Thoughts For Thursday: In The House, Debt Deal Done

On Wednesday night, the United States House of Representatives passed a bill to raise the debt ceiling for two years. The bill passed with 314 votes for and 117 votes against the measure. 165 Democrats voted for the bill, 149 Republicans provided the rest of the votes. The naysayers were split between 49 Democrats and 71 Republicans. The bill must now be approved in the Senate as is before reaching the President's desk for signature.

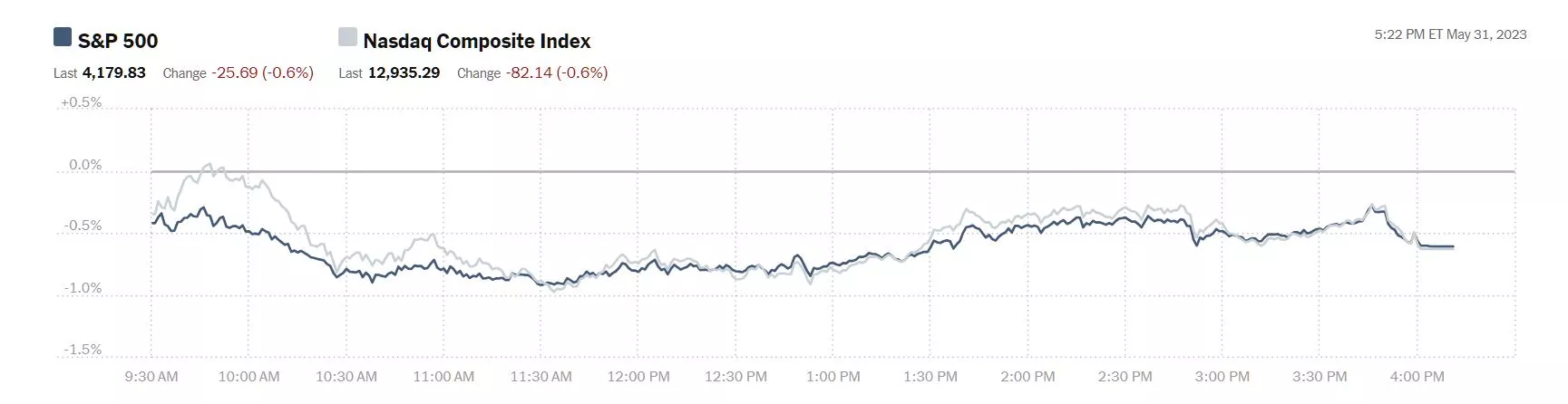

In the run-up to the House vote the markets had an up and down day. There was observable profit-taking in some of the big tech AI-related stocks like Nvidia (NVDA) and AMD (AMD), down 5.7% and 5.6% respectively. The S&P 500 closed at 4,180, down 26 points, the Dow closed at 32,908, down 135 points and the Nasdaq Composite closed at 12,935, down 82 points.

Chart: The New York Times

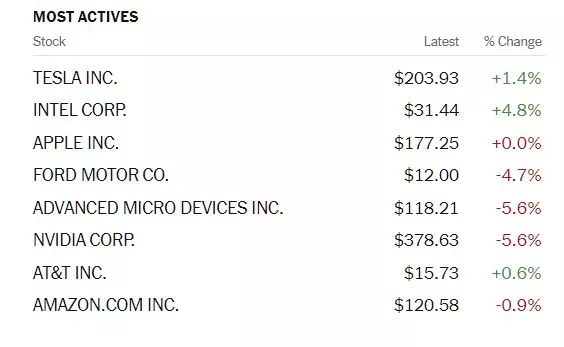

Most actives were again led by Tesla (TSLA), +1.4%, followed by Intel (INTC), +4.8% and Apple (AAPL) which closed unchanged.

Chart: The New York Times

In morning futures action, S&P 500 market futures are trading up 11 points, Dow market futures are trading up 11 points and Nasdaq 100 market futures are up 27 points.

Even with the debt deal done in the House, there still is a lot of hot air in the room. Today's column provides some short takes from some of our contributors.

