Harvest Health Q4 Financials

Harvest Health & Recreation Inc. (OTCQX: HRVSF), a vertically integrated cannabis company and multi-state operator in the U.S., today reported its financial and operating results for the fourth quarter ended December 31, 2020, as follows:

Q4 Financial Highlights

(Unless otherwise stated, the results are in American dollars - to convert to other currencies go here - and compared to the previous quarter.)

- Revenue: increased 13% to $69.9M

- Gross Profit: increased 9% to $31.3M

- Gross Margin: decreased to 44.8% from 46.6%

- Net Loss: increased 25.2% to $(7.4)M

- Adj. EBITDA: declined 21% to $9.1M

- Gen. & Admin. Exp.: increased 22% to $25.3M

- Sales/Mktg. Exp.: doubled to $1.6M

- Compensation: increased 215% to $4.1M

Q4 Operational Highlights

- opened two new dispensaries in Camp Hill and King of Prussia, Pennsylvania

- terminated the agreement to sell two California retail assets to Hightimes Holdings

- raised gross proceeds of approximately $32.4 million, including the overallotment option, in a bought deal financing

- completed the purchase and license transfer of THChocolate, LLC, including cannabis manufacturing licenses in Colorado. The consideration paid was immaterial.

- acquired three vertical medical cannabis licenses in Arizona from Devine Holdings in exchange for the repayment by Devine Holdings of an outstanding $10.45 million receivable owed to Harvest concurrently with the license acquisition

- divested its ownership in dispensary and cultivation assets in Arkansas, with net cash proceeds to Harvest of $12.9 million.

- settled a legal dispute with minority owners of Interurban Capital Group in which it canceled a total of 42,378.4 Multiple Voting Shares and received a $12 million secured promissory note with 7.5% interest and five-year maturity and cancelled all service agreements and call option agreements for Washington retail locations

- As of December 31, 2020, Harvest owned, operated, or managed 38 retail locations in six states, including 15 open dispensaries in Arizona.

2121 Outlook

- a full year 2021 revenue target of $380 million

- at least $87 million in revenue expected in Q1

- expect gross margins to trend upwards overall, with some fluctuations from quarter to quarter.

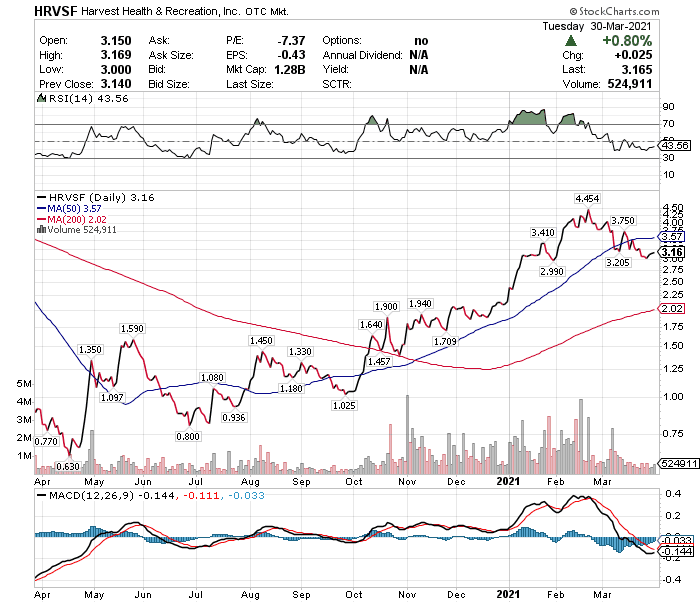

Stock Performance

While the Harvest Health stock price is UP 46.3% YTD it went DOWN 16.8% in March as illustrated in the chart below:

If you found the above analysis of interest check out the other recent analyses of Hexo, Columbia Care, Ayr Wellness, Curaleaf, Cronos, Tilray, Aurora, Canopy, Aphria, Organigram, Green Thumb, Valens, TerrAscend, and Trulieve.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more