Tuesday Talk: Post-Holiday Tuesday

One hopes most were able to enjoy the last long weekend of summer with family and friends, despite the fact that many others had to work yesterday.

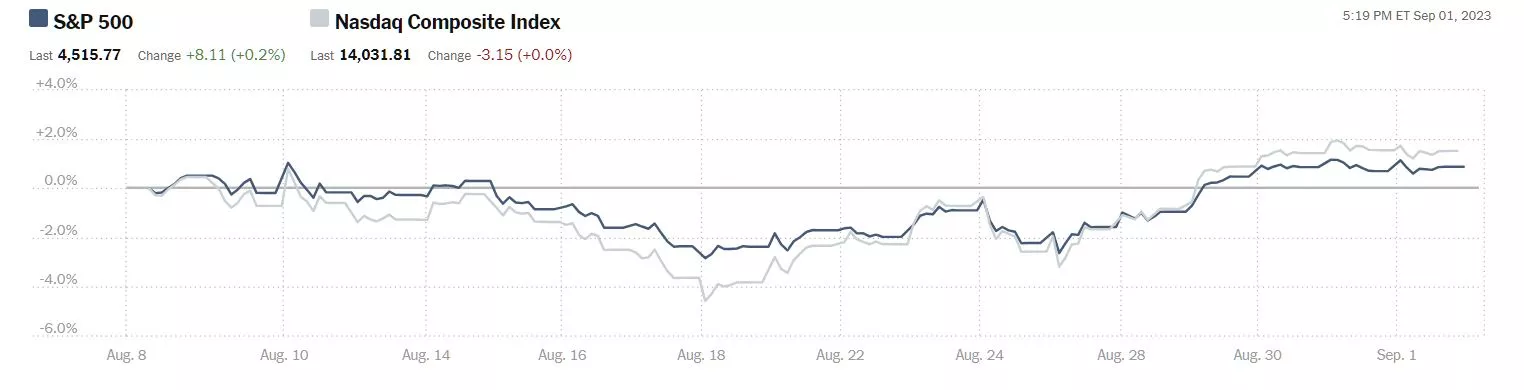

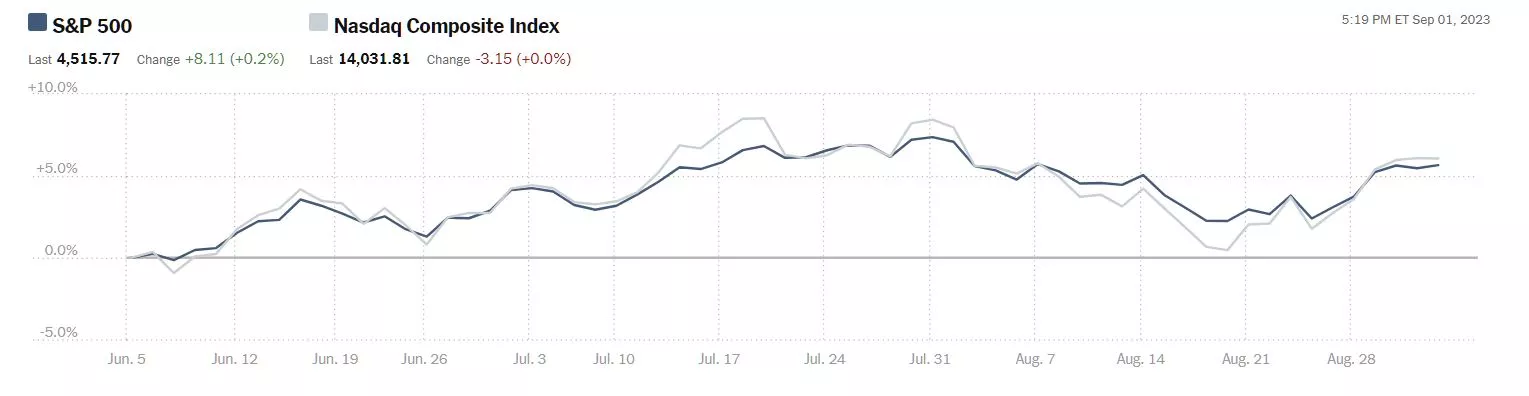

If you were enjoying the holiday fully, you perhaps missed Friday's market close. The S&P 500 closed at 4,516, up 8 points, the Dow closed at 34,838, up 116 points, and the Nasdaq Composite closed at 14,032, down 3 points. The market did close the month higher than where it started and it is certainly higher than where it was 3 months ago.

