Thoughts For Thursday: Is A Soft Landing Paramount?

Inflation is slowing with disturbing undertones, but strong retail results pulled the market higher on Wednesday, showing some investors that there is room for a hawkish Fed and a rally, and hope that this pull and tug will guide the economy through the winds of inflation to a soft landing.

Yesterday the S&P 500 closed at 4147, up 11 points, the Dow closed at 34,128, up 39 points and the Nasdaq Composite closed at 12,071, up 110 points.

Top gainers were led by Paramount (PARA), up 9.3%, buffeted by the announcement that Berkshire-Hathaway (BRK-B) increased its holdings by 2.4 million shares in the company, followed by SolarEdge Technologies (SEDG), up 9.1% and Generac Holdings (GNRC), up 8.0%.

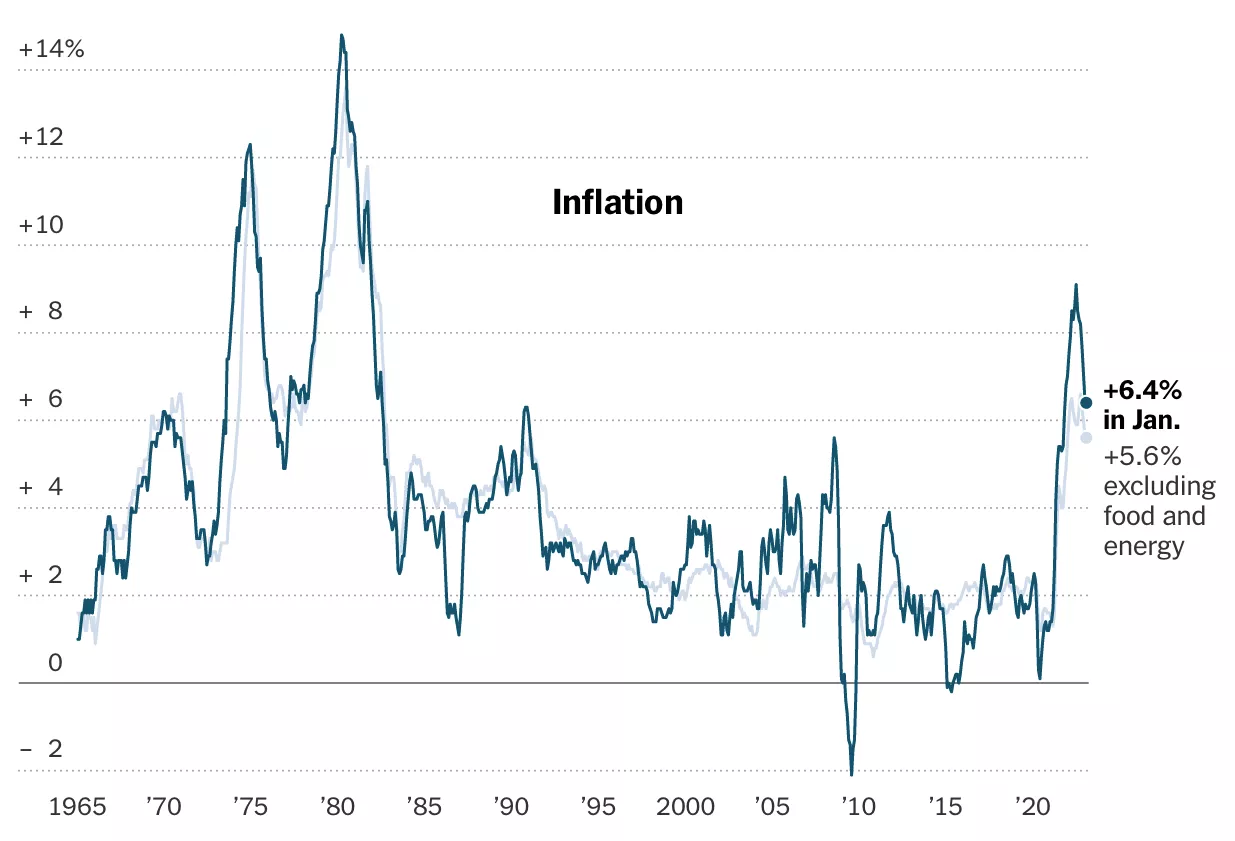

Chart: The New York Times

European markets, also closed higher on Wednesday, as did Asian markets, this morning.

