Thoughts For Thursday: Still Slipsliding

The stock market carried its slip-slide action into March on Wednesday with two of the major indices closing slightly lower and a third edging just ever so slightly higher.

Yesterday the S&P 500 closed at 3,951, down 19 points, the S&P 500 closed at 32,662, up 5 points and the Nasdaq Composite closed at 11,379, down 76 points.

Top gainers were largely Energy related, though Mining, Industrials and Entertainment sectors also made the chart. Leading the pack on Wednesday was First Solar (FSLR), the solar energy solutions manufacturer, up 15.7%, after beating street estimates for Q4 results. Second was Valero Energy (VLO), up 5.7% and third was copper mining heavyweight Freeport-McMoran, up 5%.

Chart: The New York Times

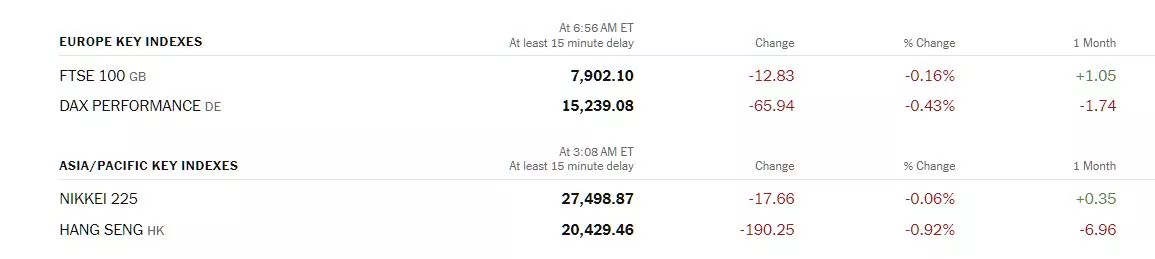

Overseas Asian markets closed the day lower and European markets have started downwards out of the gate this morning.

Chart: The New York Times

In morning futures action S&P market futures are trading down 12 points, Dow market futures are trading up 100 points and Nasdaq 100 market futures are trading down 71 points.

Market analyst and TM contributor Fiona Cincotta spots Two Trades To Watch: EUR/GBP, Nasdaq - Thursday, March 2.

"EUR/GBP is falling for a third straight day as investors digest the latest comments from BoE Governor Andrew Bailey and look ahead to eurozone inflation data.

Eurozone inflation is expected to cool to 8.2% YoY in February, down from 8.6% in January. Core inflation is expected to hold steady at 5.3% after unexpectedly taking higher in the previous month."

"EURGBP has rebounded off the 100 sma, rising back into the multi-month rising channel and above the 50sma. This, combined with the RSI above 50 keeps buyers hopeful of further upside."

"The Nasdaq has been trending lower from 12900 reached at the start of the month, taking out support at 12215 and the 200 sma at 11900. This along with the RSI below 50 keeps sellers hopeful of further downside.

Sellers will look to test the 50 sma at 11780, with a break below here exposing the 100 sma at 11600, before bringing the 11200 support into focus."

Contributor Mish Shedlock brings us a conversation with Minneapolis Fed President Neel Kashkari in Minneapolis Fed "Wage Growth Is Too High" For Our Two Percent Inflation Target. Worth a quick read or view. Below are some discussion highlights:

"A couple of years ago, I said, and my colleagues said, some of these factors look like they are temporary or transitory. Supply chains are going to get sorted out. So maybe we do not need to overreact. Well, it took a lot longer than we expected. And now you are seeing wages climbing. And wages are climbing trying to catch up to that inflation rather than leading the inflation. But now wage growth is at a level that it is actually too high to be consistent with our 2 percent inflation target."

"The services economy continues to be very strong. We are not yet seeing much of a sign of our interest rate increases slowing down the services side of the economy. And that is concerning to me."

"We would like to avoid a recession but we know we have to get inflation down. Getting inflation down is job one."

"This is a very complicated economic environment that we are in, in terms of our ability to analyze it using the traditional analytical tools that we have."

And in a great segue from Kashkari's remarks contributor Stefan Gleason writes of a possible Catch-22: Rate Hikes May Fuel Even More Inflationary Deficit Spending.

"Federal Reserve rate hikes meant to quell inflation may ultimately have the opposite effect...contrary to popular misconceptions perpetuated by the Fed, the root causes of inflation aren't tied to employment or economic growth. Inflation occurs when the currency supply expands too rapidly as confidence in the ability of U.S. dollars to retain their value falls.

Higher interest rates may well induce a recession that temporarily causes demand for money and credit in the private sector to contract.

Meanwhile, such conditions wouldn't blunt government demand for new currency. Quite the opposite!

During recessions, the government tends to increase spending on "stimulus" programs even as revenues shrink."

