Alibaba: Plenty Of Upside Runway

Andrew Burton

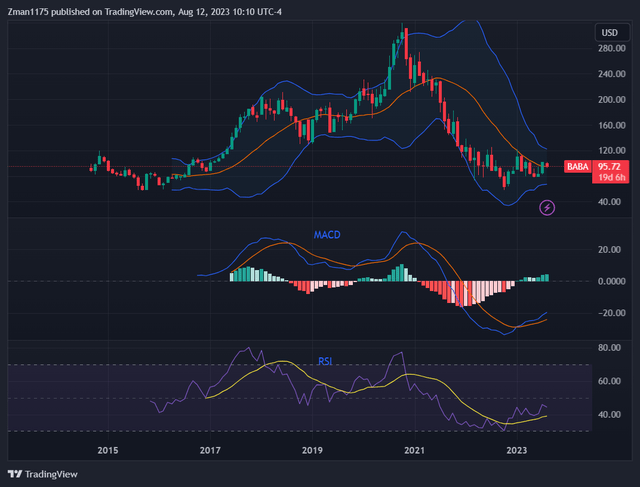

Alibaba Group Holding Limited (NYSE: BABA) was certainly a volatile stock over the past decade. The stock experienced significant increases and declines before, during, and after the COVID pandemic. China's reopening increased economic activity and should act as a tailwind for Alibaba. While many others have covered Alibaba's low valuation, recent earnings results, and future expected growth, I will focus on technical analysis of the stock which supports a bullish thesis.

Alibaba's Long-Term Outlook: Monthly Chart

Alibaba's Monthly Stock Chart (tradingview.com)

I zoomed out to the monthly chart, where each candle represents an entire month. We can see a large rise and fall over this time period. Alibaba's stock is currently bouncing higher from the long-term, multiple-year support level just below $60.

The chart is really an illustration of the various events of Alibaba's history before, during, and after the COVID pandemic. Alibaba's strong growth led to strong stock gains before the pandemic. China's strict COVID-related lockdown led to lower growth for Alibaba and a sharp sell-off in 2021 and 2022.

Now, with China's reopening in place, Alibaba's stock has recovered and is poised to move higher from a low valuation (forward PE of 10.8 & PEG of 0.57) and strong expected growth (3-5 year earnings CAGR of nearly 19%).

Continue reading on Seeking Alpha.

More By This Author:

American Airlines Stock: What To Expect For The Long Term

Leidos: Likely To Thrive With Ongoing Defense Contracts

Tesla SWOT Analysis

Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives.

Disclaimer: The article is for informational purposes ...

more