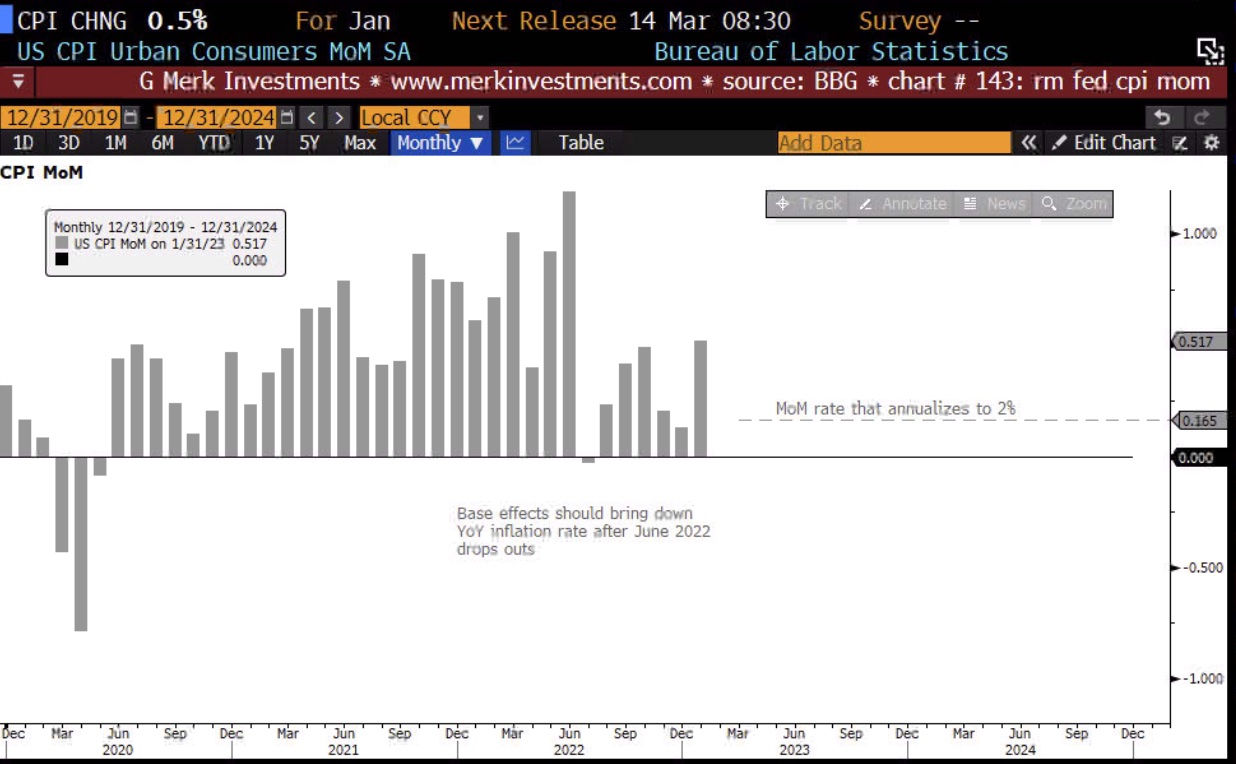

Chart: The New York Times

In early morning futures trading, S&P 500 market futures are flat, Dow market futures are down 2 points and Nasdaq 100 market futures are up 6 points.

TalkMarkets contributor Ryan McMaken writes Food And Shelter Prices Keep Climbing As CPI Growth Hits A Three-Month High.

"The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data, and according to the report, price inflation during the month decelerated slightly, coming in at the lowest year-over-year increase in sixteen months. According to the BLS, Consumer Price Index (CPI) inflation rose 6.4 percent year over year in January before seasonal adjustment. That’s down very slightly from December’s year-over-year increase of 6.5 percent, and January is the twenty-third month in a row with inflation above the Fed’s arbitrary 2 percent inflation target. Price inflation has now been above 6.0 percent for sixteen months in a row.

Meanwhile, month-over-month inflation rose to a three-month high, with the CPI rising 0.5 percent (seasonally adjusted) from December to January.

January’s year-over-year growth rate is down from June’s high of 9.1 percent, which was the highest price inflation rate since 1981. But January’s growth rate still keeps price inflation above growth rates seen in any month during the 1990s, 2000s, or 2010s. January’s increase was the fourteenth-largest increase in forty years."

"The ongoing price increases largely reflect price growth in food, energy, transportation, and especially shelter. In other words, the prices of essentials all saw big increases in January over the previous year...

As of January, there was no sign of price growth in shelter slowing down. Last month, shelter prices increased by 7.9 percent year over year, which was the highest growth rate since July 1982. Month-over-month growth in shelter costs also remained among the highest we’ve seen since 1983...

Wall Street, heavily dependent on easy money, wants to see inflation fall so that the Fed will begin loosening again. If price inflation is seen to be slowing, this could be interpreted as an excuse for the Fed to force interest rates back down and resume asset purchases. If a soft landing were already in the cards, Wall Street would be planning for an acceleration of monetary loosening.

The Fed has signaled that it is ready to end its current cycle of rate hikes if it can come up with a political excuse to do so. But with year-over-year CPI inflation still above 6 percent, the Fed is clearly a long way from its arbitrary 2 percent target rate. With this latest CPI report, markets are probably now expecting another 25 basis point rate hike in March...

Donald Trump repeatedly called for massive amounts of monetary inflation (in the form of QE), complaining on numerous occasions that the Federal Reserve was not inflating the money supply enough. Later, Trump’s record-breaking peacetime government deficits drove even more inflation. We are now living with the consequences of the Trump profligacy. Biden, however, will do nothing to reverse these policies and is thus making inflation and declining real wages part of his own legacy."

Not sure if McMaken wants a more hawkish Fed or higher wages? See the full article for more.

