Tuesday Talk: That Old Up And Down...

The major indices popped and dropped and popped and dropped again on Monday, closing lower for the day. Still the Tech sector is hanging tough and top gainers on the day included consumer cyclicals such as Bath and Body Works (BBWI), Caesars Entertainment (CZR) and Norwegian Cruise Lines (NCL), as well healthcare giant Cigna Group (CI).

On Monday the S&P 500 closed at 4,274, down 9 points, the Dow closed at 33,563, down 200 points and the Nasdaq Composite closed at 13,229, down 11 points.

In morning futures trading S&P 500 market futures are trading down 4 points, Dow market futures are trading down 54 points and Nasdaq 100 market futures are trading down 6 points.

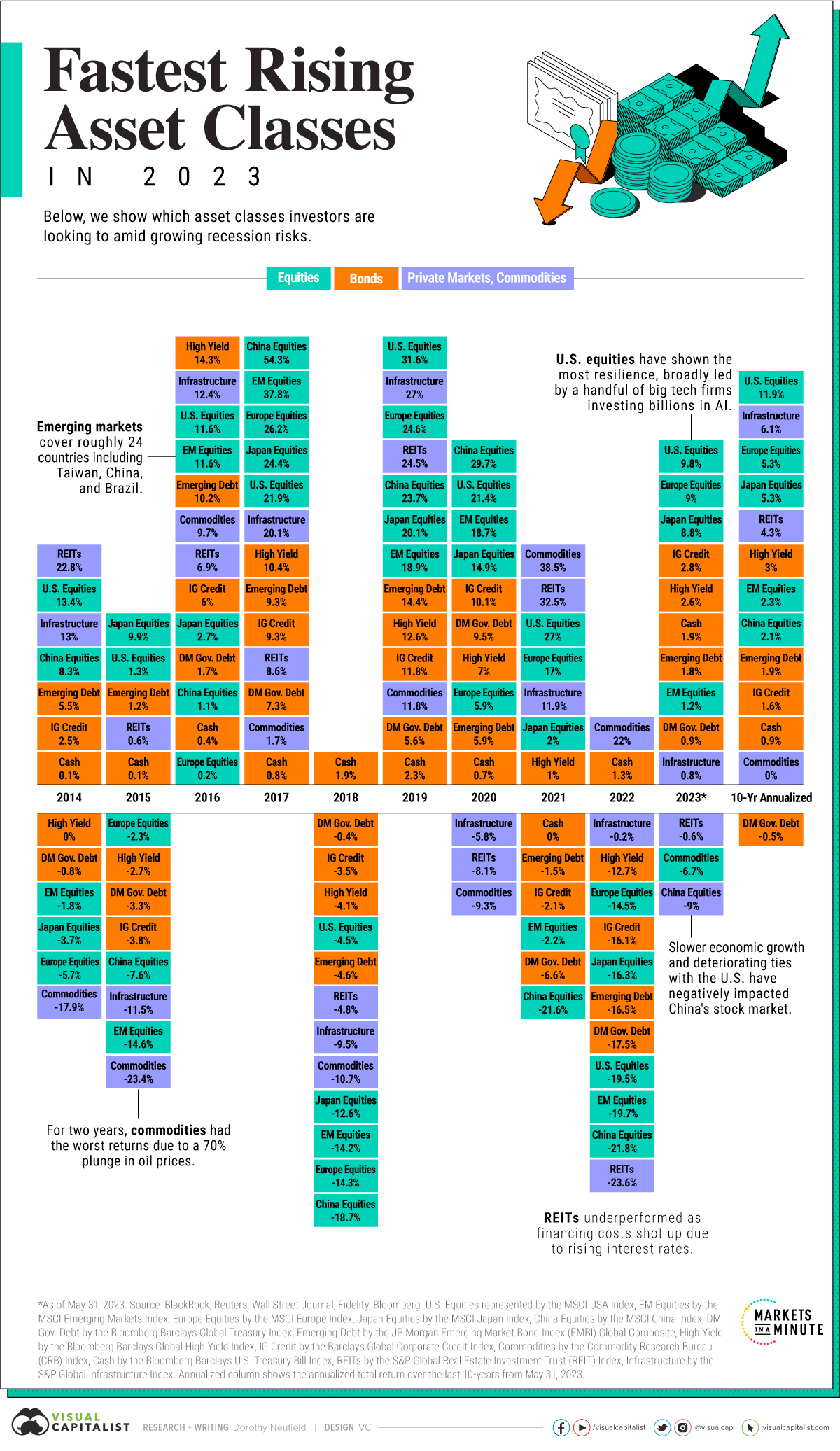

TalkMarkets contributor Dorothy Neufeld looks at 2023 equities action so far this year in The Fastest Rising Asset Classes In 2023 and ponders if the foundation for a strong bull market has been set.

"Many corners of the market have shown resilience despite persistent inflation and slowing economic growth in 2023. U.S. equities, international equities, and a variety of bonds have seen positive returns so far this year.

In the above graphic, we rank the top-performing asset classes to date with data from BlackRock.

Asset Class Performance, Ranked

Here’s how select asset classes have performed in 2023 as of May 31:

| Asset Type | 2023 Return (as of May 31) | 10-Year Annualized Return |

|---|---|---|

| U.S. Equities | 9.8% | 11.9% |

| Europe Equities | 9.0% | 5.3% |

| Japan Equities | 8.8% | 5.3% |

| Investment Grade Credit | 2.8% | 1.6% |

| High Yield Bonds | 2.6% | 3.0% |

| Cash | 1.9% | 0.9% |

| Emerging Market Debt | 1.8% | 1.9% |

| Emerging Market Equities | 1.2% | 2.3% |

| Developing Market Gov. Debt | 0.9% | -0.5% |

| Infrastructure | 0.8% | 6.1% |

| REITs | -0.6% | 4.3% |

| Commodities | -6.7% | 0.0% |

| China Equities | -9.0% | 2.1% |

After a troublesome 2022 for markets, you can see above that U.S. equities have rebounded the fastest in 2023. They are sitting at 9.8% returns year-to-date."

"As investors pour into (these) mega cap stocks, S&P 500 returns have rebounded almost 20% from their October lows, moving closer into the bull market territory.

As it stands, investor optimism has increased across the broader market. The investor fear gauge hovered near its lowest point since February 2020. The CBOE Volatility Index (VIX) sank to 15, a significant drop from its average reading of 23 over the past year."

