Tuesday Talk: An August Itch

Two weeks into the month of August the stock market continues its itchy mood. While it keeps trying to maintain an upward trajectory it keeps falling short. Bugs and bad weather? Nvidia? Perhaps all three.

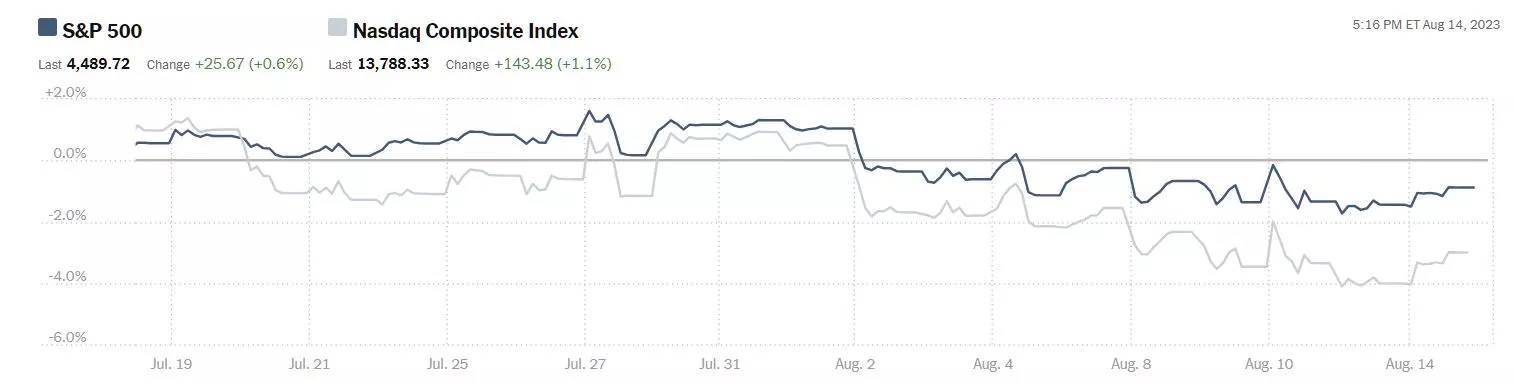

Yesterday the S&P 500 closed at 4,490, up 26 points, the Dow closed at 35,308, up 26 points, and the Nasdaq Composite closed at 13,788, up 143 points.

Chart: The New York Times

A look at the monthly chart illustrates the market's restless behavior. On August 1, the S&P 500 was at 4,577, the Dow was at 35,631 and the Nasdaq Composite was at 14,284.

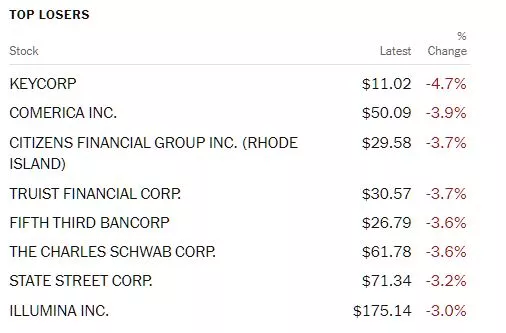

While the market closed up Monday, banking stocks were top losers. Leading the line-up was KeyCorp (KEY), down 4.7%, followed by Comerica (CMA), down 3.9%, and Citizens Financial Group (CFG), down 3.7%.

Chart: The New York Times

In morning futures action, S&P 500 market futures are down 28 points, Dow market futures are down 225 points, and Nasdaq 100 market futures are trading down 97 points.

TalkMarkets contributor Brandon Chapman assesses the month to date market action in a 17 minute video entitled Bears Falter After Their Two Week-Week Streak.

Brandon is bullish on Tech, Nvidia (NVDA), Communications, Energy and Healthcare.

However, contributor Nomi Prins presents a slightly contrarian view writing that Tech Boom’s Bubble May Spell Trouble For Investors.

"The tech rally might have veered into the territory of irrational exuberance.

Look no further than Nvidia.

The chip technology company recently became a trillion-dollar enterprise and the world’s newest tech giant.

Right now, Nvidia is trading at a mind-boggling 24 times its next 12 month’s revenue. That’s not even earnings, just revenue.

And it’s not just Nvidia.

The AI narrative is driving tech returns across the board.

The S&P 500 Information Tech sector has already climbed 41% this year..."

However, using the burst of dot-com bubble as a reference point (see the article for the historical details, with Amazon (AMZN) as her main example) Prins sounds a both bullish and cautionary note.

"...investors overestimated hyped-up companies (during the dot-com bubble) burdened with inflated valuations. And they got the timing wrong.

But they weren’t wrong about the future during the dot-com bubble. Plenty of successful tech businesses founded during that time still dominate today...

