Tuesday Talk: On The Way Up - Again

After a continuation of the ride down (which was already in motion the week before) earlier in the week, stocks ended last Friday heading upward and the rally continued on Monday. The Dow closed at 34,398, up .54%, the S&P 500 closed at 4,197, up .99% and the Nasdaq Composite closed at 13,661, up 1.41%. Currently, futures for all three indices are up firmly.

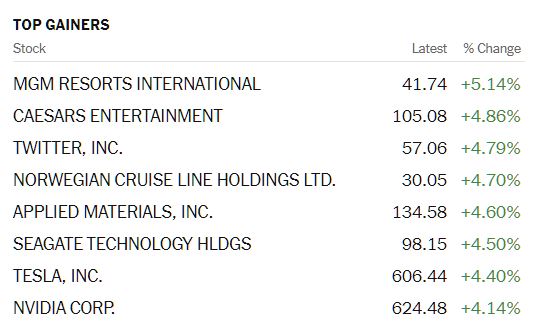

Yesterday some of the major tech names had strong one day gains as did some of the entertainment and leisure stocks (based on strong anticipated re-opening activity, one assumes). See the chart below for a look at the action (NVDA, TSLA, AMD, MGM, NCL).

Source: The New York Times

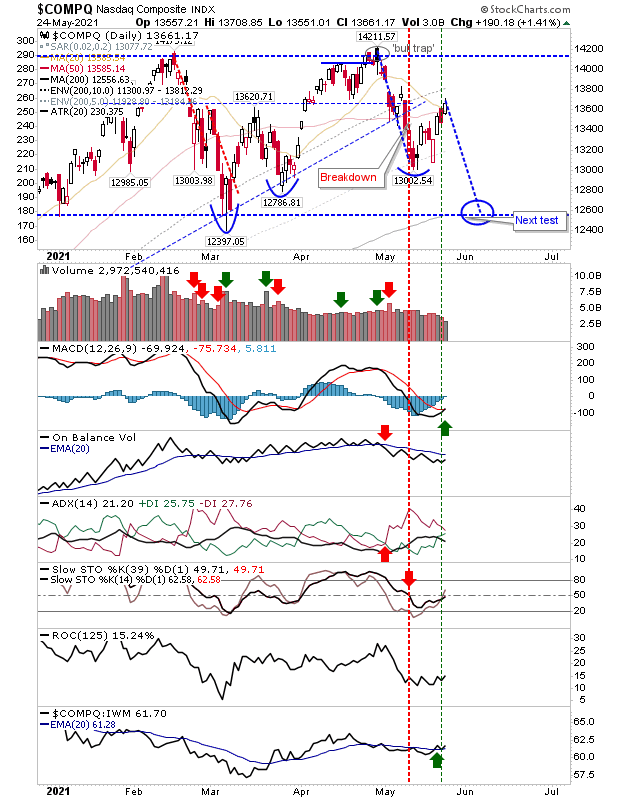

Declan Fallon in his article Market Gains Take The Edge Off Friday's Losses takes a look at the charts to explain yesterday's market action.

"For the Nasdaq (COMP), today's gains managed to finish above both its 20-day and 50-day MA. Volume was light but gain did come with a MACD trigger 'buy'. Not to mention, the index continues to outperform the Russell 2000 (IWM). The other side of today's action, is that each gain focuses the measured move lower on to the 200-day MA. Convergence increases the possibility of it happening. "

"Today's action simply extended Friday's trading. It looked good on paper, but didn't change the overall picture. We need to see trading ranges broken on volume to suggest there is an end to the consolidations in play for the Nasdaq and Russell 2000."

So the market seems to playing catch-up and no clear break is yet detected.

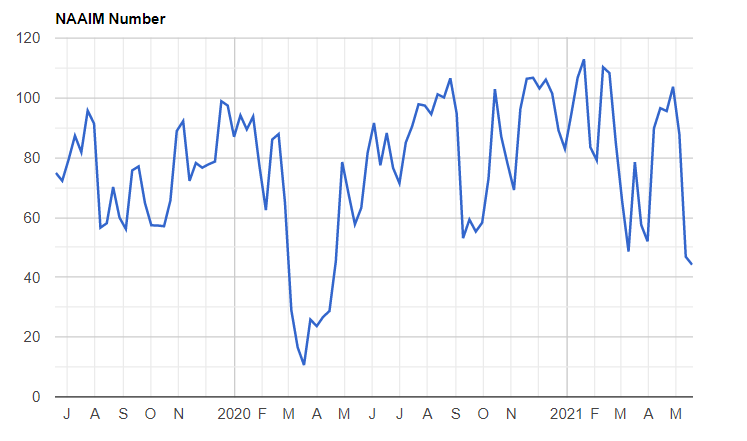

In fact, TM contributor Terry Grennon writing in Bearishness Hits Advisors says that "As indicated by the NAAIM index, the "smart money" sentiment among professional investment managers has dropped to the second-lowest level in almost two years." He provides the below chart to show readers what that looks like.

