Thoughts For Thursday: Expectations Met, Time To Go Fishing?

With expectations for a 25 bps rate hike met, things may quiet down to the slower pace the market often adopts in August, until the September 20, FOMC meeting. You may want to go fishing, just keep in mind that there are the rest of the Q2 earnings to run through and the war in Ukraine is still creating havoc.

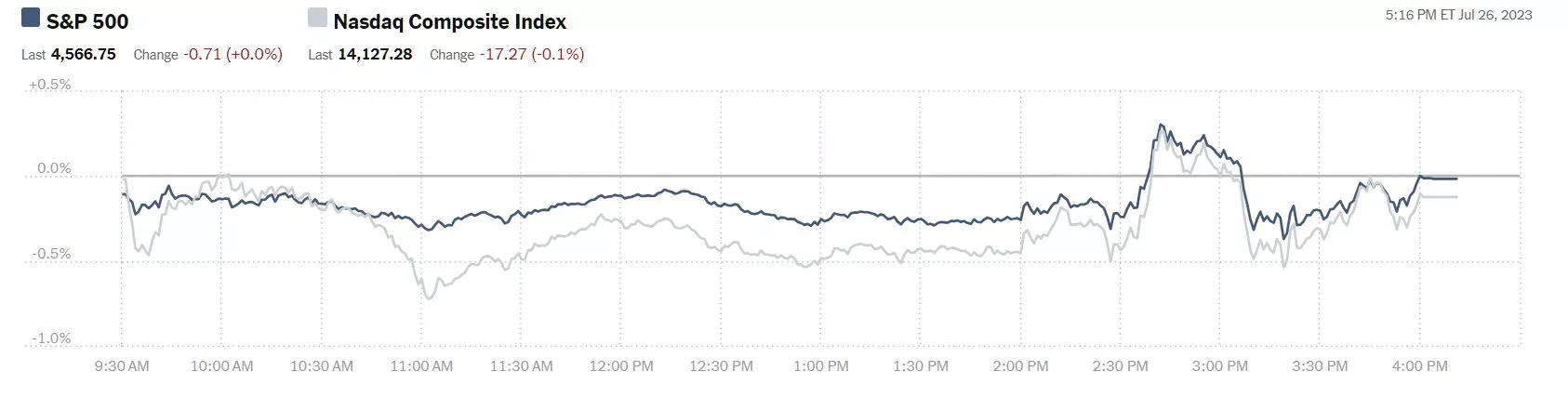

Yesterday, the market graphs were not too choppy, save for a short burst upwards around 2:30 pm which was quickly deflated. The S&P 500 closed at 4,567, down 1 point, the Dow closed at 35,520, up 82 points, and the Nasdaq Composite closed at 14,127, down 17 points.

Chart: The New York Times

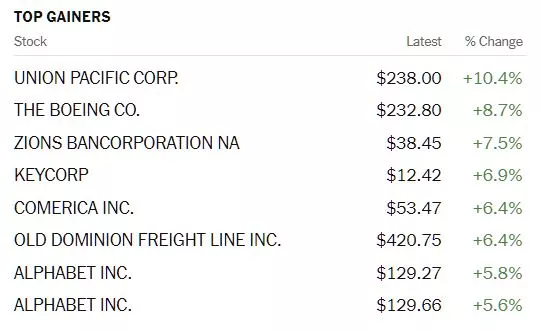

Among the action there were some big top gainers. Leading the list was Union Pacific Corp. (UNP), up 10.4%, followed by Boeing (BA), up 8.7%, and Zions Bancorp. (ZION), up 7.5%.

Chart: The New York Times

In early morning futures action, S&P 500 market futures are trading up 25 points, Dow market futures are trading up 53 points, and Nasdaq 100 market futures are trading up 176 points.

Contributors Chris Turner, Frantisek Taborsky and Francesco Pesole of ING Markets, write Fed Patience Provides Breathing Room For Risk Assets.

"In the end, the dollar tracked US yields and marginally softened after yesterday's FOMC rate decision and press conference. Fed Chair Jerome Powell delivered another credible performance, and it seemed that markets – perhaps because of positioning – latched onto comments that the Fed "could afford to be a little patient" as a result of all the tightening implemented so far. US two-year yields edged some 7-8 bps lower, and December 2024 futures contracts priced Fed Funds some eight ticks lower at 4.07%, embracing five 25bp cuts in 2024.

