Tuesday Talk: My Sweet CPI

The street is hoping for sweet January CPI data today and that anticipation pushed stocks higher on Monday.

Yesterday the S&P closed at 4,137, up 47 points, the Dow closed at 32,246, up 377 points and the Nasdaq Composite closed at 11,892, up 174 points.

Chart: The New York Times

Most actives were again all tech issues, save for Ford (F). Tesla (TSLA) took the number one spot, down 1.1%, followed by Ford, up 2.8% and Apple (AAPL), up 1.9%, in the third spot.

Chart: The New York Times

Currently in morning futures trading S&P 500 market futures are flat, Dow market futures are trading down 6 points and Nasdaq 100 market futures are trading up 4 points.

Contributor Jesse of Jesse's Cafe Americain waxes poetic about yesterday's action in To Be Human - CPI Tomorrow.

"Stocks were in a mood to move higher today, although the CPI data point tomorrow morning had them on edge.

Gold and silver were hit.

The Dollar slide lower. Although it's funny because if I had just listened to bubblevision I would have thought it moved higher.

The VIX fell.

There will be an index option expiration next week.

If the CPI makes an unexpected print tomorrow we may have some action."

See the article for his charts on Metals action. Said USD action (UDN) is illustrated below.

In individual stocks ramping higher, contributor Wajeeh Khan reports and posits: Palantir Stock Jumps 20% On First-Ever Profit: Sell Into The Strength?

"Palantir Technologies Inc (PLTR) jumped more than 20% in extended hours after turning in its first-ever quarterly profit.

Shareholders are happy also because the data analytics company said it expects to remain profitable this year. In terms of revenue, though, it guided for $2.18 billion to $2.23 billion – slightly below $2.28 billion that analysts had anticipated.

Versus the start of the year, Palantir stock is up nearly 50% at writing.

The quarterly update arrives more than a month after Bank of America analyst Perez Mora reiterated her “buy” rating on Palantir stock and said:

First, the company is sitting on $2.4 billion of net cash. Second, Palantir is working with defense primes and services contractors to expand the use of its products. Palantir is only one out of three companies with IL6 certification.

She valued the company’s government business alone at $7.0 a share. Mora’s price target of $14 suggests about a 50% upside on top of the after-hours price action.

Notable figures in Palantir’s Q4 earnings report

- Earned $31 million that translates to a cent per share

- That compares to a $156 million loss last year

- Adjusted EPS printed at 4 cents as per the press release

- Revenue climbed 18% year-on-year to $509 million

- Consensus was 3 cents of EPS (adj) on $503 million revenue"

Sweet.

TM contributor Rod Raynovitch who follows Biotech and Pharma writes, Large-Cap Biopharmaceuticals: Bearish Sentiment Curbs Buyers.

"Large cap biopharma are off their highs despite reasonable valuations plus dividends.

- Capping of prescription drug prices for seniors remains a big political concern.

- Macro and sentiment dominate trading with S&P Range bound 3600-4200.

Biopharma stocks took a hit last week as investors shifted to other sectors amidst the usual Fed rate rise concerns and now some hard criticism of the drug industry by Biden in his State of the Union speech. Also, a bearish article in the Wall Street on Saturday offered bleak prospects on funding for early-stage companies because of higher interest rates, geopolitical tensions with China, and dire prospects for an exit through IPOs. But the companies mentioned are relatively unknown and maybe do not have broad and deep product pipelines. We know that 2021 was boom times for biotech funding so maybe too many companies were created. Nonetheless, we need to look at funding of smaller companies so that they can advance their pipelines. Also since valuations of many SMID companies have come down this could create more M&A, and certainly more licensing deals. Large and mid-cap biopharma companies have strong balance sheets and need to bolster their pipelines."

"Many large-cap biopharmaceutical stocks are now down significantly YTD: AMGN 7.67%, ABBV 5.92%, LLY 5.67% but remain strong holds with good dividends above 3%. In early trading today biopharma stocks are holding up. Our favorite large caps for 2023 are ABBV, MRK, REGN, and VRTX. Good dividend plays are BMY, GILD, and PFE."

