Cannabis Central: Trulieve Q4 Financials Reveal Record Revenue, Net Income And Adjusted EBITDA

Trulieve Cannabis Corp. (TCNNF) announced its Q4 financial and operational results for the period ended December 31, 2020, today that revealed record revenue, net income, and Adjusted EBITDA.

Trulieve had nothing to hide in its Q4 financial report providing a straight-forward comparison of its latest performance vs. the previous quarter allowing the true picture of its ongoing operation and trends to be easily assessed compared to the more common "sleight-of-hand" deployed by under-performers to mask weaknesses in their business.

Q4 2020 Financial Highlights

(Unless otherwise stated, all currency is expressed in U.S. dollars and in comparison to the previous quarter.)

- Revenue: increased 24% to $168.4M

- Gross Margin: decreased to 71% from 75%

- Operating Expense: increased to 27% of revenue from 29%

- Net Income: decreased 83% to $3.0M

- Adjusted EBITDA: increased 31% to $52M

- i.e. Earnings Before Interest Taxes Depreciation Appreciation

Q4 2020 Operational Highlight

- Acquired Solevo Wellness, adding three operational dispensaries in Pennsylvania

- Acquired PurePenn, a cultivator and processor supplying wholesale product to 100% of dispensary operations in the state

- Entered West Virginia with a processor permit and four dispensary permits subsequent to year-end

- Announced an agreement to acquire Mountaineer Holding, LLC, a West Virginia company that holds a cultivation permit and two dispensary permits, resulting in a vertical platform.

- Opened 11 new retail dispensaries ending the year with 75 stores in the U.S.

- Added over 200,000 square feet of cultivation facilities during 2020, ending the year with almost 2 million square feet of cultivation facilities

- Ended 2020 with a 49% market share in oil and 53% market share in flower in the state of Florida and achieved record flower and oil sales at the end of December, selling 93.7M mgs of oil and 36,330 ounces, or over one ton of flower.

Management Commentary

Kim Rivers, Trulieve CEO, had the following comments regarding the company's Q4 results:

- "...We had an excellent Q4 with strong financial performance capping off our highest annual revenue, net income, and Adjusted EBITDA...

- Growing demand for Trulieve products coupled with our successful expansion efforts in Q4 are strong validations of our strategy and our business overall...

- As we enter 2021 with the political changes and heightened focus on cannabis in the country, we believe these shifts along with our momentum and strategic vision position us for a strong year ahead.

- We remain committed to maintaining our leadership position in the southeast while continuing to build-out our hub strategy throughout the U.S. in preparation for the expected accelerated adoption of cannabis in the U.S."

2021 Financial Guidance

Based on Trulieve’s markets, current regulations, and foreseeable store growth, and the incorporation of a full year of operations from Trulieve’s Pennsylvania operations, continued growth in Florida as well as the Company’s Massachusetts, Connecticut, and California locations, the company estimates:

- 2021 revenues to increase by 56% to 63% to between $815M and $850M

- 2021 adjusted EBITDA to increase by 41% to 49% to between $355M and $375M

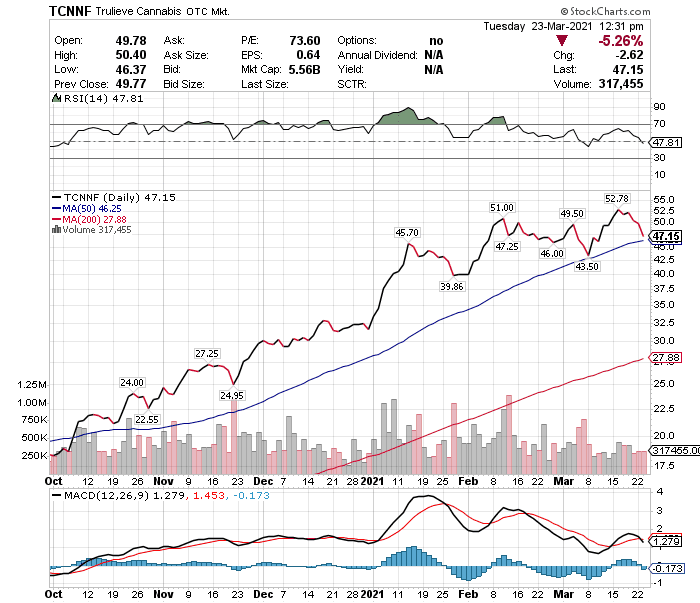

Stock Performance

munKNEE's American Pure-Play MSO Pot Stock Index of 21 constituents is UP 55% YTD and Trulieve, a Multi-State Operator itself, is UP 59% YTD which demonstrates:

- how well managed,

- how well-financed and

- how well the company is executing its business plan.

In recognition of the company's outstanding Q4 performance and extremely positive forward guidance, its stock price continues to do extremely well as illustrated in the chart below.

About Trulieve

Trulieve is a vertically integrated "seed-to-sale" medical cannabis company operating primarily in Florida but also with operations in Pennsylvania, California, Massachusetts, Connecticut, and now West Virginia. The company cultivates and produces all of its products in-house and distributes those products to Trulieve-branded stores (dispensaries) throughout Florida, as well as directly to patients via home delivery.

If you found the above analysis of interest check out the other recent analyses of Hexo, Columbia Care, Ayr Wellness, Curaleaf, Cronos, Tilray, Aurora, Canopy, Aphria, Organigram, Green Thumb, and Valens.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more