Thoughts For Thursday: Good Up, Bad Up And Giddy Up

Both the October CPI and the Rivian IPO entered the stock market corral on Wednesday at a fast gallop. When the dust settled at the end of the trading day, the market closed down.

Rising inflation is coming home to roost on Main Street, Wall Street and your street. Despite Treasury Secretary Yellen's insistence that it is transitory and supply-chain influenced, which it well may be, the supply-chain bottleneck isn't coming unstuck anytime soon, thus creating headaches for President Biden, the Department of Treasury, the Fed and Jane and Joe investor's wallets. The chart below shows price increases by type of good or service:

Rivian (RIVN) the Ford (F) and Amazon (AMZN) backed EV truck start-up IPOed on the Nasdaq, yesterday. The stock's IPO price was set at $78 per share and opened it's first day of trading at $106.75. The stock had a first day, intra-day range of $95.20-$119.44 and closed at $100.26.

All three major indices were down for the day. The S&P 500 closed down 38 points at 4,647, the Dow closed at 36,080, down 240 points and the Nasdaq Composite closed down 264 points at 15,263. Currently market futures are trading green; S&P futures are up 16 points, Dow futures are up 41 points and Nasdaq100 futures are up 99 points.

Economist Scott Sumner asks Why Is Inflation Bad? Sumner has a contrarian position and is less concerned than others. The article is short and recommended reading. His introductory remarks are as follows:

"I have what might seem like contradictory views on inflation. On the one hand, I’m an inflation hawk who came of age in the 1970s and I view the high inflation of that decade as a major policy mistake. On the other hand, I’ve argued that inflation doesn’t really matter, that the so-called “welfare costs of inflation” are better measured by looking at NGDP growth. And (a model produced by David Beckworth suggests that) NGDP is back on track"

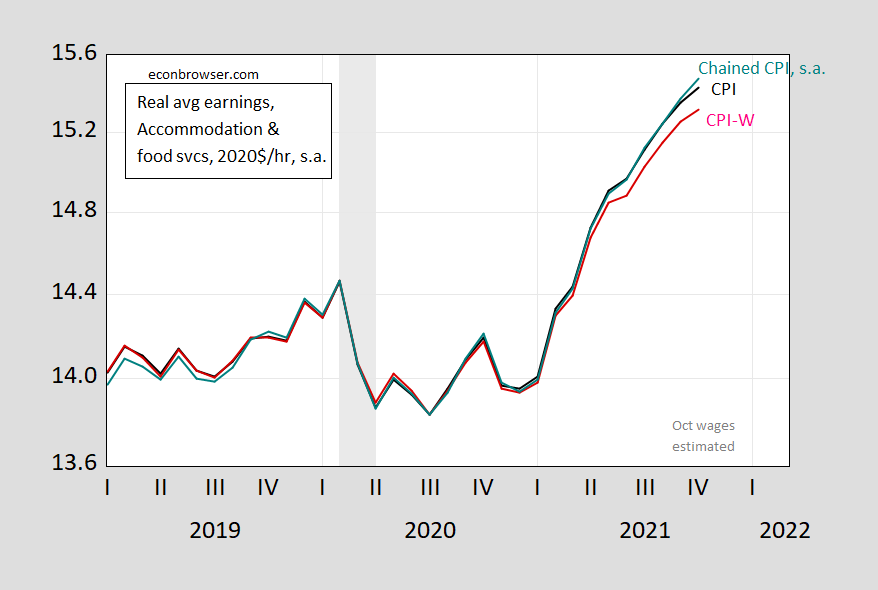

Contributor Menzie Chinn finds that despite the assumption that inflation hurts those at the lower ends of the wage scale the most, wages for service industry workers are keeping up with inflation. Chinn charts this for readers in his article Are Low Wage Wages Keeping Up With Inflation?

"If accommodation and food service wages evolve in October in the same way they have covaried with overall leisure and hospitality service wages, then the answer is yes, for a variety of price indexes."

Figure 1: Average hourly earnings of production and nonsupervisory workers in accommodation and food services, in $/hour, deflated by CPI (black), chained CPI, seasonally adjusted (teal), and CPI-wage earners and clerical (red), into 2020$. NBER defined recession dates peak-to-grough shaded gray. Chained CPI seasonally adjusted by X-12/X-11 ARIMA. October observation on wages extrapolated from leisure and hospitality services average wage over 2021, using log first differences specification. Source: BLS, NBER, and author’s calculations.

