Tuesday Talk: Rally In The Shadow Of Debt

The A.I. driven rally in Tech continues amidst nagging concerns regarding resolution of the debt ceiling crisis. Despite Bidenspeak about progress being made, Speaker McCarthy continues to say no.

And so be that as it may, on Monday the S&P 500 closed at 4,193, up .65 points, the Dow closed at 32,287, down 140 points and the Nasdaq Composite closed at 12,721, up 63 points.

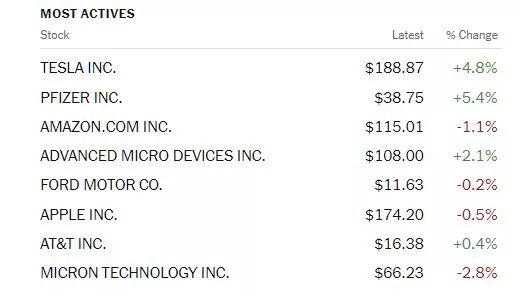

Chart: The New York Times

Most actives continue to be led by Tesla (TSLA), up 4.8%, followed by Pfizer (PFE), up 5.4% and Amazon (AMZN), down 1.1%.

Chart: The New York Times

In morning futures trading S&P 500 market futures are down 4 points, Dow market futures are down 66 points and Nasdaq 100 market futures are up 2 points.

Economist and contributor Robert Reich participates in a 9 minute MSNBC discussion and answers the question What Happens If The U.S. Doesn’t Raise The Debt Ceiling?

"A default would explode the economy, and we must act swiftly to avoid it. If Republicans won’t agree to raise the debt ceiling, Biden has a constitutional duty to continue paying the nation’s bills."

Also looking at the debt ceiling issue, contributor Daniel Lacalle in a TalkMarkets Editor's Choice column writes Lifting The Debt Ceiling Is Not A Social Policy.

"Politicians believe that raising the debt ceiling is a social policy and that debt does not matter. Until it does. United States debt to GDP is now 123.4% and the risk of losing confidence in U.S. Treasuries as the lowest-risk asset is exceedingly high.

The problem in the United States budget is evident in mandatory and discretionary spending. Focusing all the attention on discretionary spending does not solve the deficit and debt problem...Mandatory spending is around 63% of the budget, discretionary spending is almost 30%, and, despite low borrowing costs, net interests already consume 8% of the budget.

The United States budget is unsustainable however you want to look at it...

The world is questioning the United States’ public finances and that is why Congress needs to act and reign in spending. If things continue this way, discretionary spending will reach $2.5 trillion in a decade, and deficit spending will still be half a trillion US dollars at the end of the same period even if the economy grows without recessions or crisis years, a true impossibility, and employment does not suffer...

If politicians really care about U.S. citizens and their welfare, they should defend the currency and the solvency of the public accounts. Any other measure will only make the debt-ticking bomb explode earlier in the face of our sons and daughters."

Contributor Michael Ashton in an in depth article tackles one of the key components of the national debt, namely, Social Security Solvency, Solved.

Ashton writes in great detail regarding the current $22.8 trillion Social Security obligation facing the nation and the most interesting part is his proposed solution:

"Here is my proposal. Starting in 10 years, raise the full retirement age by just one month. But do it every year after that. And, here’s the key word: forever. Someone who is 57 today would still retire at the age of 67, so it doesn’t really affect them. Someone who is 45 today would retire at 68. They’re not really happy about the extra year, but that’s better than the prior example which was three years.

Someone who is 33 today would retire at 69. That’s still better than the prior proposal, for them. Someone who is 21 today would retire at 70. They’re no worse off, and arguably much better off because the 20-somethings all assume there won’t be a Social Security when they are old enough to claim it. With this proposal, there would be.

And unlike the current attempts to repair the system, this would be predictable.

The key word forever means that eventually, almost no one would get Social Security benefits and so the liability would dwindle to zero. But this would happen over generations. Would we leave our old folks penniless? Of course not – there are plenty of other safety nets to protect the needy. But we would remove the ‘entitlement’ part where everybody gets a slice because they paid into it."