There has been a lot of chatter about a Fed rate pause at its June meeting but contributors Chris Turner, Frantisek Taborsky and Francesco Pesole write Surprise RBA Hike Gives The Dollar Food For Thought.

"The Reserve Bank of Australia surprised with a 25bp hike, citing upside risks to inflation and the trade-off that delaying rate hikes could be costly. This may raise expectations for a similar move from the Bank of Canada tomorrow and that the Fed will sound hawkish next week – which may well frustrate dollar bears."

"Having paused its aggressive hiking cycle in April, the RBA hiked another 25bp, citing increased upside inflation risks and – like many central banks around the world – frustrated that core inflation was not falling more quickly. The RBA's move to restart its tightening cycle may throw extra focus on tomorrow's Bank of Canada (BoC) meeting after paused rate hikes at its March and April meetings. A 25bp BoC rate hike tomorrow (now priced with a 43% probability) would probably cause ripples across core bond markets around the world and could keep the dollar bid on the view that the Fed might be closer to hiking than first thought. Let's see."

Digging into the details of how investors are participating in the current tech driven rally, TM contributor Tom Roseen details just how the Tech Rally Attracts Interest In Select ETF Classifications.

"The strong surge in mega-cap technology stocks has helped the Nasdaq composite post its strongest fund-flows week return since the week ended February 1...Of the often-followed U.S. indices, the Nasdaq has been the rockstar of the group, posting an eye-popping 23.59% return year to date, while the S&P 500 returned 8.86% and the Dow Jones Industrial Average lost 0.72% for the same period...On the equity side, investors embraced some of the deeply out-of-favor macro-classifications of 2022, injecting the largest amount of net new money so far this year into international funds (+$20.5 billion, including conventional funds and ETFs), followed by sector-technology funds (+$6.6 billion) and the commodity and materials heavy sector-other funds (+$3.2 billion) macro-classifications. At the other end of the spectrum, investors gave the cold shoulder to large-cap funds (-$39.4 billion), mid-cap funds (-$14.2 billion), and global equity funds (-$12.7 billion).

