Disney Stock: An Investing Strategy To Consider

The Walt Disney Co. (DIS) is a company that is poised to benefit from their legacy businesses and from new growth from the upcoming Disney+ streaming service which is set to launch in November at a low price of $7 per month. However, the market has been anticipating this launch as the stock increased from $100 to the current price of $146 for a 46% gain since Christmas of 2018.

The new Disney+ service was the positive catalyst that investors were looking for. The stock was previously trading range bound below the peak of $120 which it hit in July 2015. That level was finally exceeded earlier this year as more clarity was released regarding the new streaming service. However, there are a few reasons why this rally may stall out over the next few months.

Disney Technical Stock Perspective

It looks like the good news is priced in at the moment. The stock reached an overbought level according to the RSI reaching over 70, but is now dipping below that level, showing a loss of price strength. The MACD increased to an extremely high level and looks ready to drop back down. Money flow has been decreasing slightly from a peak level that was reached in April.

From a technical perspective, the stock looks ready for a pullback. The last time the stock was overbought on the RSI, it pulled back from about $112 down to the $90s. The stock could also trade sideways for a while. However, the technicals indicate that the stock is not likely to increase much further before pulling back. This isn't a guarantee, but temporary profit taking looks likely at these levels.

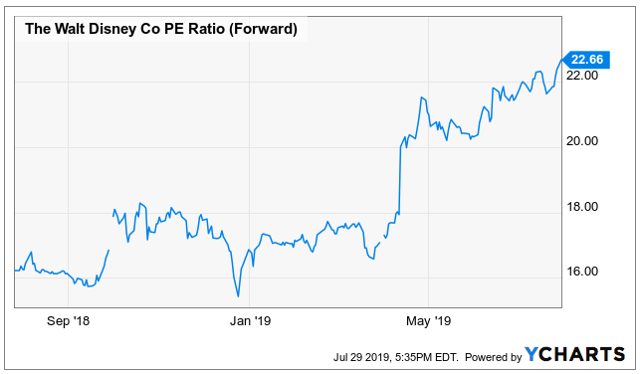

Valuation is Above the Long-Term Averages

The fundamental valuation metrics reinforce the idea that the stock is due for a pullback. The forward PE ratio increased to 22.6, which is 31% above the 5-year average of 17.24. The EV/EBITDA ratio is now trading at 18.9, which is about 72% above the 5-year average of 11. The price to sales ratio of 4.4 is trading 38% above the 5-year average of 3.18.

After the large run-up in the stock price, the valuation is trading significantly above recent historical average levels. As a result, large investors could be looking to take some profits off the table.

The anticipation of the new Disney+ streaming service looks priced in to the stock. From here, investors will probably want to see how the actual subscription sales materialize after the service launches. Therefore, the stock has a good chance of stalling out over the next few months.

Upcoming Earnings Report Could Be a Sell the News Event

Disney is scheduled to report earnings on August 6. Even if the company exceeds estimates and provides positive future guidance, I don't see the stock rising significantly. The reason for that is because the stock already increased at a much higher than average pace this year. So, any good news is probably already priced in to the stock.

Even if the stock does spike higher on earnings, it could provide an opportunity to lock in gains.

The Strategy: Covered Calls

For those who already own at least 100 shares of Disney, the covered call strategy will allow you to extract additional money from the investment if the stock moves sideways or down through the next month and a half.

Consider selling the September $150 call option which has a premium of about $322 ($3.22 x 100 shares). You can sell one call option for every 100 shares that you own. By selling the call option, you get the $322 credited to your account. That is the equivalent of getting a quick 2.2% return based on the current stock price. So, it is like creating your own extra dividend payment.

The $150 strike price is out of the money (higher than current price) and likely to decay in value by the September 20 expiration if the stock remains below $150. The risk to this trade is that if the stock price increased to $150 by the September 20 expiration date, you could be forced to sell the underlying stock at that strike price. But, you would probably be locking in a solid gain if that happened (depending on when you bought the stock). So, only sell covered calls if you are willing to sell your shares if the stock increases to the strike price.

If you want to reduce the chance of being called away and just collect some premium, you could pick a higher strike price. The $155 strike price for the September 20 expiration will give you less premium of about $177. However, the underlying stock price would have to increase to $155 by September 20 before the stock would be called away. So, you would get a wider cushion which would lessen the chance of being forced to sell.

You could also consider the covered call as a way to make a trade on the stock with a defined exit strategy. For example, lets say you don't own the stock, but want to purchase it to make a quick return. You buy 100 shares of Disney at $146 and then sell the September 20 $155 call because you think $155 would be a great price to exit the stock. You get the $177 premium for selling the call. If the stock rises to $155, you could exercise the option and sell the stock for a 7% profit ($9 per share gain plus the $1.77 per share premium for selling the call option). If the stock remains below $155 by the expiration date, you could keep the stock and repeat the process by selling another call option at an exit price of your liking.

Note that the stock price has moved since this article was written and the stock/option prices have changed. So, you could choose different call options to sell at this point.

For those who don't own Disney stock and missed the recent move higher, a better buying point could be coming up on a pullback given the current technical and valuation levels. Overall, I think that Disney will perform well over multiple years, I just think a temporary pullback was due for the stock.

I contribute to Kirk Spano's Margin of Safety Investing where we offer a more in-depth analysis of individual companies. Subscribers have access to a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) on Disney and for other companies. These are balanced, unbiased articles that help investors decide whether to invest in a company.

Try Margin of Safety Investing free for two weeks and get your first year for 20% off.

Learn our 4-step investment process that top hedge funds use.

Invest with us in a changing world that demands a margin of safety.

Note: This article was previously released exclusively for subscribers of Margin of Safety Investing. The stock has dropped ...

more