Tuesday Talk: Waiting For The CPI, Market Takes No Prisoners

Despite hits to Apple and Tesla, the market was punching upwards on Monday, while waiting for the July CPI data to come in on Thursday, morning.

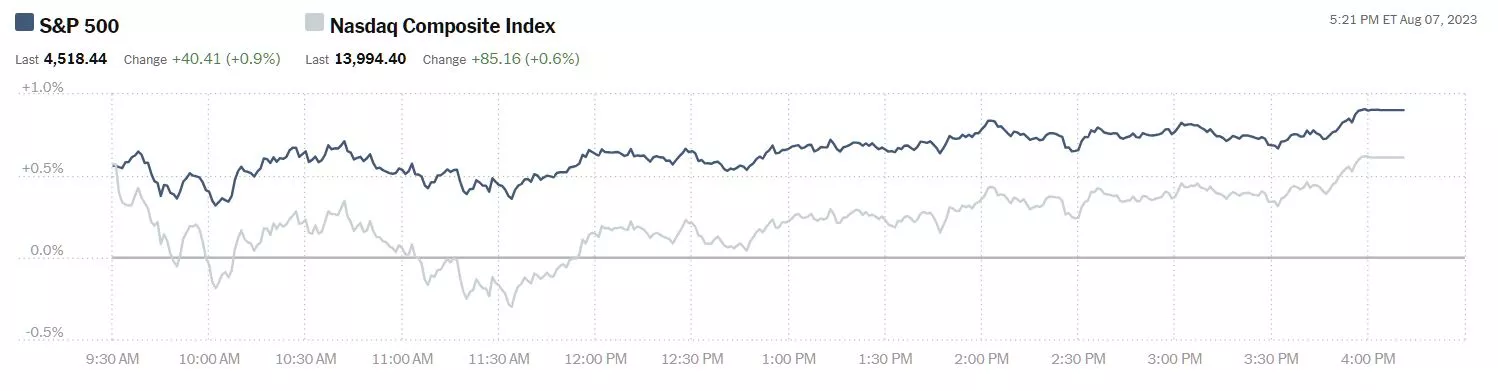

The S&P 500 closed at 4,519, up 40 points, the Dow closed at 35,473, up 408 points and the Nasdaq Composite closed at 13,994, up 85 points.

Chart: The New York Times

Most actives were led by Tesla (TSLA), down 0.9%, followed by Apple (AAPL), down 1.7%, and Amazon (AMZN), up 1.9%.

Chart: The New York Times

In morning futures action, S&P 500 market futures are down 20 points, Dow market futures are down 136 points and Nasdaq 100 market futures are down 76 points.

This morning we bring you an eclectic (Dog Days of August) round-up of topics on the minds of TalkMarkets contributors as we wait for the CPI data to be released on Thursday.

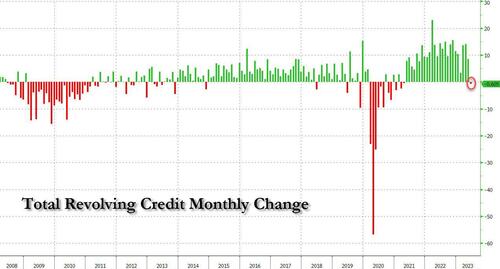

Contributor Tyler Durden reports that Consumers Finally Crack: Shocking Drop In June Credit Card Debt Marks End Of Spending Binge.

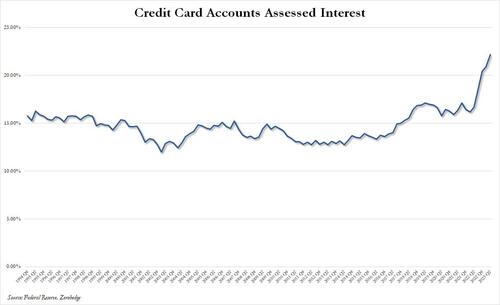

"Amusingly, in our commentary last month, we also said that "with non-revolving credit now shrinking, the final straw will be the reversal in (record) credit card debt. With credit card interest rates also at a record 22.16%, we won't have long to wait."

