Valens' Q1 Financials Show Improvement In All Metrics But EBITDA Is Still Negative

The Valens Company Inc. (VLNCF), formerly known as Valens Groworks Corp., is a global leader in the end-to-end development and manufacturing of innovative, cannabinoid-based products and a constituent in the munKNEE.com Pure-Play Pot Stock Index and it reported its Q1, 2021, financials today, as follows:

Q1 Financial Highlights

(All figures below are in Canadian dollars and compared to the previous quarter)

- Net Revenue: increased 24.7% to $20.0M

- Gross Profit ($): increased to $4.8M from $(6.0)M

- Adj. EBITDA*: increased 47.6% to $(4.3)M

- Net Income (Loss): loss reduced 66.1% to $(5.6)M

- Income (Loss) per Share: loss reduced to $(0.05) from $(0.13)

- Cash on Hand: increased 130% to $49.3M

*Valens' management defines adjusted EBITDA as:

- income (loss) and comprehensive income (loss) from operations, as reported, before interest, tax, depreciation, and amortization,

- and adjusted for removing share-based payments, realized gains and losses from short-term investments and liabilities, and other one-time and non-cash items including impairment losses.

- and believes adjusted EBITDA is a useful financial metric to assess its operating performance on an adjusted basis as described above.

Q4 Operational Highlights

- Increased market share to ~5.5% of the Cannabis 2.0 market in Alberta, British Columbia, and Ontario from 4.9%

- Continued to entrench the Company's position as the largest third party vape manufacturer in Canada

- Manufactured 14.5% less SKUs (53) to focus on sales velocity of existing products that have proven to lead within their respective categories within the Canadian market.

- Advanced discussions with respect to a number of global expansion initiatives, including increasing its existing international shipments with receipt of EU GMP certification on track for year-end.

- Closed LYF Food Technologies acquisition which has accelerated Valens' entry into the edibles market, increasing its edible product portfolio and market share with collective capabilities to produce innovative gummies, chocolates, and baked goods.

- Launched soft chews in partnership with Verse Cannabis.

- Launched an additional three vape cartridge flavors in partnership with Verse Cannabis

- Launched Summit soft chews alongside partner A1 Cannabis in Ontario.

- Launched nūance CBD bath bombs as its first entry into the topicals category.

- Expanded domestic distribution network into a fifth Canadian province (Manitoba) thereby increasing Valens' ability to capture increased market share in Canada.

- Increased the total addressable market with the amendment of its Health Canada license to sell dried cannabis products in Canada and now offers a complete portfolio of products to its customers in the Canadian cannabis market. Valens expects to begin manufacturing and shipping dried cannabis products, including flower and pre-rolls, to various provinces in the second quarter of 2021.

- Submitted a site evidence package to Health Canada for a fourth facility in Canada, which is in the final stages of construction in the Greater Toronto Area, and upon receiving its micro-processing license in Q2 will begin manufacturing products at the 30,000 square foot facility which is focused on the formulation, co-packing, and manufacturing of cannabis-infused beverages and other customized 2.0 and 3.0 products.

- Improved its capital position with the closing of its bought deal public offering for total gross proceeds of $39.7M.

Management Commentary

Jeff Fallows, the President, said:

- "With our recent public financing, we have a strong capital position to:

- fuel our growth as we launch new and innovative Cannabis 2.0 and 3.0 product formats and agreements,

- continue to build out our manufacturing capabilities and to

- accelerate our international expansion strategy."

Tyler Robson, Chief Executive Officer, Co-Founder and Chair of The Valens Company, said:

- "...We expect to grow our provincial sales through fiscal 2021 as we continue to manufacture winning SKUs across all Cannabis 2.0 categories, including the newly-entered edibles and topicals segments, and an evolving portfolio of Cannabis 3.0 products.

- With the addition of the LYF Facility and the GTA Facility nearing completion, our strengthened manufacturing platform allows us to:

- efficiently launch new SKUs,

- increase our market share alongside our customers

- and provides the capacity for us to drive significant volumes of previously launched and trusted products..."

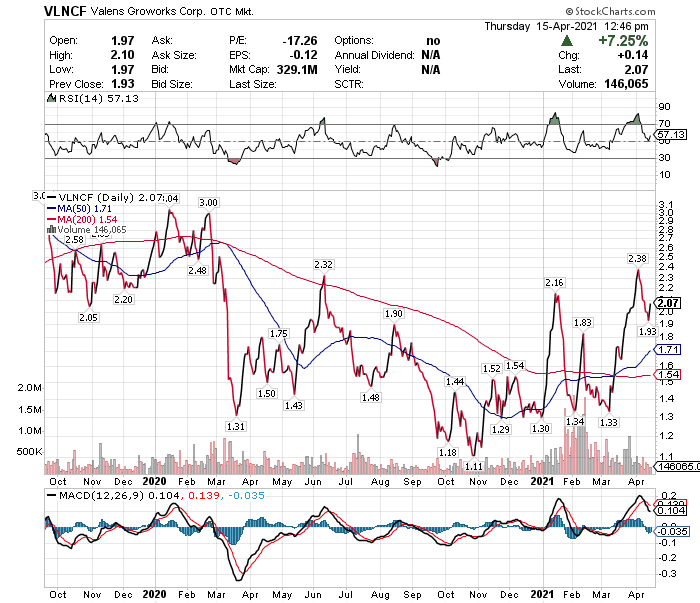

Stock Performance

As you can see from the chart below Valens' stock is up 59% YTD albeit down 8.7% so far in April.

If you found the above analysis of interest check out the other recent analyses of Hexo, Columbia Care, Ayr Wellness, Curaleaf, Cronos, Tilray, Aurora, Canopy, Green Thumb, TerrAscend, Trulieve, Rubicon, Harvest Health, Aphria, and Organigram.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more