Thoughts For Thursday: August's Rocky Road Is Coming To An End

As the last trading day in August comes into focus, it appears that the month may end close to where it started. At least that is where the trading day ended on Wednesday. It has been something of a rocky road for investors this month and heading into September, traditionally one of the weaker months of the year, the outlook for the rest of 2023 is far from certain.

Yesterday the S&P 500 closed at 4,515, up 17 points, the Dow closed at 34,890, up 38 points, and the Nasdaq Composite closed at 14,019, up 76 points.

Daily Chart, Aug. 30

Chart: The New York Times

Monthly Chart, Aug. 30

Chart: The New York Times

Top Losers for the day were HP Inc. (HPQ), down 6.6%, followed by Brown-Forman (BF-B), down 4.0%, and Evergy (IXC), down 2.9%.

Chart: The New York Times

In morning futures trading, S&P 500 market futures are up 5 points, Dow market futures are up 120 points, and Nasdaq 100 market futures are down 16 points.

TalkMarkets contributor Steve Sosnick gives his insights regarding the current state of the market in That Escalated Quickly. Here is some of what he has to say:

"In a week when we were focusing on more widely watched reports like GDP, the PCE Core Deflator, and Nonfarm Payrolls, the JOLTS job openings report jolted stuporous markets into rally mode. Equities got plenty of assistance from big drops in bond yields, with the 2-year note falling 15 basis points, from 5.05% to 4.9%. That is a stunning move...

If you throw a bit of good news into a thin US equity market, the positive vibes can take on a life of their own. We have seen several times this year how equity market rallies can become turbocharged. One recurring theme of this market environment is that speculators are primed to pounce on modest rallies and push them higher throughout the day. Zero-dated (0DTE) options have certainly abetted some of the one-day upswings since they provide ready opportunities for aggressive traders. As we noted in a recent podcast:

I think there is the potential for sort of one day, not gonna say hiccups even, but exacerbated moves on an intraday [basis]. And I do think we’ve seen that particularly on some of the big upside days.

The markets’ mood remains relatively bright this morning, though hardly euphoric. And with VIX falling further, to a current 14.10 level, it is clear that there is little demand for protection from suddenly sanguine equity investors. Let’s see how that pans out over the rest of the week."

Contributor Chris MacIntosh in a TalkMarkets Editor's Choice piece entitled Bull ... Or Bear? takes up a contrarian view to that of Sosnick.

"When you take a closer look, you realize the rally in the Nasdaq this year is not broad based. It is essentially being powered higher by a relative few stocks (we covered that a few weeks ago), while the rest have hardly budged since the start of the year.

Take a look at what’s known as the New Highs-New Lows Index (the cumulative index of the number of stocks making 52 week highs less 52 week lows), which has been trending down since late 2021 and is lower YTD."

"This isn’t bullish. The fact that fewer and fewer stocks are rallying to new highs suggests that the bear market is alive and well and that this year’s rally in the Nasdaq is a sucker rally.

And this isn’t limited only to the Nasdaq, by the way.

The NYSE is very much the same. The strength since October last year simply isn’t broad based, at least not typically what you would see at the start of a bull market.

Now, you might be thinking, “Enough with the theory, already. How can I make money with this information?”

Here are our two practical takeaways from all this:

- It looks like we are still in a bear market, where the next big move for the major market indices is down… or at best we are in for a long period of the market going nowhere but with a lot of +/-20% moves, so index tracking probably isn’t going to be a very rewarding strategy.

- Investments should be REALLY focused on markets/sectors/stocks that are offering great value and where the earnings outlook is positive for the next five years (if you’re a long-time reader, this won’t be news for you as this is precisely what we do in Insider).

We believe that we are in a bear market not unlike the dot-com bear market of 2000-2003, where the Nasdaq did fall some 75% during this time."

Taking a closer look at the macroeconomic dynamics of the US economy, contributor Menzie Chinn writing in GDO, Revised GDP For Q2 charts the revised data points for Q2 Gross Domestic Product and Gross Domestic Output, on a Seasonal Adjusted Annual Rate basis. Not bad, but not as robust as at first blush.

"While GDP is revised down, GDO matches my guess from last month.

Figure 1: GDP advance (light blue), GDPNow as of 8/24 (light blue square), GDP 2nd release (dark blue), GDO guess of 7/29 (pink), GDO (dark red), final sales advance (light green), final sales (dark green), all in bn.Ch.2012$ SAAR. GDO guess assumes net operating surplus drops $100 bn SAAR in Q2. Source: BEA 2023Q2 advance, and 2nd release, Atlanta Fed, and author’s calculations.

GDO grew 1.3% – slower than the downwardly revised 2.1% of GDP (SAAR). Notice that final sales were not substantially revised, with the growth rate at 2.2%.

GDPNow is registering a 5.9% growth rate (SAAR) as of 8/24. Note that other tracking estimates differ. Goldman Sachs is at 2.6% (8/28), Wells Fargo at 2% (8/25)."

