Tuesday Talk: To The Moon With QT!

If there were awards for fighting the Fed, to date, the month of January would walk away with the Gold, the Silver and the Bronze. It's as if the market is saying "To the moon, Jerome Powell, to the moon!"

On Monday the market blasted higher with the S&P 500 closing above the 4,000 mark at 4,020, a gain of 47 points, while the Dow closed at 33,630, up 254 points and the Nasdaq Composite at 11,364, up 224 points. Whew!

Top gainers were all tech issues, save for Ford (F), which means investors are ignoring the effect of interest rates on emerging tech companies and start-ups? Huh? Do I need to continue this article in French? Still, a green chart is a green chart:

Chart: The New York Times

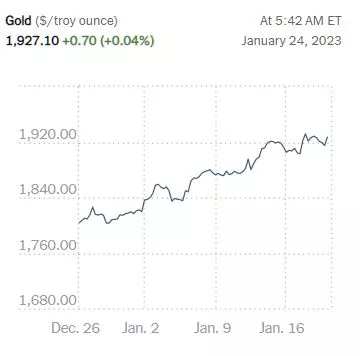

Despite the risk-on mood on Wall Street, Gold (GLD) is continuing its January climb as well.

Chart: The New York Times

In morning futures trading S&P 500 market futures are trading down 9 points, Dow market futures are trading down 63 points and Nasdaq 100 market futures are trading down 50 points.

Contributor Jennifer Nash in World Markets Update - Monday, Jan. 23 tallies up the numbers and finds that it is not only New York that is up month to date.

"Seven of eight indexes on our world watch list posted gains through January 20, 2023. The top performer is Hong Kong's Hang Seng with a YTD gain of 11.44%. France's CAC 40 is in second with a YTD gain of 8.07%, and Germany's DAXK remains in third with a YTD gain of 7.97%. Coming in last for the third straight week is India's BSE SENEX with a loss of 0.36% YTD."

In an Editor's Choice piece TalkMarkets contributor Douglas Gammons writes The Short-Term Uptrend Continues With Large Price Swings.

"The short-term uptrend looks set to continue, although with some large swings in price appearing for the major indexes. The PMO index reached the top of the range, then fell back just a bit, which looks similar to the previous cycle seen in November. With the PMO at its current level, it suggests that the best time to buy stocks in the short-term has passed, and it is important now to be more selective.

Also, if there are any stocks that you own that are looking extended, this is the time to be calculating appropriate sell stops in order to lock in partial profits. Although, I should note that the past two short-term term cycles lasted for a number of weeks, so it is a bit early for aggressive profit-taking."

"The new 52-week lows continue to behave well and are at harmless levels, which is another signal that favors owning stocks at the moment...I continue to see quite constructive market indicators, including a number of stocks that are setting up nicely for breakouts. The challenge for the indexes and stocks will be to hold above their break-out levels. That is the real test, and it has been disappointing so far...

Outlook Summary

- The short-term trend is up for stock prices as of Jan. 6.

- The economy is at risk of recession as of March 2022.

- The medium-term trend is higher for Treasury bond prices as of Nov. 19 (prices higher, yields lower)."

Bob Lang, a long time TM contributor writes Bullish Sentiment Has Become Overwhelming.

"Bullish sentiment has come on strong this month – never mind that we are still in a bear market. That label has become somewhat of a misnomer for some, especially given good results so far this year. Bear markets don’t last forever, and we are probably more than halfway through this one...This week will bring us a massive number of Q4 earnings reports. Analysts have been pruning down growth estimates, which will make the bar much easier to hurdle over. Listen carefully to management on their earnings calls...In the end, earnings growth rates matter the most, and if a company is not growing – or does not expect to grow – investors will hit the sell button."

See Lang's full article for additional insights.

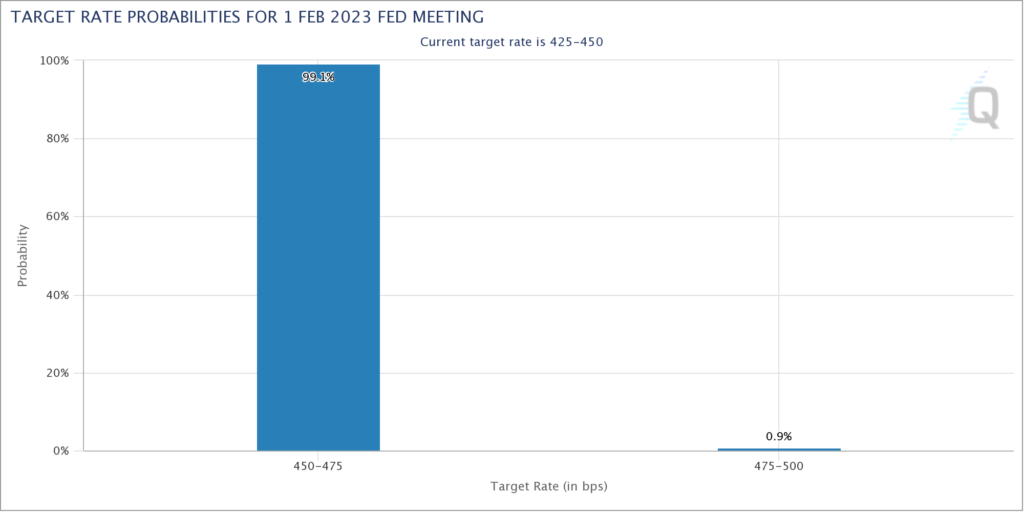

In contributor Greg Feirman's Monday column he takes the time to consider current expectations for the Fed in his article, Stocks Run Up Into Earnings Season As The Fed Considers Pausing.

