Tuesday Talk: Money Time For McCarthy

As markets open after the Memorial Holiday Weekend market makers will turn their attention to Washington and Speaker McCarthy who now has to push the debt ceiling deal through the House.

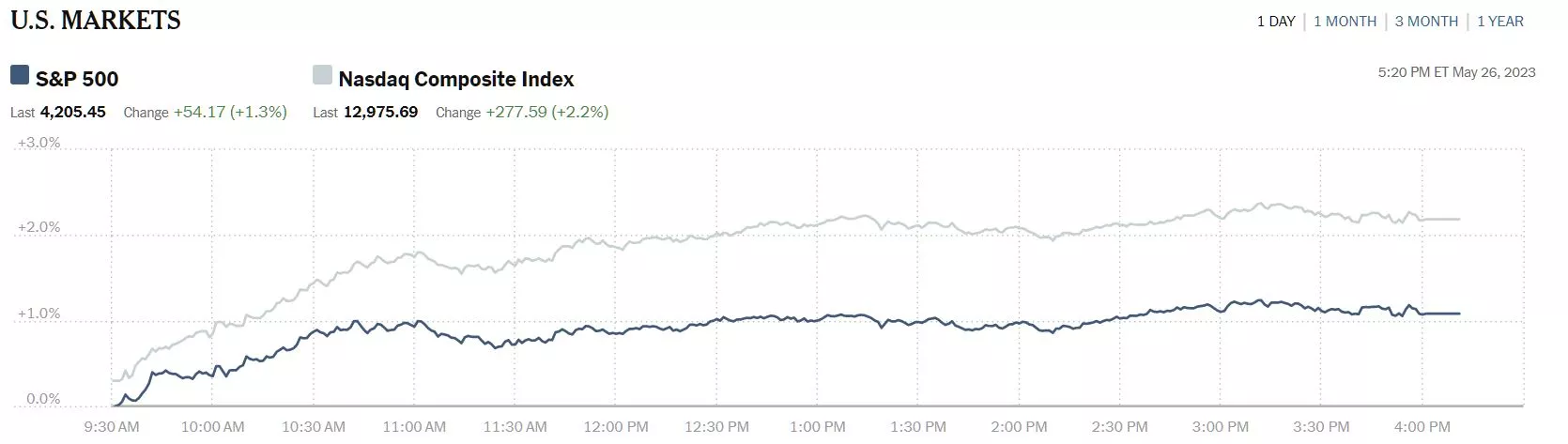

On Friday, before the holiday recess the S&P 500 moved higher by 54 points to close at 4,205, the Dow gapped up 329 points, closing at 33,093 and the Nasdaq Composite closed at 12,976, up 278 points.

Chart: The New York Times

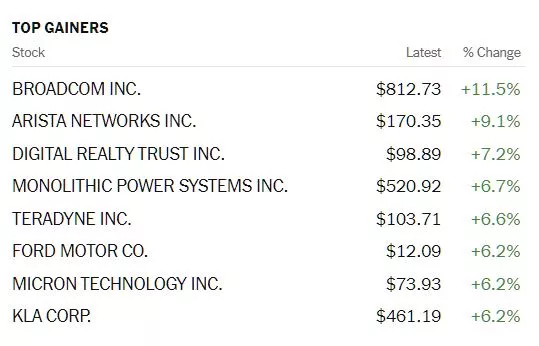

Top Gainers were Broadcom (AVGO), up 11.5%, Arista Networks (ANET), up 9.1% and Digital Realty Trust (DLR), up 7.2%.

Chart: The New York Times

In early morning futures trading on Tuesday, S&P 500 market futures are up 11 points, Dow market futures are up 25 points and Nasdaq 100 market futures are up 69 points.

As to be expected TalkMarkets contributors are weighing in on where the market will go now that the debt ceiling increase appears to be a done deal.

Contributor Taki Tsaklanos notes that the current market rally is not broad in his article Value Stocks Lagging, Growth Stocks Leading? Wrong, 5 Stocks Leading.

"The Nasdaq index is in great shape. However, it’s the index that is in great shape, not all tech stocks, big difference. At this very point in time, the strong performance of the Nasdaq index is driven by 5 stocks approx...

The (NYSE Composite) chart below has not improved in recent months, it did deteriorate.

That said, the question is whether investors should feel FOMO’ed or not.

Our viewpoint is that FOMO is not justified at this very point in time, for 2 reasons:

- The market will come down again.

- The number of stocks that are driving the Nasdaq (to a much less degree also the S&P 500) is just a few of them.

This implies that we firmly believe that prices will come down in the 2nd half of June, a period which will most likely come with good entry prices...

Don’t feel FOMO’ed, it’s not justified. This current ‘pop’ is solid and bodes well for the 2nd half of 2023, in line with our expectations, but this is not a runaway market, for sure not, not yet at least."

The Staff at Forex.com headline with Nasdaq 100 Set To Extend 2023 Rally?