Tyler Durden says Beige Book Shows U.S. Economy Turning More Sluggish.

"The Fed's latest beige book released this (Wednesday) afternoon was a boring affair, one signaling the US economy remained sluggish at best, and describing economic activity as "little changed overall in April and early May". Four Fed districts reported small increases in activity, six no change, and two slight to moderate declines. Expectations for future growth deteriorated a little, though contacts still largely expected a further expansion in activity. A summary of the big picture:

- Consumer expenditures were steady or higher in most Districts, with many noting growth in spending on leisure and hospitality.

- Education and healthcare organizations saw steady activity on balance.

- Manufacturing activity was flat to up in most Districts, and supply chain issues continued to improve.

- Demand for transportation services was down, especially in trucking, where contacts reported there was a "freight recession."

- Residential real estate activity picked up in most Districts despite continued low inventories of homes for sale.

- Commercial construction and real estate activity decreased overall, with the office segment continuing to be a weak spot.

- Outlooks for farm income fell in most districts, and energy activity was flat to down amidst lower natural gas prices. Financial conditions were stable or somewhat tighter in most Districts.

- Contacts in several Districts noted a rise in consumer loan delinquencies, which were returning closer to pre-pandemic levels.

- High inflation and the end of COVID-19 benefits continued to stress the budgets of low- and moderate-income households, driving increased demand for social services, including food and housing."

Contributor Mish Schneider says the Consumer Sector ETF XRT Has Some Words For You.

"Granny Retail is super close to the precipice of a major breakdown under the 80-month moving average or 6-8 year business cycle..

Fed’s playing pickle ball.

Last time we saw a breakdown under that moving average (if XRT fails it) was KRE Regional Banks in March.

Can XRT hold here?

Consumer Sector ETF XRT Has Some Words for You and here they are:

First, the test of the 80-month MA (green and price 56.24) on the last day of the month of May is mad interesting.

Secondly, do not assume it will fail until it does. And even if it fails that MA-June has 30 days before we can determine what happens the second half of the year.

Thirdly, XRT could just as easily hold that level offering a very low risk/reward trade or more importantly, a relief for the rest of the market.

Fourth, XRT is below the March 2023 lows but above the October 2022 lows at 55.32.

Finally, on the Daily chart, momentum is declining.

In fact, our Real Motion indicator shows that XRT’s momentum HAS NOT been below a key Bollinger Band until NOW. Not in March and not last October.

Mean reversion potential? Sure.

But also, fair warning that the consumer sector is yet another potential harbinger that the lower trading levels in SPY going back to March and/or October are not to be dismissed."

In a TalkMarkets Editor's Choice piece, contributor Michael Ashton asks Is Inflation Dead…Again?

"There is something that seems very weird to me. Prices of short-dated inflation swaps in the interbank market suggest that NSA headline inflation is going to rise less than 0.9% for the entire balance of 2023 (a 1.45% annualized rate). And actually, most of that rise will be in the next 2 months. The market is pricing that between June’s CPI print and December’s CPI print the overall price level will rise 0.23%…less than ½% annualized!..

The only market where you can sort of trade core inflation rather than backing into it, the Kalshi exchange, has the current prices of m/m core at 0.35% in May, 0.32% in June, 0.57% in July, 0.45% in August, 0.35% in September, 0.18% in October, and 0.22% in November...

Markets, of course, trade where risk clears and not necessarily where “the market thinks” the price should be. I find it hard to understand though who it is who would have such an exposure to lower short-term prices that they would need to aggressively sell short-term inflation…unless it is large institutional owners of TIPS who are making a tactical view that near-term prints would be bad. Sure seems like a big punt, if so.

Naturally, it’s possible that inflation will suddenly flatline from here. I just don’t feel like that’s the ‘fair bet’...

