Thoughts For Thursday: Hazy Days

As much of the Mid-Atlantic region continued to be under severe smoke particulate skies the NYSE continued to move up and down on Wednesday, ending with a mixed close.

Image K. Siu

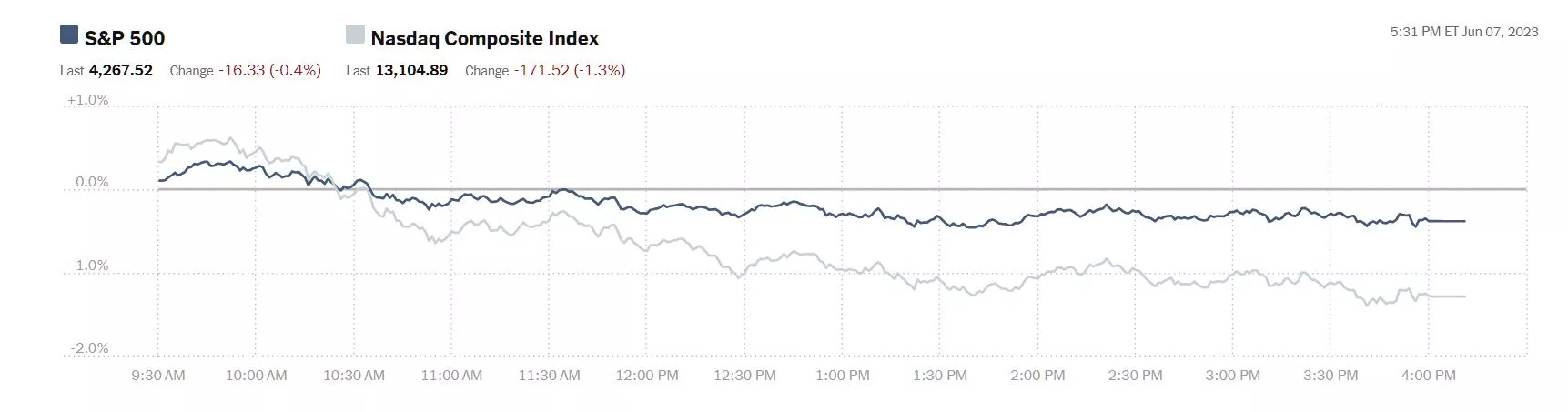

The S&P 500 closed down 16 points, at 4,268, the Dow closed up 92 points, at 33,665 while the Nasdaq Composite closed at 13,105, down 172 points.

Chart The New York Times

Most actives included Warner Bros. Discovery and AT&T, up a whopping 8.4% and 2.7%, respectively.

Chart The New York Times

Currently, in morning futures action S&P 500 market futures are up 2 points, Dow market futures are down 18 points and Nasdaq 100 market futures are flat.

While waiting for next week's FOMC rate hike or pause decision TalkMarkets contributors are weighing in on a range of topical issues.

The Staff at Schaeffer's Research are of the opinion that Tesla Stock Could Perform Particularly Well In June.

"Tesla (TSLA) is already up 84.6% in 2023, and trading at its highest level since November. The shares also broke above long-term resistance from their 200-day moving average in late May, and according to a recent study from Schaeffer's Senior Quantitative Analyst Rocky White, could do particularly well in June.

Tesla stock appeared on White's list of best S&P 500 Index stocks to own this month. TSLA finished higher in eight of the last 10 years, bringing its average one-month return for June to a lofty 10.1%. From its current perch, a comparable move would place the equity over the $247 mark for the first time since October."

Contributor Nomi Prins writes, Raising The Debt Ceiling Hurts The U.S. Dollar.

"...today, I’ll explain why rising debt takes away from the dollar.

First, let’s examine the new bipartisan debt bill that was just signed into law.

Overall, it suspends the debt ceiling until 2025 and slashes government spending by a modest amount.

Here’s what it constitutes:

-

The bill offers a two-year extension for the debt limit, meaning the debt cap will be suspended until January 2025. That takes us through the election period, leaving the next president and next Congress to deal with what happens in 2025.

-

The bill eliminates $1.4 billion in IRS funding and redirects about $20 billion of the $80 billion that had been allocated to improve the IRS back to the budget.

-

The bill restarts federal student loan payments after a long pause that began at the start of the pandemic.

-

The bill introduces new work requirements for Supplemental Nutrition Assistance Program and Temporary Assistance for Needy Families benefits for people up to 55 years old. The current age requirement is for people up to 50 years old. However, it also introduces new exemptions for veterans and for the homeless.

"Now that the debt ceiling will be raised, the U.S. will have the money needed to avoid a default on its debt.

