains well above our longer-run goal of 2 percent—4 percent over the 12 months ending in August—and that, excluding the volatile food and energy categories, core PCE prices rose 3.9 percent. Inflation has moderated somewhat since the middle of last year ... Nevertheless, the progress—the process of getting inflation sustainably down to 2 percent has a long way to go.

This meeting of the FOMC was described as "hawkish" by Wall Street observers and pundits, mainly because the FOMC's Summary of Economic Projections (SEP) suggested that the target inflation rate will remain at 5.5 percent—or even slightly higher—throughout the rest of the year...

If we read between the lines, it is apparent that the Fed is hoping that price inflation will fall to politically acceptable levels without any additional tightening and without a recession. But "hope" is all the Fed has. The FOMC voting members have no idea what comes next. But, the members apparently still fear politically damaging price inflation isn't going away as evidenced by most members' admission that the target rate is unlikely to fall much before the end of 2024. This is notable because the FOMC members tend to strenuously avoid any predictions that rates might tighten further.

A look at the past three years of SEPs shows very little upward movement in target rates. Moreover, in 2021, Fed personnel were insisting with the utmost confidence that the target rate would not increase at all until late 2023. In reality, the Fed was forced to raise rates in 2022 as price inflation soared to 40-year highs. The Fed's misplaced confidence in 2021 that low rates would endure all relied on a false narrative that price inflation would be either nonexistent or—at most—would be transitory. Fed economists were either lying or were utterly wrong about the state of price inflation. So, if Fed personnel have failed so miserably at predicting price inflation in recent years is there reason to now believe that the Fed now has the situation in hand? No...

The claim that interest rates are "high," of course, is unsupportable so long as the central bank replaces market interest rates with artificial central-bank-manipulated interest rates. The Fed has no idea what the "natural interest rate" is or what market interest rates would be in the absence of the central bank's incessant interventions. So, it is impossible to say what the "correct" target rate is...

The last decade has shown us that the Fed clings to a bias very much in favor of ramming down interest rates again and again. This is what happened in the ten years of near-zero rates that followed the 2008 financial crisis. Every month, the FOMC would come out and say that the economy was "growing" and was showing "strength" yet repeatedly refused to raise rates. In our current predicament, the Fed is afraid of price inflation but is also afraid to raise rates even further, even as the August CPI data showed rates ticked upward again. Political expedience demands that the Fed do what it can to rein in price inflation without triggering sizable increases in unemployment. The Fed is holding the current rate steady because politics demands it."

These are McMaken's main points, but there are more as well as charts in the full article.

Closing on an upbeat note, TalkMarkets contributor Robert Carnell finds that India Is Bucking The Global Slowdown Trend.

"India is the fastest-growing major economy this year. While others in the region look to be struggling, there are few clouds on the horizon for India. Inflation is high, but falling, and the rupee is one of the strongest currencies in the region, which will be further helped as Indian government bonds are set to be included in global indices next year.

In the second quarter, India recorded a growth rate of 7.8% YoY, which was a marked increase over the 6.1% rate of growth recorded for the first quarter. This makes India the fastest-growing major economy in the world and leaves growth on track to achieve 7% for the full year...

Growth is coming mainly from domestic demand and is spearheaded by capital investment. This bodes well for future growth too, with investment likely to raise India’s non-inflationary growth potential. Net exports aren’t helping much, but weaker imports have helped offset falling exports...

India’s sovereign credit rating of BBB- puts it precariously at the edge of investment grade and leaves the bond market vulnerable to downgrade risk. Those fears seem to have been allayed with the recent announcement of global bond index inclusion for Indian government bonds.

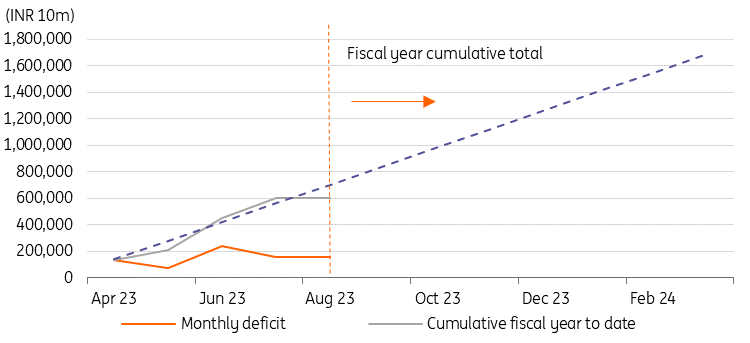

India's deficit - on track so far

So far as India’s progress in gradually reducing the deficit and its debt-to-GDP ratio, things seem to be roughly on track this year, and maybe a little ahead of the game.

In order to hit the 5.9% deficit ratio, and assuming real GDP growth of around 7% and inflation averaging about 4%, India’s cumulative deficit needs to come in at about INR 16.9tr by March next year. So far, the monthly deficit figures have kept close to the projected “on target” track required to achieve this, and there seems little danger of any credit downgrades on this basis, with the debt-to-GDP ratio still high but likely to moderate to about 81.5% by the end of this fiscal year, down from 83.8% last year...

India is delivering very solid economic growth currently, and there isn’t much in the current run of data to suggest that this shouldn’t continue to be the case. Inflation has spiked higher and that means that we probably aren’t looking at an immediate easing of policy rates and indeed, this will probably not take place until next year. That said, and notwithstanding what is obviously some direct support for the INR from the Reserve Bank of India, the support for the currency from overseas direct investment and equity listing would probably have seen the INR outperform its peers anyway and will take a further boost from the inclusion of Indian government bonds into global bond indices next year. That also removes an impediment to eventual easing, where some other regional peers are deliberately keeping policy tight despite better inflation credentials to offset currency weakness..."

These are excerpts from a lengthy and detailed article. Risk for India still remains high. See the complete article for more.

Have a good one.

More By This Author:

TalkMarkets Image Library

Thoughts For Thursday: CPI Keeps The Market In Neutral

Tuesday Talk: Neutral Positive Energy