Recently, markets have also been starting to price the possibility that the Federal Reserve could continue to hike interest rates, despite fairly clear signals from the Chairman after the last meeting that a ‘pause’ was in the offing. That certainly makes sense to me, since 25bps or 50bps makes almost no difference and after one of the most-aggressive hiking cycles in history, putting rates at approximately long-term neutral at the short end, it would seem to be prudent to at least look around. If, in looking around, the Fed were to notice that the balance of the market is suggesting that inflation has a chance of going instantly and completely inert, it would seem to be even stranger to think that the FOMC is about to fire up the rate-hike machine again for another few hikes."

See the full article for more detailed examples of why "core" inflation must be going down.

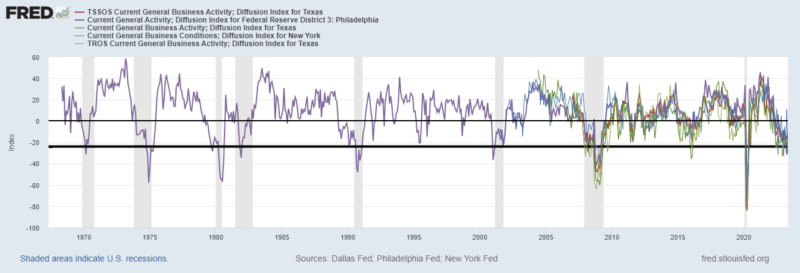

Contributor Douglas R. Terry, CFA in his article Macro: Regional Business Surveys says the signals say recession.

"Regional Surveys from Philly, NY, Texas, and Chicago are all at levels previously indicative of a recession...

No region has absolutely fallen off a cliff, but all have Z-scores below -1. The NY data point is the first release of the group and is prone to volatility. It just dropped from +10.8 in April to -31.8 in May. The April NY Fed print of +10.8 appears to be the outlier as it is the lone print above 0 in 2023 and the only series with a positive print since the summer of 2022. The current -31.8 data point is the 6th lowest print in the history of the monthly data set that goes back to July 2001...

Contributors Chris Turner, Francesco Pesole and Frantisek Taborsky of ING Economics in their daily Forex column write Dollar Skips To The Fed Beat.

"USD: We're hearing more of this term 'skip'

Having enjoyed a decent rally on the back of some surprisingly strong JOLTS job opening data, the dollar sold off late yesterday on a couple of Federal Reserve speakers (Patrick Harker and Philip Jefferson) suggesting that the Fed could potentially 'skip' a rate hike at the June meeting - but leave the door open for a July hike. That term 'skip' first entered the Fed lexicon with remarks from Christopher Waller last week and suggests the Fed is indeed starting to use a new communication tool for gracefully ending its tightening cycle.

While that new strategy does provide some flexibility for the Fed, the data will be a key determinant on whether indeed it does skip the June hike. The release of the Fed's Beige Book last night looked reasonably positive. It was hard to identify any clear signs of slowing activity and consumption was holding up well. Perhaps there were some early signs that pressures in the tight labor market were easing - but nothing to support any recessionary narrative. That suggests this current dollar dip does not need to run too far."

Closing us out contributor Fiona Cincotta gives us, Two Trades To Watch: EUR/USD and Oil.

"EUR/USD falls ahead of Eurozone inflation data

- EZ inflation set to cool to 6.3% YoY

- ECB meeting minutes are also due

- EUR/USD needs to break 1.0635 for further losses

EUR/USD is falling for a second straight day ahead of the eurozone inflation and US jobs data and as the US debt bill passes through the House of Representatives.

Eurozone inflation is expected to cool to 6.3% YoY in May, down from 7% in April. The data comes after inflation in France, Germany, and Spain cooled by more than expected, easing pressure on the ECB to raise interest rates aggressively..."