In that vein contributor Jesse Felder says Hawkishness Is In The Eye Of The Beholder.

“Once inflation gets above 5% it’s never come down unless fed funds have gotten above the CPI.” –Stan Druckenmiller

"As I first noted here a couple of months ago, despite the Fed’s aggressive rate hike campaign over the past year, the funds rate remains below CPI. As such, it’s hard to call current policy “hawkish” in the context of history. In fact, on this basis, the fed funds rate has now been negative in real terms for nearly 40 months running. Only in the aftermath of the Great Financial Crisis have we ever seen a longer stretch during the post-war era. Of course, this was understandable at the time because the disinflationary impulse of the crisis enabled an extreme monetary response. Today, in contrast, inflation is running at its hottest levels since the Great Inflation of the 1970s and early-1980s. And back then, Arthur Burns didn’t even manage to pull off such a feat of protracted dovishness."

Contributor Terry Grennon examines the the slower pace of increase in the CPI, From An Annualized Peak Of 9.1% Last Summer, Inflation Has Dropped.

"The general decline in inflation in recent months has been caused by moderating price increases for goods and commodities."

"An unanticipatedly large number of jobs were created by employers in January, and while increases in average hourly wages and other pay metrics have slowed, they still remain rapid.

The central bank's effort to curb the economy has so far been unsuccessful.

On an MoM basis, core retail sales growth exceeded expectations, while the YoY dropped to just +4.4%, the lowest level since March."

So dropping, but not enough.

Which brings us back to the Fed. In an Editor's Choice column, TM contributor Axel Merk looks at what it means when the Fed says, Higher For Longer. It's an in depth piece and merits a look at the full article, but here are a few highlights:

"To fight inflation, the Fed is committed to “higher for longer”. We may agree or disagree with the Fed’s approach, but we may be well served to take the Fed literally. Specifically:

- The Fed had only initiated rate hikes in March 2022, raising the Federal Funds rate by 0.25. At the March 2022 meeting, the February Consumer Price Index (CPI) was available indicating 7.9% year-over-year inflation. The Fed’s sense of urgency increased only thereafter, raising 0.5% in May, then 0.75% in June; that month the month CPI accelerated to 9.1%.

- I’ve argued that the “whole point” of raising rates is to “tighten financial conditions.” In plain English, this means it is more difficult to access credit; there are many (imperfect) ways of measuring financial conditions. Powell has expressed frustration that despite higher rates, financial conditions haven’t tightened further.

- What the Fed wants to see is that interest rates are above the inflation rate. That sounds easy enough (why they didn’t raise rates faster, earlier?). When you talk inflation, there are lots of measures and any year-over-year measure contains data that references a data point that is, well, a year old. We will have to wait until after June for the high reading from last summer to drop out to provide the likelihood of a more benign inflation reading.

- Except the January jobs report was much stronger than expected. That’s a problem because the Fed wants the economy to slow down. There continue to be almost two job openings per job seeker. While some argue this is not necessarily inflationary, the dogma at the Fed (and common sense) dictate caution. Upon the release of the jobs report, the market priced in another 0.25% rate hike in May with the possibility of another June rate hike hovering around 50%.

- As indicated earlier, some easing down the road is always priced into it to reflect the risk of a shock. However, the sort of easing that’s priced in is more significant than would be if the market took the Fed seriously with its call that it will hold the line unless there is some shock that warrants urgent action. What gives?

- In my view, the Fed’s main problem is that “higher for longer” is not a strategy, but a tactic. The goal post is moved with any data point that comes out. Fair enough. Except, the quirks of the calendar as elaborated on above aside, we can’t really see beyond the next goalpost. What that means in practice is that the market is likely to continue to predict rate cuts within months, even if rates move higher."

Contributor Jharonne Martis has a Q4 2022 Retail Preview: Restaurant SSS Outperform Retail SSS.

" Of the 201 retailers tracked by Refinitiv, the Hotels, Restaurant & Leisure sector is headed for the highest earnings growth rate in the fourth quarter, recording a 257.4% surge over last year’s level.

In fact, it has been the strongest-performing sector this year. These firms have been benefiting from the fact that consumers feel more comfortable traveling, staying at hotels and eating out.

At the other end of the spectrum, Internet & Catalog Retail is facing difficult comparisons and has the weakest anticipated Q4 2022 estimate, with profits expected to decline by 92.7%."

"To date, 83 companies in the Retail/Restaurant index have reported revenue for Q4 2022. For this group, the Q4 2022 blended revenue growth estimate is 5.1%; 63% have reported revenue above analyst expectations, and 37% reported revenue below analyst expectations."

"The Restaurant SSS data is in line with the restaurant earnings data suggesting that despite difficult comparisons from last year, they are still on track for healthy profits. This is due to consumers feeling more comfortable with the reopening and eating out."

See the article for a complete data dump.

That's a wrap for today.

Have a good one and remember Ukrainians, Turks and Syrians need assistance.

More By This Author:

Tuesday Talk: My Sweet CPI

Thoughts For Thursday: Risk-Off, Risk-On