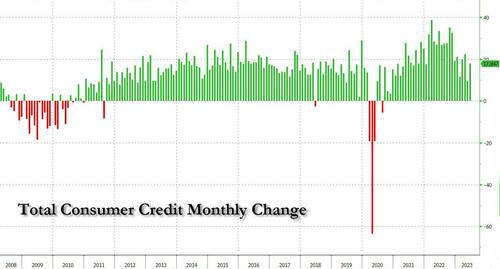

We were right as we had to wait just one month because fast forwarding to today's release of the latest Fed consumer credit report at 3pm ET, moments ago we had another shocker, this time on the other side of the credit spectrum, because while non-revolving credit jumped by a whopping $18.5 billion, up from last month's drop..

... it was the revolving credit that was the jawdropper this month, because after several months of solid increases, including a near-record $14.8 billion in April, in June credit card debt actually dropped by $0.6 billion - the first negative print since April 2021 when the US consumer was still in shock from the post-covid reality and was aggressively saving money, money which has now been long spent - as Americans actively paid down their debt, something they only do when a recession looms!

Needless to say, a drop in revolving credit is a stunner because outside of a crisis, this is usually indicative of an end-of-cycle recession, when US consumers - traditionally responsible for 70% of US GDP with their debt-fueled purchases - go into hibernation and start to repay their bloated credit card bills, which as of today are accruing a mindblowing 22% average interest (see below).

Adding across these two categories, the total June consumer credit print was +$17.85BN which was entirely thanks to the $18.5BN increase in non-revolving (student and auto loans) credit.

...Meanwhile, with average credit card interest rates rising above 22% to a new record high...

... this month's drop in credit card debt was just the beginning..."

You can be sure other pundits will also be watching the consumer debt numbers for signs the economy is cooling off.

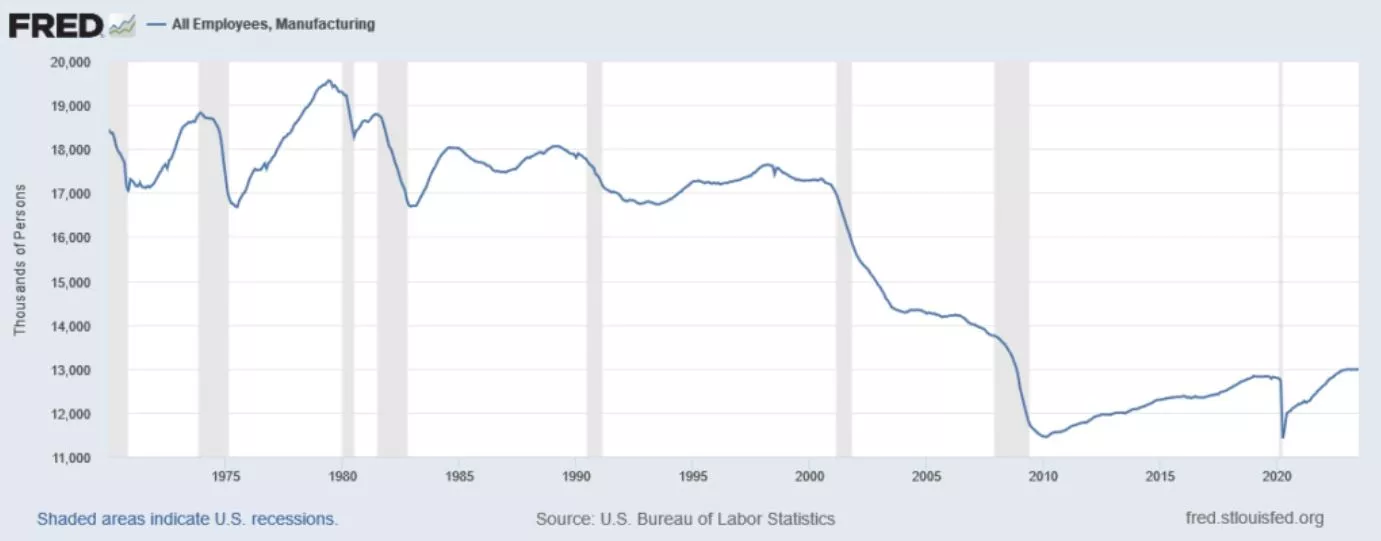

Economist and contributor Dean Baker says the decline in U.S. manufacturing jobs is not just a case of globalization in Manufacturing Jobs And Trade: A Tale Of Two Graphs. Below are some of his findings.

