Goldman Warns If The Short Squeeze Continues, The Entire Market Could Crash

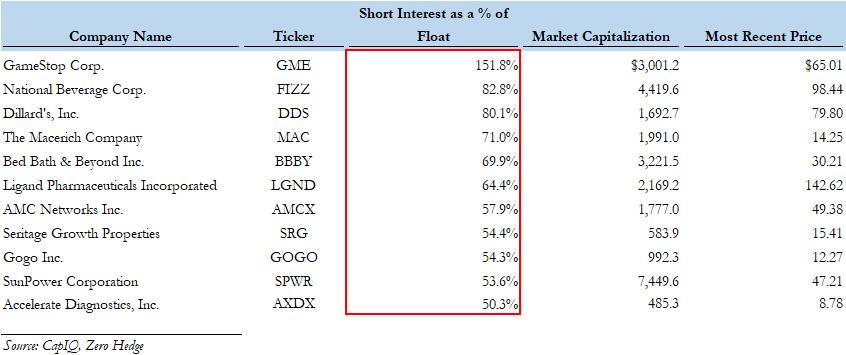

Last Friday (Jan, 22) we advised readers who thought they had missed the move in GameStop GME (they hadn't), to position appropriately in the most shorted Russell 3000 names which included such tickers as FIZZ, DDS, BBBY, AMCX, GOGO and a handful of other names, as it was likely that the short-squeeze was only just starting.

We were right and all of the stocks listed above - and others - exploded higher the coming Monday, and all other days of the week, with results - encapsulated by the WallStreetTips vs Wall Street feud - that has become the top conversation piece across America, while on WSB the only topic is the phenomenal gains generated by going long said most shorted stocks. To wit, the basket of top shorts we compiled on Jan 22 has tripled in the past week.

And while some are quick to blame last week's fireworks on the "dopamine rush" of traders at r/wallstreetbets who seek an outlet to being "copped up with little else to do during the pandemic" (as Bloomberg has done), the reality is that at the end of the day the strategy unleashed by the subreddit is merely an extension of the bubble dynamics that were made possible by the Federal Reserve (of which Bloomberg is also a very staunch fan) pumping trillions and trillions of shot-gunned liquidity into a financial system where there are now bubble visible anywhere one looks. In short, main street finally learned that it too can profit from the lunacy of the money printers at the Eccles building, and some are very unhappy about that (yes, it will end in tears, but - newsflash - $300 trillion in debt and $120BN in liquidity injections monthly will also end in tears).

That aside, one week later, Goldman has finally caught up with what Zero Hedge readers knew one week ago, and all the way down to a chart showing a basket of the most-shorted Russell 3000 stocks...

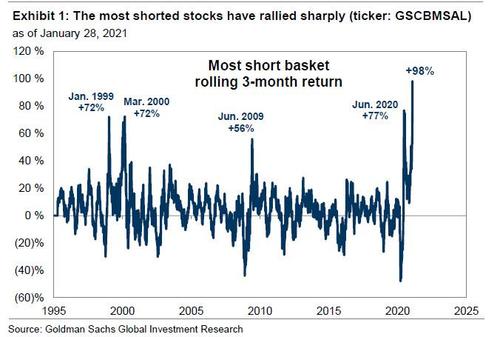

Goldman's David Kostin has published a post-mortem of what happened last week, writing that "the most heavily-shorted stocks have risen by 98% in the past three months, outstripping major short squeezes in 2000 and 2009."

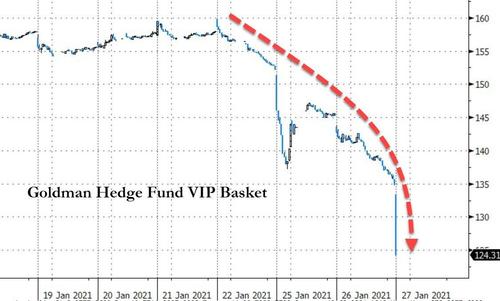

He then points out something we discussed in "Hedge Funds Are Puking Longs To Cover Short-Squeeze Losses", noting that while aggregate short interest levels are remarkably low (imagine what would have happened has shorting been far more aggressive marketwide) "the -4% weekly return of our Hedge Fund VIP list of the most popular hedge fund long positions (GSTHHVIP) showed how excess in one small part of the market can create contagion."

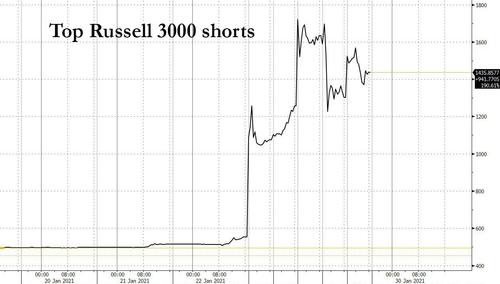

As an aside, and as we showed previously, as the most shorted stocks soared.

Hedge funds were forced to cover (as well as paying for margin calls), and as part of the broader degrossing they also had to sell some of the favorite hedge fund names across the industry, in this case represented by the Goldman Hedge Fund VIP basket.