"For the year-to-date period, equity ETF investors injected the largest amount of net new money into iShares MSCI USA Quality Factor ETF (QUAL, +$9.9 billion), followed by Vanguard 500 Index ETF (VOO, +$9.7 billion), JPMorgan Equity Premium Income ETF (JEPI, +$8.9 billion), Vanguard Information Technology Index ETF (VGT, +$5.9 billion), Vanguard Total Stock Market Index ETF (VTI, +$5.9 billion), and JPMorgan BetaBuilders Europe ETF (BBEU, +$5.7 billion). At the other end of the spectrum, iShares ESG Aware MSCI USA ETF (ESGU, -$7.7 billion) suffered the largest net redemptions in the equity universe, bettered by iShares Core S&P 500 ETF (IVV, -$5.5 billion) and iShares Russell 1000 Value ETF (IWD, -$5.3 billion)."

See the full article for additional specifics.

Contributor Mish Schneider tries to throw a little water on the rally in If It Weren’t For These 7 Stocks…

"Apple (AAPL), Nvidia (NVDA), Meta (META), Alphabet (GOOGL), Microsoft (MSFT), Amazon (AMZN), and Tesla (TSLA) have now been penned as the “Magnificent 7”.

Only around 25% of the S&P 500 stocks have outperformed the benchmark, while these stocks continue to show massive leadership.

The Nasdaq is up around 15% year-to-date, outpacing the S&P.

Smaller cap stocks have struggled way more.

The Russell 2000 is flat this year, largely because bank stocks have dealt with significant deposit outflows.

Some say that tech has led every market rally so who cares if only 7 stocks lead the charge? I agree with that statement…

To a point.

...watching small caps and retail is the best way to assess how long tech can rally and lead for."

"XRT and IWM are not only stuck, but they are also teetering if neither can rally from here.

We love to zoom out to a monthly view.

The chart shows our 80-month moving average (green), which represents a 6–8-year business cycle.

We could call it our soft-landing barometer.

XRT is holding on after last Friday’s bounce. But marginally unless it clears 60.00.

IWM is further up from the 80-month MA, but nowhere near the 23-month moving average (blue) or the 2-year business cycle or period of growth."

In the "Never A Dull Moment In Crypto" Department TalkMarkets contributor Tim Fries reports SEC Sues Binance And Changpeng Zhao Alleging Securities Laws Violation.

"This Monday, the SEC filed a lawsuit against the cryptocurrency exchange Binance (BNB-X). According to the complaint, the company offered unregistered securities in the form of several cryptocurrencies including BNB and the stablecoin BUSD. The company’s CEO, Changpeng Zhao, was also sued by the SEC.

The Commission also alleges that Binance’s yield-bearing products—Simple Earn and BNB Vault—also constitute the offering of unregistered securities. SEC Chair Gary Gensler, has, in the aftermath of shutting down Kraken’s staking service, stated that most yield-breaking products offered by cryptocurrency exchanges are essentially the same."

Image courtesy of 123rf.

"In response to the complaint, the exchange stated it is disappointed with the Commission’s decision to go forward with the complaint. Binance also announced it is intent on defending its platform and added that the SEC’s lawsuit is another example of the watchdog undermining “America’s role as a global hub for financial innovation and leadership”...The complaint caused a significant price drop among different digital assets. One of the hardest hit was Binance’s BNB which fell by more than 8% by the time of writing. The shares of the cryptocurrency exchange Coinbase—which has been warned of likely enforcement action earlier this year—also saw a decline and were down more than 10% by the time of writing."

Caveat Emptor!!!

That's a wrap for today.

Have a good one.

More By This Author:

Thoughts For Thursday: In The House, Debt Deal Done

Tuesday Talk: Money Time For McCarthy