Rod Raynovitch who covers BioTechs seems less concerned up about current market hiccups as he notes in Biotech Stocks Cruise Through The Volatility.

"The XLV Healthcare Select SPDR is up 10% YTD. (And) This would be a safer way to play the overall sector... Some favorite stocks today are already moving today as of 2:30 p EDT trading in anticipation of product pipeline news: BMY, LLY. Other movers today are MRNA, NTLA, RETA…This good is a good time to add beta to your portfolio as the small-cap, equal-weighted XBI is in bottoming process at the $125 level. The XBI reached highs above the $170 level in the speculative blowout just recently in early February."

Some tips perhaps, but not free of volatility, especially for anyone who bought XBI in Feb.

When the market is volatile investors can certainly find calm in an old guard dividend stock like AT&T (T) right? Well the answer seems to be yes or no, depending on who is doing the talking. The market reacted in a mixed manner to the company's plan to spin off it's entertainment unit and merge it into a new entity with Discovery (DISCA). TalkMarkets contributor Tim Plaehn takes a look at why this might be good for investors in AT&T Dividend Cut Could Be Good For Dividend Investors For The Next 12 Months.

"Included in the announcement was news that the AT&T dividend would be significantly reduced after the spin-off. As investors learned about the dividend cut, the AT&T share price shed over 12% in two days. The question for AT&T investors now is whether the stock is a buy, a hold, or a sell. Before this recent move, AT&T had paid a stable and growing dividend for 25 years. In November 2020, when AT&T shares traded to yield more than 7.5%...

Since the announcement, I have seen numerous – dozens of, maybe – articles, both pro, and con, about what the transaction will mean for investors. With the AT&T share price now below $30, I think there is a significant upside for investors. Here are a couple of factors to consider:

First, the spin-off/merger transaction is scheduled to take place in mid-2022. That is a full year and up to four more $0.52 per share dividend payments away...

Second, the spin-off will release the growth potential of WarnerMedia, which will be a major player in the entertainment content world when combined with the Discovery assets. It’s hard to predict what DSCA will be worth after the merger and a year in the future, but history shows that corporate spin-offs to unlock growth potential can be very profitable for investors.

With a year until the transaction, there is plenty of time for the investing public to get excited about owning AT&T as a pure-play telecom company and Discovery as potentially one of the most valuable media companies. I intend to suggest my subscribers continue to hold their AT&T shares but would be ready to take profits if the share price approaches $40.00."

Caveat Emptor, as always.

Rounding out today's column we take another look at the U.S. housing market, something that we have been following since last year. Tyler Durden in his article Robert Shiller: "In Real Terms, Home Prices Have Never Been So High" looks at what MSNBC economist Robert Shiller has to say about housing prices as well as the view of Glenn Kelman, CEO at Redfin. It seems an unsettling time to buy a house for sure.

Here's a quote from Shiller:

"If you go out three or five years, I could imagine they'd [prices] be substantially lower than they are now, and maybe that's a good thing," he added. "Not from the standpoint of a homeowner, but it's from the standpoint of a prospective homeowner. It's a good thing. If we have more houses, we're better off."

Here's Kelman's view:

"on an intermediate basis...housing prices are set to cool. He said the housing market is in a frenzy, with most houses selling above the asking prices, which has never happened before."

And this, "Kelman warned: "I think you're going to see a little bit of air come out of the ballon," referring to the housing market bubble the Federal Reserve engineered by sending mortgage rates to record lows at the start of the virus pandemic in 2020."

Durden ends his article on a slightly cynical note (which he often does), but the warning is not one to be taken lightly, nonetheless.

"Between Shiller and Kelman, both believe housing prices are in a frenzy. However, Kelman's view is that housing prices will cool on an intermediate timeframe, and Shiller is on a multi-year view. The broad consensus is that today's environment is not sustainable. But as we all know, the Fed can sometimes maintain bubbles for quite some time. And who may deflate today's housing bubble? Well, the Fed, of course, which has been hinting about tapering of bond purchases."

This coming weekend is one for cookouts and perhaps getting together with friends and family for the first time since the pandemic (depending on relaxing of restrictions by specific geography of course), but it is also Memorial Day. Have a safe and meaningful holiday.

"Heroism doesn't always happen in a burst of glory. Sometimes small triumphs and large hearts change the course of history." - Mary Roach

Interesting indeed, and I also am wondering as to when the housing bubble will burst. I see no way that my house is worth 11 times what I paid for it.