Two Trades To Watch: EUR/USD, Oil - Thursday, June 1

Image Source: Pixabay

EUR/USD falls ahead of Eurozone inflation data. Oil rises as hawkish Fed bets ease, the House passes the debt ceiling bill & China data beats.

EUR/USD falls ahead of Eurozone inflation data

- EZ inflation set to cool to 6.3% YoY

- ECB meeting minutes are also due

- EUR/USD needs to break 1.0635 for further losses

EUR/USD is falling for a second straight day ahead of the eurozone inflation and US jobs data and as the US debt bill passes through the House of Representatives.

Eurozone inflation is expected to cool to 6.3% YoY in May, down from 7% in April. The data comes after inflation in France, Germany, and Spain cooled by more than expected, easing pressure on the ECB to raise interest rates aggressively.

However, core inflation is still proving to be sticky and is expected to ease to 5. 5%, down from 5.6%. Hotter-than-expected inflation figures would force the ECB to continue raising interest rates to tame inflation.

The market is currently pricing in two 25-basis-point rate hikes. The minutes to the latest ECB meeting are also due to be released and could shed more light on the future path for interest rates. ECB President Christine Lagarde was hawkish in the post-meeting press conference, confirming that the central bank wasn’t finished hiking rates. Hawkish minutes could also boost the euro.

In addition to inflation data, investors are digesting weaker-than-expected German retail sales, which rose 0.8% after falling -2.4% in April. Expectations had been for a rise of a 1% rise.

Eurozone manufacturing PMI data is expected to confirm the preliminary reading of 46.9, a deeper contraction in May than 47.8 in April.

Meanwhile, the USD is rising as the debt ceiling bill passes its first test in the House of Representatives and makes its way to the Senate for a vote there. The bill needs to be agreed upon before the 5th of June.

US ADP payrolls, jobless claims, and ISM manufacturing data are due and could influence the greenback.

EUR/USD outlook – technical analysis

EUR/USD has been trending lower across May, taking out the multi-month rising trendline and, more recently, support at 1.0750. The 20 sma crossed below the 100 sma and looks to be crossing below the 50 sma in a bearish signal, while the RSI below 50 supports further downside.

The price found support at 1.0635, which is the level the sellers need to take out to create a lower low and extend the sell-off to 1.06 round number, before bringing 1.0516, the March low, into play.

Buyers could be encouraged by the long lower wick on yesterday’s candle, pointing to dip buying at the lower price. Buyers will look for a rise above 1.0750 to extend gains to the 100 sma at 1.0815.

(Click on image to enlarge)

Oil rises as hawkish Fed bets ease, the House passes the debt ceiling bill & after China data

- Fed speakers hint at a pause in rate hikes

- China paints a mixed picture

- API inventories rise

Oil prices are pushing higher after three straight days of losses as investors cheer a potential pause in US interest rate hikes and as the debt ceiling bill passes a key vote in Congress.

The US House of Representatives passed the debt ceiling bill, improving the chances of the US avoiding an economically disastrous debt default. The bill is now passed to the Democrat-controlled Senate to be voted on and approved before the 5th June X-date.

With the debt bill on track, investors are back Fed watching. Several Fed speakers yesterday hinted at a pause in rate hikes in June. These comments helped to ease fears of an overtightening and a recession in the US, which would hurt the oil demand outlook.

Meanwhile, Chinese Caixin manufacturing PMI was better than expected, rising to 50.9 in May, up from 49.5 in April. The data showing a return to expansion came following the official gauge yesterday, which showed a deeper contraction. The data for the world’s largest oil importer has painted a mixed picture.

Meanwhile, on the supply side, API data showed that crude oil inventories rose by 5.2 million barrels last week, which could keep the lid on oil’s upside. EIA data is due later today.

Attention is also turning to the OPEC+ meeting at the weekend. Members have been sending mixed signals. Goldman Sachs has said that they don’t expect further cuts to be announced.

