Thoughts For Thursday: The Pause That Refreshes?

Yesterday the Fed, as expected did not increase the Fed funds rate, however it remains to be seen if this pause will relieve some of the current strain in the credit markets without fueling inflation, further.

Federal Reserve Chair, Jerome Powell, made the following statement in his post-FOMC meeting press conference remarks, regarding the decision:

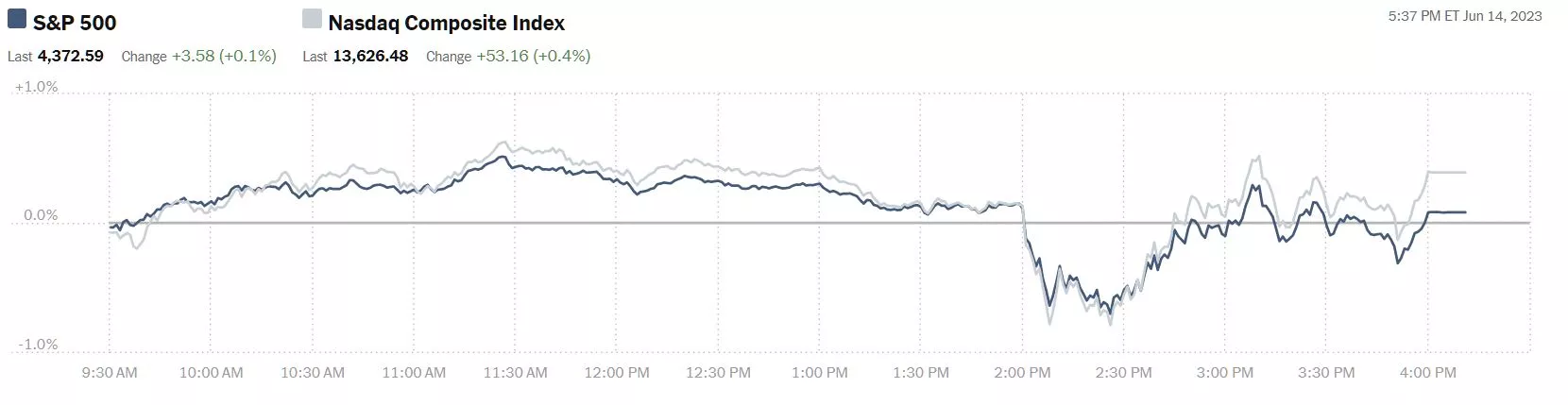

Wednesday the stock market started to drop around 2:00 pm prior to the start of Powell's press conference, but both the S&P 500 and Nasdaq recovered completely by the close of trading.

The S&P 500 ended the day at 4,373, up 4 points, the Dow closed at 33,979, down 233 points and the Nasdaq Composite rose 53 points higher, to 13,626.

Chart: The New York Times

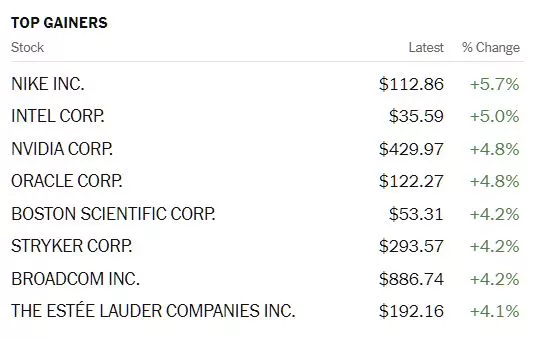

Top gainers on Wednesday were Nike (NKE), up 5.7%, followed by Intel (INTC), up 5.0%, and Nvidia (NVDA), up 4.8%.

Chart: The New York Times

In current futures trading, S&P 500 market futures are down 17 points, Dow market futures are down 84 points and Nasdaq 100 market futures are down 103 points.

TM contributor James Harte calls yesterday's decision by the Fed a Hawkish Hold.

"Stocks were seen rallying yesterday as the Fed paused its tightening campaign after 15 months of rate increases...On the back of the meeting, we’ve seen a little softening in equities prices as traders digest the details. The broad strokes are that the Fed stands ready to act further if needed, and currently thinks that is likely...We can now expect incoming data, particularly around employment and inflation, to create above-average volatility as traders look to anticipate forthcoming Fed moves. The rally in the Nasdaq 100 (NDX) has seen the index breaking out above the top of the bull channel, though stalling just ahead of the 15177.5 level. For now, with momentum studies bullish, the focus is on a further push higher and an eventual break of the level. On the downside, 14288.2 is the next support to watch."