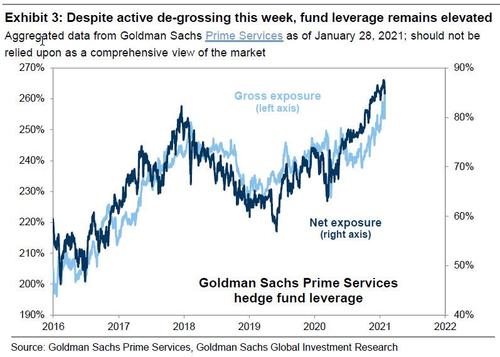

Yet what may come as a surprise to some, even as hedge funds deleveraged aggressively and actively cut risk this week, gross and net exposures "remain close to the highest levels on record" (something which may come as a huge surprise to Marko Kolanovic who has been erroneously claiming the opposite), suggesting that if the squeeze continues, hedge funds are set for much more pain.

According to Goldman Sachs Prime Services, this week "represented the largest active hedge fund de-grossing since February 2009. Funds in their coverage sold long positions and covered shorts in every sector" and yet "despite this active deleveraging, hedge fund net and gross exposures on a mark-to-market basis both remain close to the highest levels on record, indicating ongoing risk of positioning-driven sell-offs."

With that in mind, here are Kostin's big picture thoughts:

It was a placid week in the US stock market – provided one was a long-only mutual fund manager. US equity mutual funds and ETFs had $2 billion of net inflows last week (+$10 billion YTD). Although the typical large-cap core mutual fund fell by 2% this week, it has generated a return of +1.3% YTD vs. S&P 500 down -1.1%. However, life was very different last week if one managed a hedge fund. The typical US equity long/short fund returned -7% this week and has returned -6% YTD.

With the average WSB portfolio up double digits this past week, one can see why hedge funds are upset. Anyway, moving on:

The past 25 years have witnessed a number of sharp short squeezes in the US equity market, but none as extreme as has occurred recently. In the last three months, a basket containing the 50 Russell 3000 stocks with market caps above $1 billion and the largest short interest as a share of float (GSCBMSAL) has rallied by 98%. This exceeded the 77% return of highly-shorted stocks during 2Q 2020, a 56% rally in mid-2009, and two distinct 72% rallies during the Tech Bubble in 1999 and 2000. This week the basket’s trailing 5-, 10-, and 21-day returns registered as the largest on record.

Thanks Goldman, and yes, your "brisk assessment" would have been more useful to your clients if it had come before the event (like, for example, this) instead of after.

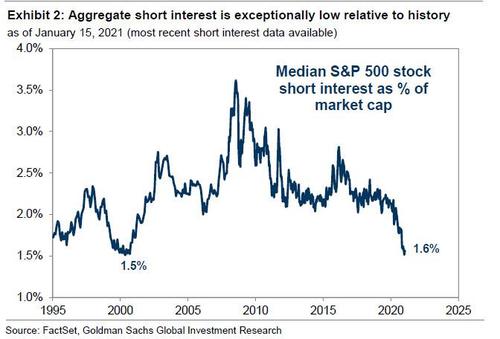

Kostin then goes on to point out that the "mooning" in the most shorted stocks took place even though aggregate short interest was near a record low (imagine what would have happened had short interest been higher), which is odd because historically, "major short squeezes have typically taken place as aggregate short interest declined from elevated levels. In contrast, the recent short squeeze has been driven by concentrated short positions in smaller companies, many of which had lagged dramatically and were perceived by most investors to be in secular decline" to wit:

Unusually, the rally of the most heavily-shorted stocks has taken place against a backdrop of very low levels of aggregate short interest. At the start of this year, the median S&P 500 stock had short interest equating to just 1.5% of market cap, matching mid-2000 as the lowest share in at least the last 25 years. In the past, major short squeezes have typically taken place as aggregate short interest declined from elevated levels. In contrast, the recent short squeeze has been driven by concentrated short positions in smaller companies, many of which had lagged dramatically and were perceived by most investors to be in secular decline.

Of course, there is nothing "historical" about what happened last week, because - as we all know - the biggest difference between the typical short squeeze of the past and the recent rally in heavily-shorted stocks "was the degree of involvement of retail traders, who also appear to have catalyzed sharp moves in other parts of the market." Why thank you WSB, but that's ok - you will be handsomely rewarded.

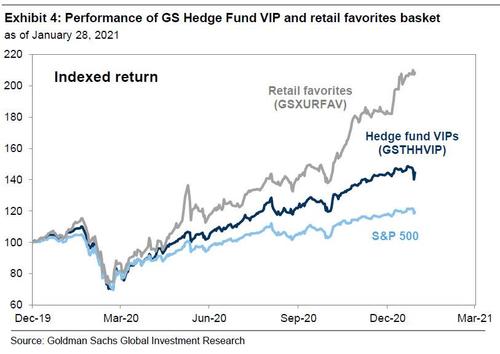

Last week we discussed the surging trading activity and share prices of penny stocks, firms with negative earnings, and extremely high-growth, high-multiple stocks. These trends have all accompanied a large increase in online broker trading activity. A basket of retail favorites (ticker: GSXURFAV) has returned +17% YTD and +179% since the March 2020 low, outperforming both the S&P 500 (+72%) and our Hedge Fund VIP list of the most popular hedge fund long positions (GSTHHVIP, +106%).