Technical analysis by the Staff at contributor ReadTheTicker shows that Bitcoin Accumulation Is Real.

"Richard Wyckoff told his students to think of waves of price and volume. This in short is the essence of tape reading...

"The Bitcoin (BITCOMP) chart (above) uses a fixed bar period to form a 'price wave' and sums up the raw volume for each price wave. Up price waves are blue, and down price waves are red.

To expand further, let's examine the consolidations A and B.

Consolidation A shows red volume higher than blue volume, blue volume is not substantial at all, hence there was little demand, little accumulation, and the consolidation result was one of re distribution to lower prices.

Consolidation B shows blue volume higher than red volume, blue volume is substantial, hence there is solid demand, and strong accumulation and this consolidation is leaning to pure accumulation which is likely to lead to higher prices (of course this pattern does not mean a spike to a new low, like a terminal shake out, is not off the table)."

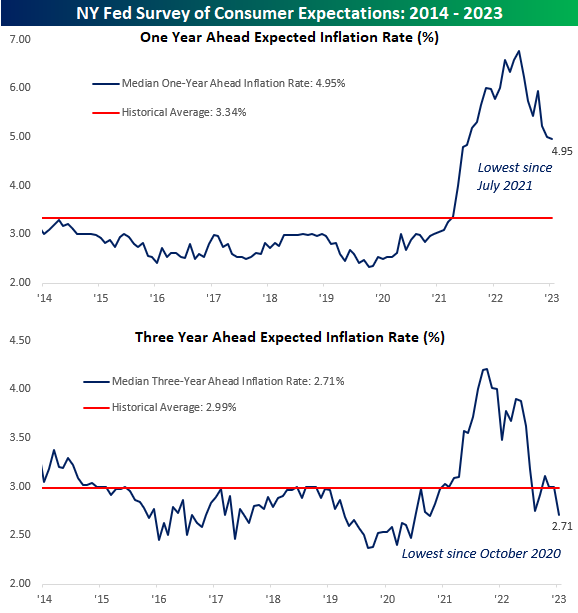

Turning to domestic economic news the Staff at contributor Bespoke Investment Group finds Inflation Expectations Trending Lower.

"The monthly survey of consumer expectations from the New York Federal Reserve was released this morning and showed that ahead of January’s CPI report on Tuesday, consumer expectations towards inflation are generally stable and trending lower. On a one-year basis, inflation expectations dropped ever so marginally falling from 4.99% down to 4.95%. Three-year inflation expectations dropped from 2.99% down to 2.71%, and the only increase was in five-year expectations which increased from 2.4% to 2.5%."

See the full article for additional commentary.

TalkMarkets contributor New Deal Democrat says The #1 Likely Reason The Economy Has Not Gone Into Recession Yet is housing starts.

"despite the huge downturn in housing permits and starts, that important sector isn’t really in recession yet at all! That’s because, due to the supply chain issues in building materials that plagued the industry last year, the number of houses under actual construction hasn’t turned down at all. In fact, last month it was at a new record high:"

"And why do I think that is the #1 reason the economy hasn’t gone into recession yet? Below is a graph of the YoY% change in housing units under construction (blue) vs. the YoY% change (*4 for scale) in real GDP (red):"

"There has *never* been a time when real GDP turned negative YoY without housing construction having turned negative YoY first. Never.

And as the graph shows, as of December YoY housing units under construction were up 12%.

I fully expect this to turn down sharply, and soon. Of course, it has been something I have expected for a few months already. We’ll find out what happened in January when housing permits, starts, and construction for January are reported on Thursday."

Thanks for the punch New Deal Democrat ![]() .

.

That's plenty of candy for today, whether you like yours sweet, salty, or sour.

Happy Valentine's Day!

More By This Author:

Thoughts For Thursday: Risk-Off, Risk-On

Tuesday Talk: Risk-On, Risk-Off