Thoughts For Thursday: Thanks For The Bounce, Nvidia!

The market bounced higher yesterday on the back of the much anticipated Nvidia (NVDA) earnings report. Whether this will carry through to Friday and Powell's Jackson Hole speech, is a question. Yesterday's deadly plane crash in Russia carrying Wagner Group head Yevgeny V. Prigozhin and the subsequent fall-out is big enough news that it may damper the mood on Wall Street.

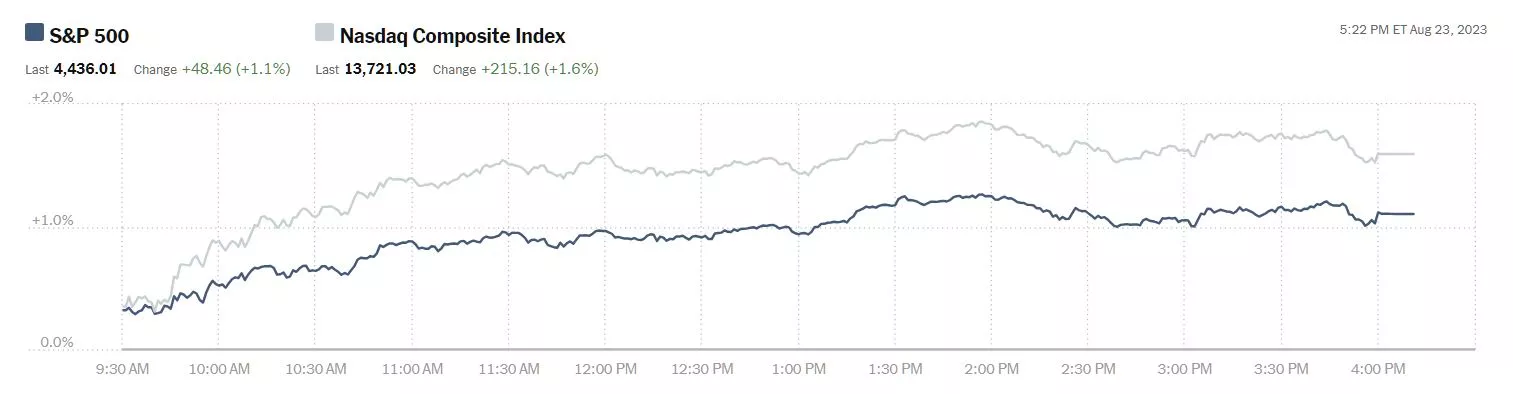

Wednesday the S&P 500 closed at 4,436, up 48 points, the Dow closed at 34,473, up 184 points and the Nasdaq Composite closed at 13,721, up 215 points.

Chart: The New York Times

Most actives were led by Johnson and Johnson subsidiary Kenvue (KVUE), down 0.5% followed by Tesla (TSLA), up 1.6% and Johnson and Johnson (JNJ) itself, down 0.9%. Nvidia, up 3.2% came in fourth.

Chart: The New York Times

In morning futures action S&P 500 market futures are up 24 points, Dow market futures are down 36 points, and Nasdaq 100 mark futures are up 175 points.

TalkMarkets contributor Greg Feirman notes NVDA Delivers A Huge Quarter.

"In “All Eyes On NVDA” I wrote that Nvidia’s quarterly report due out Wednesday afternoon would be the first big test of the idea that this is an “iPhone moment” for Artificial Intelligence (AI). Well: NVDA passed the test, exceeding sky high expectations. Revenue of $13.5 billion far exceeded their $11 billion guidance and they are guiding current quarter revenue to $16.0 billion."

"That is about twice NVDA’s highest revenue quarter ever excluding the one they just reported. Astounding. Clearly the demand for chips to run AI is real and NVDA shares – already up 222% YTD – were up another 8% in the after hours."

Good news is also found in the retail sector where contributor Jharonne Martis reports on the Q2 2023 U.S. Retail Scorecard.

"To date, 160 of the 199 companies in our Retail/Restaurant Index have reported their EPS results for Q2 2023, representing 80% of the index. Of those companies that have reported their quarterly results, 78% announced profits that beat analysts’ expectations, while 5% delivered on-target results and 17% reported earnings that fell below estimates. The Q2 2023 blended earnings growth estimate now stands at 19.4%."

"The blended revenue growth estimate for the 199 companies in this index is 3.3% for Q2 2023. Of those companies that have reported their quarterly results so far, 63% announced revenue that exceeded analysts’ expectations and the remaining 37% reported that revenue fell below analysts’ forecasts."

"Inflation, the ongoing shift towards services, and a cautious consumer are still big concerns for retailers. Of the 160 retailers that have reported Q2 earnings, 94 mentioned inflation...Looking ahead to Q3 2023, 18 retailers issued negative preannouncements, while 14 issued positive EPS guidance so far. Of those retailers offering revenue guidance, 17 warned of disappointing results, while only 12 said revenue might be better than previously expected."