"US equities are poised to continue the past 2-month rally after today’s Memorial day holiday, with the Nasdaq 100 likely to benefit most. Of major markets open today, the Nikkei 225 was up over 1% (clocking a 20% rise for the year.) US stock futures rose modestly. The VIX, Wall Street’s fear index, fell to 17 this morning, on debt ceiling news...

We are seeing some very sharp price movements amongst tech stocks which could be a theme for the week ahead. Nvidia’s extraordinary rally was the standout last week, with the tech conglomerate’s price rising 26% on Thursday after reporting better-than-expected quarterly results. This year has seen a tremendous appetite to buy tech stocks, after a one-third decline in the Nasdaq 100 in 2022. In May alone, eight tech stocks are up 30%-plus: Nvidia (89.9% (NVDA), Salesforce (49.6% CRM), Advanced Micro Devices (38.0% AMD), Arista Networks (32.0%), Monolithic Power Systems (30.6% MPWR), Apple (30.6% AAPL), Cadence Design Systems (30.4% CDNS) and ANSYS (30.0% ANSS).

Financial markets could move to risk-on this week if the debt ceiling deal is approved, with tech stocks likely to benefit most."

TM Contributor Mircea Vasiu also, asks Debt Ceiling Deal: Will The U.S. Stocks Rally This Week?, and cautions that the agreement must still be passed by Congress.

"Details of the debt ceiling deal are yet to be officially revealed. According to CBS, though, the U.S. government will likely keep its non-defense spending flat over the next two years.

At writing, the benchmark index is up 10% versus the start of the year.

On the flip side, the recent economic data has been positive for U.S. stocks. Last week, the Fed’s preferred inflation gauge was reported to have eased further in April.

But the debt ceiling deal is still awaiting approval from a divided Congress that will remain the center of attention for markets, Cavarero noted today on CNBC’s “Street Signs Europe”.

It’s possible that the market in the next few days will focus on execution risk – the fact that this agreement needs to be sealed down with proper laws and needs to find the votes.

The U.S. GDP was recently reported to have grown at an annualized pace of 1.3% in the first quarter."

Contributor Michael Kramer reminds readers that The Debt Ceiling Deal May Be A “Sell The News” Event.

Ditch Plains beach entry Montauk Long Island New York in the Hamptons with rip current warning sign

"The upcoming week promises to be busy in the stock market, with significant data due for release, ranging from ISM manufacturing figures to the BLS job report. The PCE data, disclosed last Friday, suggests the Federal Reserve still has substantial work ahead, nudging the likelihood of a rate hike back to 60% for June and almost a 100% chance by July. Additionally, any prospects of rate cuts have been removed for 2023.

The Jobs data on Friday is anticipated to reveal an uptick in the unemployment rate to 3.5% from 3.4% last month and a drop in job creation figures to 190,000 in May, down from 230,000. Meanwhile, average hourly earnings are predicted to have risen by 4.4%, maintaining pace with the previous month. If these figures meet or exceed estimates, it seems probable that more rate hikes will be factored into future forecasts.

For weeks, I have been emphasizing that the trajectory for interest rates is higher for a longer duration. This forecast and thought process seem to be unfolding as expected, with rates experiencing a steep increase in recent weeks. Much of the escalation is noticeable at the longer end of the yield curve, with the 30-year nominal rate now at 3.95% and on the verge of exceeding the 4% threshold once more."

The contributors on the Staff at Equity Management Academy are interested in gold. In their long article Gold: Debt Ceiling Deal Is Done - Here's Why A Recession And Stock Market Drop May Follow, they cover many possible impacts to the economy and markets resulting from the agreement to increase the U.S. National Debt ceiling. Below is what it may mean for gold. See the full article for more.

"Debt Increase and Gold:

The relationship between debt increase and gold is more complex and can be influenced by various factors. Here are a few points to consider:

-

Safe-Haven Asset: Gold is often considered a safe-haven asset, particularly during times of economic uncertainty or inflationary concerns. When debt levels rise and there is increased uncertainty in financial markets, investors may turn to gold as a store of value. This increased demand for gold can potentially drive up its price.

-

Inflation Expectations: Rising debt levels can lead to concerns about inflation, especially if the debt is monetized or if there are expectations of future inflationary policies. Inflation erodes the value of fiat currencies, making gold relatively more attractive as a hedge against inflation. Consequently, higher inflation expectations due to increased debt levels can contribute to higher gold prices.

-

Monetary Policy and Interest Rates: Central banks often respond to rising debt levels by implementing monetary policy measures, such as lowering interest rates or engaging in quantitative easing (QE) programs. These actions can increase the money supply and potentially weaken the value of the currency. When the value of the currency depreciates, the price of gold, which is priced in that currency, may rise.

-

Market Sentiment: Market sentiment and investor perception of the relationship between debt levels, economic stability, and the value of fiat currencies can also influence gold prices. If investors perceive higher debt levels as a sign of economic instability, they may seek the relative safety of gold, driving up its demand and price."

That's a wrap for today.

Have a good one.

More By This Author:

Tuesday Talk: Rally In The Shadow Of Debt

Tuesday Talk: Trying To Keep The Beat