Tuesday Talk: Monday Rebound

On Monday, the market rallied to rebound higher after a tough week of sideways and downward action. It remains to be seen if the rebound will be sustainable.

Yesterday the S&P 500 closed at 4,400, up 30 points, the Dow closed at 34,464, down 37 points, and the Nasdaq Composite closed at 13,498, up 207 points.

Chart: The New York Times

Top gainers for the day were led by Palo Alto Networks (PANW), up 14.8%, followed by Moderna (MRNA), up 9.3%, and Nvidia (NVDA), up 8.5%.

Chart: The New York Times

In morning futures action, S&P 500 market futures are up 19 points, Dow market futures are up 80 points, and Nasdaq 100 market futures are up 88 points.

The CME FedWatch tool currently has 84.5% of respondents expecting the Fed to hold rates at its September meeting and 15.5% expecting a rate increase.

TM contributor and chartist Declan Fallon gives a small thumbs up to the Dow in his article Dow Jones Index Defends Support As Breadth Metrics Stall In No-Mans Land.

"I didn't mention this yesterday, but the Dow Jones Industrial Average has managed to defend breakout support, continuing to do so today. While other indices fluff their lines, there is still a buying opportunity for this index. While the index has undercut its 50-day MA, one day's worth of gains would be enough to regain it. While today's volume registered as accumulation, the 'hammer' candlestick, paired with yesterday's, has the potential to be a tweezer bottom assuming a higher finish tomorrow.

The other index to watch is the Semiconductor Index (SOX). This index is an important bellwether for the Nasdaq and Nasdaq 100. The Semiconductor Index did manage a strong rally today, but that only brought it as far as former resistance, resistance that could stall this nascent recovery. The CCI indicator has climbed out of an oversold state (although a technical 'buy' for this index is a cross above 100). Even if it manages to breakthrough tomorrow, it will soon find itself challenging converged 20-day and 50-day MAs.

If there is a warning sign, it's that Nasdaq breadth metrics are caught in a no-man's land and therefore vulnerable to further losses. This could be the start of a more protracted decline, at least until the percentage of Nasdaq stocks on point-n-figure 'buy' signals, and above their 50-day and 200-day MAs, reaches an oversold state. Optimists could argue it's someway from becoming overbought, but realistically, looking at a chart that has delivered a 13-year rally, to see a decline that could go into 2024 after peaking in 2021, is not unreasonable, nor should be seen as surprising.

As an investor, we are in the 'hold' part of the investment. Markets aren't overbought enough to consider profit-taking or covered call selling, but neither are they oversold enough to suggest buying would deliver good value."

See the article for the Nasdaq chart.

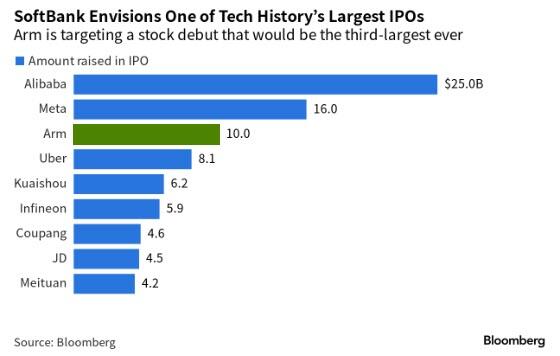

As things continue to heat up in the Semiconductor sector, contributor Tyler Durden reports that SoftBank's Arm Files For IPO.

"In what could be 2023's largest IPO, SoftBank Group's semiconductor unit Arm Holdings publicly filed a registration statement on Form F-1 with the SEC relating to the proposed initial public offering of American depositary shares representing its ordinary shares...Barclays, Goldman Sachs, J.P. Morgan, and Mizuho are acting as joint book-running managers for the proposed offering...Arm plays a pivotal role in the world of consumer electronics, designing the architecture of chips that are found in 99% of all smartphones, making it a key provider of technology to Apple, Google,and Qualcomm...

Bloomberg reports that while Arm had been aiming to raise $8 billion to $10 billion in the IPO, that target could be lower since SoftBank has decided to hold onto more of the company after buying Vision Fund’s stake in it.

Bloomberg has previously reported that Arm was aiming for valuations between $60 billion and $70 billion, as the chip designer tries to cash in on investors’ frenzy for stocks that can benefit from the rise in artificial intelligence.

-

Arm reported $524 million in net income on $2.68 billion in revenue in its fiscal 2023, which ended in March, according to the filing. Arm’s 2023 revenue was slightly down from the company’s 2022 sales of $2.7 billion.