TM contributor Tim Fries finds evidence that the credit crunch is not easing, writing that US 30-Year Mortgage Rate Climbs To Highest Level Since 2000 At 7.48%.

"The US 30-year mortgage rate soared to 7.48% on Monday, resulting in the least affordable homebuying market in the US in four decades."

"With the latest increase, the 30-year mortgage rate nearly tripled in just a few years from the lows recorded during the coronavirus pandemic. In January 2021, the average 30-year rate was as low as 2.65%.

Mortgage rates are heavily impacted by changes in bond yields, which have been rising rapidly due to a combination of factors, one of them being the reduced demand for T-bonds due to the resilient US economy. In addition, the US government’s unceasing borrowing, which boosts the supply of Treasury bonds, also contributed to declining T-bonds prices.

Following a continual increase for 10 straight quarters beginning in the fall of 2020, the median US home sale price has decreased for two consecutive quarters to $416,100. This level is still $87,100 higher than the quarter just before the pandemic, representing an increase of 26.4%.

US residents who purchase the median-priced home with a 20% down payment and an average interest would have to pay an estimated monthly mortgage fee of roughly $2,300. According to the mortgage services firm Black Knight, this is the costliest homebuying market in the US in almost 40 years."

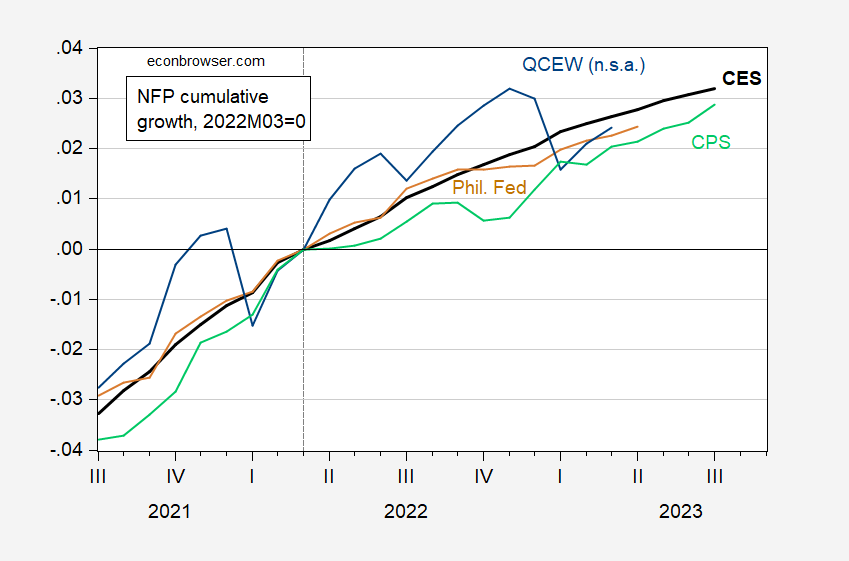

Contributor Menzie Chinn plots the latest Quarterly Consensus of Employment and Wages published by the Bureau of Labor Statistics, QCEW Release And 4 Measures Of NFP Employment.

"Here’s a picture of employment, normalized to 2022M03.

Figure 1: Nonfarm payroll employment from CES (bold black), from CPS adjusted to NFP concept (light green), from Philadelphia Fed early benchmark (brown), all s.a., and from QCEW, n.s.a. (blue), all in logs 2023M03=0. Source: BLS via FRED, BLS, BLS/QCEW, Philadelphia Fed, and author’s caclulations.

While QCEW indicates a slightly lower cumulative growth than the official NFP series, it is only slightly less through March (2.4% vs. 2.6% official, and 2.3% from Philadelphia Fed). Since the graph is in logs, the flattening of the curves indicates deceleration."

See the article for a second graph which addresses seasonality.