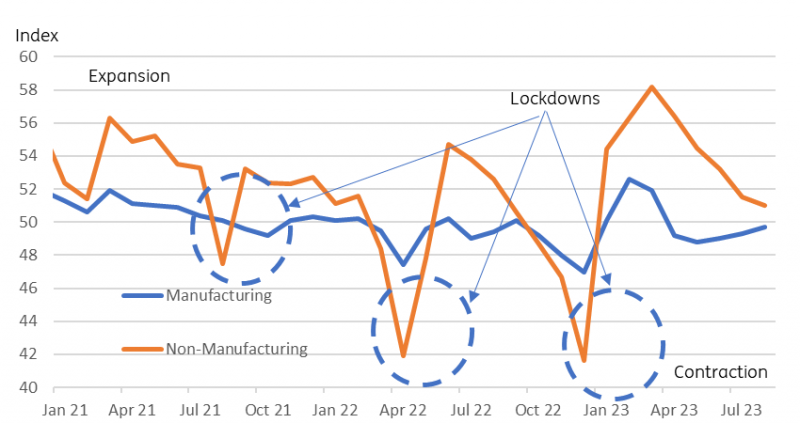

China's domestic economic issues continue to be a source of concern for the global economic outlook as a whole and TM contributor Robert Carnell reports that China PMIs Remain Downbeat.

"The latest official PMI data were not uniformly bad. The manufacturing index actually rose slightly, to 49.7, and this is the third consecutive increase since the May trough of 48.8. But it remains below the 50-level that is associated with expansion, and so merely represents a moderation in the rate of decline. That may be of some comfort to those of a sunny disposition.

The non-manufacturing series, which had reflected the bulk of the post-re-opening recovery, fell further in August. The index of 51.0 was a little lower than the forecast figures (51.2) but it is at least still slightly above contraction territory.

China official PMIs (50 = threshold for expansion / contraction)

CEIC, ING

Brighter signs in manufacturing

Looking at the components underlying both series and starting with the manufacturing series: the latest data show an improvement in production to a point which actually points to expansion. That has to be tempered by the forward-looking elements of orders. Here, the data is mixed. Total orders have improved to hit the 50 threshold signalling that contraction has ended. This must be mainly domestic orders, as the export orders series remains bombed out. But that at least provides some encouragement about the near-term outlook.

Outlook for service sector remains negative

The forward-looking elements of the service sector PMI index remain in contraction territory, unlike their manufacturing counterparts, and that suggests that the headline index has probably not yet troughed and will fall further. A glimmer of hope may be in the export series, which, while clearly continuing to signal contraction, did fractionally rise this month.

Overall, though, both series seem to be converging on a point close to 50 consistent with an economy that is neither expanding nor contracting. Things could be worse. But markets are not likely to take too much comfort from this set of data."

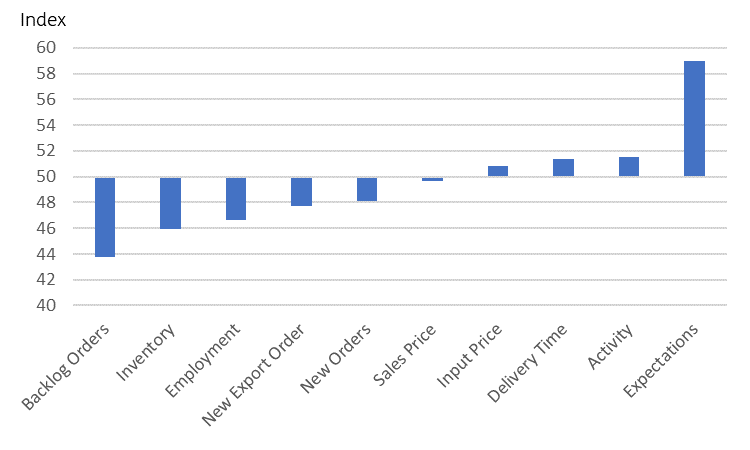

Non-manufacturing PMI sub-components

CEIC, ING

TM contributor Seb notes that Chinese Stock Markets Retreat On Mixed PMI Data And Economic Uncertainties.

"The Shanghai Composite declined by 0.55% to close at 3,120, and the Shenzhen Component lost 0.61% to reach 10,418 on Thursday.

The retreat followed a three-day streak of gains as investors responded to the latest Chinese Purchasing Managers’ Index (PMI) figures."

See the rest of Seb's article for additional comments regarding local market and government reaction to the PMI data.

As for the US economy Tim Fries reports US Hiring Slows To Lowest In 5 Months At 177k Jobs: ADP Report.

"US firms recorded the slowest gain in monthly job additions in 5 months, new ADP data shows.

US companies added 177,000 jobs in August, down from 371,000 in July and missing the estimates by Bloomberg economists of 195,000. The ADP report marks the slowest hiring activity in the country’s private sector in 5 months, indicating a notable slowdown in the labor market.

The slowdown in corporate hiring underscores a downtrend in labor demand, one of the vital inflation drivers. According to ADP, the deceleration was particularly evident in the leisure and hospitality sectors, which have been key growth drivers during the coronavirus pandemic. The two sectors recorded the slowest job gain since March 2022 in August.

Nevertheless, no sector displayed job cuts, while the sharpest gains were seen in education and health services. Moreover, trade and transportation categories also witnessed noteworthy growth.

The change in dynamics comes alongside a downturn in wage growth. Per ADP, employees who retained their existing job positions saw a 5.9% year-over-year median pay increase in August, the weakest gain since 2021. In the meantime, the median jump in annual wages for workers who changed jobs stood at 9.5%.

Following a drop in job openings, the slowdown in corporate hiring suggests that the hot US labor market is cooling down. While many companies are hesitant about making layoffs, the ADP report illustrates that some are scaling back hiring or cutting hours to rein costs. "

The Bureau of Labor Statistics will release their August jobs data tomorrow morning.

Here's to a restful and meaningful Labor Day Weekend.

"The basic goal of labor will not change. It is - as it has always been, and I am sure always will be - to better the standards of life for all who work for wages and to seek decency and justice and dignity for all Americans." - George Meany

More By This Author:

Tuesday Talk: Like A Carousel

Thoughts For Thursday: Thanks For The Bounce, Nvidia!