Goldman's Clients Are Freaking Out About A Stock Bubble: Here Is The Bank's Response

One doesn't have to be a "legendary" investor to call out bubbles, especially ones who correctly called the excesses of the dot com and housing eras, but it helps. And it's probably why Jeremy Grantham had such conviction last week when he said that not only is the market currently an "epic" bubble but that it will suffer a "spectacular" crash in "the next few months." Needless to say, such an alarmist view is hardly in the best interests of banks who make commissions on two-way trades instead of outright sales (or liquidations), but in a notable departure from tradition, several banks have joined Grantham in calling for a sharp market correction either imminently (Bank of America) or in the second half of the year (Wells Fargo).

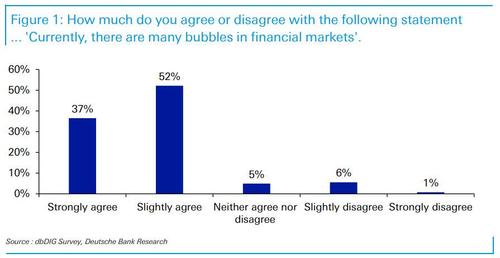

To be sure, concerns about an asset bubble have grown so widespread, with the latest Deutsche Bank survey finding the the vast majority of respondents (89%) see some bubbles in financial markets currently...

... that even Goldman's clients - traditionally among the most cheerful and optimistic of all, pied pipered by the perpetually bullish view of Goldman strategists - are starting to freak out.

As Goldman's chief equity strategist David Kostin writes in his latest Weekly Kickstart report, "among the questions we receive most frequently from clients is whether US stocks trade at unsustainably high levels (read: “Bubble”)."

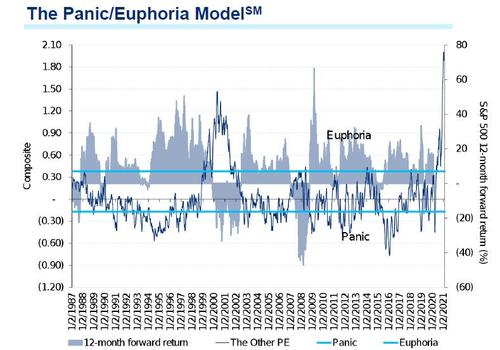

So as the latest Citi panic/euphoria model shows...

... yet without sparking a liquidation-driven market crash by admitting that it is in fact, a "massive bubble":

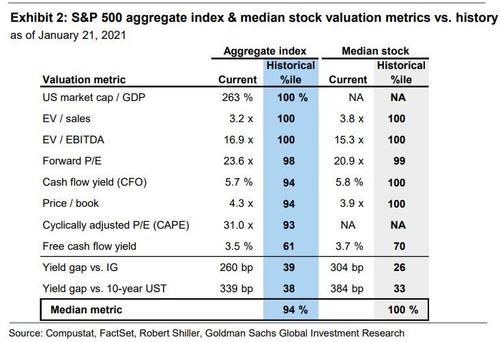

Well here's how Kostin delicately threads the needle: first, he admits that valuations have indeed rarely (read never) been higher, writing that "on an absolute basis there is no doubt that valuations are extremely elevated. The index trades at the upper end of the historical range when measured using a variety of metrics, including P/E, P/B, EV/sales, EV/EBITDA, and market cap/GDP. These measures point to equity valuation ranking in the 96th historical percentile (Exhibit 2)."

"However", he then quickly counters before readers call their favorite Goldman salesman and bark the "sell all" order, when "taking into account the yield on Treasuries, corporate credit, or cash, the aggregate stock market index trades at below-average historical valuation." Kostin then tries to ease lingering concerns that stocks are in a massive bubble (which they are), writing that "in fact, as economist Robert Shiller recently pointed out, his oft-cited CyclicallyAdjusted P/E Ratio (“CAPE”) shows that equity valuations are “not as absurd as some people think,” provided interest rates remain relatively low. Our economists forecast the 10-year Treasury yield will rise to just 1.5% at the end of 2021 and only exceed 2% in mid-2023."

Kostin here falls back to the only partially credible justification he can make for exorbitant valuations, namely that near-record low yields means that stocks are cheap compared to bonds, and thus deserving of high multiples.

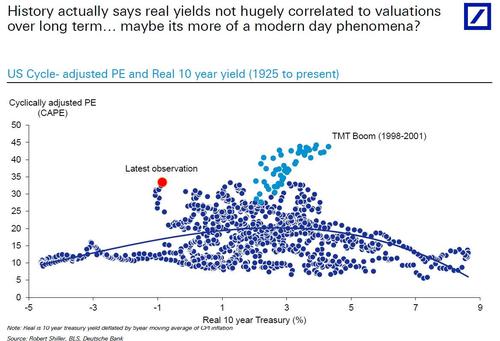

This, as we explained last December in "No, Low Rates Do Not Lead To Higher Earnings Multiples", is total rubbish since over time low real rates have never led to - or justified - the record market multiples except for cases when the market was infact in a bubble, and it's not just us making this observation but last week, Deutsche Bank's Jim Reid did too showing the following chart (which was adopted from Jerry Minack and which we first showed on Dec 5):

But why does Kostin, knowing well that his argument has already been debunked, keep making this ridiculous justification for continued buying of risk? Simple, because as he says in the very next sentence, "we expect modestly higher rates will be offset by a declining equity risk premium, leaving the S&P 500 P/E effectively unchanged and allowing strong EPS growth to drive the market towards our year-end target of 4300."

