TerrAscend Q4 Report Shows Strong Revenue Growth, Margin Expansion And Cash Generation

TerrAscend Corp. (OTCQX: TRSSF), a leading North American cannabis operator with vertically integrated operations in Pennsylvania, New Jersey, and California, in addition to operating as a licensed producer in Canada, reported financial results for its fourth-quarter ending December 31, 2020, today, as follows:

Q4 Financial Highlights

(Unless otherwise stated, the results are in Canadian dollars - to convert to other currencies go here - and compared to the previous quarter.)

- Net Sales: increased 28% to $65M as a result of:

- an increase in cultivation capacity in Pennsylvania and California,

- the first sales into the New Jersey market,

- the continued growth and ramp-up at its three retail stores in Pennsylvania as well as two new store locations in California.

- Gross Margin: increased to 60% from 59%

- the result of a higher mix as well as improved yields and lower cost per pound from the Pennsylvania operations

- Gen./Admin. Exp.: reduced to 23% of net sales from 27%

- the result of tight control of costs combined with continued robust revenue growth

- Adjusted EBITDA: increased 44% to $26M

- Adjusted EBITDA Margin: increased to 40% of net sales from 35%.

- driven by improvements in both gross margin and G&A leverage.

- Net Income: loss increased by 521% to $(109)M

- largely impacted by a net increase in fair value of warrant and derivative liability of $124 million and a revaluation of contingent consideration of $5 million.

- Adj. Net Income: increased by 54% to $20M from $13M

- the second straight quarter the company has recorded a positive result

- Cash Flow: increased to $24M from $0

- driven by continued ramp-up in U.S. operations partially offset by income taxes

Management Commentary

Jason Wild, Executive Chairman said:

- "In Q4, we drove strong revenue growth, margin expansion, and cash generation by focusing on operational excellence, disciplined cost control, and effective allocation of capital...

- The business is firing on all cylinders and we are only now just beginning to realize the benefits of our recently completed investments:

- Sales from facility expansions in Pennsylvania, New Jersey, and California are just starting to come to market,

- our acquisition in Maryland is expected to close imminently,

- and two additional retail stores are set to open in New Jersey."

Q4 Operational Highlights

- Commenced sales from newly expanded State Flower cultivation facility in California

- Realized first sales from 25% capacity expansion in Pennsylvania

- Closed on US$120 million term loan secured by Ilera business in Pennsylvania

- Closed on US$20 million loan from Canopy Growth to the Company's Arise Bioscience division

- Announced expansion of U.S. footprint via the acquisition of Maryland Based Grower Processor

- Opened fifth California Apothecarium dispensary in Capitola

- Received Permit to dispense medical cannabis at first New Jersey dispensary in Phillipsburg

2121 Guidance

Expects 2021 Net Sales to exceed US$290M and Adjusted EBITDA to exceed US$122M driven by the Company's emphasis on organic growth through expansion in high-quality, limited license markets while continuing to maintain tight control on costs.

- In Pennsylvania, sales and profits are expected to benefit from the annualization of multiple increases in cultivation capacity completed in 2020.

- In New Jersey, sales from the Company's 40,000 square foot greenhouse and 80,000 square foot indoor cultivation facilities are expected to ramp up throughout 2021

- its Phillipsburg dispensary will achieve its first full quarter of sales in the first quarter of 2021 and

- plans to open two additional dispensaries in the state in the second quarter and third quarter of 2021.

- In California, the Company is expected to increase the annual production capacity of super-premium craft flower from its expanded State Flower cultivation facility by 500%.

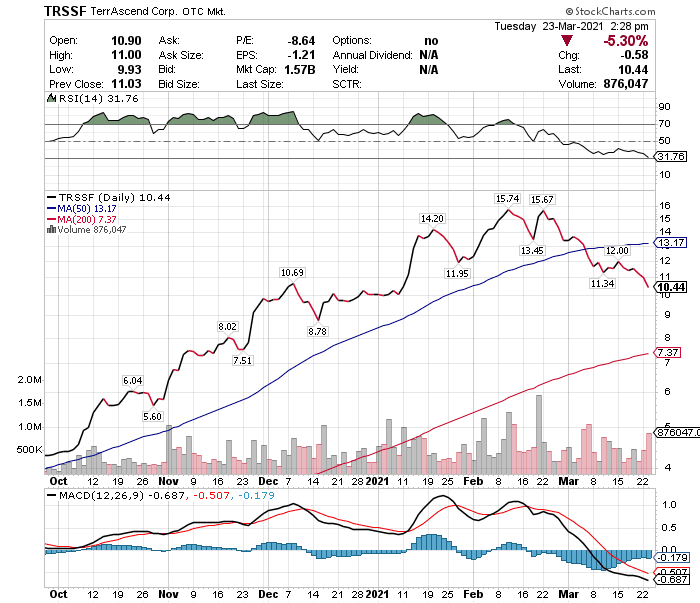

Stock Performance

While the TerrAscend stock price is UP 12.2% YTD (as of March 19th) it is DOWN 15.9% so far in March as illustrated in the chart below:

If you found the above analysis of interest check out the other recent analyses of Hexo, Columbia Care, Ayr Wellness, Curaleaf, Cronos, Tilray, Aurora, Canopy, Aphria, Organigram, Green Thumb, and Valens.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

Interesting.