"Rate hikes represent a Catch-22 for Fed policymakers. If they stop hiking while inflation continues to run above target, they may never be able to get out in front it. But if they keep hiking, they will induce the U.S. Treasury Department to extend its lines of credit – which is inflationary.

Some members of Congress are putting their foot down on deficit spending – or at least making a show of it – and vowing not to raise the statutory debt ceiling without at least some budget concessions from the Biden administration."

Stay tuned.

Contributor Wade Slome looks at Q1 so far and asks From Hard Landing To Soft Landing To No Landing?

"With the Federal Reserve approaching the tail end of an aggressive interest rate hiking cycle, investors have been bracing for a hard landing. However, with near record-low unemployment (3.4%) and multi-trillion dollars in government stimulus still working its way through the system, others see an economic soft landing. More recently, economic data has been flying in at an accelerating pace, which could mean the economy will stay in the air and have no landing.

For those waiting for an imminent recession, it looks like there could be a delay. In other words, bearish pessimists may be waiting at the gate longer than expected...economists at the Atlanta Federal Reserve are currently forecasting economic growth (GDP – Gross Domestic Product) to increase to a respectable +2.8% rate for the first quarter."

This good news does not come without complications and Slome wanders into the weeds further on in the article.

In a TalkMarkets "In the Spotlight" feature, contributor Stephen Innes discusses the market's concerns regarding the Fed's Rate Hike Fever.

"Stocks are down slightly Wednesday as investors navigate hawkish Fed-speak, mixed results from consumer-facing companies, and the relentless push higher in 10-year Treasury yields that touched and continue to probe the psychological 4 % level.

Last week's PCE report is proving to be the ultimate dagger that sees markets kicking off March with a severe case of "rate hike fever" -- more robust growth that may be accompanied by more substantial inflation has the consensus forming around a higher-for-longer rate regime. Hence the S&P 500 obstinate trend in the face of limited disinflation progress could persist longer.

But there seems to be a growing asymmetry concerning the next move from here. It appears to be much more skewed negatively today than at any point this year as investors ultimately come to terms with the fact that prices are not decelerating as quickly as expected earlier this year.

Given all this, the most significant move across the macro landscape is taking place in the most critical asset of them all - US interest rates, which featured yet another notable break higher in yields. At the same time, thoughts of rate cuts are getting bled out of the futures strip as the US economy is proving remarkably resilient to Fed tightening.

It does not matter if you think rates went up because the Fed raised their target rate on Fed funds or if you believe it was because of rising inflation or improving growth; you get the same result. Bond yields are at a level that is now competing with stocks for medium-term investors' attention.

In real-time analysis, while getting whipsawed around in this still post-pandemic era (partly due to SPX zero-days-to-expiration options), it is difficult to determine what trends will endure and quickly fade. Investors will remain cautious ahead of next month's Jobs and Inflation data, which could ultimately be the straw that breaks the camel’s back in the absence of a tack lower on the data.

We can not stress how much the following two weeks loom massively critical for market participants. Events are predominantly US-centric: a reaffirmation of a preferred Fed hiking pace of 25bps, some reversion of the February employment data & CPI prints is precisely what the market doctor is ordering."

Beef or chicken, bonds or stocks, the butcher sells both...

Contributor Tim Fries hits on more than one theme in Value Stocks Likely To Outperform Growth In New Marco Regime: BlackRock but his title related remarks are worth noting:

"With PCE running hotter than expected, that narrative seems less viable now. At the same time as inflation looks to be a sticker, spurring more hikes, this also leads to a steeper yield curve, as projected by the Congressional Budget Office."

Image credit: CBO

"As a gap between short-term and long-term interest rates, a steep yield curve signals economic slowdown, i.e., recession. However, this steepening typically occurs in anticipation of a recession before the actual economic downturn. BlackRock (BLK) sees this combination as a positive outlook for value stocks because:

- Inflation bites the future cash flow of companies, negatively impacting growth stocks that rely on earnings growth. In contrast, value companies are less affected by inflation, as they have more consistent earnings.

- A steep yield curve places long-term interest rates above short-term interest rates, which benefits value stocks with higher dividend yields, and is preferred by investors as such.

Although value stocks historically underperform when heading into recession, this atypical macro environment, expressed by a steep yield curve, would give value companies an extra edge. After all, the recession has been telegraphed well in advance, giving them room to prepare.

In this light, BlackRock sees the energy sector as the optimal combination of value and quality. BlackRock still expects a mild recession, which could be interpreted as the Fed’s ‘soft landing.’"

That's a (big) wrap for today.

Have a good one.

More By This Author:

Tuesday Talk: A Whole Lotta Shakin' Goin On

Thoughts For Thursday: Is A Soft Landing Paramount?