Canopy Growth Q3 Results Reveal Eye-Popping Net Loss Of $829M

Canopy Growth Inc. (CGC), a constituent in the munKNEE Pure-Play Pot Stock Index, reported its financial results for the third quarter fiscal 2021 ended December 31, 2020, today with an eye-popping net loss of $829 million.

(Canopy published its Q3, 2021 financial results in comparison to the same period a year ago (Q3, 2020) but the following summary is in comparison to the previous quarter (Q2, 2021) to provide clearer insights into the on-going, and most recent, trend and health of their business.)

Q3 Financial Highlights

(All figures are in Canadian dollars and compared to the previous quarter - see here)

- Net Revenue: increased 12.7% to a quarterly record of $152.5M (and by 23% vs. Q3, 2020)

- Other Revenue: increased 24.9% to $53.7M

- Cannabis Revenue: increased 7.0% to $98.8M

- Business-to-Business Recreational: increased 2.1% to $43.1M

- driven by store openings across Canada and improved market share performance

- Business-to-Consumer Recreational: increased 8.0% to $20.2M

- due to a full quarter of sales from ten new stores in Alberta, and same-store sales growth of 4% over Q2 2021 resulting from seasonal sales and promotional programs

- Canadian Medical: increased 0.7% to $14.0M

- driven primarily by a higher number of orders

- International Medical: increased 22.9% to $21.5M

- due to resolution of packaging issue with distributor that limited sales in Q2 2021

- Business-to-Business Recreational: increased 2.1% to $43.1M

- Gross Margin: declined to 16% from 19%

- Adj. EBITDA (Loss): improved 20.2% to $(68.4)M

- driven by net revenue growth and a decline in operating expenses

- Net Income (Loss): increased 758% to $(829.3)M from $(96.6)M

- driven primarily by impairment and restructuring charges and other related charges of $416M

- Cash on Hand: decreased 7.6% to $1.59B

- reflecting the EBITDA loss and capital investments

Q3 Business & Operational Highlights

(All figures are compared to the previous quarter)

- Further strengthened competitive positioning in the Canadian recreational market

- Increased recreational cannabis market share by 30bps to 15.7%

- Increased flower category market share by 180 bps

- increased value flower category market share by 310bps to 16.8%

- Maintained beverage category market share at 34% in spite of new beverage brands entering the marketplace, retaining the top 3 brands

- Increased recreational cannabis market share by 30bps to 15.7%

- Built further momentum in the U.S. market

- Increased distribution of its Martha Stewart health and wellness CBD products into 580+ Vitamin Shoppe and Super Supplements retail locations and is now outselling over 94% of all CBD brands in the U.S. in just 4 months since launch

- Improved distribution and strong consumer pull ensured continued strong growth in its S&B vaporizer products

- Strengthened direct (TW.com, shopcanopy.com) and third-party ecommerce sales channels.

- Further streamlined operations and improved organizational focus

- Ceased operations at a number of production facilities in Canada

- Divested its ownership in Canopy Rivers

- Increased its direct conditional ownership of TerrAscend Corp.

- Increased its ownership of Vert Mirabel greenhouse

Expected Medium-Term Financial Guidance

- Net Revenue CAGR of 40%-50% from FY 2022 to FY 2024

- Adjusted EBITDA to be positive during the second half of FY 2022

- Adjusted EBITDA Margin of 20% for the full year FY 2024; and

- Operating Cash Flow for the full year FY 2023 to be positive

- Free Cash Flow to be positive for the full year FY 2024.

Key drivers underpinning the Company's financial targets include:

- Growth of 40% in the Canadian legal recreational cannabis market growth in FY 2022 and market share gains;

- Increase in CAGR of 25%-30% from FY 2022 to FY 2024;

- Gains in market share in a stable-to-declining Canada medical cannabis market;

- Growth in international medical cannabis driven by the German market;

- Growth of the Company's U.S. CBD business, and consumer packaged goods business as a result of new product launches and distribution expansion in the U.S.;

- Cost savings of $150M - $200M; and

- Reduction in Capital Expenditures to below $200 million per year in FY 2021 and FY 2022.

Management Comments:

- David Klein, CEO, said: "...We are building a track record of winning in our core markets, while also accelerating our U.S. growth strategy with the momentum building behind the promising cannabis reform in the U.S."

- Mike Lee, CFO, added: "We are executing against our cost savings program, with several initiatives already completed and more underway to build a leaner and more agile business...[and] these cost savings, along with our top-line growth and continued cost discipline, puts Canopy firmly on a path to achieve profitability during Fiscal 2022, with further improvement anticipated beyond."

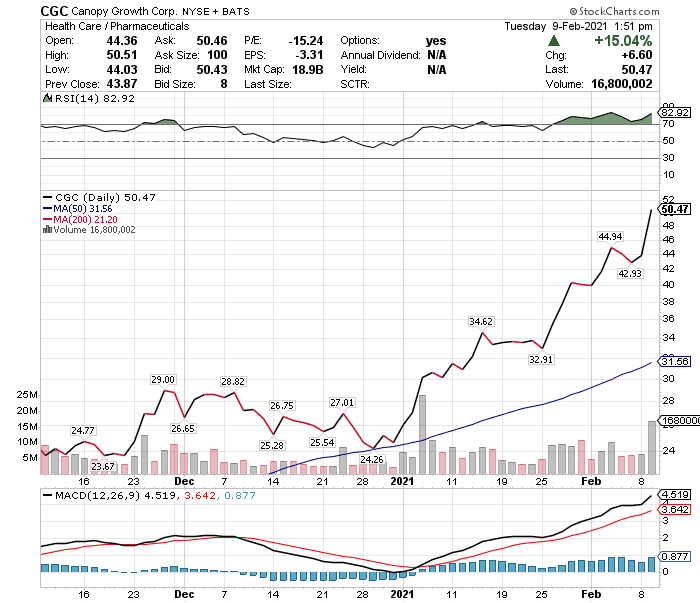

Stock Performance

As can be seen in the chart below Canopy Growth's stock price has been on a tear since the beginning of the year (up 78%) with no sign of it slowing down (+9.5% since the beginning of February) despite the poor Q3, 2021 financial results.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

Was that an actual loss, or was $829m an estimate of the profit that should have been made, but instead was less than what was guessed?