EUR/USD, Oil Outlook: Two Trades To Watch

EUR/USD falls as Germany enters a recession. Oil steadies around 3-week high.

EUR/USD falls as Germany enters a recession

- German GDP falls -0.3% QoQ

- Fitch puts US AAA rating on negative watch

- EUR/USD falls to a 4-week low

EUR/USD is falling amid a cautious mood in the market as U.S. debt ceiling jitters continue and after take your choice that Germany slipped into a recession.

While Germany has managed to avoid the bleakest of scenarios following the aftermath of Russia's invasion into Ukraine, it hasn't managed to avoid a recession.

The latest German GDP data change that the eurozone 's largest economy contracted by -0.3% QoQ in Q1, after contracting by -0.5% in Q4 2022. Two straight quarters of negative GDP growth is a technical recession. The preliminary reading had pointed to great stooling at 0%.

German consumer confidence was also weaker than expected improving to -24.2, from -25.2 but worse than the -24 forecast.

The benders bank did offer some optimism this week suggesting that the economy group may grow slightly this quarter thanks to lower energy costs and easing of supply bottlenecks. However the consumer is still facing high inflation and rising interest rates.

Meanwhile the US dollar is finding support from safe haven flows getting talks continue without a deal Bing agreed. Ratings agency Fitch said that it is put the US AAA rating on negative watch amid the uncertainty surrounding that talks.

Looking ahead USD GDP data and US durable goods orders will be in focus as well as jobless claims figures.

EUR/USD outlook – technical analysis

EUR/USD trades within a descending channel since the start of the month. The price has broken below support a 1.0760, the monthly low, which, combined with the RSI below 50 keeps sellers hopeful of further downside. Sellers will look for a break below 1.0710 the March 27 low to extend the bearish trend.

On the flip side, buyers will be looking to regain 1.0760 to break out of the falling trendline resistance and expose the 100 sma at 1.0810. Above here the confluence of the 20 & 50 sma at 1.09 could offer resistance.

Oil steadies around 3-week high

- US inventory data shows inventory 12.4 million barrel build

- Saudi energy minister comments & debt ceiling nerves

- Oil tests resistance at 50 sma

Oil prices are holding steady after 3-days of gains and reaching a 3week high overnight, as investors weigh up the possibility of a US debt default against the prospect of further OPEC+ production cuts.

U.S. debt ceiling negotiations have continued and while House Speaker Kevin McCarthy said that while some progress has been made, several issues remain unresolved. The deadline of early June X-date is fast approaching.

The USD has benefitted from safe-haven flows, rising to an almost 2-month high versus a basket of currencies. While oil prices have managed to rally regardless, additional dollar strength could keep the lid on further gains.

Comments from Saudi Arabia’s energy minister earlier in the week helped to boost oil higher. Some in the market understood his warning to short speculators as a hint that OPEC+ could cut production further when they meet again in June. OPEC+ announced in April that it would cut production by 1.1 million barrels per day, catching the market by surprise.

US EIA crude oil stockpile data showed that inventory levels dropped by a huge 12.4 million barrels in the week ending May 19th, after a 5.04 million barrel build in the previous week. Gasoline inventories dropped by 2.1 million barrels.

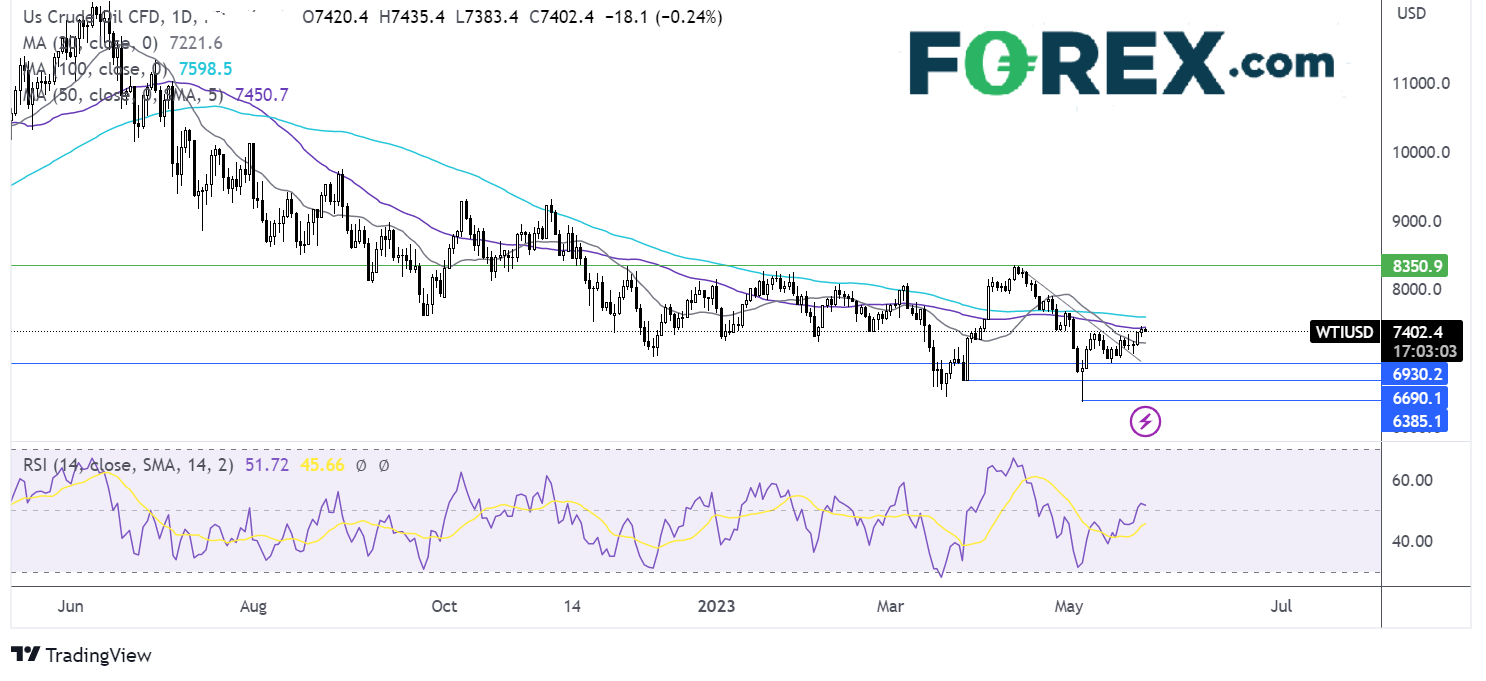

Oil outlook – technical analysis

WTI crude oil rebounded higher off the falling trendline support and has run into resistance at the 50 sma at 74.50. A rise above here is needed to attack 76.50, the 100 sma and the May high.

On the flip side, sellers could look for a fall below the 20 sma at 72.40 opens the door to 70.00 the round number and 69.35 the May 15 low and the falling trendline support. Beyond here 66.85 comes into target.

More By This Author:

GBP/USD, DAX Outlook: Two Trades To Watch

Dow Jones Outlook: Debt Ceiling Uncertainty, PMI Data Due

Two Trades To Watch: GBP/USD, Oil - Tuesday, May 23

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more