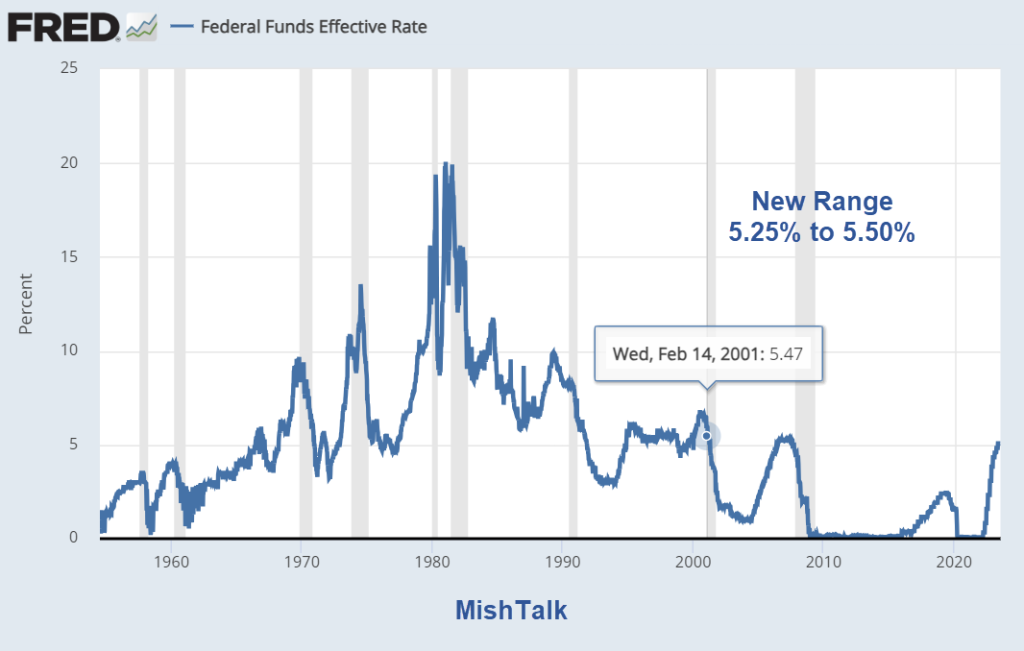

Fed Hikes Key Interest Rate To 5-1/4 To 5-1/2 Percent, Highest In 22 Years

As widely expected, the Fed hiked its base interest rate by a quarter of a point. It’s the highest in 22 years.

(Click on image to enlarge)

FOMC Statement

Recent indicators suggest that economic activity has been expanding at a moderate pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated.

The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

There is nothing in the FOMC Statement that is the least bit surprising although some will suggest the Fed may have tightened too much.

If you missed it, please see Beware the Huge Negative Lag Impact of Three Rounds of Covid Stimulus

The Fed’s fear is backing off too soon and getting another inflation blast higher.

The Fed will surely welcome a two-month pause. The next FOMC meeting is not until September 20.

More By This Author:

New Home Sales Dip 2.5% From 6.3% Negative RevisionThe Housing Bubble, As Measured By Case-Shiller, Is Expanding Again

Beware The Huge Negative Lag Impact Of Three Rounds Of Covid Stimulus

Disclaimer: The content on Mish's Global Economic Trend Analysis site is provided as general information only and should not be taken as investment advice. All site content, including ...

more