Meta Jumps After Beating Estimates, Topping 3 Billion Monthly Users, Boosting Guidance

Image Source: Pixabay

After a stellar report from Google and lukewarm earnings from Microsoft, moments ago the 3rd of the tech Megacaps, Facebook, Twitter 2.0, META reported Q2 earnings that smashed expectations (despite the debacle that is the Reality Labs division) as a result of a record 3+ billion monthly users, but more importantly, provided Q3 revenue guidance that blew away estimates (even as operating expenses are expected to soar while capex is being slashed, in what is hardly an expression of confidence in future growth).

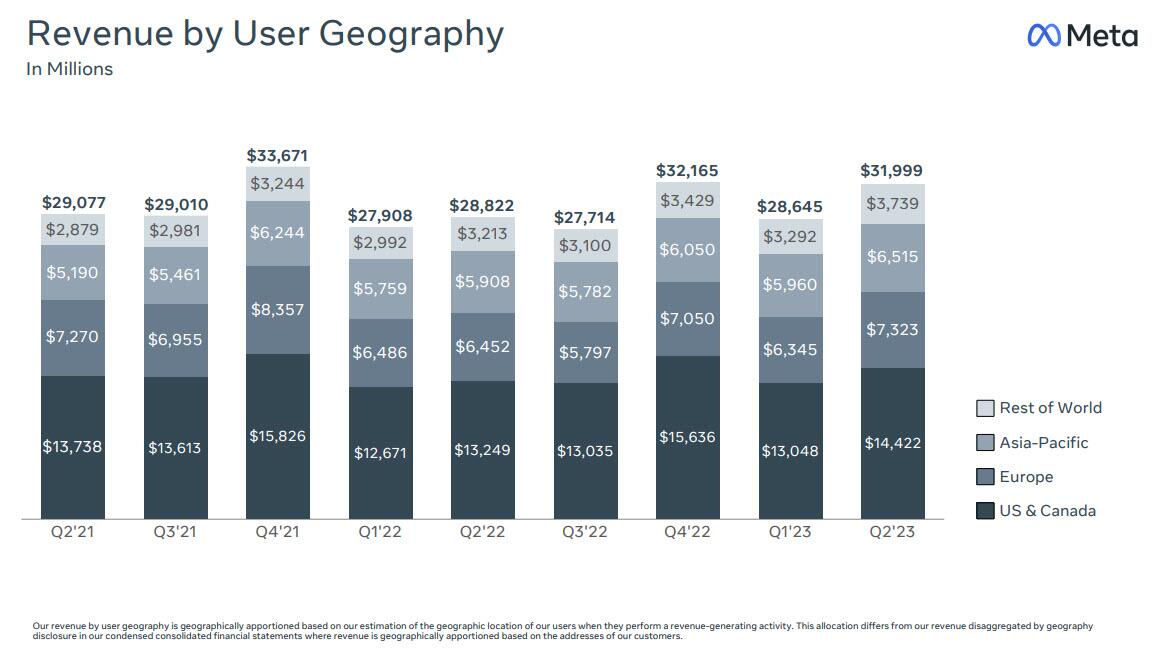

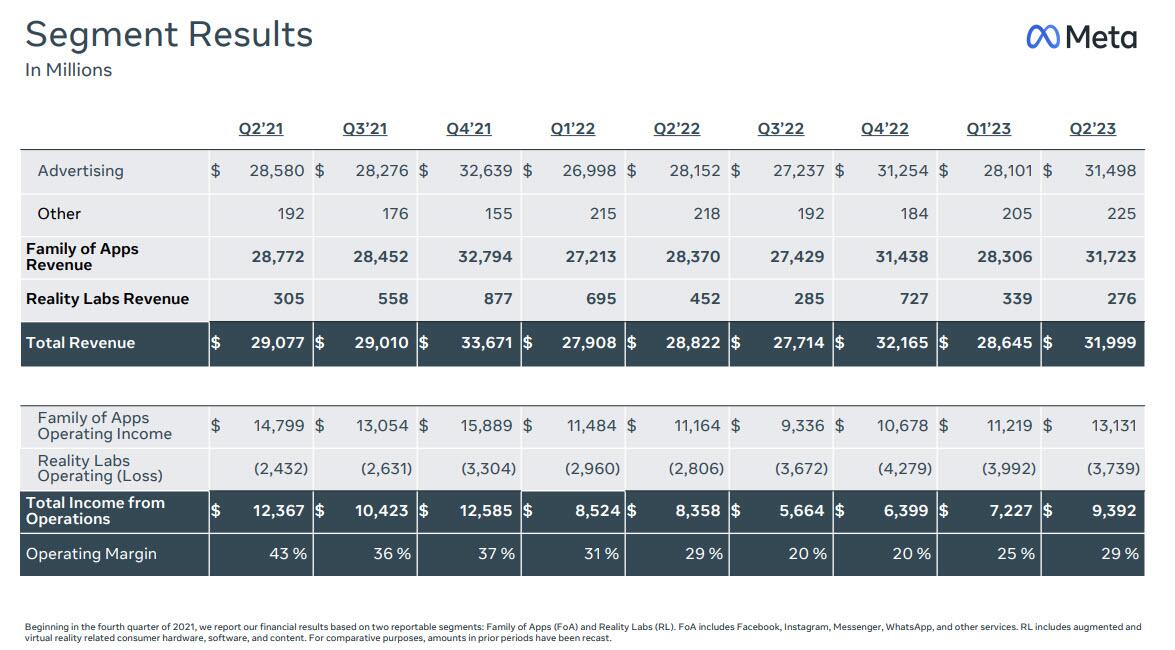

Here is what the company reported for Q2:

- Revenue $32.00 billion, +11% y/y, beating estimates of $31.06 billion

- Advertising rev. $31.50 billion, +12% y/y, beating estimates of $30.43 billion

- Family of Apps revenue $31.72 billion, +12% y/y, beating estimates of $30.55 billion

- Reality Labs revenue $276 million, -39% y/y, missing estimates $391.9 million

- Other revenue $225 million, +3.2% y/y, beating estimate $224 million

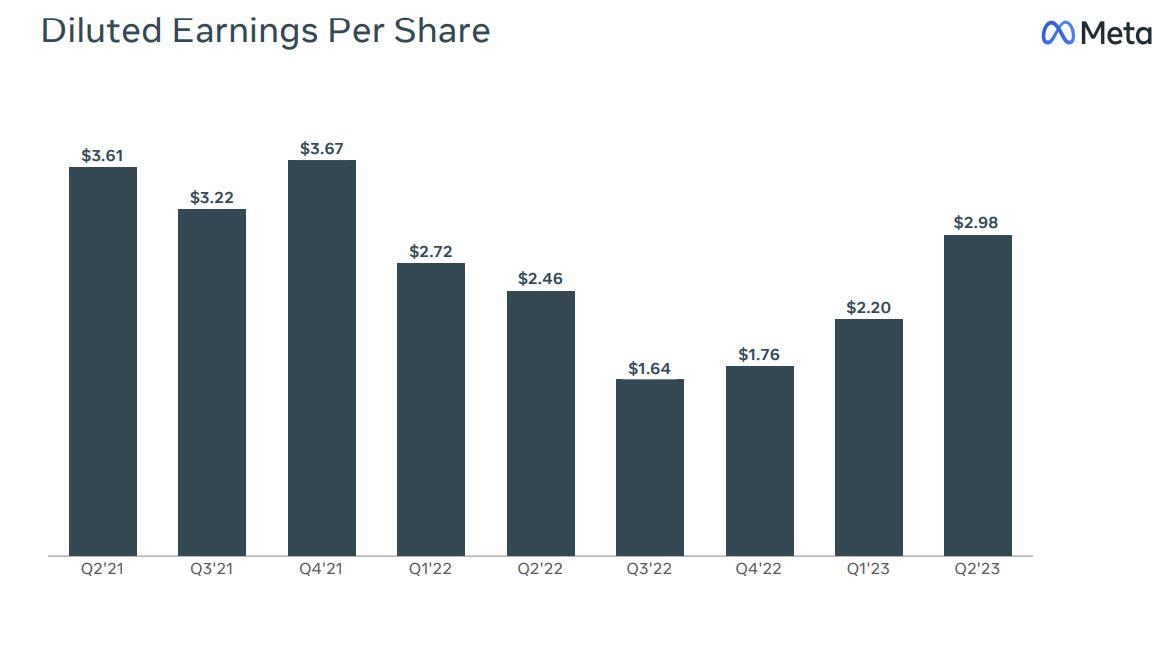

- EPS $2.98 vs. $2.46 y/y, beating est. 2.91

(Click on image to enlarge)