One Month

Chart: The New York Times

Three Month

Chart: The New York Times

A lot can change between now and September 20, the date of the next FOMC meeting, but the CME FedWatch Tool is showing that 93% of respondents expect The Fed to keep rates the same and 7% anticipate an increase of 25 basis points.

In early morning futures action, S&P 500 market futures are down 12 points, Dow market futures are down 45 points, and Nasdaq 100 market futures are down 63 points.

In trying to navigate September the Staff at TM contributor Fullerton Markets in their column Stocks Pick Of The Week - Stock Market Faces Murky September Outlook Amid Heightened Uncertainties, favor Big Tech.

"The stock market, marked by the turbulence witnessed throughout August, shows no signs of settling, with expectations of sustained instability in September. This unease stems from the market's anticipation of an economic deceleration triggered by the delayed repercussions of the Fed's previous interest rate hikes, exacerbated by soaring mortgage rates that bear down on the housing sector.

Prudence is the watchword for traders, as prevailing market conditions paint risk assets as "relatively expensively valued." Moreover, subtle indications of an economic slowdown have begun to surface."

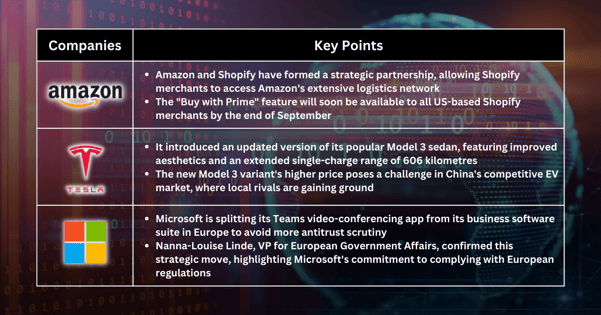

Still, they have these comments regarding AMZN, TSLA and MSFT.

"Amazon, the e-commerce and cloud computing juggernaut, continues its impressive run of consecutive monthly gains. Recent developments have seen Amazon.com Inc. and Shopify Inc. (SHOP) entering a strategic partnership. This collaboration grants merchants utilizing Shopify's e-commerce tools access to Amazon's extensive logistics network."

"Tesla has unveiled a refreshed iteration of its immensely popular Model 3 sedan, characterized by an enhanced aesthetic and extended range. However, the new variant comes with a more substantial price tag than anticipated, marking a competitive challenge in China's electric vehicle market, where local rivals are gaining ground."

"In a strategic move aimed at averting further European Union antitrust scrutiny, Microsoft Corp. has announced plans to disentangle its Teams video-conferencing application from a broader suite of business software...Nanna-Louise Linde, Microsoft's Vice-President for European Government Affairs, made this announcement via a recent blog post, solidifying the tech giant's commitment to navigating the intricate European regulatory landscape."

Contributor Joseph Calhoun takes economists to task in his column titled, Wrong Again.

"There were some very smart people a year ago saying that you couldn’t kill inflation without a big rise in unemployment. Last October, Larry Summers – former Treasury Secretary and President of Harvard – said we’d need a recession and an unemployment rate of 6% to kill inflation. In the summer of last year, he said we’d need 5 years of 5%+ unemployment to kill inflation. He may be right someday but right now this is looking like…well, it’s looking like what I’ve come to expect from people like Larry Summers.

The revision to Q2 GDP last week showed that real GDP rose by 2.1% annualized while the GDP deflator (a measure of inflation) rose 2% annualized. While the GDP deflator isn’t the Fed’s preferred inflation gauge, if I were them I’d declare victory and send a Bronx cheer to Larry Summers...