SoftBank Group Corp. (SFTBY), which owns Arm, bought a 25% stake in the company from the Vision Fund at a $64 billion valuation.

Those kinds of levels are high compared with the valuations that investors have awarded smaller Arm competitors like Synopsys Inc. and Cadence Design Systems Inc.

Using the price-to-sales ratios of those public companies for Arm would imply a value of between about $32 billion and $43 billion for the chip designer...

If using an average blended forward price-to-earnings ratio across Nvidia, AMD, Synopsys and Cadence, then Arm would need to generate $1.1 billion of income to justify a $40 billion valuation or around $1.7 billion for a $64 billion value (more than 3x the current level).

Finally, we can't help but wonder - with all the exuberance around chipmakers and AI - whether Arm's long-anticipated IPO could ring the bell on this boom."

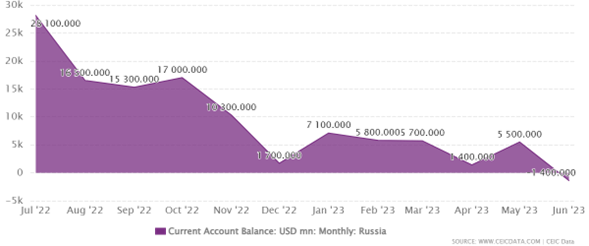

Economist and TalkMarkets contributor Menzie Chinn discusses how Russia’s Current Account Surplus Disappears.

"BOFIT also notes the ruble’s weakening. Here’s a picture of the CA through June.

Source: CEIC, accessed 8/21/2023.

