Tuesday Talk: Neutral Positive Energy

Monday the market continued to maintain its neutral positive energy exhibited since late last week. Rising a bit, but no breakout in sight. Maybe that will change following the big Apple event later today, which is titled "Wonderlust".

On Monday, the S&P 500 closed at 4,487, up 30 points, the Dow closed at 34,664, up 87 points, and the Nasdaq Composite closed at 13,918, up 156 points.

Chart: The New York Times

Most actives were led by Tesla (TSLA), up 10.1%, followed by Apple (AAPL), up 0.7% and Amazon (AMZN), up 3.5%.

Chart: The New York Times

In morning futures action S&P 500 market futures are trading down 11 points, Dow market futures are trading down 59 points, and Nasdaq 100 market futures are trading down 35 points.

TalkMarkets contributor Sweta Killa puts Apple ETFs In Focus Ahead Of Iphone 15 Launch Event

"Apple is gearing up for its iPhone launch event at the Steve Jobs Theater in California on Sep 12...The event will happen just days after the iPhone maker shed nearly $200 billion in market value in two days due to reports of China planning to expand a ban on the use of iPhones to government-backed agencies and state companies."

"That said, ETFs having the largest allocation to the tech titan are in focus. Technology Select Sector SPDR Fund (XLK), Vanguard Information Technology ETF (VGT), MSCI Information Technology Index ETF (FTEC), iShares US Technology ETF (IYW ) and Invesco QQQ (QQQ) have Apple as the top or second firm with a double-digit allocation and carry a Zacks Rank #1 (Strong Buy) or 2 (Buy)...

iPhone 15: Apple is projected to release four iPhone models. Speculations suggest two middle-range iPhones with 6.1-inch and 6.7-inch screens, and two high-end "Pro" models with enhanced cameras and titanium casings. The new phone is rumored to have a new design, improved camera system, faster performance, longer battery life and new software features. The significant change this year might be the introduction of a USB-C charging port, aligning with European regulations and offering users faster charging...

Apple boasts the world’s highest stock market valuation, at nearly $2.8 trillion...

Based on short-term price targets offered by 27 analysts, the average price target for Apple comes to $205.07. The forecasts range from a low of $140.00 to a high of $240.00.

Currently, Apple carries a Zacks Rank #3 (Hold) and a Growth Score of B, suggesting that the iPhone maker is primed for growth. Apple stock is cheap, trading at a P/E ratio of 29.47..."

Contributors Chris Turner, Francesco Pesole and Frantisek Taborsky find signs for an uptick in the risk-on environment in FX Daily: Muddling Through.

"Risk assets are marginally better bid as troubled Chinese property developer Country Garden is reported to get a reprieve on bond payments and investors expect good demand for British chip designer ARM's IPO in New York. Yet oil could push higher today on OPEC August production figures and we doubt the market wants to chase the dollar too much lower...

The dollar softened a little yesterday as investors seemed to put money back to work in equities. Some of the recent underperforming currencies such as the Australian dollar and Mexican peso enjoyed decent rallies - both currencies we like on a medium-term basis. That mildly optimistic trend has continued overnight, where troubled Chinese property, Country Garden, is reported to have received creditor support for a three-year extension on some of its yuan-denominated bond payments. The idea of a China property crisis somehow spiraling into a full-scale banking crisis has ebbed over the last month, where China's 5-year USD sovereign default swap has corrected back to 71bp from 87bp last month..."

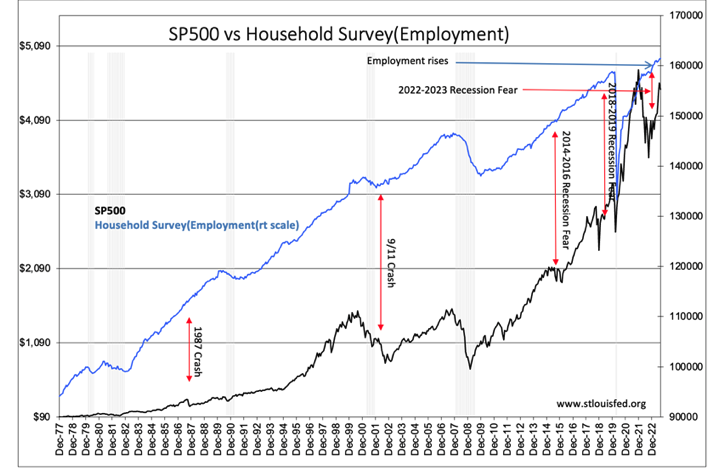

Contributor Todd Sullivan says regarding market sentiment It Really Is As Simple As Employment.

"...The consensus and the media are obsessed with market’s short-term trend. In the discussion, the most important market predictor is ignored. That predictor is the long-term trend of employment...In every instance when the employment growth trend stalls and then rolls over a recession occurs. Regardless of $WTI, market sentiment, interest rates and other short-term indicators used by algorithmic traders, if the employment trend is rising then so is the economy and eventually equities will follow. That is what we see today."

