Inflation Expectations Trending Lower

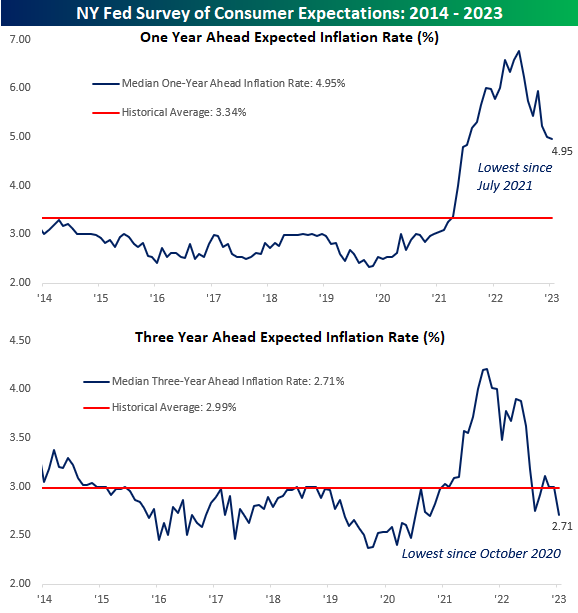

The monthly survey of consumer expectations from the New York Federal Reserve was released this morning and showed that ahead of January’s CPI report on Tuesday, consumer expectations towards inflation are generally stable and trending lower. On a one-year basis, inflation expectations dropped ever so marginally falling from 4.99% down to 4.95%. Three-year inflation expectations dropped from 2.99% down to 2.71%, and the only increase was in five-year expectations which increased from 2.4% to 2.5%.

Regarding expectations for the next five years, it’s hard to read too much into the trend since the NY Fed has only been surveying consumers on this time frame for a year. For the one and three-year time frames, however, we have close to 10 years' worth of monthly responses so we can get a better read on how things stand now versus the past. Starting with expectations for the next year, consumers expect inflation to continue to trend lower from the peak of 6.78% last June, and at the current level of 4.95%, they’re at the lowest level since July 2021 even as they remain well above the historical average of 3.34%.

Inflation expectations for the next three years are more interesting. While expectations peaked at 4.21% in October 2021, January’s reading came in at 2.71%, which was the lowest since October 2020, but more importantly, below the historical average of 2.99%.In other words, consumers expect less inflation over the next three years than they have across the majority of other times in the last ten years.

More By This Author:

New 52-Week Highs In 2023Jobless Claims Above Expectations

Refis Rise

See more analysis of economic data with a Bespoke Premium membership. more