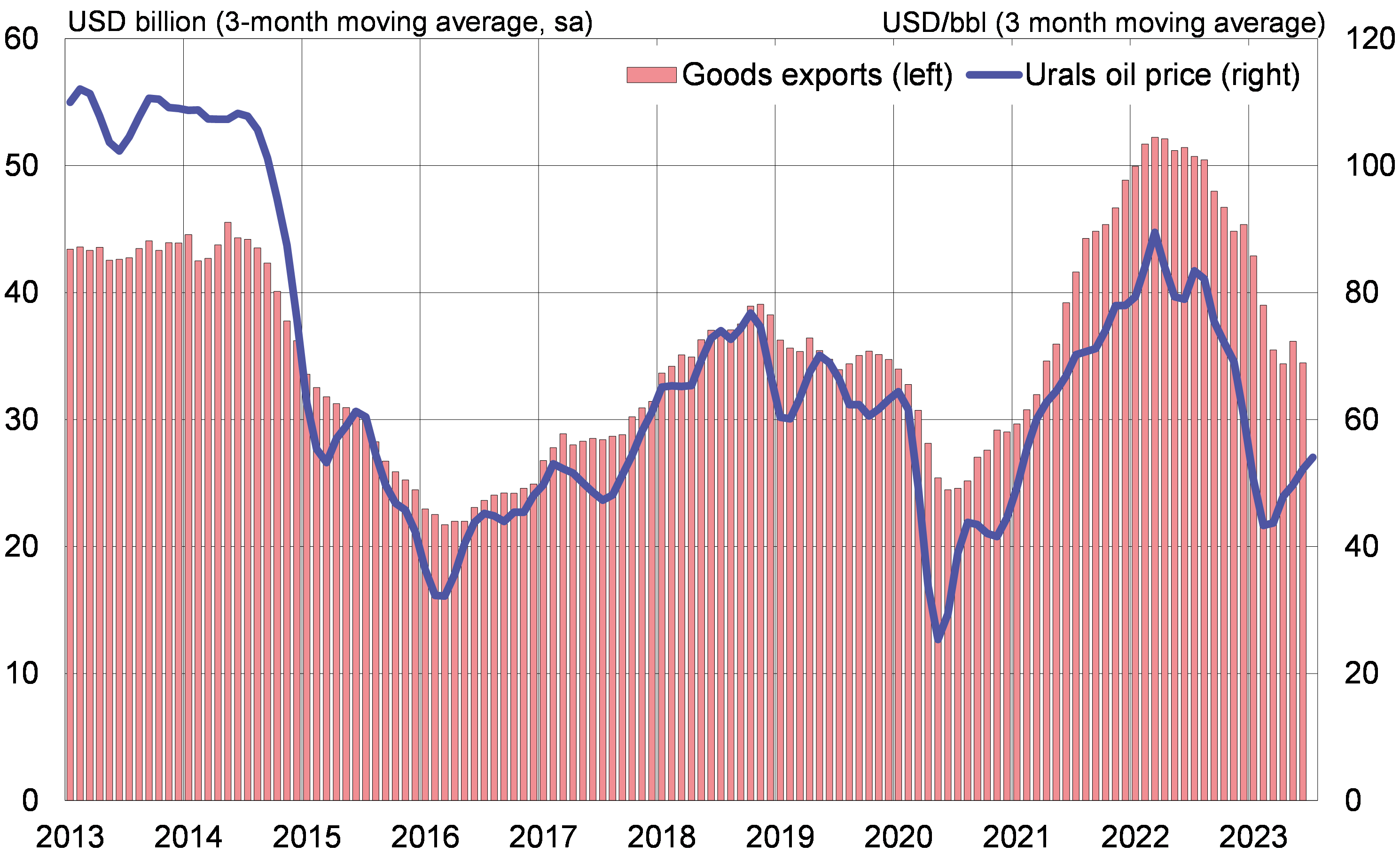

This development is largely driven by the drop in the value of Russian exports:

Source: BOFIT, August 18, 2023.

Heli Simola at BOFIT has a good overview of current and prospective conditions facing Russia. One interesting passage (based on my GoogleTranslate output):

Russia’s goal has also been to alleviate the problems caused by lost imports by increasing domestic production. However, no investments have been made in the necessary production capacity. Total investments did increase in Russia last year as well, but the growth was mainly directed to other than import-substituting industrial production: transport infrastructure, construction and the real estate sector, and extractive production. On the other hand, in the automotive industry, investments collapsed and contracted clearly also in e.g. the manufacture of electrical equipment. The share of the machinery, equipment and automotive industry in total investment has halved over the past decade and was only one percent last year."

None of this bodes well for the Russians or the rest of the world.

In a TalkMarkets "In the Spotlight" piece contributor Norman Mogil writes that also for our neighbor to the North, Waiting For The Anticipated Recession Is Very Tiresome.

"For many economic forecasters waiting for the recession to begin is very frustrating, as the Canadian economy continues to resist tipping over into decline. Starting in 2022, when the Bank of Canada announced it was tackling inflation head on, economists started to point out reasons why we should expect a recession, perhaps as early 2023. The Bank clearly had the pedal to the metal, and issued warnings of future rate hikes...Some of most revered forecasters are still looking a little sheepish as they confront incoming data that refuses to confirm a recession So, why is the anticipated recession not showing up after the most aggressive monetary tightening in over two decades? ...

Federal government spending continues to support economic growth. While Federal spending is below trend line, established during the pandemic period, it continues to represent over 20% of the national income. Recently announced budget trimming does not appear to be significant in the overall trend.

Federal Govt Spending

Debt service ratios have not increased...

The housing market has not collapsed as feared...

Commercial banks are tightening credit conditions but not to the extent feared earlier...

Loans to the Private Sector, Canada

However, do not make the mistake that every aspect of the economy is on solid ground. Business capital formation---- investment in new buildings, new equipment, and software--- is well below historical norms. For this reason, Canada’s productivity performance has been well below that of other advanced nations. Finally, our balance trade is going into the red, a reflection in the slow down in international trade, especially from the impact of the Chinese economic malaise."

A Canadian cautionary tale?

Contributor Tim Fries reminds us that investing in crypto is still an amazingly high-risk proposition noting that Digital Asset Investment Products Saw Outflows Of $55M Last Week.

Image courtesy of 123rf. via The Tokenist

"Outflows in digital asset investment funds rose to $55 million last week amid the industry-wide downturn that sent crypto prices tumbling and pushed market volumes significantly below average. According to CoinShares, one factor that may have contributed to rising outflows are recent reports suggesting that a decision by the US Securities and Exchange Commission (SEC) on a spot Bitcoin exchange-traded fund is not imminent.

Bitcoin (BITCOMP) accounted for most outflows at $42 million, marking a sharp U-turn from the week prior...

The steep downturn in fund flows comes amid the latest crash in crypto prices that pushed the global cryptocurrency market cap from $1.22 trillion to $1.09 trillion over the past week. Bitcoin was on track to record its worst weekly slump since the FTX collapse in November 2022 on Thursday, sending the leading cryptocurrency to as low as $25,392 on that day."

Currently Bitcoin is trading at $26,301.

As always, caveat emptor.

Have a good one.

More By This Author:

Thoughts For Thursday: Slipsliding Sideways

Tuesday Talk: An August Itch