"The SP500 is well above the lows of Oct 2022 but sentiment continues to register a decent level of pessimism. The SP500 Net Non-Commercial Futures Position, currently -142.1, is 340pts below the 200 level of past periods of market optimism. The current market likely has 2yrs-5yrs of price increases till the next serious peak and market correction in my experience."

TM contributor Tim Fries notes SPN Outperformed All Other Sectors This Quarter Amid Surge In Oil Prices.

"The Strategic Petroleum Reserve (SPR) is at its lowest point since 1983, at 347 million barrels...This puts the SPR level at less than half (48%). As the chart below shows, this is an anomalous level of energy security, having mainly remained flat since the mid-1980s."

"Because the Strategic Petroleum Reserve (SPR) is a buffer against supply disruptions, it sends out important signals. For one, the stock energy market prices higher oil prices as the government’s ability to withdraw from SPR wanes.

This has already come to fruition in the last three months, as Brent crude oil price jumped by 21% to $90.84 per barrel, the level it was in November 2022. Second, this also means that inflation is heading for reacceleration...

S&P 500’s energy sector (SPN) adds 7.5% weight to the overall benchmark index. In other words, this is how much SPN contributes to the total market capitalization of the S&P 500, presently holding at $37.16 trillion.

Expectedly, SPN followed closely as Brent crude oil went up since Q2 (ending in June). Overall, the S&P 500’s energy sector increased 11% this quarter. At the same time, the S&P 500 (SPX) rose by 1.87%...

Across individual energy stock companies, Marathon Petroleum Corporation (MPC) yielded the largest gains in the same period, at 32%. Halliburton (HAL) closely followed at 28% and ConocoPhillips (COP) at 18%...

Of course, higher oil prices would trigger higher transportation costs and spill over to products relying on plastics and fertilizers. If the Fed reacts to these price spikes with heavier hikes than expected, we may also be looking at less optimistic recession forecasts for the US.

Then, energy stocks could undergo another boom-and-bust cycle that is so prevalent in the commodity markets."

Closing out the column for today, economist and TM contributor Robert Reich asks Why Does Flying Suck So Much?

"You might not believe this, but I’m old enough to remember when flying was fun.

Now I’m sure you’ve got your own airline horror stories, which I hope you’ll share. But what happened to make flying such a nightmare?

The answer is simple: the same things happening across most industries. In fact, a close look at airlines reveals five of the biggest problems with our economy...

Number 1: Consolidation means fewer choices.

While there were once many more airlines, a series of mergers and acquisitions over the last three decades has left only four in control of about 80% of the market...

Number 2: Companies Charging More for Less

Even before recent airfare spikes, air travel was getting more expensive because of new fees for things that used to be free, like in-flight meals, checked bags, or even carry-ons...

This parallels other industries where you’re paying more for less — just look at how cereal boxes, rolls of toilet paper, and candy bars are all shrinking.

Number 3: Exploiting Workers

While their jobs have become more difficult, many flight attendants haven’t had a raise in years.

And a lot of their hardest work is totally unpaid, because most flight attendants don’t get paid during the boarding process. They’re off the clock until the plane’s doors close.

And if the flight is delayed, those are often extra hours for no extra money.

Again, this mirrors trends in the overall economy, where too many workers are pushed into unpaid overtime or made to do work or be on call during their off hours.

Number 4: The Illusion of Scarcity

Airlines pretend they have no choice but to raise prices, cut services, and limit payroll. But their profits are in the stratosphere. In the five years before the pandemic, the top 5 airlines were flush enough to pay shareholders $45 billion, largely through stock buybacks...

Whether it’s multi-millionaire movie moguls pretending they can’t afford to pay writers or a grocery chain blaming “inflation” for high prices while raking in record profits, this illusion of scarcity is a sham.

Number 5: Misdirected Rage

Instead of being mad at the people at the top, we’ve been tricked into being mad at each other. Fights have broken out over whether it’s ok to recline a seat or who gets overhead bin space. But reclining’s only an issue because airlines intentionally put the seats too close together...

Airlines are pitting us against each other the same way billionaires and their political lackeys pit groups against each other in society, hoping we’ll blame unions or immigrants or people of other races or religions or gender identities for why it’s so hard to get ahead...

Companies get away with bad behavior when we accept their excuses that there’s just no other way to run a business. They’re counting on us not knowing what’s really going on."

You cant watch Dr. Reich present his ideas in video form as well:

I'll end with this final quote from Robert Reich:

"Finally, try to be a little nicer to service workers and your fellow passengers — on planes and in life. After all, we’re all on this journey together."

Have a good one.

More By This Author:

Thoughts For Thursday: Oil Prices Bring On The Blues

Tuesday Talk: Post-Holiday Tuesday