Tesla SWOT Analysis

Our SWOT analysis are meant to serve as a baseline for doing research on companies that we might invest in at certain prices. As Warren Buffett has repeated many times, only by getting to know a company's business, can we start to understand whether or not to invest our hard earned money.

Tesla (TSLA) operates as a popular and unpopular designer, manufacturer, and seller of high-performance fully electric vehicles [EVs]. The company also produces, installs, and maintains energy generation and storage systems (rechargeable lithium-ion battery systems, solar energy systems, and sales of renewable energy.

Tesla is credited as being the world's first vertically integrated sustainable energy company.

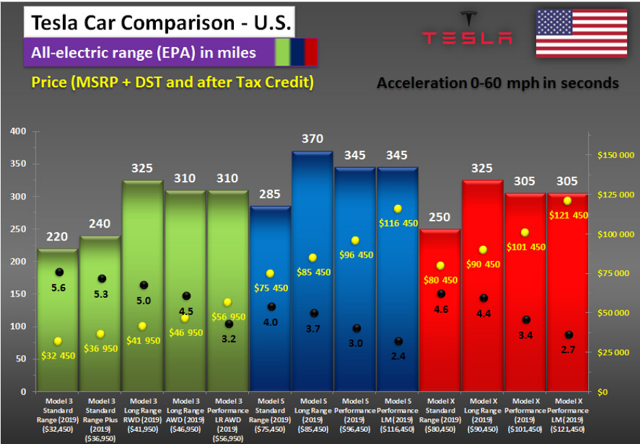

Tesla sells the high-end Model S [sports sedan] and Model X [SUV] EVs. These appeal to wealthy consumers as these models can cost over $100,000 with certain options added-on. The company produced the lower-priced Model 3 to be affordable to more consumers. However, Tesla is only recently selling the Model 3 at the $35,000 price. The Model 3 was previously selling at $40,000 and higher when it was first launched in 2016. The average selling price of the the Model 3 was over $55,000 in 2018.

Tesla is the automaker with the highest revenue growth. However, the company only had two quarters of profitability in Q3 and Q4 of 2018. So, Tesla is challenged with getting costs down while selling a lower-priced EV that is affordable to a wider number of consumers.

Tesla is a company with a lot of future potential. Tesla's business 5 to 10 years from now could be very different from how the business looks today. Tesla could evolve into more of an energy company if they are able to increase sales of solar panels and possibly sell batteries or license their technology to other companies and consumers.

However, the stock must be considered risky and speculative as the company struggles to become profitable while trying to grow at a strong pace. If Tesla executes effectively, the stock can be a winning investment over the long-term.

Strengths

Tesla's collection of strengths allows the company to stand above the competition, which can be a long-term driver for their success.

- Strong brand image - a brand that consumers aspire to.

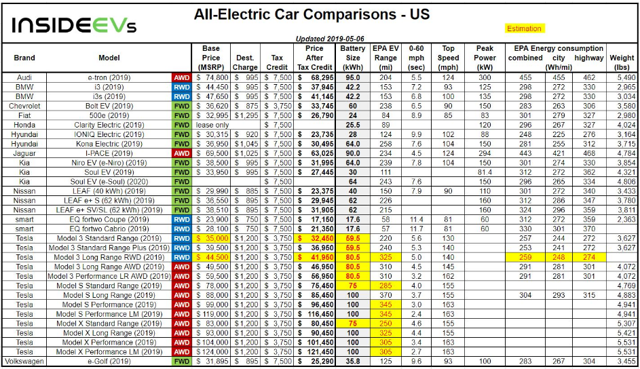

- EVs with longer range capabilities as compared to the competition (some of Tesla's models can achieve over 300 miles on a single charge, while the Nissan Leaf gets 150 miles to 226 miles, the Chevy Bolt gets 238 miles, the Jaguar i-Pace gets 234 miles.

- Eco-friendly product - appeals to environmentally-sensitive consumers.

- Leader in EVs - Tesla has the highest revenue growth as compared to other automakers.

- Supercharger network of charging stations makes charging easier and more convenient for Tesla owners.

- Elon Musks' engineering expertise and vision keeps the company's technology on the cutting edge.

- The company's strong engineering and vision for innovative earth-friendly products with high performance appeals to environmentally-conscious consumers.

source: insideevs.com

Weaknesses

Tesla's stock should be considered risky and speculative as a result of some of the company's weaknesses, which can have a large impact on their ability to remain solvent.