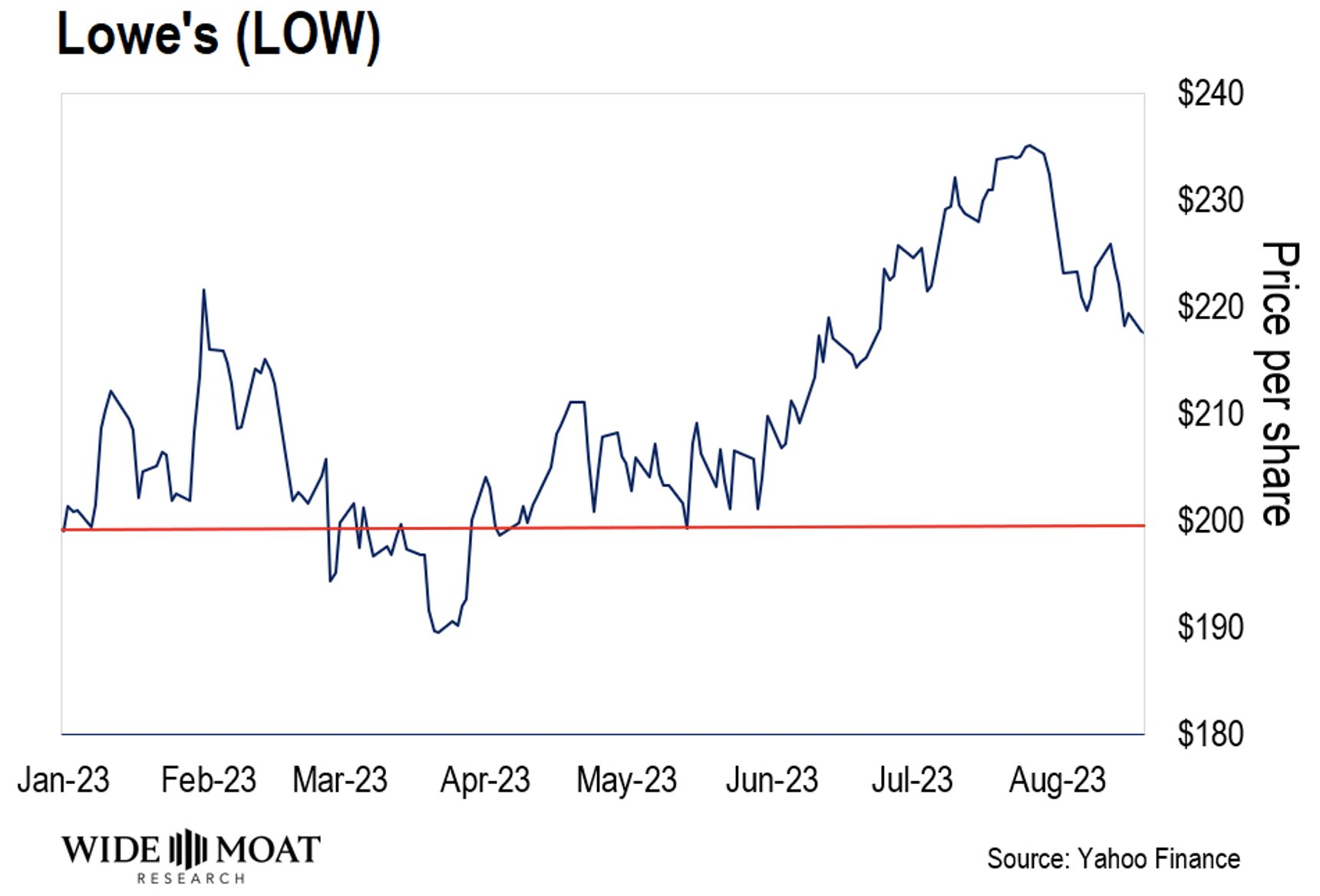

In the "Where To Invest Department" TalkMarkets contributor Brad Thomas discusses the idea that A Stock’s Share Price Is Not As Important As Its Dividend Growth, using Lowe's (LOW), as an example. The article is a bit of a deep dive, but below are some of the highlights.

"Share Price Is Not the Most Important Number

Lowe’s is a retail stock focused on home improvement. There’s nothing flashy about its lumber, plumbing, or garden offerings…

But Lowe’s operates more than 1,700 stores. And it’s one of the 10 largest box-retail stores in the country, along with Walmart, Costco, and Target...

Lowe’s shares are up by 367% during the last decade. Comparatively, the S&P 500 is up by 163% over the same period.

But the year ahead is causing concern for some investors.

Lowe’s is expecting to see sales fall by roughly 9% this year due to higher interest rates hurting the housing/construction markets. That’s made its share price movements volatile this year..."

"The best way we know to reliably make money from the stock market is not to try and time to highs and lows… But to buy and hold shares of great companies.

And it’s not because of their capital gains, but instead, because of their growing dividends.

That’s right, when you focus on dividend growth, share price doesn’t matter anymore.

Because you don’t just own a company like Lowe’s… you get paid to own it.

Right now, every quarter, Lowe’s pays $1.10 for every share. That’s around a 2% dividend yield. It may seem small now, but it adds up quickly – especially considering how much Lowe’s consistent performance has grown that dividend.

The company has raised its annual dividend now for 61 consecutive years. That’s longer than I’ve been alive…

Over the past two decades, it’s grown that dividend 25% annually – on average...

Lowe’s is a proven company that’s been around for decades. And while I don’t expect its share price to go down 32% in the next few years… Its growing dividend gives investors a cushion to weather any kind of volatility.

And it’ll keep exponentially growing over time.

This is the kind of security I look for in sleep-well-at-night (SWAN) investments.

And it’s why I’d rather pay attention to the perfect stair-step pattern on Lowe’s dividend growth chart than its volatile share price movement any day."

Caveat Emptor.

Have a good one.

More By This Author:

Tuesday Talk: Monday Rebound

Thoughts For Thursday: Slipsliding Sideways