Thoughts For Thursday: Somewhere In Between

In the incessant chatter about inflation, interest rates and recession, continued job growth and the onward march of technology somehow seems to get lost in the discussion. Inflation while persistent, does seem to be coming down and new technology, with some help from the CHIPS Act, will bring additional growth to the economy. There will however be stumbles along the way, which means by the end of the year the economy may find itself somewhere in between less inflation and edging lower interest rates. Some of those stumbles will be people badly hurt by higher mortgage rates and falling home prices, others will be seniors whose nest eggs have been raided by inflation and stock market volatility. On the plus side will be better wages and opportunities for many in the labor force. In the meantime prudence and perseverance are called for when making investment decisions.

On Wednesday the markets closed without any dramatic shift up or down, though action throughout the day was not without rhythm. The S&P 500 closed at 3,992, up 6 points, the Dow closed at 32,798, up 58 points and the Nasdaq Composite closed at 11,576, up 46 points.

Chart: The New York Times

The Staff at TalkMarkets contributor Schaeffer's Research notes S&P 500, Nasdaq Pare Losses For Slight Gains.

"Investors continued to brood over the prospect of higher interest rates on Wednesday. The Dow lost 58 points but pared a triple digit deficit, while the S&P 500 and tech-heavy Nasdaq managed to close in positive territory despite spending most of the afternoon in the red. As Federal Reserve Chair Jerome Powell's two-day testimony wrapped up, a hotter-than-expected private payrolls report for February pointed to a strong economy."

Contributor Mish Shedlock writes Single Family Housing Transactions Have Crashed, But When Will That Matter?

In a piece flush with charts, below are a few of them with comments:

"Private Residential Housing vs Residential Building Employees Short Term

With total housing units flatlining and single family units under construction falling pretty hard, it's likely that residential housing employment is poised to fall.

The rate of decline in employment will depend on how fast the units under construction finish.

No Rebound in Existing Home Sales Despite a Drop in Mortgage Rates

Meanwhile, please note No Rebound in Existing Home Sales Despite a Drop in Mortgage Rates

That matters too. Employment is not just a matter of new construction but also remodeling.

30-Year Mortgage Rates

People are pulling listings. With falling housing prices and slumping listings, remodeling work is also falling.

So is demand for appliances, furniture, landscaping etc. But with the service sector still humming (for now), Powell's Hawkish Speech to Congress Sends Interest Rate Hike Odds Soaring

And mortgage rates are back above 7.0 percent. Who wants to trade a mortgage below 3.0 percent for a 7.0 percent mortgage."

No matter how you look at it, housing is still a hot mess.

TM contributor Steve Sosnick tries to understand the impact of Fed Chair Powell's testimony on the Hill on the markets in Aftermath Of A Big Wake Up Call.

"As we meander around the unchanged line on the S&P 500 Index (SPX), digesting yesterday’s moves in stocks and bonds, here are a few takeaways:

- Even though we gave back all of Friday’s big gains, we never re-tested Thursday’s lows. As a result, the technical factors that have been supporting this year’s advance in stocks – and a good portion of the bulls’ case – remain in place. The chart below shows how the 50-day moving average remains a magnet for SPX, while the 200-day and major trendlines remain in place.

- It would be fascinating, if not concerning, to see what might follow if those supportive levels are clearly broken. For now, while they hold, there is still a general lack of concern. We noted the tepid rise in VIX yesterday, and there is no apparent rush for volatility protection today. The term structure of implied volatility for SPX shows some spikes around Friday’s Payrolls report, CPI/PPI next week, and the FOMC rate announcement two weeks from today but these are not levels that imply major concern. The 21.6% peak for Friday implies a 1.35% move around the Payrolls data, and all the subsequent peaks imply smaller moves. To be fair, the current levels are well above those of a week ago – the implied volatility for this Friday was 18 – but one might reasonably expect more concern about volatility surrounding a Fed meeting that is now considered “in-play”...

The key takeaway was the Chair reaffirmed the notion of a data-dependent Fed. The magic word “disinflation” has gone by the wayside after a trifecta of higher-than-expected inflation reports. That is why I have a difficult time wrapping my mind around the relatively low levels of VIX and other implied volatility measures as a series of key data points approaches. Traders’ risk-on mentality remains in place as long as the technical remain in place."

See the full article for the accompanying charts.

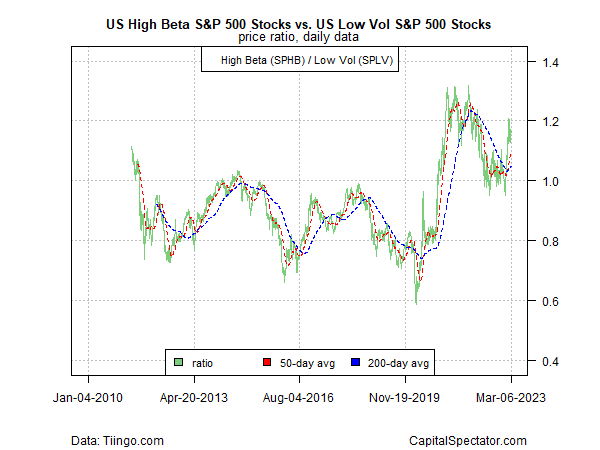

Check the TalkMarkets Editor's Choice corner for this piece from contributor James Picerno entitled Markets Continue To Flirt With Risk-On Signals.

"There’s no shortage of threats lurking, ranging from inflation, elevated interest rates that may go higher still, and various geopolitical threats. But market sentiment has improved recently, climbing a wall of worry and suggesting that investors are presuming that the worst has passed for the world economy, based on various ETF pairs through Monday’s close on March 6.

Consider the ratio between high beta US stocks (SPHB) and their counterpart via low-volatility shares (SPLV). This measure of appetite for risk has shot higher recently and is holding near the highest level in a year."

Contributor Daniel John Grady looks towards the February NFP And Chance Of A Surprise.

Photo by Cristina Glebova on Unsplash

"Following Fed Chair Powell’s comments on Capitol Hill last Tuesday, there is a lot of expectation around the upcoming NFP figures. Powell essentially said that if economic data came in well above expectations, then there would be a 50bps hike at the next FOMC meeting...

The consensus among analysts was that around 210K jobs were created in February, which would be in line with the last months of 2022. But it’s still down from the 517K number reported in January which more than doubled expectations. The unemployment rate, however, is expected to remain steady at the historic low of 3.4%...

(As far as surprises go) The other thing is that last month already included the adjustment for seasonality, so there is unlikely to be another adjustment boost to the numbers this time around. And, given the large number in January, the prior month could also be revised lower, as typically happens with this way out of the mean results."

Uncertainty aside, at the opening bell on Wall Street, the S&P 500 is up 16 points, the Dow is up 156 points and the Nasdaq Composite is up 43 points.

Have a good one.

More By This Author:

Tuesday Talk: Waiting For Jerome

Thoughts For Thursday: Still Slipsliding