One of the clearest messages coming through from the press conference was that Chair Powell felt the Fed was "not in an environment where we want to provide a lot of forward guidance". In other words: listen to the data, not the Fed. On that subject, he highlighted that by the time of the next meeting on September 20th, the Fed would have two new CPI reports, two new job reports, and the Employment Cost Index (which will be released tomorrow).

While the dollar is a little lower today post-Fed, we would not chase the move just yet and prefer to take our cue from the data, starting with tomorrow's ECI. As we discussed in our FOMC preview, the carry trade environment will still be popular and with overnight deposit rates at 5.25%, the dollar is clearly not a funding currency.

Beyond the ECB meeting today, the US calendar should see some downward revisions to second-quarter GDP, durable goods orders, and initial jobless claims. Of these, claims might be the most important given the ongoing need to see tight conditions ease in the US labor market.

Barring any hawkish surprise from the ECB today, DXY should trade within a 100.60-101.20 range."

TM contributor and chartist Tim Knight has three dramatic earnings charts to share in Shock Treatment.

"I’ll chime in on the day’s events later today, but for now, I just wanted to look at a few earnings reactions. The first one, of course, is this sucker:

My self-talk with respect to META (which is one of my positions) was something along these lines:

- Earlier today: “I’ve got a profit on this position. Maybe I should just take the money and run. Who knows what’s going to happen with earnings.”

- A little later: “Tim, seriously, are you going to spook yourself out of every position that just happens to have earnings. Good Lord! It expires next year. Man up and stay put!”

- After the close, when META exploded almost 30 points higher: “Jesus H. Christ, I knew I should have dumped this crap and taken profits!”

- A little later, when META’s rise was cut substantially: “Meh. Maybe this isn’t a total disaster. We’ll see.”

As I’m typing these words, the conference call hasn’t even started, so I’m not sure if I’m going to hang on to this sucker or not. Suffice it to say, I sure had wished for a big, fat tumble, MSFT-style.

Another tech stock I was watching was ServiceNow (NOW). I have no position (I kind of gave up on the thing), but it ripped higher and then collapsed. Pretty cool stuff.

Also in “no position land” is Chipotle (CMG), which last time I checked was down something like $170. I’ve always puzzled over how on earth this utterly mediocre chain of Mexican restaurants was valued like it possessed the cures of every form of cancer known to man. It’s nice to see it get wrecked.

I remain quite light with a mere 7 positions (long gone are the days when that number was in the 30s). I’ll be interested to see if META survives the next 16 hours or not."

TalkMaarkets contributor Tyler Durden gives his report on Meta's earnings writing, Meta Jumps After Beating Estimates, Topping 3 Billion Monthly Users, Boosting Guidance.

"After a stellar report from Google and lukewarm earnings from Microsoft, moments ago the 3rd of the tech Megacaps, Facebook, Twitter 2.0, META reported Q2 earnings that smashed expectations (despite the debacle that is the Reality Labs division) as a result of a record 3+ billion monthly users, but more importantly, provided Q3 revenue guidance that blew away estimates (even as operating expenses are expected to soar while capex is being slashed, in what is hardly an expression of confidence in future growth)."

"Here is what the company reported for Q2:

- Revenue $32.00 billion, +11% y/y, beating estimates of $31.06 billion

- Advertising rev. $31.50 billion, +12% y/y, beating estimates of $30.43 billion

- Family of Apps revenue $31.72 billion, +12% y/y, beating estimates of $30.55 billion

- Reality Labs revenue $276 million, -39% y/y, missing estimates $391.9 million

- Other revenue $225 million, +3.2% y/y, beating estimate $224 million

- EPS $2.98 vs. $2.46 y/y, beating est. 2.91

...while Meta has also been investing heavily in artificial intelligence, using the technology to make recommendations — for both content and advertising — more tailored to users’ interests, one would be hard pressed to find that in the cut capex guidance.

In any case, investors were easily fooled that growth for the company with the - don't laugh - 3 billion monthly users will continue apace, and shares surged 4.5% in late trading, trimming an earlier gain of as much as 9%, and bringing the YTD gain to a stunning 158%."

Go to the full article for a detailed breakdown of Meta's Q2 results as well as links to the investor presentation and the like. It is worth the click if you follow the stock.

