Two Trades To Watch: GBP/USD, Oil - Tuesday, May 30

Photo by Colin Watts on Unsplash

GBP/USD falls amid debt ceiling jitters & ahead of US consumer confidence data. Oil weighs up debt ceiling news & economic growth concerns.

GBP/USD falls amid debt ceiling jitters & ahead of US consumer confidence data

- USD rises as debt ceiling deal agreed but passage through Congress is uncertain

- Fed June rate hike bets rise

- GBPUSD trades between 50 & 100 sma

GBP/USD is falling on Tuesday, snapping a three-day winning run amid ongoing debt ceiling jitters and more hawkish Federal Reserve bets.

President Joe Bidden and House Speaker Kevin McCarthy have agreed on a deal to raise the $31.4 trillion debt ceiling. Complicating the situation, the deal must now be agreed by the Republican-controlled House of Representatives and the Democrat-controlled Senate before the X-date in early June. The passage through Congress could face challenges as several hard-right Republican lawmakers have said that they will oppose it.

Meanwhile, hawkish Federal Reserve bets are on the rise, and that market is now pricing in a 60% probability of the Fed hiking rates in June after hotter-than-expected US core PCE data. The Fed’s preferred inflation gauge rose to 4.7% YoY in April, up from 4.6%.

The pound had been supported in recent sessions by an improving economic outlook after UK retail sales rebounded in April after bad weather sent sales sharply lower in March.

Sales have been supported by a solid labor market and improving consumer confidence despite inflation remaining very high at 8.7%. With inflation elevated, the BoE is expected to raise interest rates again in June.

There is no high-impacting UK economic data today, meaning that the pound will be driven by sentiment.

GBP/USD outlook – technical analysis

After falling below the multi-month rising trend line, GBPUSD trades in a narrow range, caught between the 50 & 100 sma. The RSI below 50 supports further downside.

Sellers could look for a break below the 100 sma at 1.2290 and the April low at 1.2275 to extend the selloff toward 1.2190 the March 27 low.

On the flip side, buyers could look for a rise above 1.24 Friday’s high and 1.2430 the 50 sma to bring 1.25 the round number and rising trendline resistance into target.

(Click on image to enlarge)

Oil weighs up debt ceiling news & economic growth concerns

- Debt ceiling agreement heads to Congress

- Fed worries hurt the growth outlook

- Oil rises above 20 sma, but stays in the range

Oil prices are heading modestly lower for a second straight day on Tuesday, after booking gains across the previous week.

Hopes that the US will avoid a debt default are being offset by concerns of more interest hikes by the Federal Reserve and slowing economic growth.

Hotter than expected US core PCE data, has lifted Fed rate hike bets. Meanwhile. Michigan consumer confidence tumbled to a 6-month low, raising worries about the economic outlook for the US, the world’s largest oil consumer.

The oil market is now awaiting fresh clues. Attention will shift towards China’s PMI data this week, which is expected to show that the economic recovery in China, the world’s largest importer of oil is expected to slow further, after a string of weak data from April.

Further cues from OPEC+ are expected this coming weekend as OPEC+ meets to discuss production levels. So far the message has been mixed from the oil cartel with Saudi Arabia hinting at deeper output cuts but Russia pushing back against these claims.

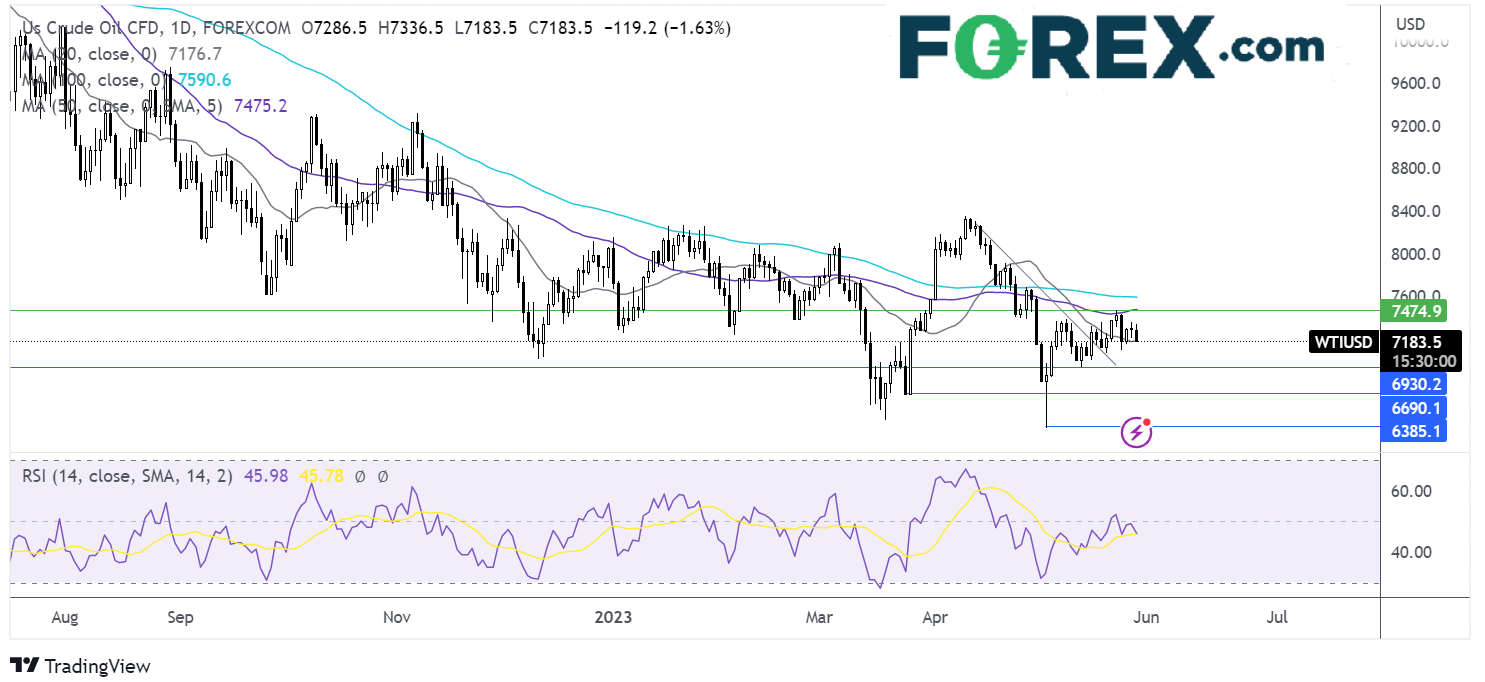

Oil outlook – technical analysis

WTI trades within the range 69.35 to 74.70 across most of May. The RSI is neutral at 50.

The price has recently risen above the 20 sma at 71.7, bulls will now look for a break above 74,75 the May high and 100 sma. A rise above here exposes the 100 sma at 76.15

Should sellers break below the 20 sma at 71.90, the May 15 low at 69.35 comes into play. Beyond here sellers could target 66.85 the March 24 low.

(Click on image to enlarge)

More By This Author:

EUR/USD, Oil Outlook: Two Trades To Watch

GBP/USD, DAX Outlook: Two Trades To Watch

Dow Jones Outlook: Debt Ceiling Uncertainty, PMI Data Due

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more