Organigram Q1 2021 Financial Results Are Unmasked And They Are Dismal

![]()

Organigram Holdings Inc. (OGI), a leading licensed producer of cannabis, announced its results for the Q1 2021 ended November 30, 2020 and they were dismal across the board and the stock is declining as a result.

Q1 Financial Highlights

(All results are presented in Canadian dollars and compared to the previous quarter. Go here to convert into other currencies.)

Interestingly, it would seem that ORGANIGRAM management has tried to mask its dismal financial results in Q1 2021 by comparing said results with those of 12 months previous (i.e. Q1 2020) instead of the more current - and more meaningful - results from the prior quarter (i.e. Q4 2020). That being said, this summary does just that to give a better picture of how ORGANIGRAM is trending.

- Net Revenue: declined 5.2%% to $19.3M

- primarily due to significantly lower wholesale revenue from licensed producers and a lower average selling price

- Gross Profit (Loss): decreased to a loss of $(12.8)M from a profit of $6.2M

- largely due to similar factors impacting net revenue described above and reflected the increase in excise taxes as a percentage of gross revenue

- Gross Margin: reduced to 10% from 30%

- primarily due to lower net revenue as described above and excise sales taxes and value segment offerings comprising a larger proportion of total revenue

- SG&A Expenses: increased 2.7%

- largely due to higher insurance costs and general wage increases.

- Adj. EBITDA: decreased 139.8% to $(6.4)M

- largely due to lower adjusted gross margin as discussed above.

- Net Profit (Loss): improved 11% to $(34.3)M

- largely due to greater negative gross margin as described above.

- Cash/Equiv.: increased 79% to $133.9M

- largely due to the prior period’s increase in working capital assets as the Company scaled operations ahead of Rec 2.0 legalization.

Management Commentary

Greg Engel, CEO, had the following comments:

- “We are pleased with our double-digit sales growth in the Canadian adult-use recreational market this past quarter as it reflects the success of many of our new product launches, particularly in the dried flower value segment.

- Now we look forward to our new higher margin Edison dried flower offerings contributing substantially to overall revenue with even more new products to come in the next few quarters.

- We believe we are well position to generate further top-line growth and significantly improve gross margins as a result of:

- product portfolio revitalization

- additional resources to ramp up production and achieve greater economies of scale and

- our relentless focus on increased automation and cost efficiency opportunities position.”

Management Outlook

Within the Q1 report management had the following to say in reformatted, edited and abridged comments about the near-future:

Tailwinds

1. "...The Company believes there are a few factors creating tailwinds to further industry growth, namely:

- The legalization in October 2019 of Rec 2.0 products has attracted consumers who were not interested in smoking or vaping.

- The number of brick and mortar retail stores has increased significantly particularly in the back half of calendar 2020. After doubling the number of retail store authorizations in September 2020 from 20 to 40 per month, the Ontario cannabis store retail regulator announced in early December 2020 that it was doubling the number again to 80 per month. Since July 2020, the number of retail stores in Canada’s 10 provinces grew by approximately 47% and more than tripled in Ontario alone.

- The industry as a whole has made a concerted effort to match or beat illicit market pricing, particularly for dried flower, which has helped accelerate the conversion of consumers from illicit to legal consumption.

2. In mid-calendar 2020, ORGANIGRAM began a product portfolio revitalization to address what it believes to be some of the biggest consumer trends and preferences, including demand for value in large format, higher THC potency in dried flower as well as new genetic strains and novel products.

Headwinds

1. Accelerated industry growth from the accelerated store build out coupled with stronger than expected demand for many of the Company’s new products, resulted in competing priorities for ORGANIGRAM’s existing staffing and production levels.

- This contributed to delays in product launches and hindered consistent order fulfillment, which resulted in some meaningful missed revenue opportunities in Q1 Fiscal 2021 and is expected to continue to impact Q2 Fiscal 2021. As such, management has decided to ramp up staffing.

- By early Q3 Fiscal 2021, the Company plans to have hired 100 more positions, mostly in cultivation, and up to and additional 30 more positions in packaging.

- The benefit from the ramp-up in staffing and increased cultivation production is not anticipated to start having an impact until Q3 Fiscal 2021.

- Further, the Company believes it will still take time for the new products to reach their full potential and gain market share to drive meaningful sales growth.

2. The Company believes there is the potential for temporarily suppressed industry demand to impact net revenues in Q2 Fiscal 2021 as cannabis stores in certain densely populated parts of Ontario (Toronto and Peel) have been closed to physical retail traffic since November 23, 2020 and the rest of the stores in Ontario have been closed to physical traffic since December 26, 2020 due to the COVID-19 lockdown. The stores are still able to offer click and collect as well as delivery.

3. ...the Company's...new value segment products...have been well-received by the market, particularly SHRED which is the Company’s deepest value offering, droving the Company’s revenue growth in Q1 Fiscal 2021 in the Canadian adult-use recreational market over Q4 Fiscal 2020...

-

- [This has] contributed to a decline in gross margins for ORGANIGRAM...

- As such, the company is focused on further revitalizing its Edison mainstream brand, which attracts higher product gross margins, by launching new dried flower offerings with unique strains and higher potency THC.

4. Opportunities to scale up new genetics require a patient and deliberate process where cultivation protocols are trialed for each cultivar and adjusted through multiple grows before full roll-out to multiple rooms in the facility. The Company has successfully launched new genetics over the past 18 months...[and] these genetics help provide deep bench strength to the Edison portfolio.

-

- ORGANIGRAM is committed to continue investing in new genetics and expects at least three new high THC genetics to come to market in the next few quarters.