And there you have it: it's kind of tough to agree there is a bubble when your own S&P price target in 11 months is almost 500 points higher at least when it comes to Goldman's clients; the answer to what Goldman's prop book is doing now will have to wait until the congressional hearings after the bubble bursts. As a reminder, back in the 2007 bubble, Goldman's desk was actively betting on a housing crash by selling CDOs to the very same clients it told to buy CDOs (sometimes in collusion with other major clients such as Pauslon), knowing well that the crash was imminent. But we digress.

Anyway, back to Kostin who naturally realizes that any "all clear" signal would be immediately laughed out by most sophisticated finance professionals (with 89% of them already believing there is a bubble as the DB survey showed, he is caught between a rock and a hard place), and so he is forced to strategically caveat his cheerful assessment, writing that "although the aggregate equity market appears reasonably valued, pockets of the market have recently appeared to demonstrate investor behavior consistent with bubble-like sentiment."

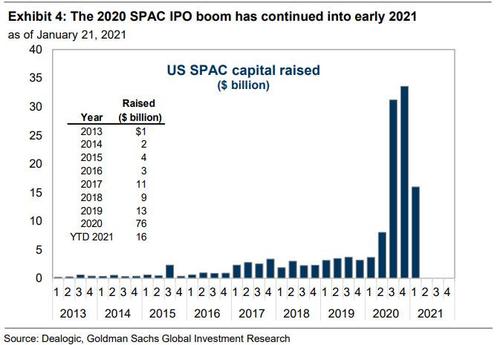

One such area is unbridled growth is SPACs. As Kostin then notes, in 2020 (which he dubbed the “Year of the SPAC”), 229 US SPACs raised $76 billion, a figure 6 times greater than in 2019. During the first three weeks of 2021, another 56 SPACs have raised $16 billion, already half the total raised in all of Q4 2020.

According to Goldman calculations (which we presented previously), "if the 5x ratio of equity capital to target M&A enterprise value persists, the $80 billion of uncommitted SPAC capital would drive $400 billion in M&A during the next two years." However, as he also notes, that is conditional on each of those SPACs finding a suitable private company target and negotiating a merger.

Yet even as Kostin warns that Spacs are clearly one aspect of a market bubble, he doesn't see it as having dire consequences, to wit:

Low interest rates, the flexible structure, and the two-year window to find a target before returning capital suggest the popularity of SPACs will continue in the near term. Importantly, we see little risk to public equity markets should investor enthusiasm for SPACs subside.

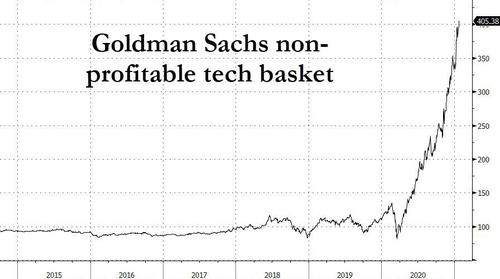

It's not just SPACs, however, that Goldman is telling its clients to be ware of - as the bank notes next, "the sharp recent outperformance of stocks with negative earnings is another potentially bubble-like phenomenon that many clients have highlighted. During the last 12 months, the shares of firms with negative LTM EBITDA have outpaced the average stock by 40 percentage points (82% vs. 42%), a 97th percentile ranking since 1985. By comparison, negative EBITDA stocks outperformed by a similar 30 pp following the Financial Crisis but by 140 pp in 1999-2000 during the Tech Bubble." This unprecedented surge in the stock prices of non-profitable tech companies is shown below. If anyone looks at this chart and says no bubble, they should never be allowed to opine on anything finance-related ever again.

Ok fine, at least Goldman admits that there are two clear bubble signs. Wait, wait... there's a third: as Kostin continues, even "more than the outperformance of negative earners, the recent surge in trading volumes of negative earnings stocks registers as a historical extreme. These firms account for 16% of equity trading volumes, exceeding the 15% share in 2000." Yet like above, Kostin is reduced to pleading with clients not to worry about this clear and grotesque bubble indicator either, because "although this surge appears unsustainable, it also appears to pose little risk to the broad market because these companies account for just 5% of total market cap." And just in case you start worrying about the insanity that has gripped retail daytrading, Kostin has some encouragement there too: "Similarly, the share of trading volumes in stocks with share prices below $1.00 has doubled in the last two months and ranks in the 99th historical percentile. But these firms only account for 1% of trading volume and less than half of 1% of market value."