"Stocks are bouncing hard into the start of the 4Q22 earnings season as investors anticipate the end of the Fed’s rate hiking cycle."

"The Fed Whisperer Nick Timiraos had a must-read article on the front page of today’s Wall Street Journal in which he said that the Fed will raise 25 basis points on February 1 and start to deliberate about when to pause rate hikes entirely. As you can see in the chart of Fed Futures above, investors are currently putting a 99% probability that the Fed will hike 25 basis points on February 1.

My concern is that investors are thinking like this:

- The Fed rate hikes to counteract inflation caused the bear market.

- The rate hikes have cooled inflation so the Fed can stop hiking rates.

- Therefore, the bear market is over.

While this appears to be a syllogism it is in fact not. What investors aren’t considering is the effect all this Fed tightening will have on the economy. As we all know, monetary policy acts with a lag and we’ll only understand its impact over the course of 2023."

Which brings us to contributor Mish Shedlock, who asks What Do Real Income And Spending Suggest About Recession Timing?

"The Real Income and Spending report for December comes out on Friday, with GDP out on Thursday. This is an advanced look at income. I added a new column for the November data."

"The word "real" means inflation-adjusted. It's real income and spending that are inputs to GDP. I added Real DPI Less Transfer Payments to the chart because that is what the NBER uses as an input to determine recessions...

Lacy Hunt at Hoisington Management and I discussed the timing of the recession. We both think a recession has started.

Although DPI minus transfer payments may be higher, real PCE is a strong favorite to be negative.

The NBER, the official arbiter of recessions looks at real personal income less transfers, nonfarm payroll employment, real personal consumption expenditures, wholesale-retail sales adjusted for price changes, employment as measured by the household survey, and industrial production.

Industrial production, retail sales, full time employment are negative. I expect negative revisions to jobs and income. Even without jobs, if this data holds, we are in recession."

There are additional charts in Shedlock's full article.

