Tuesday Talk: Trying To Keep The Beat

The major indices struggled to stay up during the day on Monday but were able recover their rhythm by the close of trading. A debt ceiling solution remains elusive as talks resume today.

Yesterday the S&P 500 closed at 4,136, up 12 points, the Dow closed at 33,349, up 48 points and the Nasdaq Composite closed at 12,365, up 80 points.

Chart: The New York Times

Asian markets closed the day up and European markets have started the day up as well.

Chart: The New York Times

In morning futures trading S&P market futures are down 6 points, Dow market futures are down 84 points and Nasdaq 100 market futures are down 9 points.

Contributor Patrick Munnelly shows that world markets are moving cautiously as the day opens in his Daily Market Outlook - Tuesday, May 16.

"Asian equities have had a mixed trading session overnight, with the positive momentum from Wall Street failing to be sustained. US regional banks experienced a short squeeze, driving stocks higher. However, the upside was limited due to concerns over the debt ceiling and a disappointing NY Fed Manufacturing survey."

"UK investors are digesting this morning's release of UK employment market data showing slightly weaker numbers than anticipated. Unexpectedly, the unemployment rate rose from 3.8% to 3.9%, and regular pay growth (excluding bonuses) increased by a smaller margin than expected, reaching 6.7% compared to the previous 6.6%."

"Stateside, investors will focus on data deemed to support expectations of a pause in the Fed's interest rate policy. Today's focus lies on April's industrial production and retail sales figures. Markets expect a month-on-month increase in retail sales, marking the first rise in three months, however, this growth is likely driven by auto sales rather than broad-based strength."

Consult the full article for current Forex related data.

TM contributor Alex Barrow in his Monday column titled A Nuclear Resurgence covers a multitude of topics including a resurgence in nuclear power, the Turkish stock market and trucking; but he starts off with the below comments on Q1 earnings.

" 1. Q123’ earnings came in better than the market expected. Goldman Sachs writes “margins in every sector surprised to the upside .. we believe the worst of the 2023 negative earnings revision cycle is now behind us.” (h/t @carlquintanilla)"

Contributor Chris Kimble writing in Economic Slowdown, Falling Interest Rates And Inflation? This Ratio Says Yes finds support for his argument in a place where many Jane and Joe investors wouldn't think to look.

"Recently, the Copper to Gold ratio closed below the lows of last year."

"Typically, when this ratio is rising, the economy is strong and interest rates are firm to rising. But when it's falling, there is a great degree of economic uncertainty and rates tend to follow lower...If history is a guide, a break of support here would suggest a lower risk of inflation and higher odds of interest rates falling. And perhaps an uncertain economy as well."

Elsewhere contributor Miltos Skemperis captures US Retail Sales And Canadian CPI Inflation In The Spotlight.

"April’s US retail sales report will be published by the US Census Bureau later today. Market experts project a 0.7% rise on a month-to-month basis. Some analysts suggest that a positive retail sales figure combined with a strong labor market could mean the US economy might avoid recession."

"On Wednesday, investors will be waiting for the Canadian CPI inflation data reports released by the Bank of Canada (BoC) and Statistics Canada...Market analysts suggest that the BoC’s CPI report will likely show headline inflation coming in at 3.9% on a year-to-year basis while Statistics Canada data is expected to show CPI inflation dropping to 3.7% on an annualized basis. The BoC’s target is to bring inflation down to 2% which, according to its analysts, is expected to happen by the end of 2024."

Skemperis also reports that the Eurozone (EZU) economy will likely grow more than expected: "A survey released by the European Commission (EC) showed that the eurozone’s economies are likely to grow faster than anticipated this year, despite high inflation figures and elevated interest rates. Economists at EC said the EU’s 27 members would grow at an average of 1% this year, up from a previous estimate of 0.8%. The report noted that the forecast for growth in 2024 was upgraded to 1.7% from 1.6%."

I would like to draw your attention to a two coffee cup article by contributor Scott Martindale entitled Fed’s Singular Focus On Inflation Is Creating Undue Fallout. Martindale covers the current state of the economy in depth including a critique of the Fed and some ETF investment recommendations. Below are some of his insights:

"Most commentators expect small caps to lead the next bull leg up—and that makes sense as the mega caps have been “bought up” due both to their solid earnings reports and their modern status as all-weather defensive plays. But with valuations at 24.6x forward P/E for the Nasdaq 100 (QQQ) and 18.1x for the S&P 500 (SPY), mean reversion would suggest that their smaller brethren will outperform...