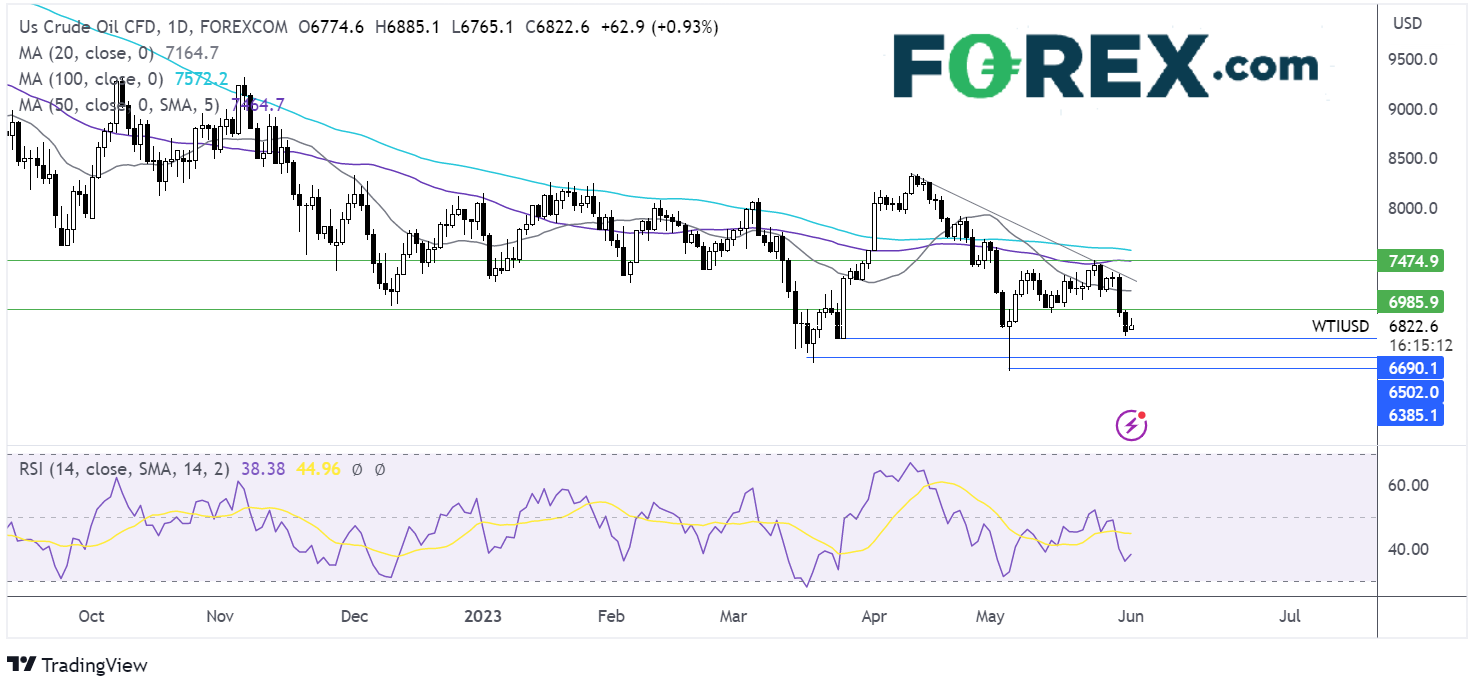

Oil outlook – technical analysis

Oil has been forming a series of lower highs since early April. After running into the falling trendline resistance at 73.35, the price rebounded lower.

Oil fell aggressively below the 20 sma and 70.00 psychological level, which, together with the RSI below 50, supports further downside.

Sellers will look to take out 67.00, the weekly low, to bring 65.35 into focus, the March low, ahead of 63.60, the May low.

On the flip side, a rise above 70.00 exposes the 20 sma at 71.70 and 73.20, the falling trendline resistance.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: DAX, USD/JPY - Wednesday, May 31

S&P 500 Outlook: Stocks Rise On Debt Ceiling Deal

Two Trades To Watch: GBP/USD, Oil - Tuesday, May 30

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more