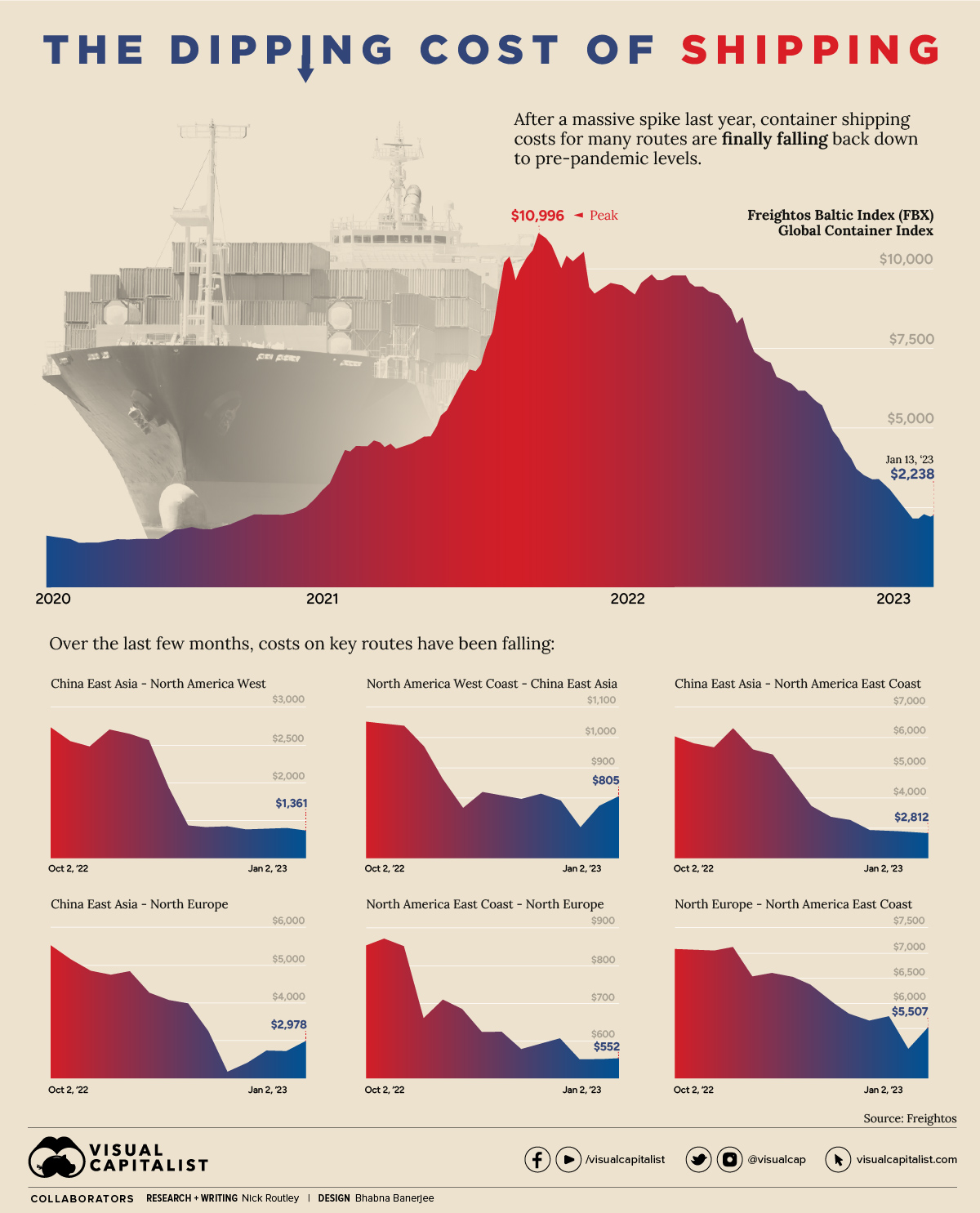

One key factor which has caused inflation to begin to wane has been a sharp drop in worldwide shipping costs since their peak during the pandemic. Contributors Nick Routley and Bhabna Banerjee have Charted: The Dipping Cost Of Shipping.

"A little over one year ago, congestion at America’s West Coast ports was making headlines, and the global cost of shipping containers had reached record highs.

Today, shipping costs have come back down to Earth, with some routes approaching pre-pandemic levels. The graphic above, using data from Freightos, shows just how dramatically costs have fallen in a short amount of time.

The Freightos Baltic Index (FBX)—a widely recognized benchmark for global freight rates—has fallen 80% since its peak in late 2021."

"A recent study from the IMF, which included 143 countries over the past 30 years, found that shipping costs are an important driver of inflation around the world. In fact, when freight rates double, inflation increases by 0.7 of a percentage point."

As for the flip side of the coin...

"Falling shipping costs are great news for everyone except, well…shippers.

While most of us can eventually look forward to improved supply chain efficiency and less inflationary pressure, shipping companies are seeing the end of a two-year boom period.

For example, major shippers like COSCO and Hapag-Lloyd saw a staggering 10x or more increase in profit per 20-foot equivalent unit (TEU) shipped.

For the time being, carriers are canceling voyages and sending obsolete ships to scrap to keep prices from bottoming out completely. In early January, container spot freight rates rose for first time in 43 weeks, signaling that the rollercoaster ride that shipping rates have been on since the start of the pandemic may be coming to an end."

A quick pop over to the "Where To Invest Department" finds TM contributor Tom Konrad of Alt Energy Stocks, over the moon, so to speak about the prospects for green energy stocks in 2023: Looking Up Like The 2009 Disney Movie.

Below are some of his thoughts:

"When it comes to stock market investing, investor mood swings tend to overshoot. If we think other investors are tuning in to horror movie marathons, it’s often a good move to surf on over to the Disney Channel for a little hope in the face of adversity. At the Foundation Green Income Fund, our mood is less Texas Chainsaw Massacre [1974] and more Up [2009]."

"Without a doubt, there are going to be moments when things don’t look good for our animated stock market heroes in 2023, but we’re feeling optimistic about the prospects for the clean energy income stocks that are the core of our portfolio. The horror movie watchers have knocked valuations back down from the romantic comedy highs we saw at the end of 2021, and new policies like the inflation reduction act and Europe’s push to free itself from Russian fossil fuels are both greatly boosting the chances of an uplifting ending, despite the challenges. The Russians are likely to inspire clean energy stock market progress. Call it an October Sky [1999] theme for 2023."

"Since I started writing for AltEnergyStocks.com in 2007, I’ve only been more optimistic than I am now three times. In early 2016. A group of clean energy infrastructure stocks called Yieldcos had gone through a bubble that popped in mid-2015. Those same Yieldcos were trading at great valuations, and I bought lots of tickets to that feel-good movie, leading to a couple of great years for my “10 Clean Energy Stocks” model portfolios in 2016 and 2017."

"This year, the previews have definitely gotten me interested again. I’m not as confident that green income stocks are ready for the blockbuster year as I was in 2016 or late 2008/early 2009, but I’m more confident than I was at the lows of the pandemic bear market of 2020. 2023 is an investment movie I am excited to see. I’m buying lots of tickets."

Caveat Emptor!

Have a good one.

Illustration: Rosanna Schmidt

More By This Author:

Tuesday Talk: Short Week - Up or Down?

Thoughts For Thursday: All Eyes On The CPI

Monday Musings: Indicators and Anticipation

Good read.