Thoughts For Thursday: Oil Prices Bring On The Blues

Looking for something to put a damper on relatively good economic news, the market seems to have found it in concerns about lower Saudi and Russian oil production which is expected to continue through the end of the year and keep prices high.

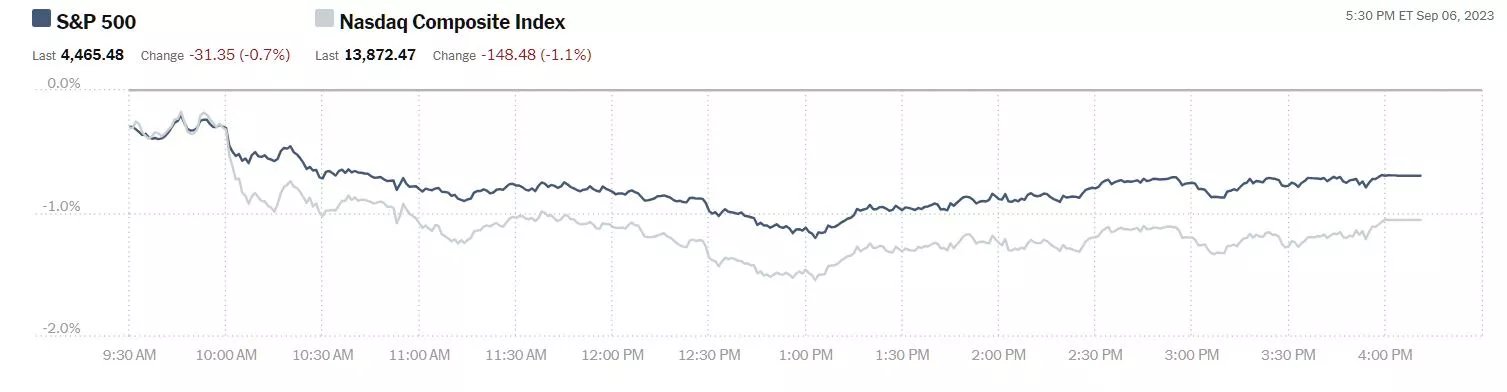

Yesterday the market continued its downward momentum (Tuesday the S&P closed down 18 points, the Dow closed down 195 points and the Nasdaq closed down 10 points.), the S&P 500 closed at 4,465, down 31 points, the Dow closed at 34,443, down 199 points, and the Nasdaq Composite closed at 13,872, down 148 points.

Chart: The New York Times

Most actives were led by Tesla (TSLA), down 1.8%, followed by Apple (AAPL), down 3.6%, on Huawei's new product announcements and manufacturing transition from China hiccups. In the number 3 spot was Advanced Micro Devices (AMD), down 1.4%.

Chart: The New York Times

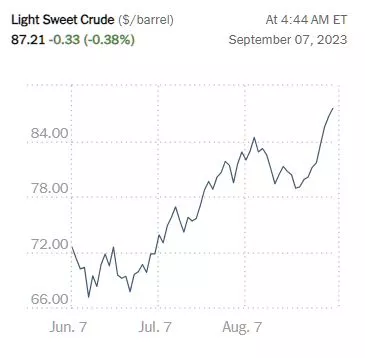

A look at the 3 month chart for crude oil reflects the current market concern about the upward trajectory of prices for oil.

Chart: The New York Times

In morning futures action, S&P 500 market futures are down 10 points, Dow market futures are up 33 points and Nasdaq 100 market futures are down 85 points.

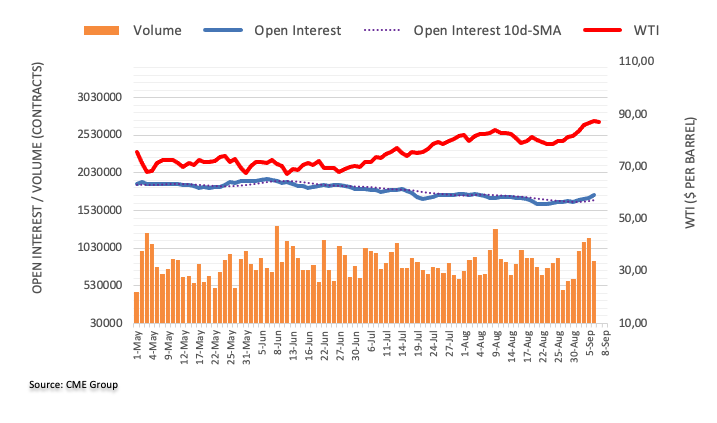

TalkMarkets contributor Pablo Piovano examines Crude Oil Futures: Room For Extra Gains Near Term.

"Prices of the barrel of WTI revisited the $88.00 region on Wednesday amidst decent gains. The move was on the back of increasing open interest, which hints at the idea that further gains remain on the cards with the immediate target at the key round level at $90.00."