5. A negative non-cash adjustment to cost of sales for unabsorbed fixed overhead costs in Q2 Fiscal 2021 is anticipated to persist as a result of the Company’s plans to cultivate less than its cultivation capacity. However, the magnitude of the charge is expected to decline in Q2 Fiscal 2021 from Q1 Fiscal 2021 as the Company begins to ramp up cultivation....

6. Some production inefficiencies are anticipated to persist in the near to medium term and impact gross margins while Organigram continues to launch new products and optimizes production and staffing.

Opportunities

There are a number of opportunities that the Company has identified which it believes have the potential to improve adjusted gross margins beyond Q2 Fiscal 2021:

- The Company expects to gain economies of scale and efficiencies as it scales up cultivation and packaging.

- The recent launches of new higher margin dried flower strains under the Edison brand, with more to come in Q3 and Q4 Fiscal 2021, have the potential to positively impact gross margins over time as these products gain traction in the market and comprise a greater proportion of the Company’s overall revenue.

- A greater proportion of the Company’s portfolio is being dedicated to higher volume SKUs, such as multi-pack pre-rolls and 1g vape cartridges, which attract higher margins.

- The Company continues to invest in automation to drive cost efficiencies and reduce dependence on manual labor. For example, a new pre-roll machine is expected to be fully commissioned and operational by the end of Q2 Fiscal 2021.

- As a result of a packaging task force project, a number of cost reduction opportunities has been identified which have the potential to benefit margins starting in Q4 Fiscal 2021.

- The Company continues to serve international markets (Israel and Australia) from Canada via export permits and looks to augment sales channels internationally over time...

Stock Performance

ORGANIGRAM, a constituent in the munKNEE Pure-Play Pot Stock Index, was down 45.7% in 2020 but, along with all the other cannabis stocks last week, has recouped some of those losses in the past week as illustrated in the chart below:

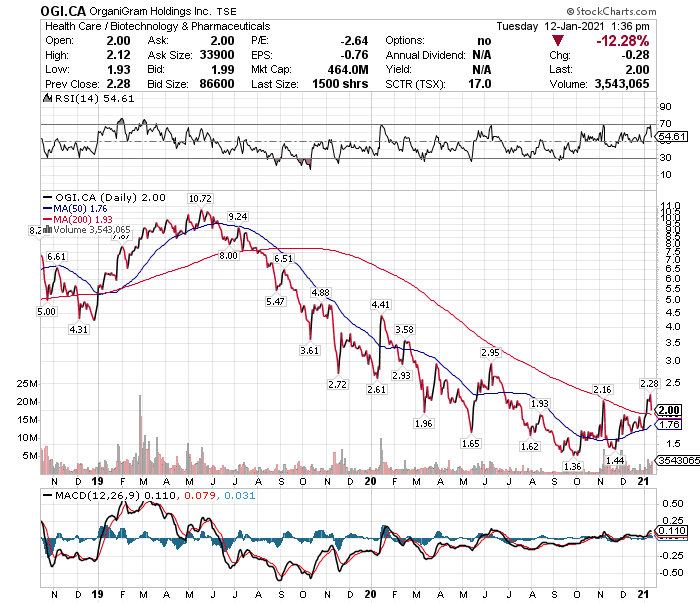

TSX Performance (in Canadian dollars)

(Click on image to enlarge)

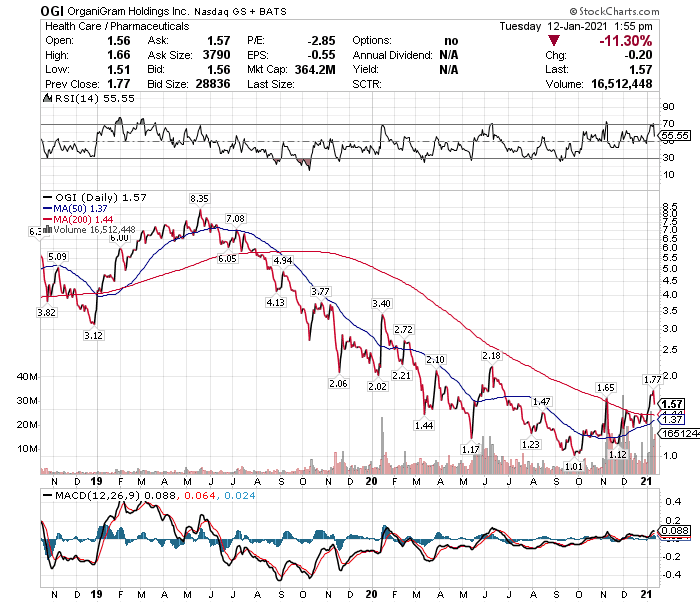

Nasdaq Performance (in U.S. dollars)

(Click on image to enlarge)

About ORGANIGRAM

ORGANIGRAM Holdings Inc.:

- is listed on:

- the NASDAQ Global Select Market exchange and

- the Toronto Stock Exchange listed company;

- is a licensed producer of cannabis and cannabis-derived products in Canada;

- is focused on producing high-quality, indoor-grown cannabis for:

- patients and

- adult recreational consumers in Canada,

- as well as developing international business partnerships to extend the Company's global footprint.

- has developed a portfolio of adult use recreational cannabis brands including The Edison Cannabis Company, SHRED and Trailblazer.

- is located in Moncton, New Brunswick, Canada and

- is regulated by Health Canada under the Cannabis Act (Canada) and the Cannabis Regulations (Canada). Source

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more