(The burst of the dot-com bubble) did teach us that nailing a call on the future doesn’t guarantee you won’t burn cash with bad timing.

So, here’s the lesson for today.

Even though AI is revolutionary, not every AI-related company will be a good investment. Don’t rush into the hype with blinders on. And be cautious about companies with art-based valuations."

TM contributor Crispus Nyaga writes Nvidia Stock Forecast: Irrational Valuation But Don’t Short.

"Nvidia share price has more than doubled this year as AI investments rise.

It is one of the most overvalued companies in Wall Street.

Analysts at Morgan Stanley boosted their estimate for the stock...

Morgan Stanley noted that the company’s growth will continue for a while. Their statement said:

“We would expect durable steady growth beyond that as well, though the current supply chain shortage will likely be less of a factor by second-half of 2024 given that overall industry conditions are oversupplied, with the exception of narrow specialty technologies to support the existing ramps.”

Still, my biggest concern with Nvidia is its valuation. Let us look at the numbers. Nvidia has a market cap of $1.01 trillion. If it was a country, Nvidia would be the 18th economy in the world.

For a company of that size, you would expect it to have billions in revenue, growth, and profits. Nvidia is growing but not as quick to justify a $1 trillion valuation...

So, is Nvidia stock a good investment? To be clear, like Mastercard, Tesla, and Visa, Nvidia has always been a pricey stock. Therefore, it is always difficult to short the company based on these fundamentals.

Nvidia has a great reputation and is a core company in key industries like AI, EVs, data centers, and gaming. All these are multi-trillion industries that will continue growing in the next decade. It is also way ahead of its key competitors like Intel and AMD. Therefore, when investing in Nvidia, the best approach is trend-following and momentum.

The next key catalyst for Nvidia will be earnings, which are set to come out on August 23. Analysts expect the company’s revenue to come in at $11.06 billion, up from $7 billion in the previous quarter."

Caveat Emptor.

With AI fever continuing, I want to draw your attention to a TalkMarkets Editor's Choice column by Shelly Palmer titled, The AI-Driven Stock Market: A Ticking Time Bomb?

"As we stand on the precipice of an overwhelmingly AI-driven financial world, we must ask ourselves: Are we prepared for the potential fallout? Gary Gensler, the SEC chair, has sounded the alarm bells, suggesting that AI could be at the heart of future financial crises...

One of the most glaring risks is the rise of AI-powered “black box” trading algorithms. These algorithms, driven by deep learning models, make decisions that are often opaque to human understanding. The most obvious danger? An improperly tuned algorithm could cause properly tuned algorithms to start panic trading, leading to a market crash...

Regulating these AI models is going to be exceptionally hard. AI algorithmic processes are not easily explainable, making it challenging for regulators to prevent market crashes. As Gensler aptly puts it, “If deep learning predictions were explainable, they wouldn’t be used in the first place.”...

The integration of AI into our financial systems is inevitable. The potential of AI to optimize trading strategies, assess creditworthiness, and predict market trends is undeniable. Gensler’s warnings underscore the intricate dance between innovation and regulation. As AI algorithms, with their inscrutable logic, become the backbone of our financial systems, the challenges those algorithms pose are multifaceted, from the unpredictability of “black box” trading to potential biases in credit assessments. The convergence on shared datasets further complicates the picture, introducing vulnerabilities that could ripple through markets..."

These are Palmer's main points, but a look at the full article is merited.

Looking for relief (maybe it's the heat...) from too much boom and bust commentary? Economist and TM contributor Scott Sumner writes Bubbles Don't Exist - Example No. 761.

"Since I began blogging in early 2009, I’ve cited one example after another of how “bubble” claims were completely meaningless and worthless, the sign of sloppy reasoning. (Akin to “rolling recessions”, or “long and variable lags”, or “greedflation”)