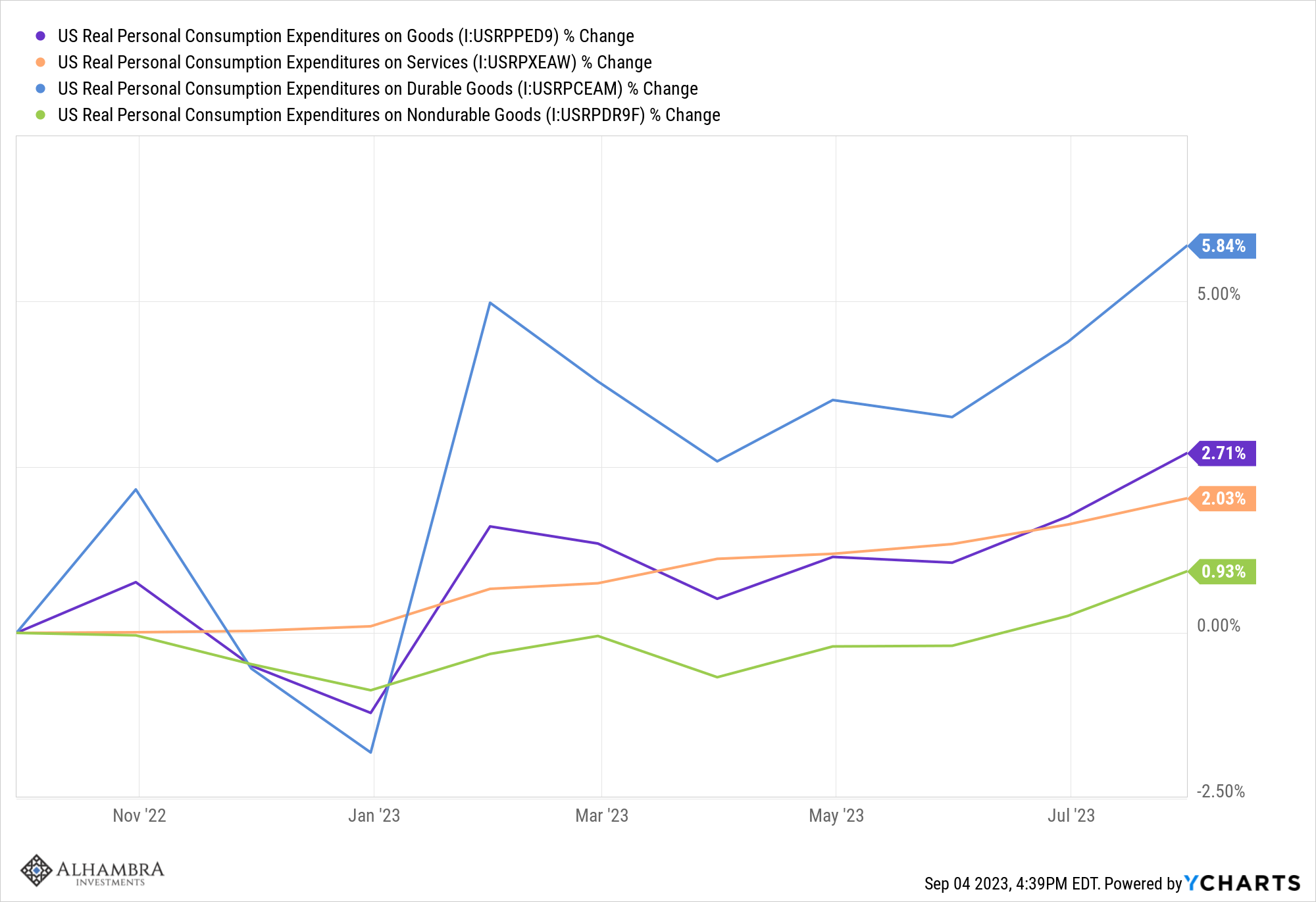

Personal consumption rose in July by 0.8%, outstripping the gain in personal income (+0.2%) and well in excess of inflation (+0.2%). This time it was goods spending that drove the gain with real PCE of goods up 0.9% and real PCE of services up 0.4%. I’ve been writing about the normalization of the economy, and more specifically consumption, for over a year now. The COVID period first saw a surge in goods spending which then moderated and stagnated for a year while services spending caught up. Now, services growth is falling back and goods spending is picking up again.

The economy has defied the naysayers for over a year now and it looks like, for now, it will continue to do so. We will get a recession at some point but there is nothing currently that points to an imminent contraction. With growth at trend and inflation back down to 2%, there is good reason to be optimistic right now. The emphasis should be on “now” though because things can change quickly...

Everyone is obsessed with terminology like “soft landing” for which there isn’t even a definition. Will the economy slow but not fall into recession? How the heck should I or anyone else know? The best we can do is interpret the economy as it is right now...