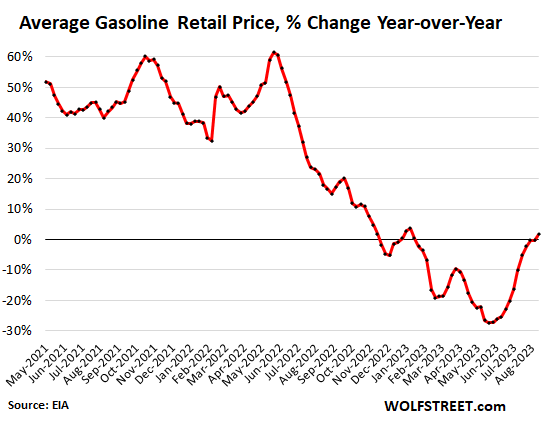

Contributor Michael Maharrey is concerned about Pain At The Pump: Rising Gasoline Prices Undermine Disinflation Narrative.

"Falling energy prices were a significant factor in the big decline in the Consumer Price Index (CPI) earlier this year.

Bad news: energy prices are now heading up. That means the CPI relief was almost certainly transitory.

Gasoline prices increased year-over-year this week for the first time since February 2022.

According to EIA data released on Tuesday, Sept. 5, the average national price of $3.93 per gallon was up by 1.7% from the same week in September a year ago ($3.86).

On an annual basis, CPI fell to 3% in June. The mainstream breathlessly reported that the end of price inflation was in sight. But big drops in energy prices helped bring the overall CPI down. Broadly speaking, energy prices fell by 16.7% year-on-year in June. Gasoline prices were down 26.5%.

Now, rising gasoline prices are unwinding that progress. As WolfStreet put it, “The great plunge in gasoline prices was a major factor had caused CPI to cool 12 months in a row, from +9.1% in June 2022, to +3.0% in June 2023 – the infamous and now bygone era of ‘disinflation.’”

"We saw signs that the big drop in CPI was transitory when the headline number ticked up to 3.1% in July. And that number still reflected a big annual drop in energy prices. The energy index decreased by 12.5% for the 12 months ending in July, and gasoline prices were down 20.3% year-on-year.

August CPI still won’t reflect the big jump in gasoline prices, but we will likely notice the impact in the September data. WolfStreet noted that gasoline prices “will switch from a downward force on CPI, although a decreasing downward force, to an outright upward force on CPI.”

Some might take solace in the fact that rising gasoline prices won’t impact core CPI. But as we’ve seen, core CPI has hardly budged. And WolfStreet projects we’ll see an increase in core CPI as well.

Core CPI itself will rise even if the usual inflation suspects (services) turn out to be benign – it will rise due the base effect (the base for the year-over-year comparison being last year’s cooling), and due to the end of the odious massive adjustments to health insurance starting with the October CPI, to be released in November.”

TM contributor Mish Schneider asks if the current action in the market is a Technical Correction Or Return Of The Bear Market?

" (Retail ETF) XRT, while significantly underperforming the benchmark, has yet to convincingly break down, or breakout for that matter.

The small caps through the ETF IWM are performing better than XRT.

However, while IWM is well below the July 6-month calendar range high, it remains well above the calendar range low at 180.72.

In other words, we are still in correction mode rather than bear market mode."

"Nonetheless, today we turn our attention to Nasdaq to see if this has indeed seen the best of the rally and is poised for lower levels.

With Tesla, Nvidia, and Apple all down between 2-4% in today’s session, QQQs are approaching a huge support area.

The QQQ chart right now has a few key aspects based on our MarketGauge proprietary indicators.

- The Phase-Bullish as the 50 DMA is above (blue) the 200-DMA (green) while the price trades above both MAs

- Fast MA - with today’s action, QQQs is holding the MA (pink). Interesting that the fast MA is in alignment with the 50-DMA

Calendar Ranges-QQQ could not clear above the July 6-month calendar range high (horizontal green line). However, it is well above the July 6-month calendar range low (red line). - Real Motion - QQQs momentum is weakening and shows a bearish divergence sitting under the 50-DMA while price remains above its 50-DMA

- Leadership - QQQ has outperformed the SPY since late August although it is failing the dotted Bollinger Band.

Put this all together and we have solid reasons why growth is supreme over value.

We also have some palpable resistance at the July 6-month calendar range highs that until clears, means with the weaker momentum, the possibility QQQs could test the July calendar range low.

The best we can say now is this is a technical correction."

Lurking beneath the positive jobs data, contributor Tyler Durden reports that ADP Finds US Worker Motivation Hits Year Low, Poses Risk To Productivity.

"This week, the ADP Research Institute, the research arm of the payroll processing firm, released a new report about a 'real-time way' to measure worker motivation. What they found is that a majority of workers aren't motivated, and this might impact long-term productivity...ADP researchers survey 2,500 workers each month and have noticed the EMC index has slid throughout 2023:

"In August 2023, the EMC Index fell from 108 to 100, its lowest point since June 2022. The index peaked in December 2022 at 121 after a year of robust pay growth, strong hiring, and the rise of remote work."

"They said, "We found a strong relationship between output and worker motivation and commitment." And noted, "A person's industry might influence their level of motivation and commitment.