"The first decade of this century was pretty awful for manufacturing workers. In December of 1999 we had 17.3 million manufacturing jobs. This number had fallen to 11.5 million by December of 2009. This amounted to a loss of 5.8 million jobs, or one-third of all the manufacturing jobs that had existed at the start of the decade. That looks like a pretty big deal."

"We lose manufacturing jobs in a downturn, but get them back when the economy recovers. That didn’t happen with the recovery from the Great Recession (2008).

This matters because manufacturing was traditionally a heavily unionized sector. Due to its high unionization rate, manufacturing jobs paid a wage premium over jobs in other sectors. This was especially important for workers (primarily male workers) without college degrees. Manufacturing was an important source of high-wage jobs for workers with less education.

The lost jobs in this period were disproportionately unionized jobs. In 2022, the unionization rate in manufacturing was just 7.8 percent, only slightly higher than the 6.0 percent rate for the private sector as a whole."

"(On the other hand) Suppose we look at manufacturing employment as a share of total employment. Here’s that picture.

It doesn’t look like anything special is going on in the first decade of this century. The manufacturing share of employment had been dropping for decades. The 00s don’t look very different from 1970s, 1980s, and 1990s. What is there to complain about?

This is the graph that proponents of U.S. trade policy like to tout. But there is another graph. This one just shows manufacturing employment since 1970.

While there are cyclical ups and downs in the prior three decades, there is only a modest downward trend over this period. That changes in a big way when we get to the 2000s. You can’t look at this graph (or at least I can’t) and say that the 00s were just more of the same.

This was the period where we saw a massive loss of manufacturing jobs in places like Ohio, Michigan, Pennsylvania, and Wisconsin. The economy looked very different in these states at the end of the decade than it did at the start of the decade.

I will make one other point here. No one should say that the issue here was “globalization”. "

See Baker's full article for additional insights.

TM contributor Nomi Prins asks What Could Happen To Bitcoin’s Price If The SEC Approves A Spot Bitcoin ETF?

"So how much money could flow into Bitcoin (BITCOMP) with the launch of a spot Bitcoin ETF? Let’s do the math…

Take the top 100 asset management companies, which manage around $56.8 trillion. We’ll round it up to a neat $60 trillion.

Let’s assume that only 1% of all that money makes it into Bitcoin. That’s roughly $600 billion.

Right now, Bitcoin’s market cap is $565 billion.

If that $600 billion from those top 100 asset managers flows into Bitcoin, it’d double Bitcoin’s market cap.

That’s not far-fetched given that Bitcoin’s market cap was at roughly $1.2 trillion in November 2021.

Doubling the market cap should result in Bitcoin’s price doubling, too. That would put the price of one Bitcoin at about $58,000 – up from just over $29,040 today.

Now, again, there is no crystal ball to tell us what Bitcoin will do next.

But I am confident that if there’s $600 billion worth of real money trying to do real buying… Bitcoin’s price will probably do more than just 2x.

And that’s based on just 1% flowing in from the top 100 asset managers. It doesn’t include all the other money sloshing around the economy, waiting to get into Bitcoin."

See the article for a comparison to the price of gold following the establishment of the SPDR Spot Gold ETF.

TalkMarkets contributor Bob Williams takes a look at current workforce quitting trends in Is Parting Such Sweet Sorrow?

