Bubbles Don't Exist - Example No. 761

Since I began blogging in early 2009, I’ve cited one example after another of how “bubble” claims were completely meaningless and worthless, the sign of sloppy reasoning. (Akin to “rolling recessions”, or “long and variable lags”, or “greedflation”)

The tech bubble of 1999? Nope, prices were rational. A housing bubble in 2006? Nope, prices were rational. Bitcoin a bubble at $30? Today, the price is near $30,000!

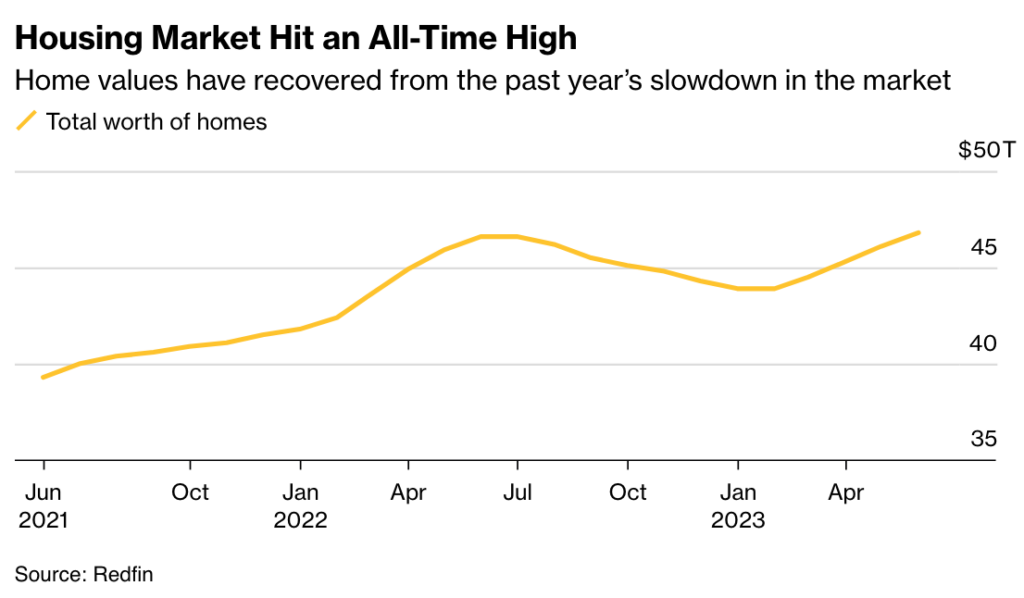

With low interest rates after 2010, bubble claims began to reach frenzied proportions. One of my favorites was that “artificially low interest rates” (a sign of sloppy reasoning right up there with greedflation) had created a housing bubble. With the end of the low interest rate environment, surely that bubble was about to pop!

Nevermind ...

You can go onto twitter and read all about how high interest rates are tight money, how the economy blows one bubble after another, how fiscal policy drives aggregate demand, how corporate greed drives up prices, how we are experiencing a rolling recession, how those “long and variable lags” will eventually kick in, and how “industrial policies” help the economy.

Or you can stay here, a blog that takes economic theory seriously. The EMH, rational expectations, monetary dominance, long and variable leads, free markets work, statism sucks.

MEGA! (Make economics great again.)

PS. Some people cite the tulip thing, which is still disputed. In any case, when you have to go back to the 1600s to find an example ...

More By This Author:

A Tale Of Twin Cities

The Actual Phillips Curve

The Future Is 1962