Rubicon Organics Q4 Financials: Net Revenue Increased But Net Loss Increased As Well

![]()

Rubicon Organics Inc. (ROMJF), a constituent in the munKNEE Pure-Play Pot Stock Index, announced its Q4, 2020 financial and operating results on Tuesday for the period ended December 31, 2020, as follows:

Q4 Financial Highlights

(All results are presented in Canadian dollars and compared to the previous quarter.)

- Net Revenue: increased 51% to $4.8M

- Net Loss: increased 16.8% to $(5.0)M

- Adj. EBITDA: loss increased 14.8% to $(3.0)M

- Cash on Hand: increased 50.5% to $12.1M

- Working Capital: increased 354% to $4.2M

Q4 Operational Highlights

- Launched in Quebec with the Simply Bare™ Organic and the 1964™ brands and received first purchase orders for both flower and hash;

- Launched BC Organic Apple Toffee in Simply Bare™ Organic, available in jar and pre-roll formats;

- Signed an agreement with PAX LABS® to fill organic cannabis oil pods for the PAX® ERA™ and PAX® ERA Pro™ premium vaporizers;

- Triggered the acceleration of 3.15 million warrants with an exercise price of $3.50, resulting in the exercise of 2.04 million warrants and gross proceeds of $7.1 million;

- Amalgamated three Canadian subsidiaries which will allow for use of over $20 million in tax losses in the future; and

- Announced intention to appoint Julie Lassonde to the Board of Directors once her security clearance is obtained from Health Canada.

Outlook

The company intends to continue:

- maintaining pricing for its premium products,

- remaining rigorous in the control of cash costs,

- implementing efficiencies across its production process and

- to continue to tailor its innovation pipeline to product categories with high consumer demand and premium margin potential.

Guidance

The Company currently expects:

- to achieve positive adjusted EBITDA on a monthly basis by year-end 2020,

- to achieve monthly positive cash flow from operations in the first half of 2021,

- to generate significant operating leverage by maintaining moderate increases in production costs and operating expenses, with linear increases in inventory expensed to costs of sales relative to net revenue, but at a lower per unit cost, and

- to refinance debt maturing in 2021 to a long-term mortgage financing facility, potentially with more favorable terms, and may seek other capital through equity, and other debt arrangements.

Management Commentary

Jesse McConnell, Chief Executive Officer, said:

- “Our focused strategy of producing the highest quality premium organic cannabis is gaining more traction as we launch new products, add brands and expand distribution.

- We are very pleased with the $9.4 million in net revenue we delivered in 2020, our first year of operation, and we believe that our expanded distribution and deep innovation pipeline will continue to drive revenue growth and improved profitability in 2021.

- We are in an excellent financial position to drive organic growth and will continue to consider strategic options towards driving shareholder value and achieving our long-term goal of being global brand leaders in organic cannabis.”

Stock Performance

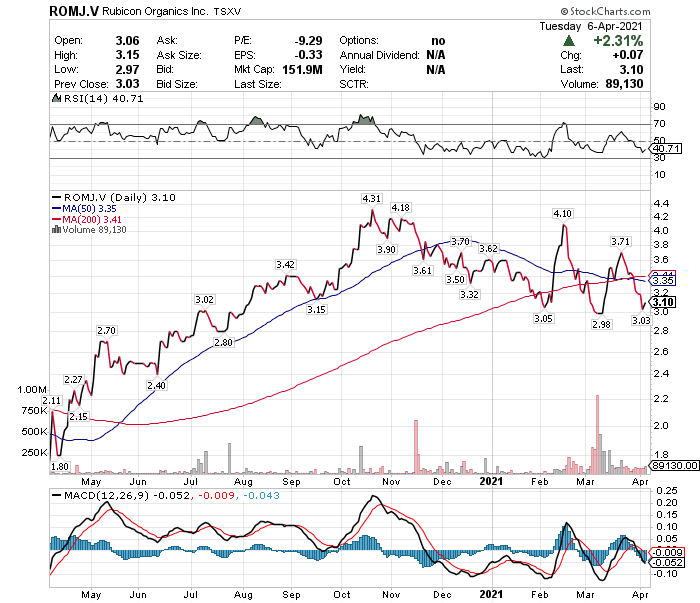

Rubicon is one of 9 companies in the munKNEE Pure-Play LP Pot Stock Index and its stock appreciated by 95% in 2020 but is down 12.4% so far this year as illustrated in the chart below:

If you found the above analysis of interest check out the other recent analyses of Hexo, Columbia Care, Ayr Wellness, Curaleaf, Cronos, Tilray, Aurora, Canopy, Aphria, Organigram, Green Thumb, Valens, TerrAscend, Trulieve. and Harvest Health.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more