For the first time since 2021, earnings growth trends are showing some improvement. Throughout 2022, earnings growth rates kept deteriorating. In Q1 2022, earnings growth was running at +10%. In Q2, it dropped to +7%, +3% in Q3, and then went negative in Q4 2022 at -3.5%. But for Q1 2023, the earnings growth rate has improved a bit to -2.5%. As Q1 reporting season nears the end, most companies in the S&P 500 are beating estimates—and by a wide margin...

My expectation is that recovering supply chains (encompassing manufacturing, transportation, logistics, energy, labor) and disinflationary secular trends will continue to provide the restraint on wage and price inflation that the Fed seeks without having to double-down on its intervention/manipulation..."

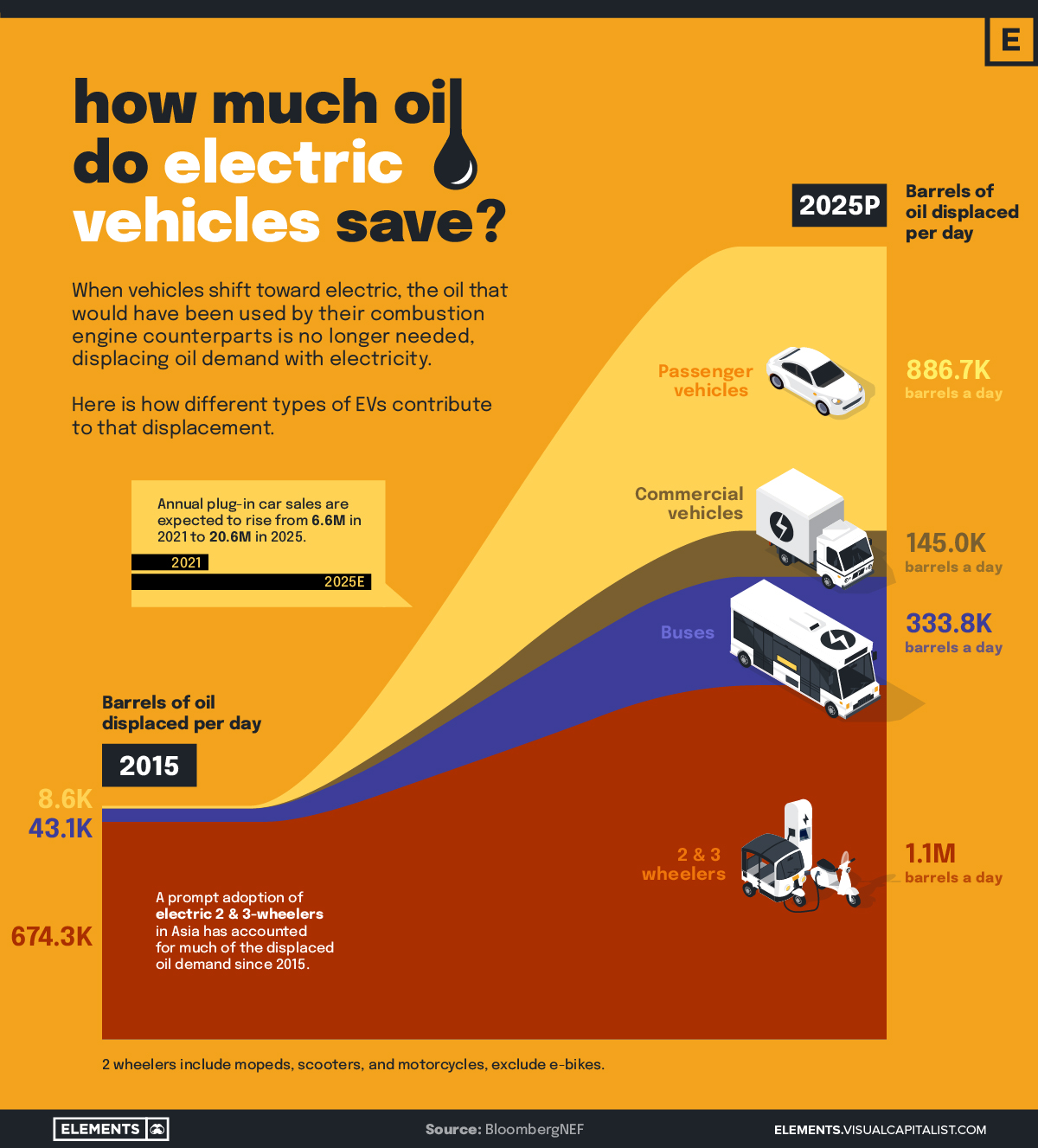

To close out the column today contributor Selin Oğuz of Visual Capitalist looks at How EV Adoption Will Impact Oil Consumption (2015-2025P) in a unique infographic.

More By This Author:

Thoughts For Thursday: Arrows Up, Down And All-Around

Tuesday Talk: The Sky's The Limit Or Not