Workers in transportation and warehousing, education, and healthcare industries were the least motivated, while technology, information, and construction workers were the most motivated. The biggest takeaway is that most workers aren't motivated at work, which could soon impact productivity. There was no clear explanation as to why workers are slacking off, whether they believe their labor is worth much more (look what's happening with the unionized workforce) or if these folks are spending too much time on TikTok."

In a TalkMarkets Featured Video, the Staff at contributor Wealthion posit, Recession By Q4? And 6% Unemployment Next Year?.

"As the market struggles to find momentum here, the question investors are wrestling with right now is: Will the rally resume? Or is it time to get out of the pool?"

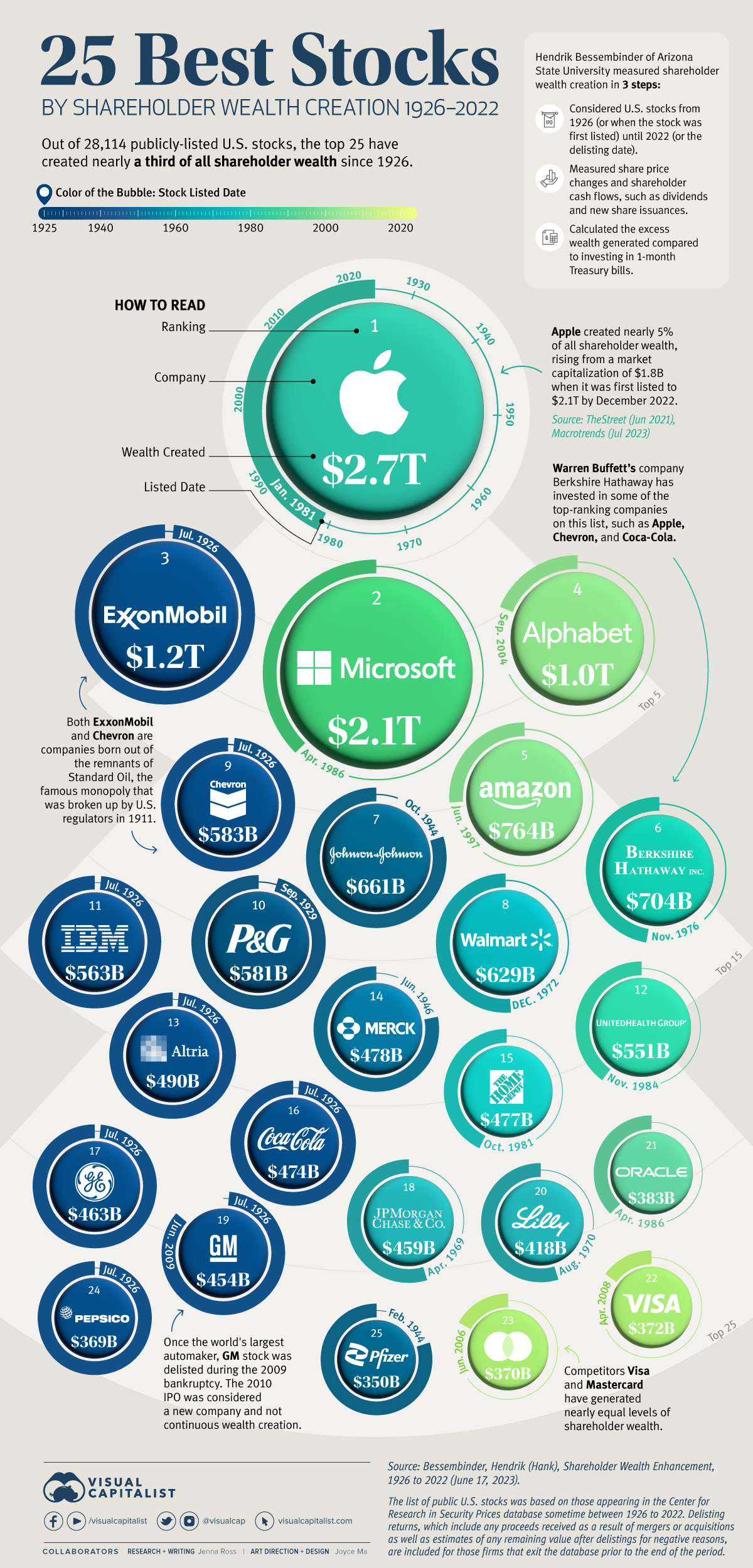

Closing out the column on a positive note contributors Jenna Ross and Joyce Ma take at visual look at The 25 Best Stocks By Shareholder Wealth Creation (1926-2022).

"Out of 28,114 publicly-listed U.S. companies analyzed over the last century, the 25 best stocks have created nearly a third of all shareholder wealth. Put another way, just 0.1% of stocks have added over $17.6 trillion to investors’ wallets. In this graphic, we use data from Henrik Bessembinder of Arizona State University to show the best stocks of the last century."

Check out the full article for more details about the top 25.

Have a good one.

More By This Author:

Tuesday Talk: Post-Holiday Tuesday

Thoughts For Thursday: August's Rocky Road Is Coming To An End