Turning to profitability, there was some modest weakness here as profit margin dropped and missed estimates:

- Operating margin 29% vs. 29% y/y, missing estimates of 30.4%

- Family of Apps operating income $13.13 billion, +18% y/y, estimate $13.12 billion

- Reality Labs operating loss $3.74 billion, +33% y/y, estimate loss $3.68 billion

(Click on image to enlarge)

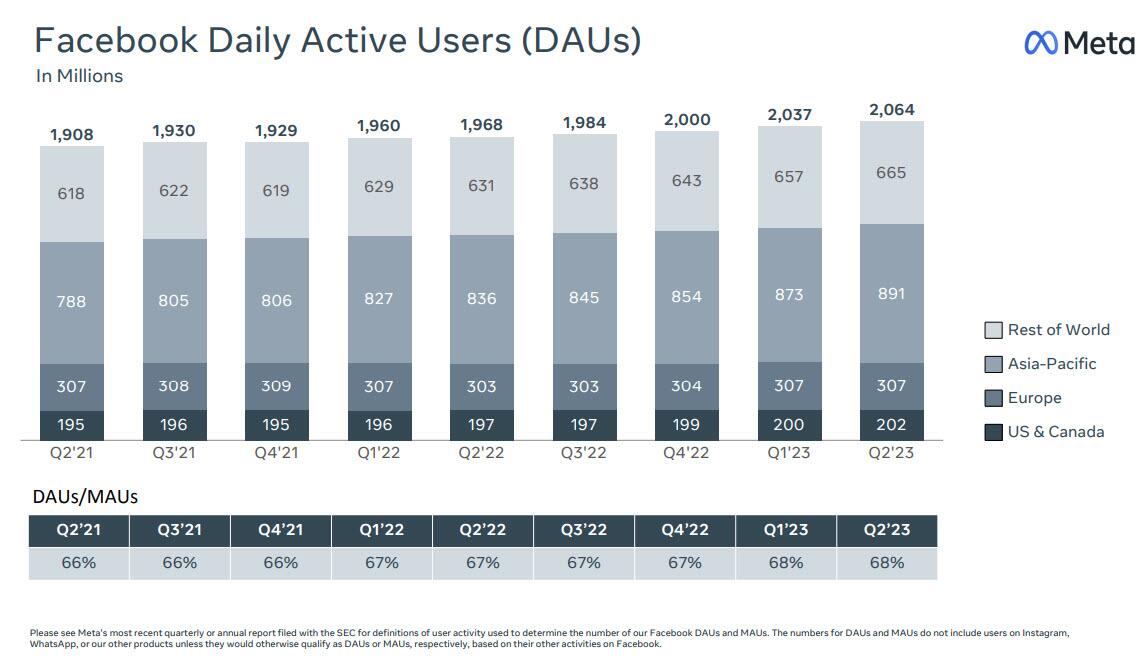

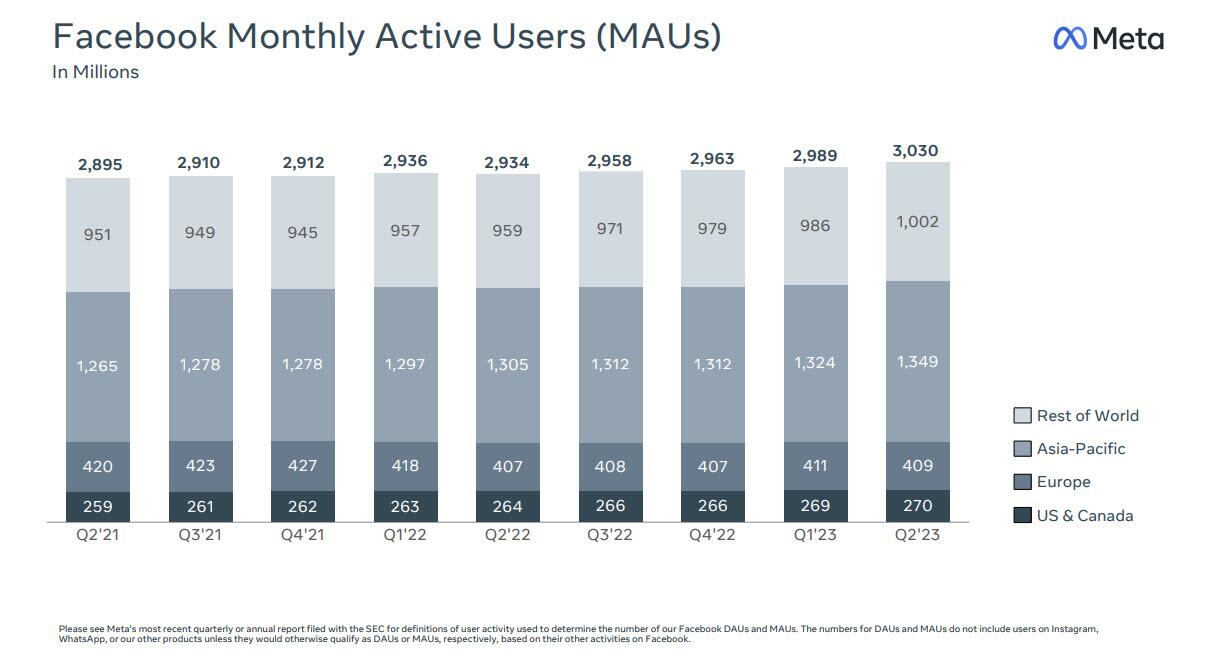

Turning to the company's user base, there was a surprise here: for the first time Meta reported over 3 billion monthly active user:

- Facebook daily active users 2.06 billion, +4.6% y/y, beating estimate 2.03 billion

- Facebook monthly active users 3.03 billion, +3.4% y/y, estimate 3.00 billion

(Click on image to enlarge)

Going down the ad side of the business, we find something troubling: Meta's price per ad is slumping, far worse than expected, and the company is making up for this by blasting ever higher ad volumes. In other words, it is cutting prices to keep and raise volumes. But what is the saturation point, and just how many ads can one user see?

- Ad impressions +34% vs. +15% y/y, beating estimate +17.8%

- Average price per ad -16% vs. -14% y/y, missing estimate -11.2%

And some more ad-linked data:

- Average Family service users per day 3.07 billion, +6.6% y/y, estimate 3.00 billion

- Average Family service users per month 3.88 billion, +6.3% y/y, estimate 3.78 billion

