Organigram Q2 Financials: Downward Trend Continues

![]()

Organigram Holdings Inc. (OGI) announced its results for the Q2 2021 period ended February 28, 2021, and, like those of Q1, were dismal across the board.

Q2 Financial Highlights

(All results are presented in Canadian dollars and compared to the previous quarter. Go here to convert into other currencies.)

Interestingly, it would seem that Organigram management has tried to mask its dismal financial results in Q2 2021 by comparing said results with those of 12 months previous (i.e. Q2 2020) instead of the more current - and more meaningful - results from the prior quarter (i.e. Q1 2021). That being said, this summary does just that to give a better picture of how Organigram is trending.

- Net Revenue: declined 24% to $14.6M

- the company claims that they missed sales opportunities of approximately $7M due to production and processing constraints, as certain employees tested positive for COVID-19 which resulted in a significant number of facility staff having to isolate and

- were also negatively impacted by certain provincial boards aiming to manage lower levels of inventory.

- Gross Profit (Loss): declined 34% to a loss of $(17.2)M

- Gross Margin: declined to -5% from +10%

- Adj. EBITDA: declined 34% to $(8.6)M

- Net Profit (Loss): loss increased 94% to $(66.4)M

- Cash/Equiv.: increased 73% to $232M

Management Commentary

Greg Engel, CEO, had the following comments:

- “...We believe there are excellent prospects ahead for the industry, Organigram, and our shareholders.

- Nearer term,

- we are currently tracking to generate higher revenue in Q3 2021 as our new product portfolio continues to gain traction and we become better staffed to fulfill demand and

- our recent acquisition of The Edibles and Infusions Corporation positions us to generate revenue from the largest single category of edibles, soft chews or gummies.

- Longer term,

- we are extremely excited about developing innovative and appealing products to consumers in collaboration with BAT

- we see the potential for meaningful gross margin improvement as we

- revitalize our dried flower portfolio with new Edison and Indi strains and

- execute on a number of opportunities including the refinement of our cultivation, post-harvesting, and packaging processes.

- Nearer term,

- All of this is made possible and supported by strong liquidity and a balance sheet that is largely debt-free.”

Q2 Operational Highlights

- launched three new Edison Indica strains

- launched milk chocolate, a new flavor of Trailblazer SNAX, a value-priced chocolate bar

- establishing a “Center of Excellence” at the Company’s Moncton facility, per the PDC agreement with BAT, to focus on developing the next generation of cannabis products with an initial focus on CBD

Outlook

Net Revenue

The company:

- expects Q3 2021 revenue to be higher than in Q2 2021 when the Company’s Moncton facility was shut down for deep cleaning after identifying positive COVID-19 cases and a significant number of staff employees had to isolate but cautions that:

- there is the risk that net revenue could be negatively impacted again if positive cases are identified in the future and the Company needs to take similar measures and

- COVID-19 restrictions for cannabis retail stores, particularly in the most populous province of Ontario, could suppress demand and negatively impact net revenue in Q3 2021

- expects to generate more revenue growth beginning in Q4 2021from the production of soft chews and other confectionery products with the specialized equipment in the Winnipeg EIC facility.

Adjusted Gross Margins

The company:

- increased the yield per plant in Q2 2021 which resulted in a lower average cost of cultivation per gram and when that inventory is sold, starting in Q3 2021, it will positively impact Q3 2021 adjusted gross margins

- identified the following opportunities which it believes have the potential to further improve adjusted gross margins over time:

- economies of scale and efficiencies as it continues to scale up cultivation.

- increased sales from the launch of new higher-margin dried flower strains under the Edison and Indi brands

- increased higher-margin international sales once the Company resumes shipments to Canndoc which is currently expected in Q4 2021 contingent upon regulatory approval from Health Canada, including obtaining an export permit, and the availability of the desired product mix

- increased higher-margin multi-pack pre-rolls and 1g vape cartridges

- continues to invest in automation to drive cost efficiencies and reduce dependence on manual labor resulting in a number of cost reduction opportunities that have been identified for implementation starting in Q4 2021

Stock Performance

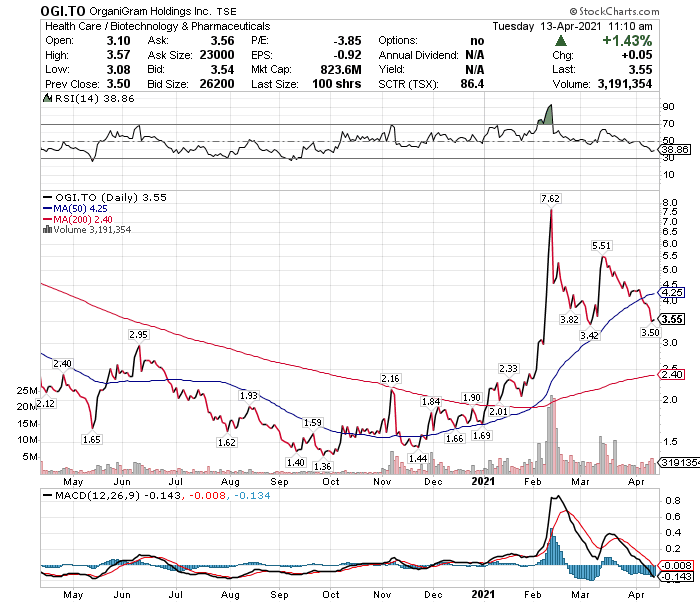

Organigram, a constituent in the munKNEE Pure-Play Pot Stock Index, was down 45.7% in 2020 but, along with all the other cannabis stocks, has advanced 114% YTD as illustrated in the chart below. Go here to convert into other currencies

If you found the above analysis of interest check out the other recent analyses of Hexo, Columbia Care, Ayr Wellness, Curaleaf, Cronos, Tilray, Aurora, Canopy, Green Thumb, Valens, TerrAscend, Trulieve, Rubicon, Harvest Health, and Aphria.

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more