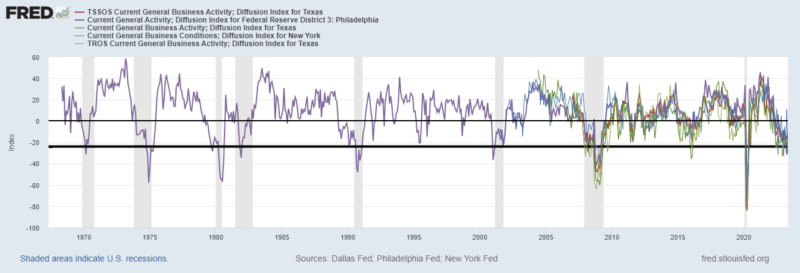

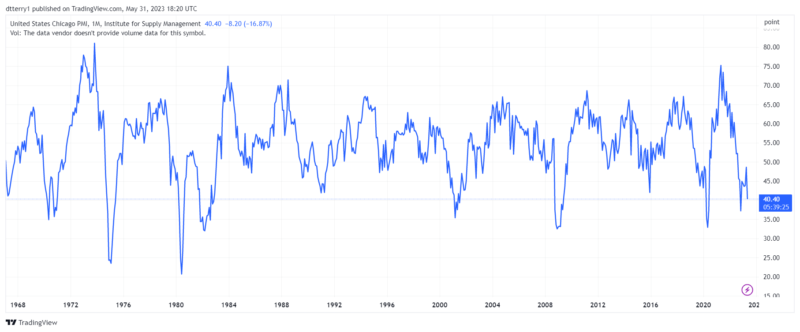

Macro: Regional Business Surveys

Regional Surveys from Philly, NY, Texas, and Chicago are all at levels previously indicative of a recession. The lone false signal was the Texas General Business Activity Index in January 2016…the weakness was regionally isolated as the price of oil went from over $100/bbl in 2014 to around $30/bbl by early 2016. No region has absolutely fallen off a cliff, but all have Z-scores below -1. The NY data point is the first release of the group and is prone to volatility. It just dropped from +10.8 in April to -31.8 in May.

The April NY Fed print of +10.8 appears to be the outlier as it is the lone print above 0 in 2023 and the only series with a positive print since the summer of 2022. The current -31.8 data point is the 6th lowest print in the history of the monthly data set that goes back to July 2001. The only data points that are worse are April and May 2020 (the onset of the pandemic), February and March of 2009 (the market lows during the GFC), and interestingly Jan 2023. The Jan 2023 low print likely a result of 2022 being the worst year ever in the 250-year history of bonds (according to Edward McQuarrie of Santa Clara University) and the worst year for the 60/40 portfolio since the 1930s.

(Click on image to enlarge)

More By This Author:

Do You Really Want AI To Pick Your Stocks?

Macro: Factory Orders

Macro: Housing Starts And Permits