"So, even though actual CPI exceeded nowcasted CPI (as described in this post), real wages still rose for these workers."

With the supply chain being blamed for inflation, contributor Bill Conerly has some suggestions for manufacturers in his article Procurement In The Supply Chain Crisis.

"The supply chain into the United States is in trouble. Some deliveries arrive on time, but many companies face challenges getting the materials they have ordered. Cheap and easy solutions can solve some problems, but the bigger challenges require businesses to consider a variety of possible solutions, halfway solutions, and frustrating tradeoffs. Considering the options will help managers make the choices that work for their particular businesses." Below are some of Conerly's suggestions:

"The cheap and easy solution applies to materials that are a relatively small portion of the final product’s cost...This “buy big” strategy was used by a pallet manufacturer who sourced wood locally but nails from a South Korean company. He bought a nine-month supply of nails. Not only did that purchase reduce the risk of having to shut down production, but it relieved the management team of a big worry."

"Alternative suppliers that are in more reliable locations can be contacted. Reliability can describe actual distance or routes. Sometimes the shortest distance entails an unreliable road or port; in these cases a more reliable location may mean longer map distance."

"Redesigning a product may solve some of the supply reliability problem. Let the engineers brainstorm on how to change the design so that an easily sourced component is used."

"Companies should consider more finished goods inventory. If production stops for a week because of a supply chain problem, having products ready to ship to customers keeps cash flowing into the company. Recall the earlier discussion of inventory drawbacks: interest, obsolescence and shrinkage. If these are of small concern, and there’s adequate storage space, then carrying more inventory is an easy solution."

The Staff at contributor Admiral Markets notes that Disney Results Highlight The Challenges Which Remain.

"Disney (DIS) shares slipped almost 5% in after-hours trading last night following results that fell short of expectations in several key areas, including total revenue and earnings per share (EPS). However, Disney+ and the Parks, Experiences and Products division will take most of the headlines...The reopening of economies around the world means that Disney+ now finds itself not only facing competition from other streaming services, but also from in-person entertainment sources.

Elsewhere, Disney’s Parks, Experiences and Products division provided a welcome boost in revenue, coming in above analysts’ expectations at $5.45 billion for the quarter, an increase of almost 100% year-on-year (YOY).

However, operating income from this division fell short of forecasts at $640 million, which Disney blamed on increased costs largely due to the implementation of Covid-19 safety measures. Despite operating income not meeting analysts’ expectations, it is worth noting that in the same quarter last year, Disney reported a loss of $945 million.

These results highlight some of the key problems still facing Disney due to the pandemic and the resultant uncertainty could see Disney’s share price fall further in the coming sessions."

Sometimes the difference in taking a pessimistic or optimistic view can be the way we look at ourselves in the mirror. Contributor Shah Gilani takes an optimistic look and finds some Inflation Stocks To Buy For The Record CPI Surge.

"I want to remind you that even though the media tends to treat inflation like a four-letter word, some inflation isn’t always a bad thing. In fact, it can be a sign of a growing economy and tends to be a bellwether for bank stocks."

"Good Stocks Can Keep You in the Black

Across your portfolio, raise your profit targets, raise your stops, and prepare to get out of stocks when the bull stumbles. Rapidly rising rates will stop this market in its tracks, and there are trillions of dollars on the table for the taking.

And then, during the initial sell-off, use that opportunity to break back in and invest in stocks that will rise along with climbing rates, like…

- ProShares Equities for Rising Rates ETF (EQRR)

- Bank of America Corp. (BAC)

- Schlumberger N.V. (SLB)

- International Paper Co. (IP)

That last one even pays you a juicy 3.5% dividend yield as you watch it appreciate."

Read the full article for Gilani's take on inflation and the real market threat rising interest rates.

Caveat Emptor, as always.

Pixabay

Don't forget to get your flu shots and COVID boosters.

I'll see you on Tuesday.

There are a whole lot og folks in that bottom 75% who are not in the service or hospitality industries, and a very large number whose incomes do not rise with inflation. So really inflation does hurt a lot of folks who have no lobby interests to speak for them.

And certainly having a bit more inventory will allow a bit of cusion, exactly the opposite of that "just intime" and "lean production" mentality.

Interesting to note that airline fares are falling against this backdrop. Travel is coming back, but is it all coming back to commercial airlines? Many found a better alternative in private aviation during the pandemic.