Contributor Dennis Miller in his article The Worldwide Inflation Dilemma examines how inflation and government responses to it create investment dilemmas amidst market uncertainty.

"While the government wants to reassure us things are under control, we know better when we pay the bills. As evidenced by the recent debt ceiling farce, politicians have no interest in fiscal sanity or balancing the budget. While many predict the demise of the dollar, and much of the world is assisting in the erosion of the USD as the world currency, there are other factors...

Urs Vrijhof-Droese is the Managing Partner of WHVP, international asset managers...He shares some interesting graphs:"

"Currently, the European Union (EU) has bigger inflation challenges than the US. It’s time to check in with Urs for a global perspective."

Miller goes on to interview Vrijhof-Droese, below are some excerpts:

"DENNIS: Urs,...Are you seeing any real spending restraint in the EU or elsewhere? Where do you see this going internationally?

URS: I don’t see any real restraint in the EU. Like the US, they have spent more than their tax revenue and borrowed, or created money to make up the difference...The worldwide government spending programs, initiated during Corona, pushed inflation even higher are taking a toll. People couldn’t support their standard of living, leading to more government spending programs. This is a vicious cycle. In the long run, I believe the EU and US government spending behavior will have a severe impact on their credibility, affecting the value of their currencies.

DENNIS: When you select investments for your clients, what are the currencies you are currently favoring?

URS: Last year, we significantly increased our exposure to the Swiss franc. We saw the strength of the Swiss economy and the flexibility we could obtain, as well as the comparatively very low inflation rates. We favor the Australian dollar. Keeping in mind the international pressure towards the energy transition, many minerals are needed. These minerals also rise in price with world inflation. Australia is one of the world’s largest lithium suppliers.

DENNIS: Since 2008, I’ve felt central banks are coordinating their efforts, and the major governments of the world are spending money they don’t have. Historically politicians are forced to revert back to gold when the currency fails.

Do you see any movement in returning to the gold standard?

URS: Yes, I am. From 1990 until 2010, central banks have been net sellers of gold. Last year we saw the second-highest year of central banks’ net purchases since 1950, reversing course. There is a reason they are buying. The political class has indeed become undisciplined with spending...An eventual return to a gold standard is still being determined... Holding assets, including gold in an offshore account, adds another level of safety."

See the full article for additional commentary.

One of the key factors in determining both growth and inflation rates are wages and wage increases. Contributor and economist Menzie Chinn examines The Labor Market – Bargaining Power, Wages, Inflation. Here are some of Chinn's and his colleagues most recent comments on this topic:

"From WPR yesterday, UW Madison experts:

Timothy Smeeding, a professor of public affairs and economics at the University of Wisconsin-Madison, told Wisconsin Public Radio’s “Central Time” that the tight labor market has helped low-wage workers the most.

Between 2019 and 2022, the lowest 10 percent of wage earners nationally saw their inflation-adjusted hourly wage grow by 9 percent, according to the Economic Policy Institute. That’s the fastest wage growth for the lowest-wage workers since 1979.

Smeeding said demand for workers exceeding supply is what led to that growth, especially as the pandemic waned and people began going out again. He expects that trend to continue as long as there’s a tight labor market...