So why does this matter? One simple reason: contrary to the bizarrely nonchalant optimism spouted earlier this week by JPMorgan's Marko Kolanovic who said "any market pullback, such as one driven by repositioning by a segment of the long-short community (and related to stocks of insignificant size), is a buying opportunity, in our view," Goldman has a far more dismal take on recent events, and writes that "this week demonstrated that unsustainable excess in one small part of the market has the potential to tip a row of dominoes and create broader turmoil."

He then picks up on what he said last weekend when responding to Goldman client concerns about a stock bubble, which we summarized in "Goldman's Clients Are Freaking Out About A Stock Bubble: Here Is The Bank's Response", and which turned out to be 100% warranted, and writes that "most of the bubble-like dynamics we highlighted last week have taken place in stocks constituting very small portions of total US equity market cap. Indeed, many of the shorts dominating headlines this week were (prior to this week) small-cap stocks. But large short squeezes led investors short these stocks to cover their positions and also reduce long positions, leading other holders of common positions to cut exposures in turn."

As a result, Goldman's Hedge Fund VIP list declined by 4%. Which is a problem because as Kostin concludes, "in recent years elevated crowding, low turnover, and high concentration have been consistent patterns, boosting the risk that one fund’s unwind could snowball through the market."

Translation: if WSB continues to push the most shorted stocks higher, the entire market could crash.

And since Kostin admits that "the retail trading boom can continue" as "an abundance of US household cash should continue to fuel the trading boom" with more than 50% of the $5 trillion in money market mutual funds owned by households and is $1 trillion greater than before the pandemic, what happens in the coming week - i.e., if the short squeeze persists - could have profound implications for the future of capital markets.

Related articles by this author:

This Is The Stunning Way Some Desperate Funds Covered Their GameStop Shorts

Siebert Financial Up 650% As "Wall Street Bets" Short Squeeze Continues

Reddit Preparing To Unleash "World's Biggest Short Squeeze" In Silver

Mark Cuban Presents A "Little Trick" For Creating The Mother Of All Short Squeezes

Siebert Financial Up 650% As "Wall Street Bets" Short Squeeze Continues

GameStop Shares Are Collapsing, Pelosi Says "Will Be Reviewing Issue"

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more

Shorting stocks should be illegal.

I read an article a few years ago about the concept that a “perfect” economy would constantly experience deflation. The idea was that technology would continually make goods and services cheaper to provide. It touches on Moore’s law, regarding computers, but how a similar (but not so dramatic) law really applies to everything.

"While short term it is amusing...long term it will crash the markets."

Ok with me! I am shorting all of Wall Street. I got all out several months ago because I could see that a major correction was coming and with Biden in office its coming fast.

When the market crashes, and it will, I will move all back in. I rode out the last 3 crashes with well over a 100K losses.

Not this time, not when the future is so easy to see.

Based on all of the additional comments, it is indeed reasonable that additional regulations should be put in place, AND probably better enforcement of those regulations already in place. Crime should not be allowed to pay.

It's a peasant revolt!

Damn elites were overly short and a peasant revolt caught them. Instead of just taking the L and moving on, they empower their paid for politicians and silicon valley to strike back. Fixing this country won’t be easy.

The fact that GS is sweating bullets tells me they’ve been doing their usual lying, cheating and stealing from the common man again. These hedge funds have been allowed to manipulate the markets and damage our investments and retirement funds. Our wonderful progressive former *resident didn’t do a damn thing to these guys after 2008.

Too big to fail = too big to exist!

They can “learn to code” or “build solar panels” along the with pipeline folks who are losing their jobs. Oh the horrors!

"excess in one small part of the market has the potential to tip a row of dominoes..."

Aren't these people supposed to be the responsible "experts" that know how to hedge risk?

I heard an interesting argument about price inflation. It goes like this: When the price of silver went over $40 an ounce back in the 2008 timeframe, the reason was that with all the money the fed was pumping into the economy, price inflation was expected. But it all went into the stock market and there was no price inflation to speak of. Silver crashed.

But this time they are giving it directly to the “little people”. some making more on unemployment than they made at their jobs. They spend the money. That may be one reason lumber is so high right now. It also may explain the bump in silver and gold.

And add the destruction of the world’s economy via the lockdowns. It does look like we’re living in interesting times.

BTW, Try to buy silver right now. Good luck...

Which shows that Wall-Street has been cooking the books for far too long. If a person used the same money to back multiple investments it would be considered fraud, when Wall Street does it is is called creative accounting.

Loading comments, please wait...