The full article makes for a fascinating read; here are some hightlights:

"In the last three years, changes in the U.S. employment market have been more rapid than bullets from a machine gun. And just when we thought things were settling down, now the newest, latest trend in employment has emerged. As with all its predecessors, this change is about employee attitude...

First, we got “The Great Resignation.” Beginning in April 2020 and moving through March 2022, there was a massive blitz of workers leaving their jobs and getting new ones...

It didn’t take long before we got The Great Regret. A survey by Paychex found that 80% of the people who quit during the Great Resignation regretted it. They changed jobs for better pay, better benefits, better work-life balance, more respect from an employer, and more power resting with the employee instead of the employer. The workers who changed jobs decided it didn’t work out the way they thought it would...

This led to Quiet Quitting, employees so unhappy with the new job that they settled into a pattern of doing the absolute minimum requirements of the job, putting in no more time, effort, or enthusiasm than absolutely necessary...

That led to Career Cushioning. Employees put in just enough effort to keep their job and their paycheck while they looked for side hustles and opportunities to moonlight, to have something in the wings just in case they get laid off or downsized.

And now we’re in the era of… Loud Quitting, young malcontents quitting their job and slamming the company on social media. According to the Gallup State of the Global Workplace 2023, loud quitters are employees “who take action that directly harms the organization while undercutting the company’s goal and opposing its leaders. For example, by bad-mouthing their boss on LinkedIn before swiftly handing in their notice.”

But loud quitting has joined forces with Live Quitting. Rather than just type a post about leaving the job, Gen Z and Millennials in particular are recording and posting the moment they hit the send button with their resignation attached, the phone call they make to their manager to quit, or the zoom call where they tell the boss to stick it...

Gallup blames management saying 70% of team engagement is attributable to the manager...

Employers say there’s more to the story. They find that young workers are demanding greater flexibility for remote and hybrid work, greater work-life balance, higher pay... companies say these workers are putting all the responsibility for their wish list on the employer without reciprocal responsibility in the employee-employer relationship...

According to Gallup, low-engagement workers cost the global economy an estimated $8 trillion and account for 9% of global GDP."

That's not chump change by any account.

Closing out the column for today, contributor Charles Hugh Smith writes that we are Fooled By What We Measure, Enlightened By What We Don't Measure.

"Economists and pundits are falling all over themselves to declare the US is chugging along splendidly, and to express their frustration with the public for their curmudgeonly lack of enthusiasm.

The point I want to make is we only manage what we measure, and the reliance on statistics that are overly broad and easily distorted/gamed leads to generalizations that ignore consequential cause and effect: we are fooled by overly broad and easily distorted/gamed statistics and enlightened by looking at what is not measured or measured inadequately...

The consensus holds that inflation is declining rapidly and unemployment remains low, so the economy is doing great...

How do we measure the "inflation"--i.e. a loss of purchasing power--when appliances that lasted 20 years a generation ago now break down in 5 years? Where does that 75% decline in utility and durability show up in the official inflation data? How about the tools that once lasted a lifetime now breaking after a few years?

It's been estimated that America's food has lost 30% of its nutritive value in the past few decades. Protein per gram has dropped, trace nutrients have dropped, and so on...

Consider the skyrocketing federal debt in terms of how many jobs are created in the era of soaring federal spending and debt. (Charts courtesy of CH / Economica) Debt doesn't matter to economists and pundits, and neither does its diminishing effect on GDP and employment. The same can be said of total debt (public and private), which is skyrocketing (last chart): diminishing returns writ large as higher interest rates are embedded in the policy excesses and neofeudal structure of the past 45 years.

In essence, nothing that is consequential is properly quantified, so the pundit class keeps insisting everything is wunnerful and is mystified why people are so foolishly dissatisfied with our wunnerful economy..."

Much more in the full article which is replete with charts to illustrate Smith's arguments. Whether you dismiss Smith's POV or not, looking at the same situation from a different angle, often helps to hone one's own view.

Have a good one.

More By This Author:

Thoughts For Thursday: Expectations Met, Time To Go Fishing?

Tuesday Talk: Treading Water Till Tomorrow