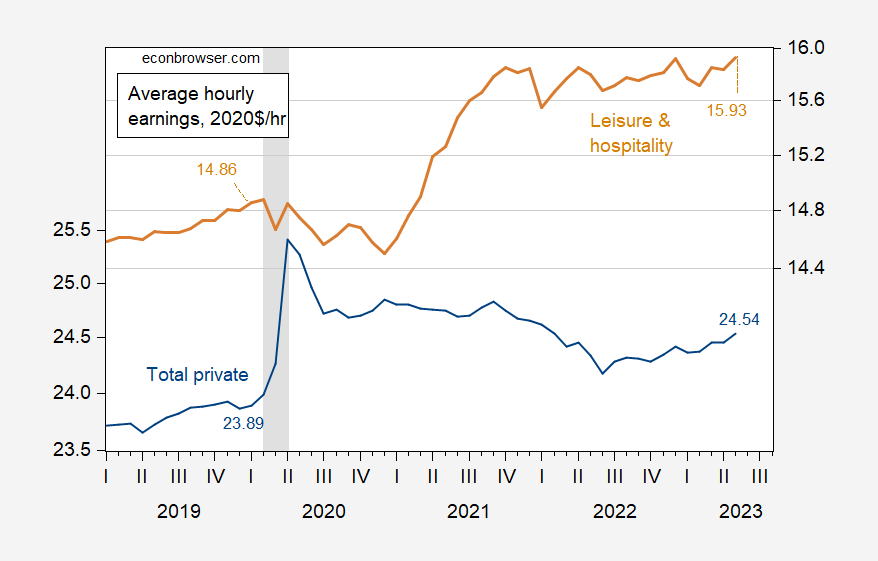

What’s happened in leisure and hospitality, traditionally one of the lowest paid sectors?

Menzie Chinn, professor of public affairs and economics at UW-Madison, said that wage gains haven’t been evenly distributed by economic sectors. He noted leisure and hospitality workers have seen the largest wage gains since the pandemic, while wages for workers in all other non-farm sectors have seen slower wage growth.

“As far as we can tell, (leisure and hospitality workers) are beating inflation, at least in terms of the wage rate,” he said. “Now, I don’t know how many hours they’re working, and it’s going to be spotty because not everybody is going to be in a restaurant that saw their wages rise.”

Beyond wages, Laura Dresser, associate director of the COWS economic think tank at UW-Madison, said the tight labor market also gives workers more leverage to negotiate with their employers for more flexible hours or to confront workplace harassment.

Using nationwide statistics, here’s what we see about real (inflation-adjusted) wages:"

"Figure 1: Average hourly earnings in total private sector (blue, left log scale), and in leisure and hospitality (tan, right log scale), in 2020$/hour (CPI-all deflated). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations."

As a contra, or perhaps in parallel TalkMarkets contributor, Bill Conerly writes Employment Gains Contradict Layoff Headlines - But Just Wait.

"Time lags account for some of the disparity between current news and employment statistics...

Significant employment declines are likely to begin in late 2023 or early 2024. And that will just be the beginning. Job losses will likely continue for six to nine months. After that, recovery of the lost jobs will take another six to nine months.

The recession isn’t here yet despite a year of talking about it. Its slow arrival should not surprise us given the usual time lags in monetary policy as well as the gradual implementation of the Federal Reserve’s interest rate hikes. But the Fed’s anti-inflation efforts will take their toll on employment. Even though today’s news headlines don’t match the employment numbers, we’ll soon see gloomy data on jobs. That’s nothing to look forward to, but it’s inevitable given where things have been going."

The full article details the reasons for the disparities in the employment statistics as well as a sector review of the labor market.

A.I. continues to be the main driver in the Nasdaq and S&P 500 rallies and in a TM Editor's Choice column, contributor Martin Hutchinson says Big Is Very Ugly.

" Apple (Nasdaq: AAPL) is bringing out yet another virtual reality headset, the “Vision Pro” to appear early next year, priced at $3,400. This follows the total failure of Meta’s (META) Metaverse and similar virtual and augmented reality products launched by Alphabet (GOOG), Microsoft (MSFT), and others – I bought my son a $30 virtual reality headset in 1999! This is yet another indication that the biggest companies tend to follow one another like sheep and are not at all where innovation comes from. Since Bigness leads to Badness, I thus applaud the work of the Federal Trade Commission’s Lina Khan in attempting to slow the flow of corporate mergers, which generally subtract value...

Large companies and innovation have always been uneasy bedfellows – one thinks back to Ford (F)’s 1958 Ford Edsel, launched in September 1957 and soon a dismal failure...

The one problem with AI currently is its partial domination by large organizations...

The large organization blight extends far beyond the tech sector. I have written at length about the decline in U.S. productivity growth since the 1970s. Much of this is due to government regulation, and another portion to insane monetary policy, but there can be little doubt that an additional retardant has been the massive unproductive blob of the Fortune 500...

Management remuneration has soared into the stratosphere, and now largely consists of stock options, which are not accounted for properly but endlessly dilute shareholder interests...

As I said, Big is Bad. In fact, it is very ugly indeed. We must restructure our economic system to break down bigness wherever it exists and return the economy to the innovations of the small-scale private sector: companies of no more than 500 employees, all of whom are personally known to top management."

You can find further axe-grinding in the full text.

That's a wrap for today.

Have a good one.

More By This Author:

Tuesday Talk: Not Clear Yet

Thoughts For Thursday: Hazy Days