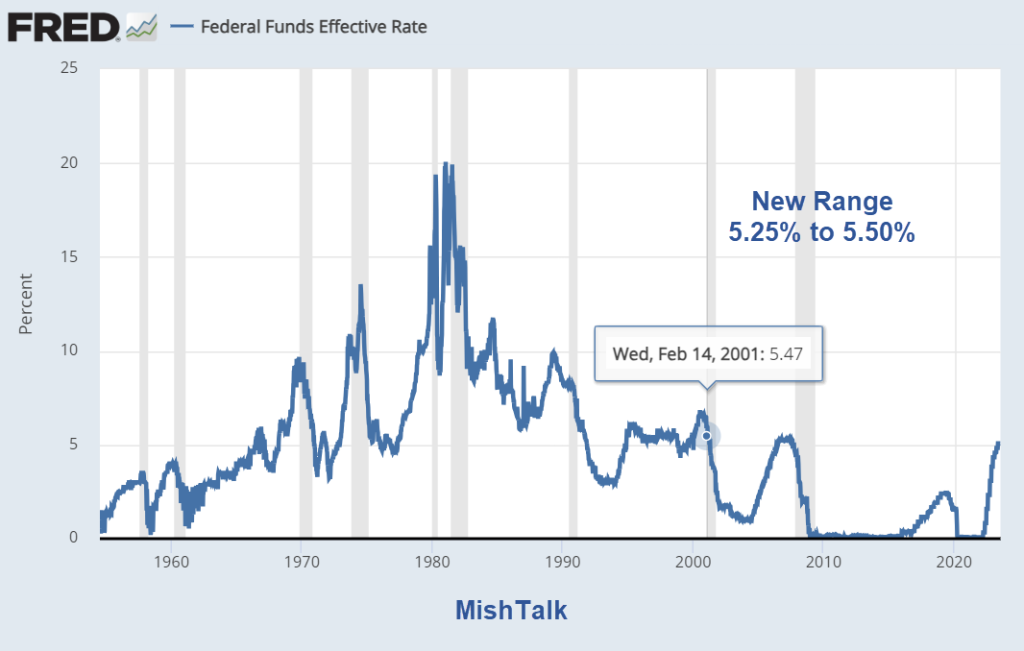

Contributor Mish Shedlock covers the FOMC meeting in Fed Hikes Key Interest Rate To 5-1/4 To 5-1/2 Percent, Highest In 22 Years.

"As widely expected, the Fed hiked its base interest rate by a quarter of a point. It’s the highest in 22 years.

FOMC Statement

Recent indicators suggest that economic activity has been expanding at a moderate pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated.

The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective....

There is nothing in the FOMC Statement that is the least bit surprising although some will suggest the Fed may have tightened too much...

The Fed’s fear is backing off too soon and getting another inflation blast higher..."

TM contributor Kevin Flanagan closes out today's column discussing the Fed action as well, in Fed Watch: The Final Countdown.

"...If you believe the Fed’s dot plot, it appears the voting members have one more rate increase in store for 2023. Indeed, their median estimate for Fed Funds was updated last month to show a 5.60% reading, or 50 basis points (bps) above the prior estimate from March. I’ve blogged before about the reliability of these dot plots, so the markets could be excused if they are not 100% on-board with this outlook at the current time. That being said, we have witnessed over the last month or so how the Treasury arena has finally come around to being more in line with Fed messaging...

The more important question now is what investors should be expecting for U.S. monetary policy for the remainder of this year. From the FOMC’s perspective, the Fed will continue to weigh the full impact of the now 525 bps in rate hikes that have already occurred in conjunction with the expected further tightening in credit conditions from the regional banking fallout. Thus, the policy makers remain in full “data dependent” mode. It is also important to remember that another key part of the Fed’s tightening process, quantitative tightening (QT), continues unabated.

Based on various reports, Powell was supposedly not a fan of the “stop and go” approach to policy decisions. However, the July rate hike seemingly puts that notion to rest...

Whether or not another rate increase is in the cards for this year, it does seem as if the Fed is now either at, or close to, the end of this rate hike cycle. In addition, rate cuts have now been completely taken off the table until perhaps later in the first quarter of next year. In other words, investors should focus on rates more likely being “higher for longer” in their portfolio decision-making process. "

Well, there you have it!

Have a good one.

Hope the fish are biting, wherever you are.

More By This Author:

Tuesday Talk: Treading Water Till Tomorrow

Tuesday Talk: Sniffing Bears Chased Out For Now