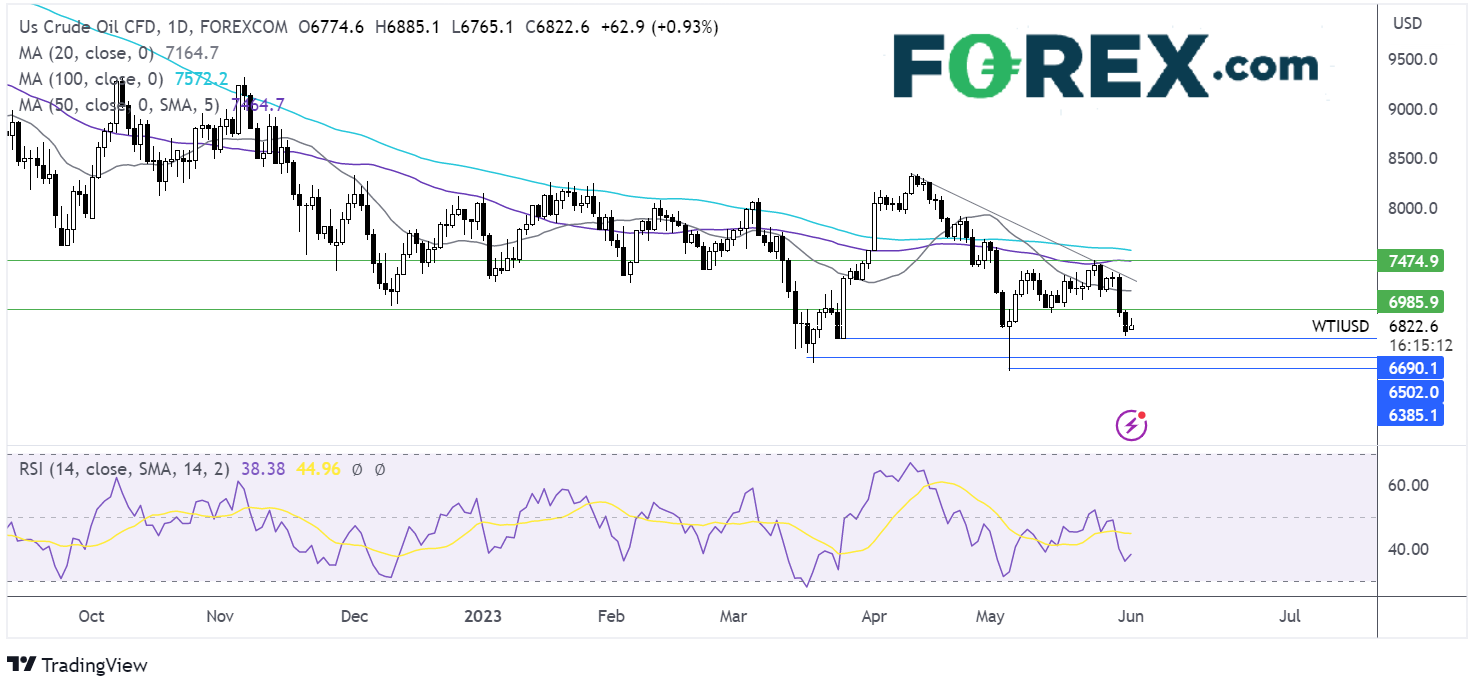

"Oil rises as hawkish Fed bets ease, the House passes the debt ceiling bill & after China data

- Fed speakers hint at a pause in rate hikes

- China paints a mixed picture

- API inventories rise

Oil prices are pushing higher after three straight days of losses as investors cheer a potential pause in US interest rate hikes and as the debt ceiling bill passes a key vote in Congress.

The US House of Representatives passed the debt ceiling bill, improving the chances of the US avoiding an economically disastrous debt default. The bill is now passed to the Democrat-controlled Senate to be voted on and approved before the 5th June X-date.

With the debt bill on track, investors are back Fed watching. Several Fed speakers yesterday hinted at a pause in rate hikes in June. These comments helped to ease fears of an overtightening and a recession in the US, which would hurt the oil demand outlook.

Meanwhile, Chinese Caixin manufacturing PMI was better than expected, rising to 50.9 in May, up from 49.5 in April. The data showing a return to expansion came following the official gauge yesterday, which showed a deeper contraction. The data for the world’s largest oil importer has painted a mixed picture..."

Have a good one!

Image: R. Schmitt

More By This Author:

Tuesday Talk: Money Time For McCarthy

Tuesday Talk: Rally In The Shadow Of Debt

Good roundup.