What I am also sure of is that absent some shock, markets will anticipate the downturn even if the Fed doesn’t. To see it all you have to do to see it is pay attention. And ignore Larry Summers."

See the full column for Calhoun's weekly comments on the action in the markets.

Hopping over to the other side of the pond, contributor Emma Bonnet takes a look at Germany’s Crisis: Energy Strategy.

"The economic powerhouse of Europe, Germany, is currently grappling with concerns over a potential recession and soaring inflation rates. These challenges are not just limited to the country’s financial landscape; they are also significantly impacting the political landscape, as experts suggest that they are causing a shift to the right."

"The resurgence of the “sick man of Europe” label has cast a shadow over Germany in recent weeks, echoing concerns from the late 1990s when the nation grappled with the formidable challenges of reunification. The largest economy in Europe is wrestling with a manufacturing slowdown and the burden of surging energy prices, making it susceptible to this historically critical moniker...

Parallel to recession, the German inflation rate has been steadily climbing. The cost of living is becoming a growing concern for German households. Rising prices for essential goods, housing, and energy put immense pressure on family budgets...

As economic challenges persist, experts observe a notable shift in Germany’s political landscape. The rise of right-wing parties and populist movements is a trend that is becoming increasingly evident. Many attribute this shift to the economic woes the country is facing.

One ambitious goal on the German government’s horizon is achieving carbon neutrality by 2045...amidst these efforts to embrace sustainability, a growing “greenlash” is becoming apparent as the public begins to feel the financial strains of the transition...

Germany’s recent economic challenges have brought back an infamous epithet, but the nation is no stranger to adversity. With a renewed focus on sustainability and a shifting energy landscape, Germany is navigating uncharted territory...As Germany navigates these turbulent waters, the world watches closely, recognizing this economic powerhouse’s significant influence on the European and global stage."

TalkMarkets contributor Brad Thomas writes that you should Be On The Lookout To Profit From This $43 Billion Internet Infrastructure Program.

“Any jackass can kick down a barn, but it takes a good carpenter to build one.”

"Sam Rayburn didn’t mince words. Though he used plenty of colorful language, he knew how to get things done. Rayburn is remembered as the longest-serving Speaker of the House, holding the position for 17 years between 1940 and 1961."

Rayburn supported legislation that helped rural Americans. One of the laws he helped pass during his career was the Rural Electrification Act.

In the 1930s, most cities had access to electricity. But only one in ten farms could connect to the grid. Electric companies thought it was too expensive to build transmission lines out into the countryside.

The Rural Electrification Act aimed to fix that by giving low-cost loans to rural co-ops to bring electric service to their members.

It was a huge success. And by the 1950s, it was just as easy to get electricity on a farm as it was in the city.

Now, nearly 90 years later, the federal government is helping rural Americans catch up again. This time, it’s not electricity, but internet access that’s on the line."

"As part of the Infrastructure Investment and Jobs Act passed in 2021, the National Telecommunications and Information Administration established the Broadband Equity, Access, and Deployment (BEAD) program. It will hand out $42.5 billion in funds to expand high-speed internet access...And while much of the funding is likely to go to local and regional service providers… the big telecom companies are looking to get a slice of the pie, too.

Here are some of the blue-chip corporations that are looking at taking a cut…

At a recent conference, AT&T (T) indicated its interest in applying for subsidies, saying that “BEAD gives you the opportunity to probably fill in areas that, economically, you might not have had high on the priority list.”

Although AT&T recently cut its dividend after spinning off Warner Media, the company is now focused on telecommunications and has a more sustainable payout. AT&T yields 7.5%.

Comcast (CMCSA) also said it is preparing to participate in the BEAD program, on an “opportunity-by-opportunity, market-by-market” basis. Comcast has been growing its dividend for 16 years and raised it by 7.4%. Shares currently yield 2.5%.

While Verizon (VZ) hasn’t committed to pursuing BEAD funding yet, it will look to participate “where it makes the most sense.” Verizon has been growing its dividend for 18 years but at a slow pace of about 2% per year. It currently yields 7.5%."

In an "In The Spotlight" piece, contributor EarningsEdge.ai notes that Dressed For Success: Lululemon's Q2 2023 Is A Tale Of Resilient Growth.