TM contributor Steve Sosnick asks Would A Debt Ceiling Resolution Be A “Sell-The-News” Event?

"...if a major piece of news has been discussed sufficiently to be fully discounted by investors, then it is unlikely that any incremental positives will follow. As a result, the affected stocks can fall – even if the news is good.

This could indeed apply to the outcome of the debt ceiling drama. On a quarter-to-date basis, equity markets moved largely sideways as the debt drama escalated, then ratcheted higher in recent sessions as signs of progress emerged. Most recently, we saw only a very modest dip on Friday when negotiations broke down, and a modest rally this morning ahead of another meeting between President Biden and Speaker McCarthy. Let’s see how it goes.

If a debt resolution results in tighter fiscal policies, it presently would create yet another hurdle for stocks and the economy.

As with all deals, the devil is in the details. If everyone is unhappy with the deal, then it probably means that it contains reasonable compromises from both sides. But if there is no incremental good news to be gained from an agreement and the deal itself is a short-term fiscal drag, then we could easily be looking at the latest in a long series of “buy-the-rumor, sell-the-news” events."

TalkMarkets contributor Timothy Taylor looks at The New AI Technologies: How Large A Productivity Gain?

Here are some of his finds and takes:

"Evidence is accumulating about how these (AI) technologies will affect actual jobs. The unifying theme here is saving time: that is, just as I save time when I can download articles while sitting at my desk, rather than walking through library stacks and making photocopies, lots of existing jobs can be done more quickly with the new technologies. Some examples:

There is an emerging literature that estimates the productivity effects of AI on specific occupations or tasks. Kalliamvakou (2022) finds that software engineers can code up to twice as fast using a tool called Codex, based on the previous version of the large language model GPT-3. That’s a transformative effect. Noy and Zhang (2023) find that many writing tasks can also be completed twice as fast and Korinek (2023) estimates, based on 25 use cases for language models, that economists can be 10-20% more productive using large language models.

But can these gains in specific tasks translate into significant gains in a real-world setting? The answer appears to be yes. Brynjolfsson, Li, and Raymond (2023) show that call center operators became 14% more productive when they used the technology, with the gains of over 30% for the least experienced workers. What’s more, customer sentiment was higher when interacting with operators using generative AI as an aid, and perhaps as a result, employee attrition was lower. The system appears to create value by capturing and conveying some of the tacit organizational knowledge about how to solve problems and please customers that previously was learned only via on-the-job experience.

We apparently are doomed to replay, one more time, one of the long-standing public dramas of new technologies: that there is only a fixed amount of work to do, and if existing workers can do it faster, then the available jobs will shrink dramatically, leading to mass poverty. This fear has been manifested many times in the past. Some of the examples I’ve collected over time include: worries from the US Secretary of Labor about automation and job loss in 1927; fear of robotics and automation in 1940; the US government commission on the dangers of automation and job loss in 1964; and when Nobel laureate Wassily Leontief predicted in the early 1980s how automation would lead to mass unemployment. A few years back I linked to an essay by Leslie Willcocks called “Robo-Apocalypse Cancelled,” going through reasons why predictions of a technology-driven economic disaster never quite seem to happen.

Surely, if technological advances and automation were likely to lead to mass unemployment, we would already have arrived at a world where only 10% or fewer of adults have jobs? But instead, needing many fewer workers for jobs like growing wheat, lighting streetlights, filling out accounting ledgers by hand, operating telephone switchboards, making a ton of steel, and so on and so on have opened the way for new occupations to arise. I see no compelling reason why this time and this technology should be different."

Closing out today's column with an eight-minute video stop in the Personal Finance department, contributor Eric Basmajian says Don't Buy A House.

"The U.S. housing market is in the middle of its 6th major downturn since the late 1960s. Home prices are declining in 75% of major cities, with many areas posting declines for six or seven consecutive months."

Have a good one!

More By This Author:

Tuesday Talk: Trying To Keep The Beat

Thoughts For Thursday: Arrows Up, Down And All-Around