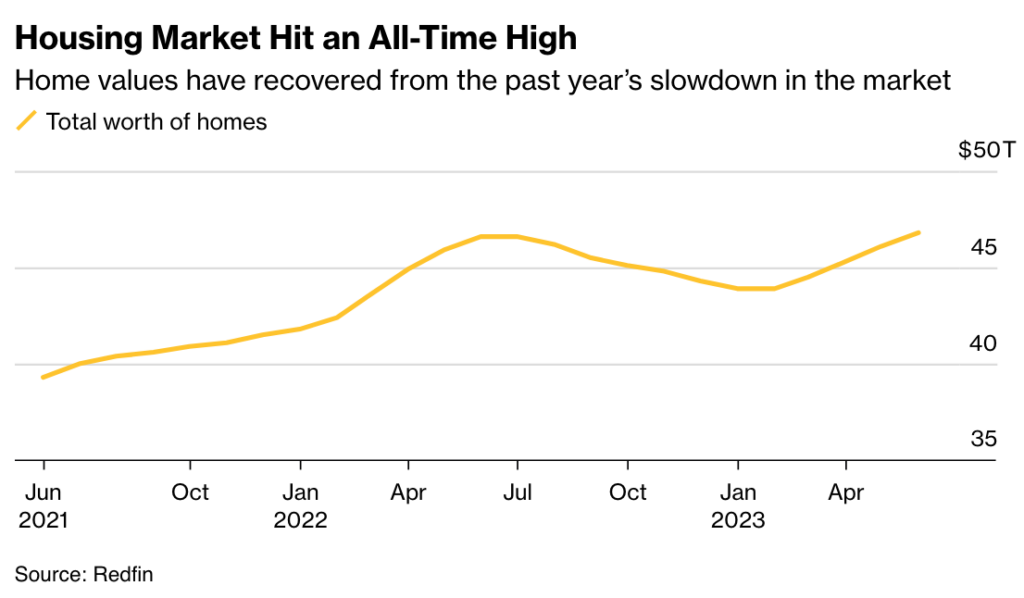

The tech bubble of 1999? Nope, prices were rational. A housing bubble in 2006? Nope, prices were rational. Bitcoin a bubble at $30? Today, the price is near $30,000!

With low interest rates after 2010, bubble claims began to reach frenzied proportions. One of my favorites was that “artificially low interest rates” (a sign of sloppy reasoning right up there with greedflation) had created a housing bubble. With the end of the low interest rate environment, surely that bubble was about to pop!

Nevermind ..."

"You can go onto twitter and read all about how high interest rates are tight money, how the economy blows one bubble after another, how fiscal policy drives aggregate demand, how corporate greed drives up prices, how we are experiencing a rolling recession, how those “long and variable lags” will eventually kick in, and how “industrial policies” help the economy...

MEGA! (Make economics great again.)

PS. Some people cite the tulip thing, which is still disputed. In any case, when you have to go back to the 1600s to find an example ..."

![]()

![]()

![]()

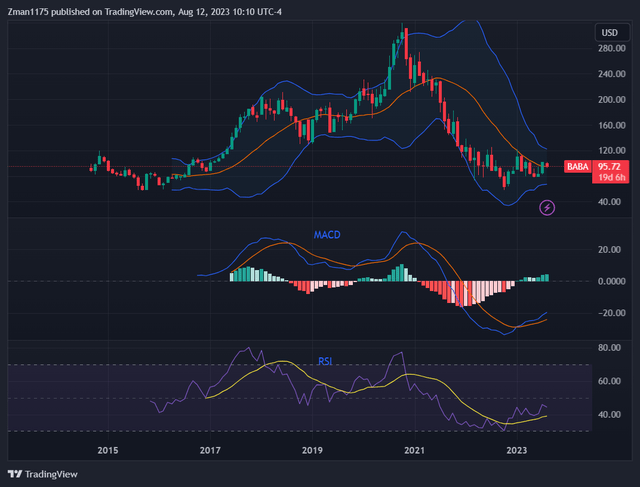

Closing out the column in the "Where To Invest Department", contributor David Zanoni posits Alibaba: Plenty Of Upside Runway.

"I zoomed out to the monthly chart, where each candle represents an entire month. We can see a large rise and fall over this time period. Alibaba's stock is currently bouncing higher from the long-term, multiple-year support level just below $60.

The chart is really an illustration of the various events of Alibaba's (BABA) history before, during, and after the COVID pandemic. Alibaba's strong growth led to strong stock gains before the pandemic. China's strict COVID-related lockdown led to lower growth for Alibaba and a sharp sell-off in 2021 and 2022.

Now, with China's reopening in place, Alibaba's stock has recovered and is poised to move higher from a low valuation (forward PE of 10.8 & PEG of 0.57) and strong expected growth (3-5 year earnings CAGR of nearly 19%)...

The stock could continue to pull back a bit on continued profit-taking/market correction in the near term. I would take an educated guess that the stock wouldn't drop below $90, keeping the new longer-term uptrend intact. The $90 level is at the bottom line of the Bollinger band, which could act as a support level. The long-term, multiple-year outlook is positive as the company's expected growth indicates...

Analysts have a one-year price target of $138 for the stock, which is 44% above the current price. This price target would take the forward PE up to 16 based on expected EPS of $8.59 for FY24. That looks reasonable for this tech-related growth stock."

See the full article for more charts and further techincal analysis.

As always, caveat emptor.

Have a good one.

Stay cool and keep the bug repellent close by.

More By This Author:

Thoughts For Thursday: Two Cups Of Coffee With the CPI Report

Tuesday Talk: Waiting For The CPI, Market Takes No Prisoners