- Tesla spends large quantities of money for research & development [R&D] and production, leading to net losses.

- Weak balance sheet: negative working capital (current liabilities are higher than current assets) - could slow growth and puts the company at risk of default.

- Elon Musk's unpredictable behavior (questionable tweets, questionable company claims) could be a turn-off for some investors and puts the company at risk of SEC scrutiny.

- The company is challenged to profitably produce EVs that price-conscience consumers can afford.

- Tesla lost its recommendation from Consumer Reports for the Model 3 as a result of issues with door handles, cracked windows, loose interior trim/ molding, and paint defects.

- Supply chain limitations - had to use employees to volunteer to deliver vehicles to their customers.

- Production challenges - Model 3s were built in a tent to reach production goals in 2018.

Opportunities

Tesla has plenty of opportunities to build on the success that they already achieved as the world moves towards the increased use of EVs and renewable energy.

- Develop or adopt improved battery technology and production to lower the cost of their EVs - this can help Tesla achieve sustained profitability. Tesla could also consider selling batteries to other companies or licensing their technology to them.

- New vehicle models: Model Y (lower priced SUV as compared to Model X), Semi truck (to drive the future of commercial transportation), pick-up truck (new market where the traditional automakers have had strength), new version of the roadster (provides another model for high-end consumers).

- Expand the energy generation/storage business to residential & commercial markets.

- Gain production efficiencies at the manufacturing level to drive down costs.

- Continue to develop self-driving vehicle technology.

- Expand globally for EVs and the energy business.

Threats

Tesla faces various external threats that could lead to slower sales growth, challenge them to grow market share, and/or make it difficult to sustain profitability.

- Competition remains the largest threat as other automakers increasingly produce EVs. On the high-end, Tesla faces competition from Jaguar, Audi, BMW, and Mercedes Benz who have or are planning to produce luxury electric vehicles. Tesla's Model 3 competes with the Chevy Bolt and Nissan Leaf with Volvo and Volkswagen planning to launch EVs in 2019.

- Sustained low oil prices could reduce demand for EVs.

- The $7500 U.S. federal tax credit for EVs expired for Teslas purchased in 2018 because Tesla hit the 200,000 vehicles sold threshold. This tax credit for Tesla's EVs was cut in half to $3750 in the beginning of 2019 and will be reduced to $1875 after July 1, 2019. However, a bill known as the Driving America Forward Act has been proposed to increase the tax credit to $7000 and allow for an additional 400,000 EVs sold per manufacturer before the tax credit is reduced. That would be in addition to the 200,000 threshold for the $7500 tax credit. The bottom line is that Tesla is subject to the government's decisions on the these credits which could affect affordability and demand for their EVs. Reductions in these credits could negatively affect sales, especially for the more price sensitive consumers that are considering the Model 3.

- Tesla is subject to government regulations for self-driving vehicles, which could delay the company's plans to get autonomous vehicles on the road legally.

Long-Term Business Outlook for Tesla

While Elon Musk can be perceived as erratic, the positive aspect to his managerial style is that he is driven to do what is necessary to reach the company's goals. Some people laughed at building vehicles in a tent, but this was a creative decision to achieve production goals in a limited time frame.

The decision to have employees deliver vehicles directly to customers is another example of creative management to achieve goals. With that mindset, Musk can steer the company to avoid bankruptcy, achieve sustained profitability and to possibly shape the company into more of an energy firm over time.

With competition increasing for EVs, expect Tesla to continue innovating to remain a step ahead. For example, Tesla's EVs have the highest mileage range on a single charge as compared to competing EVs. They also have their own battery charging network. That gives the company an edge over the competition for an issue that is important for many consumers (range anxiety). Continued focus on being a little better than the competition can allow Tesla to grow at an above average pace even with more EV competitors in the market.

When we reach the point where EVs are equal to or less expensive in price than equivalent ICE vehicles, the sales of EVs are likely to accelerate. The declining costs of lithium-ion batteries is the main factor that will reduce the cost of EVs. Tesla is poised to benefit from this trend as they remain a step ahead of the competition for EV technology. Lower battery costs will also help Tesla achieve sustained profitability as the cost of good sold decreases.

Disclosure: I'm long the ARKW ETF which currently has a 10.8% position in Tesla.

I contribute to Kirk Spano's Margin ...

more