But issuing more debt only makes our economy more fragile.

It means that in order to function, the U.S. must borrow more. That’s not a path toward economic stability. It’s quicksand economics. You can’t solve debt problems by getting deeper in debt.

The more U.S. debt there is, the lower the value it has. That’s because in a world where the main buyers of that debt are cutting their holdings, adding more to the pile makes it even less appealing.

You can only solve the issue of debt with solid economic growth. And the Fed is messing that up.

You see, the Fed’s rate hikes were sold as a policy designed to temper inflation.

But the effects of interest rate hikes are slowing our economy. They’ve also made our economy weaker as more people borrow at higher interest rates and as more bank failures pile up.

Credit card debt increased by 18% over just last year. And higher interest rates make it harder to pay off that debt than when we had lower interest rates. This also limits an American’s purchasing power.

So with a slowing economy and increased debt, the outlook for the dollar is only bound to get worse.

When Washington raises the debt ceiling, that means our debt as a nation will also increase. In fact, that’s the whole point of raising the debt cap – to be able to borrow more when necessary.

As a result, the U.S. debt will go up as a percentage of GDP. This means our economy is growing slower than our debt.

All of these factors weigh on the dollar. More debt and fewer buyers of that debt make its value appear less attractive."

Prins says to temper this hot mess, investors should buy gold and gold stocks. Hmm and hmm.

Economist and TM contributor Scott Sumner looks at A Target Band For Inflation?

"If the Fed had a single mandate to target inflation, then there would be an argument for switching from a point target like 2% to a band such as 1.5% to 2.5%. But the Fed has a dual mandate, under which an inflation band would be completely pointless. The Fed already allows inflation to fluctuate above and below 2% as required to achieve the high employment side of their mandate. Calling something “pointless” might be viewed as mild criticism, but I have other concerns.

The past two years have clearly demonstrated that the Fed is off track, and it’s not hard to see where the problem lies. Fed policy since 2021 has been far too expansionary...The best outcome for the Fed upcoming policy review would be to actually adopt flexible average inflation targeting. Under this regime, the Fed would make up for inflation overshoots with lower than 2% inflation going forward, and inflation undershoots with above 2% inflation going forward. Over longer periods, the Fed would keep the average inflation rate close to 2%. Obviously, the Fed isn’t doing that today. The policy must be symmetrical."

Contributor Kelsey Williams writing in a TalkMarkets "In the Spotlight" article asks, Does Crypto Still Have Value?

"The value of cryptocurrencies has to do with the transaction process. Bitcoin and other cryptocurrencies have value because they provide a process for the private transfer of money. Beyond that, expectations for their common use as an alternative to the U.S. dollar and other fiat currencies make little sense...

Higher price is not necessarily an indication of higher value. This is especially true for Bitcoin (BITCOMP) and other cryptocurrencies.

The only unique fundamental value for cryptocurrencies is the privacy aspect of money-based transactions. Without the privacy (decentralized control) there is nothing special about cryptocurrencies.

As the effort to regulate and control cryptocurrencies continues, the prices of Bitcoin and other cryptocurrencies will reflect the loss of fundamental value which is correlated to the loss of privacy/decentralized tracking. No privacy. No value."

See the article for more insights.

Closing out the column with a TalkMarkets Editor's Choice piece, contributor Bruce Wilds asks, Is China Failing In Its Effort To Reignite Its Economy?

"It is difficult to ignore that China is failing in its effort to reignite its economy. The proof is pouring out of China that its problems go far deeper than most people ever imagined. China is in a period of economic contraction.

The era of large-scale concentrated consumption may be over. Following the pandemic and lockdown unemployment is soaring. Simply put, the country seems to be entering into a post-Japan bubble era or even worse a situation similar to what America faced in the great depression."

"The fact that most of the wealth of Chinese households was held in housing equity and prices are falling has created a reverse wealth effect. This has caused consumer spending to grind to a halt, Many Chinese homeowners are now upside-down on their investments and owe more than the property they bought is worth...

Supply chain issues have also created another problem for China. The big move away from companies producing goods in China means China is losing its position as the world's factory. Several other countries such as Vietnam and Mexico are rapidly pulling jobs away from China and it shows...

China excels in making it extremely difficult to know what to believe. While positive stories continue to flow out of China, it is important to ask what is real and what is CCP paid for propaganda."

Wilds includes additional economic data points in his essay.

That's a wrap for now.

Have a good one and if you're on the Eastern seaboard consider masking up before venturing out.

More By This Author:

Tuesday Talk: That Old Up and Down...

Thoughts For Thursday: In The House, Debt Deal Done