Stocks Run Up Into Earnings Season As The Fed Considers Pausing

(Click on image to enlarge)

Fed officials are preparing to slow interest-rate increases for the second straight meeting.

— Nick Timiraos (@NickTimiraos) January 22, 2023

They could begin deliberating how much more softening in labor demand, spending and inflation they would need to see before pausing rate rises this spring. https://t.co/I2baGj3aGT

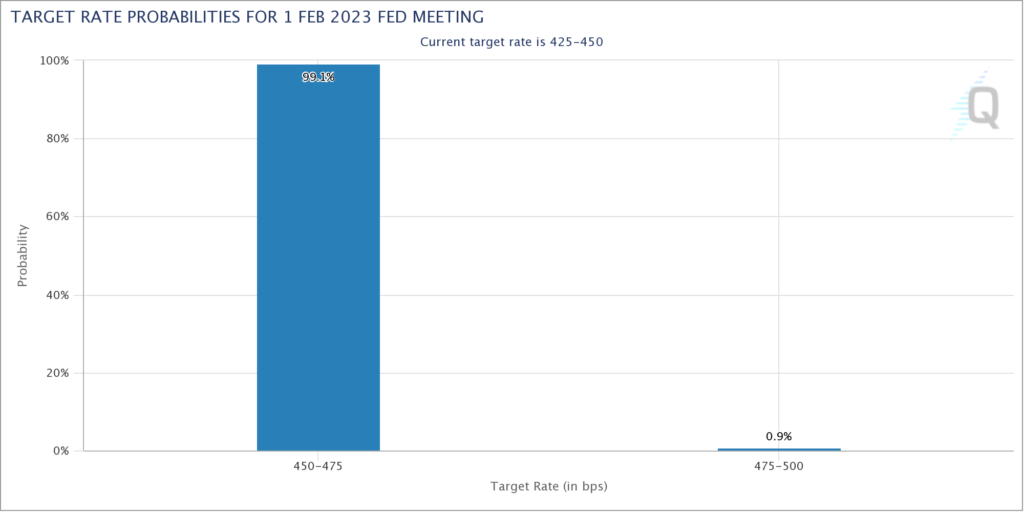

Stocks are bouncing hard into the start of the 4Q22 earnings season as investors anticipate the end of the Fed’s rate hiking cycle. The Fed Whisperer Nick Timiraos had a must-read article on the front page of today’s Wall Street Journal in which he said that the Fed will raise 25 basis points on February 1 and start to deliberate about when to pause rate hikes entirely. As you can see in the chart of Fed Futures above, investors are currently putting a 99% probability that the Fed will hike 25 basis points on February 1.

My concern is that investors are thinking like this:

- The Fed rate hikes to counteract inflation caused the bear market.

- The rate hikes have cooled inflation so the Fed can stop hiking rates.

- Therefore, the bear market is over.

While this appears to be a syllogism it is in fact not. What investors aren’t considering is the effect all this Fed tightening will have on the economy. As we all know, monetary policy acts with a lag and we’ll only understand its impact over the course of 2023.

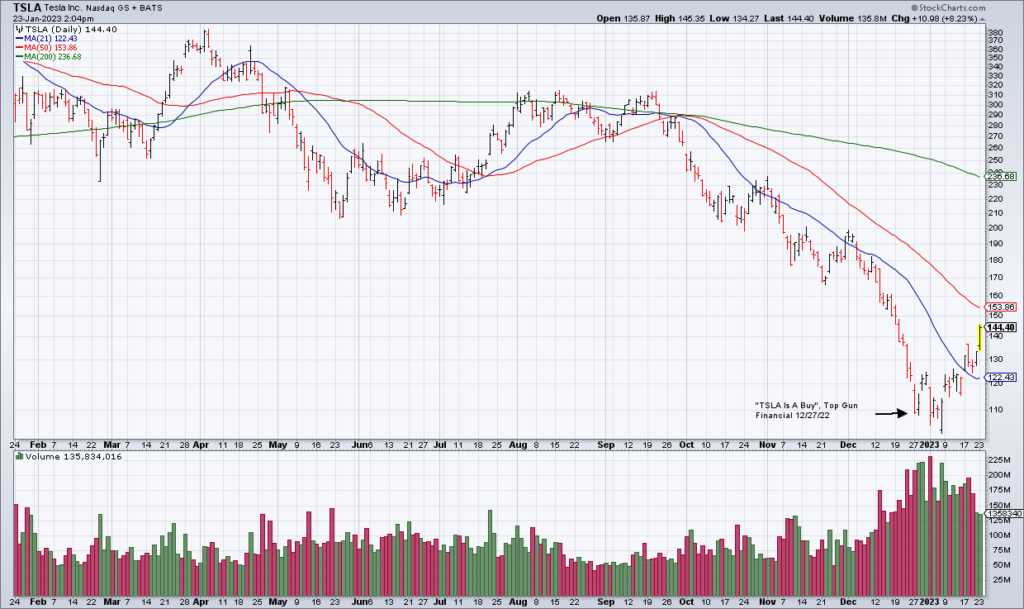

(Click on image to enlarge)

Therefore I took the opportunity this morning to lighten up on the long side by selling the Tesla (TSLA) shares I recommended and bought a month ago for an almost 30% profit. You might want to consider using this rally to prune your portfolio a bit too.

More By This Author:

Market Preview Week Of Jan. 23-27: Credit Cards, Railroads, Housing

Take Profits In NFLX

DFS: Signs Of Credit Stress