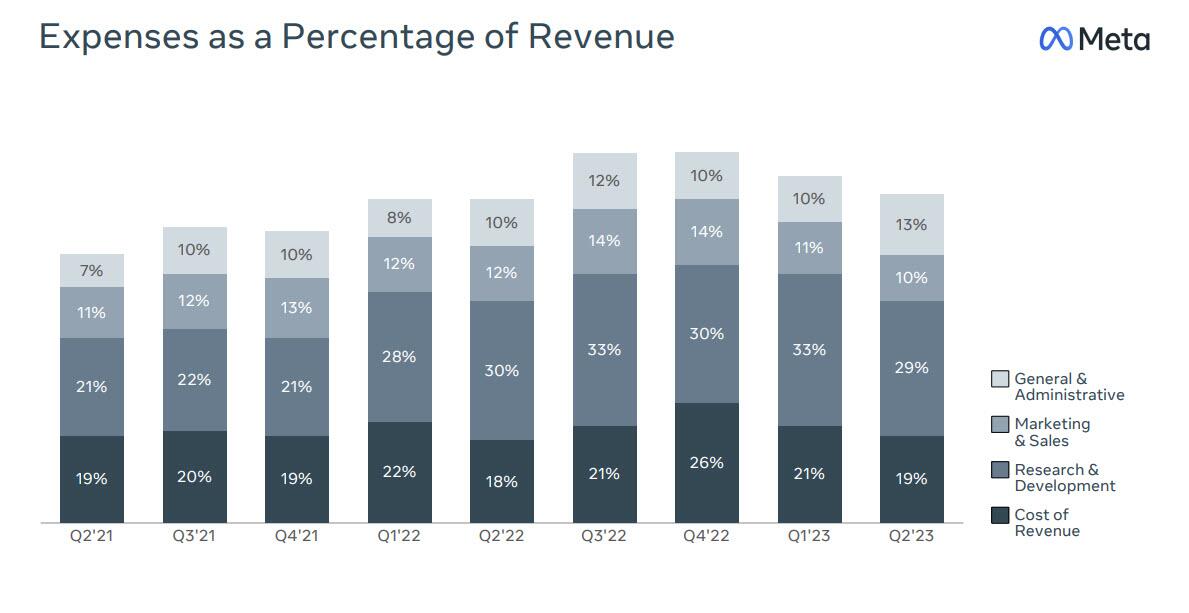

Turning to expenses we find that while there while there was a modest decline in relative terms, these still remain elevated compared to history.

(Click on image to enlarge)

But while the Q2 results were solid, if concering in that Meta had to slash prices to keep ad volumes, where the market was most impressed was the company's guidance. Here, the company said that it expects third quarter 2023 total revenue to be in the range of $32-34.5 billion, blowing away estimates of $31.18BN. And while the revenue guidance was solid, the surge in expenses largely made up for it:

- "We anticipate our full-year 2023 total expenses will be in the range of $88-91 billion, increased from our prior range of $86-90 billion due to legal-related expenses recorded in the second quarter of 2023."

- "We expect Reality Labs operating losses to increase year-over-year in 2023."

Additionally, Meta expects its full-year 2023 capex to be in the range of $27-30 billion, lowered from the prior estimate of

$30-33 billion. The reduced forecast was due to "both cost savings, particularly on non-AI servers, as well as shifts in capital expenditures into 2024 from delays in projects and equipment deliveries rather than a reduction in overall investment plans."

This suggests that contrary to expectations of an AI-driven boom, Meta is actually slashing spending, even if it desperately tried to piggyback on the hottest trend around:

- While we are not providing a quantitative outlook beyond 2023 at this point, we expect a few factors to be drivers of total expense growth in 2024 as we continue to invest in our most compelling opportunities, including artificial intelligence (AI) and the metaverse.

- First, we expect higher infrastructure-related costs next year. Given our increased capital investments in recent years, we expect depreciation expenses in 2024 to increase by a larger amount than in 2023. We also expect to incur higher operating costs from running a larger infrastructure footprint.

- Second, we anticipate growth in payroll expenses as we evolve our workforce composition toward higher-cost technical roles.

- Finally, for Reality Labs, we expect operating losses to increase meaningfully year-over-year due to our ongoing product development efforts in augmented reality/virtual reality and investments to further scale our ecosystem.

The slashed Capex - something one wouldn't do if seeing a clear runway to increased revenue as Meta supposedly does - aren't a surprise: Meta has been cutting thousands of jobs and teams in what CEO Mark Zuckerberg calls its “year of efficiency.” And while Meta has also been investing heavily in artificial intelligence, using the technology to make recommendations — for both content and advertising — more tailored to users’ interests, one would be hard pressed to find that in the cut capex guidance.

In any case, investors were easily fooled that growth for the company with the - don't laugh - 3 billion monthly users will continue apace, and shares surged 4.5% in late trading, trimming an earlier gain of as much as 9%, and bringing the YTD gain to a stunning 158%.

(Click on image to enlarge)

Here is the full Q2 investor presentation (pdf link).

More By This Author:

Fed Hikes Rates By 25bps As Expected, Stays Data Dependent

US New Home Sales Tumble In June, Prices Tumble

Futures Dip Ahead Of Fed's "Last Rate Hike" As Dow Braces For 13 Straight Gains

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more