Realizing that he has to expend on why he is dismissing all these clear bubble indicators so generously - or suffer total loss of credibility - Kostin then attempt to do just that, with the following two-paragraph "bubblesplainer":

Just like in past economic cycles, many stocks with negative earnings today were profitable companies that dipped into unprofitability during the recession.During economic recoveries investors often rotate their portfolios toward firms whose earnings and share prices suffered most during the downturns, particularly in a low interest rate environment that increases the present value of distant future cash flows. Trading activity in stocks with persistently negative earnings during the last three years – unprofitability that cannot be attributed to the pandemic recession –has also been extreme, but these firms amount to just 2% of equity market cap.

Today’s market also lacks the extreme investor leverage that is typical of bubbles. Due in large part to fiscal stimulus, US household disposable income growth was strong in 2020, and the outlook remains positive with further stimulus likely on the way. Excess savings remain elevated and the aggregate US household debt service ratio is nearly the lowest in at least 40 years. As a result, the strong recent inflows to US equities have apparently been funded by cash rather than leverage. While US margin debt has certainly risen in recent months, it currently registers a smaller share of market cap than it has as recently as during 2017-2018. And money market fund assets remain elevated after large inflows in 2020.

In short, yes - the chronic retail momentum-chasers are clearly scrambling to bid up bubble assets, but this in itself is not a risk as they haven't taken out a third mortgage to do it. Well, let's wait and see just how much leverage said Robinhooders and redditors have put on as they ravage shorts up and down the market. And that will become apparent only after the crash once the bubble pops, but there's no need to worry about that happening according to Kostin, because this time is different.

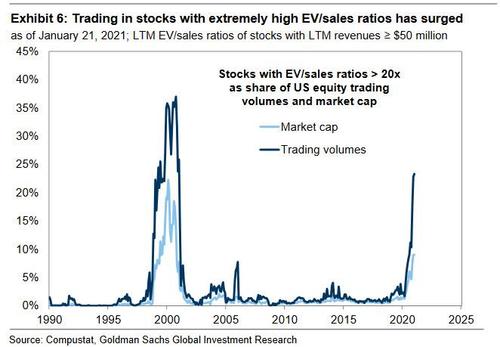

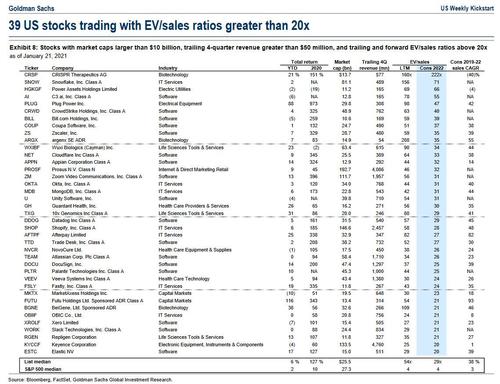

Yet one place where not even Kostin can't talk down the sheer bubbly euphoria is in high-multiple stocks. As the Goldman strategist admits, "one part of the market that appears frothy and may pose a broader risk is extremely high-growth, high-multiple stocks. Like negative earners and penny stocks, trading volumes and share prices of stocks with EV/sales multiples over 20x have soared. However, these firms are much larger, collectively accounting for 23% of trading volumes during the past month (96th percentile since 1985) and 9% of market cap."

Of course, even here Kostin has to provide some optimism, and does so by writing that some of this appreciation is appropriate "given record low interest rates. Firms with EV/sales ratios greater than 20x accounted for 2% of trading volumes in 2019. That share rose to 10% in August 2020 as interest rates plunged." However, with their share of volumes having doubled again during the most recent market rally...

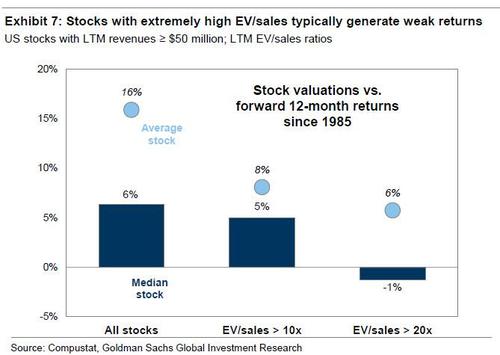

... Kostin concedes that "history shows investors face long odds of outperforming when buying the most extremely-valued firms." Why? Because since 1985, the median stock trading at an EV/sales multiple above 20x has generated a subsequent 12-month return of -1%, compared with +6% for the median US stock. The average stock trading above 20x has posted a stronger return, but still fared worse than the broad market average (+6% vs. +16%).

And just to placate all those Goldman clients who are calling bullshit on everything Kostin just said, he provides them with a handy screen of the 39 US stocks with market caps above $10 billion with both trailing and consensus 2022 EV/sales ratios greater than 20x.

What Goldman is telling its clients here is "short these names if you are so worried about bubbles." Of course, what will ironically happen in the real world is that as another round of hedge funds piles into these berserker bubble names, the retail and reddit daytrading army will rush into them, forcing another epic short squeeze, and sending this basket of 39 stocks soaring to new even more berserker highs.

Why? Because of the very same entity we have been consistently bashing since our inception 12 years ago: the Federal Reserve of the United States, which first destroyed only capital markets, and is now set to finalize its real mandate - the destruction of not only the middle class but the United States itself, while unleashing what even Ray Dalio now admits will be a "terrible civil war."

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more