American Airlines Stock: What To Expect For The Long Term

Image Source: Unsplash

Some of the best-valued stocks in the market today include the airlines. I've covered some recently here, here, and here. The airlines have been recovering from the pandemic-related slowdown. Air travel demand has been strong and is expected to remain strong for multiple years. Given the low valuation and strong expected growth, I expect most airlines to outperform the broader market through the remainder of the decade. American Airlines (Nasdaq: AAL) is one of the beneficiaries of strong air travel demand.

American Airlines is another major airline with a low valuation and strong expected future growth. The company's growth is being driven by strong bookings from consumer interest in spending on experiences and air travel, along with increased business travel. The company's return to profitability in 2022 and 2023 after two years of pandemic-related losses is another positive to help drive the stock higher.

Room for Growth

While American is seeing strong record demand, there is room for improvement in other areas. American has not yet returned to the capacity that it had prior to the pandemic in 2019. The company believes (according to CEO, Robert Isom) that the airline industry will return to the historic relationship between airlines revenues and GDP, which is 9/10 of a percent of GDP.

American Airlines plans on increasing capacity by 5% to 8% in 2023 to better serve the increase in demand that the company is experiencing. One challenge that they have with increasing capacity is securing enough pilots to fly the 150 regional aircraft that American plans to deploy over the next 18 to 24 months. However, the company is working diligently to accomplish that. The company also believes that they can get an additional 2% to 3% of utilization from the existing fleet.

The global airline market is expected to grow at an annual pace of about 3.7% to 2030. This growth is expected to be driven by rising disposable income, increased demand for air travel, and the growth of the tourism industry. This industry growth should provide a positive tailwind for American Airlines to increase revenue and earnings to 2030.

American Airlines is expected to grow revenue by 7.7% in 2023 and by about 4% in 2024. EPS is expected to grow 492% in 2023 and 10% in 2024. The expected growth rate is skewed high for 2023 as a result of pandemic-related issues and higher fuel prices last year.

Technical Perspective

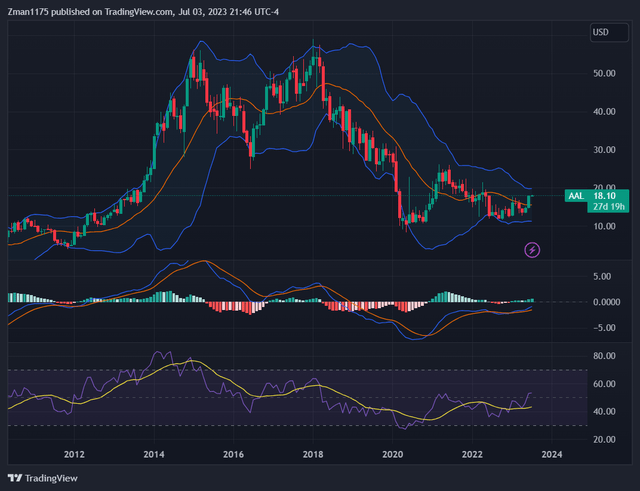

American Airlines monthly stock chart w/price, MACD, RSI (tradingview.com)

Continue reading on Seeking Alpha.

More By This Author:

Leidos: Likely To Thrive With Ongoing Defense Contracts

Tesla SWOT Analysis

Disney Stock: An Investing Strategy To Consider

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

Disclaimer: The ...

more