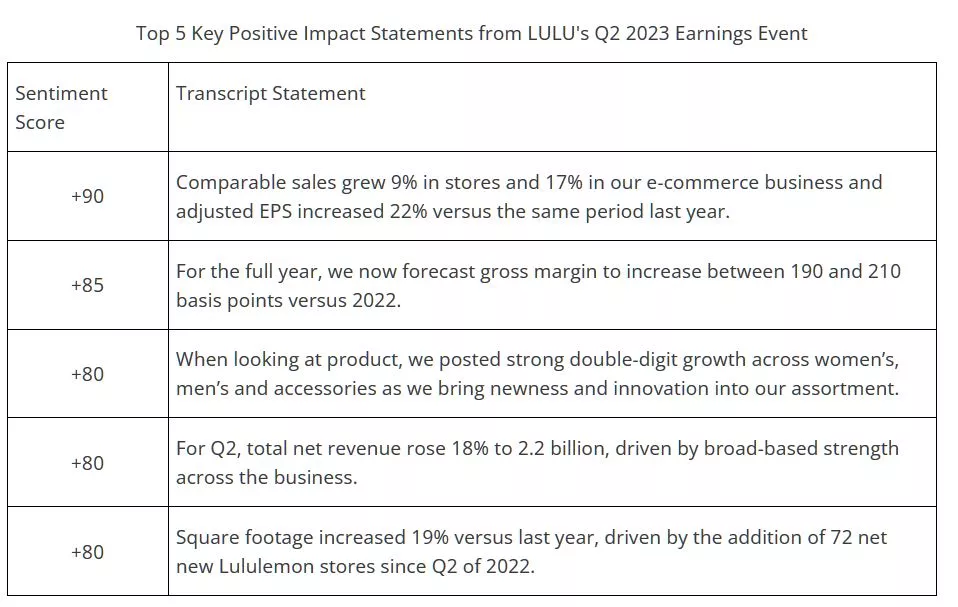

"Lululemon's (LULU) performance in the second quarter shines as a testament to the company’s resilient strength in the consumer industry. LULU’s revenue and EPS exceeded expectations, recording robust 18% and 22% YoY increases in revenue and EPS, respectively, driven by portfolio-wide outperformance. The company’s 9% growth in comparable sales and 17% growth in its e-commerce business underscore LULU’s strong positioning among preferential consumers and its proficiency in delivering operational diversification...

Driven by its relentless pursuit of innovation, expanding market presence, and impressive revenue growth, LULU stands poised to harness the evolving market landscape. Our findings illuminate a strong positive outlook, offering astute investors a compelling opportunity to partake in Lululemon's promising growth trajectory...

LULU’s sentiment score for Q2 2023, a notable +64, is a testament to its thriving growth trajectory – delivering outperformance in the U.S. market and positioning the company for further international expansion."

"LULU’s Q2 2023 sentiment score of +64 represents a 10-point sequential increase over the already impressive prior quarter earnings report. EarningsEdge.ai sentiment analysis model strategically recognizes the importance of sentiment trends between quarters and its implications on rising or deteriorating sentiment patterns. As scores ascend, substantial leaps become challenging, yet the trajectory remains noteworthy. While LULU’s 10-point increase may not immediately seem like a seismic shift, it represents a notably strong rising sentiment pattern indicative of the company’s continued outperformance and dedication to pushing the boundaries of their own achievements...

While the findings from our sentiment and behavioral analysis provide confidence in our positive outlook on LULU, it is prudent to consider downside possible risks. The looming potential for an impending downturn in the global economy poses a significant risk to LULU’s future performance. As a luxury goods company, LULU is highly dependent on consumer spending behaviors. In the event of an economic downturn, we find it likely that LULU would experience demand reduction for its products in the presence of consumer spending cutbacks...

Based on our in-depth analysis, powered by EarningsEdge.ai sentiment and behavioral analysis models, we remain bullish on LULU’s investment prospects...

With CEO Calvin McDonald's affirmation of the company's potential, and considering the sustained upward trend in their performance, we recommend LULU as a strong buy. "

Lu Lu...Caveat Emptor, Caveat Emptor.

Have a good one!

More By This Author:

Thoughts For Thursday: August's Rocky Road Is Coming To An End

Tuesday Talk: Like A Carousel