Aphria Reports Dismal Q3 Financials - Stock Craters

Aphria Inc. (TSX/Nasdaq: APHA) reported its Q3 financial results today for the 3-month period ending February 28, 2021. The only positives were a record 8th consecutive quarter of positive adjusted EBITDA.

Financial Highlights

(All amounts are expressed in Canadian dollars unless otherwise noted and except for per gram, kilogram, kilogram equivalents, and per share amounts. Go here to convert into other currencies. All comparisons are to the previous quarter i.e. Q2, 2021.)

- Adj. Cannabis Gross Profit: declined 34.9% to $20.3M was primarily due to:

- lower yields that are typically experienced in the Company's third quarter, due to less sunlight in December through February, and the impacts of the product returns and

- the overall decrease in average selling price based on sales mix.

- Adj. Cannabis Gross Margin: declined to 39.2% from 45.9%

- Ave. Price/Gram:

- Medical: decreased to $6.69 from $6.96

- Adult-Use: decreased to $3.82 from $4,29

- Net Total Revenue: declined 4.3% to $153.6M

- Adj. EBITDA from Cannabis Business: declined 38.7% to $7.9M

- Net (Loss): increased 199.3% to $(361.0)M

- Loss/Share: increased 171% to $(1.14) per share

- Free Cash Flow: improved 76.1% to $(3.9)M

Operational Highlights

- Reached a definitive agreement to combine with Tilray, Inc. to create the world's largest global cannabis company based on pro forma revenue,

- Closed a USD $120 million financing with BMO, providing a US$20M revolving facility and US$100M term debt facility;

- Maintained its #1 licensed producer status in Ontario and Alberta in terms of sales to the provincial boards, based on Headset data for the period Dec. 2020 to Feb, 2021;

- Improved its market share in Quebec, rising to #2 licensed producer in terms of sales to the provincial board, based on internal analyses;

- Expanded its premium Broken Coast cannabis offering with introduction of newly developed strain "Pipe Dream;"

- Launched SweetWater Brewing Company, LLC beverages statewide in Colorado, the first U.S. state to legalize adult-use cannabis; and,

- Introduced the Solei brand topical, a high potency topical, in the Canadian market

Management Commentary

Irwin D. Simon, Chairman, and Chief Executive Officer said:

- "..The duration and impact of [COVID-19] lockdowns across many of the regions we operate in, particularly in Canada, were greater than we initially anticipated for the cannabis industry and our business; however, we believe Aphria remains well-positioned with our leading brands and market share to experience a robust increase in our top-line as the market improves...

- Going forward, we are excited about the strategic opportunities for incremental growth as we look to parlay our branded consumer products into additional complementary product offerings in Canada, the U.S., and internationally.

- ...Our proposed business combination with Tilray...will create one of the strongest global cannabis and consumer packaged goods companies in the world...[and will allow us to] build upon our existing foundation in Canada and internationally by increasing the scale of our global operations [and]...along with the strength of our balance sheet and cash availability, enhance value for all stakeholders."

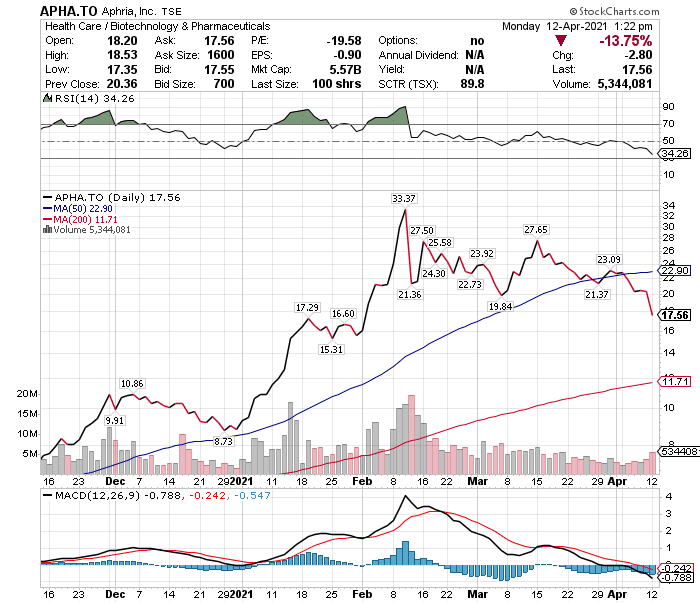

Stock Performance

Aphria Inc., a constituent in the munKNEE Pure-Play Pot Stock Index, is up 102% YTD and was up 24% in March but has declined +13% so far today in response to the dismal Q3 results as illustrated below in the TSX chart below. Go here to convert into other currencies.

If you found the above analysis of interest check out the other recent analyses of Hexo, Columbia Care, Ayr Wellness, Curaleaf, Cronos, Tilray, Aurora, Canopy, Organigram, Green Thumb, Valens, TerrAscend, Trulieve, Rubicon, and Harvest Health.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

sold shares when I got a 50% profit.considering repurchase later

50%? Nice! How long did you hold $APHA for before you sold?

2yrs